Professional Documents

Culture Documents

TQ0907728 Ack 20210531015407

Uploaded by

KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TQ0907728 Ack 20210531015407

Uploaded by

KumarCopyright:

Available Formats

1

Renewal Receipt (Provisional)

MR ANJANEE KUMAR

Date: 31/05/2021

S O RAM NARESH THAKUR , AT PO CHHATAUNA

,Samastipur - 848134 Acknowledgement No: TQ0907728

Bihar

Contact no: 9006349090

Dear MR ANJANEE KUMAR

Thank you for choosing Future Generali as your preferred life insurer. As a valued member of the Future Generali family, your continued patronage is

important to us.

Please find below the details of premium(s) which we have received.

Premium Policy No Premium Amount Reinstatement interest Goods and Total Premium Payable

Details Service Tax

01308563 20089.00 1683.00 452.00 22224.00

Receipt Amount Paid Payment Type Transaction ID Bank Name Credit/Debit card no.

Details

22224.00 Online 1456478585 NA NA

Your Advisor details:

Name SUMIT KUMAR

Phone No. 9525346279

Email ID

Should you require any further clarification or assistance, please feel free to contact your Advisor, or get in touch with us

at any of the Service touchpoints mentioned below.

Assuring you of our best services.

Customer Service

Future Generali India Life Insurance

Terms & Conditions:

1. This payment acknowledgment customer copy is issued by Future Generali India Life Insurance Company Ltd. This acknowledgment is subject to Future Generali India Life Insurance Company Limited

accepting the premium and appropriating the same in the respective policy account and subject to issuing the receipt against the same. The Renewal Premium is adjusted on the due date even if it has

been received in advance

2. Mere acceptance of premium deposit should not be construed as confirmation of renewal /revival of policy

3. This acknowledgment is subject to payment realisation

4. Goods and Service Tax, if any, are charged at the rates applicable from time to time

5. Premium payment(s) exclusive of Goods and Service Tax to Future Generali India Life Insurance Company Limited are eligible for tax bene fit(s) u/s 80C/ 80CCC(1)/ 80D as applicable subject to

satisfaction of the conditions specified under Income Tax Act, 1961

6. You now have an option of receiving payments, if any, under your policy through Electronic Fund Transfer (ECS)

7. The TDS u/s 194DA of Income Tax Act, 1961 is applicable if any amount paid/ withdrawn under the policy, if the policy at time of payment falls within the purview of section 194DA. Hence please visit

the nearest branch to update your PAN details, to avoid higher rate of tax i.e. 20% u/s 206AA. If you wish to avail benefit(s) u/s 197(1), 197(1A) & 197A(1C) of Income Tax Act, 1961 then please submit Form

15G or Form 15H

8.Premium payment(s) exclusive of Goods and Service Tax to Future Generali India Life Insurance Company Limited are eligible for tax benefit(s) u/s 80C/80CCC(1)/80D as applicable subject to

satisfaction of the conditions specified under Income Tax Act, 1961.

Operations Hub: Policy Servicing,Future Generali India Life Insurance Co. Ltd, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai

SAC- 9971 Life Insurance Services (excluding Reinsurance Services)

You can reach us via any of the following modes:

This is a computer generated communication and does not need a signature

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS. IRDAI clarifies to the public that: • IRDAI or its officials do not involve in

activities like sale of any kind of insurance or financial products nor invest premiums • IRDAI does not announce any bonus. Public receiving such phone calls

are requested to lodge a police complaint along with details of phone call, number.

Registered & Corporate Office address: Future Generali India Life Insurance Co. Ltd, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli

(W), Mumbai - 400083. Tel.: 91-22-4097 6666 Fax: 91-22-4097 6600. | Email: care@futuregenerali.in | Call us at 1800 102 2355 | Website: www.futuregenerali.in |

IRDAI Regn. No. 133 | CIN : U66010MH2006PLC165288

You might also like

- TQ1136035 Ack 20220319033835Document1 pageTQ1136035 Ack 20220319033835Mukesh YadavNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Bajaj AL-Premium Receipts1Document1 pageBajaj AL-Premium Receipts1Anil KumarNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticerajaNo ratings yet

- PS/Consolidated Premium Statement /ver 2.1/jan 2021: A Reliance Capital CompanyDocument1 pagePS/Consolidated Premium Statement /ver 2.1/jan 2021: A Reliance Capital Companyshubh1910No ratings yet

- Cf78f19cx6713xac12xe053x8d36a80ae6d3Document1 pageCf78f19cx6713xac12xe053x8d36a80ae6d3Ashish SharmaNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailschethanchethanmn8No ratings yet

- Reliance Premium Receipt y M D GDocument1 pageReliance Premium Receipt y M D Gyadavravindranath57No ratings yet

- Renewal Notice-5hshsDocument2 pagesRenewal Notice-5hshsHshshsvd hdhdNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticemahakarthicNo ratings yet

- Your Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Document2 pagesYour Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Ritik Goyal100% (1)

- Bajaj AL-Premium Receipts2Document1 pageBajaj AL-Premium Receipts2Anil KumarNo ratings yet

- TATA Premium ReceiptDocument1 pageTATA Premium Receiptthetrilight2023No ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- Appolo Munich PolicyDocument3 pagesAppolo Munich PolicyEswar VakkalagaddaNo ratings yet

- Consolidatedreceipt PDFDocument1 pageConsolidatedreceipt PDFSuyash MishraNo ratings yet

- Premium Receipt: Say Hi To Us On Our Whatsapp NoDocument1 pagePremium Receipt: Say Hi To Us On Our Whatsapp NodeepaksinghbishtNo ratings yet

- RenewalNotice 0000000030189652 PDFDocument2 pagesRenewalNotice 0000000030189652 PDFVikas YadavNo ratings yet

- 0088470515-Premium Deposit Acknowledgement PDFDocument1 page0088470515-Premium Deposit Acknowledgement PDFjayanandaNo ratings yet

- Payment Receipt: 711166520 Mohd Khalid Sayeed Mohd Khalid Sayeed C-151 Suraj Kund, GorakhpurDocument1 pagePayment Receipt: 711166520 Mohd Khalid Sayeed Mohd Khalid Sayeed C-151 Suraj Kund, GorakhpurKhalid SayeedNo ratings yet

- Zprmrnot 21163309 8704721Document1 pageZprmrnot 21163309 8704721Arnav MishraNo ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- 80C Relience InsuranceDocument1 page80C Relience Insuranceshailesh.kumarNo ratings yet

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateVijay KumarNo ratings yet

- Renewal Premium Acknowledgement: Policy DetailsDocument1 pageRenewal Premium Acknowledgement: Policy DetailsP S MITRANo ratings yet

- Zprmrnot 22891511 4720686 PDFDocument1 pageZprmrnot 22891511 4720686 PDFVishwambhara DasaNo ratings yet

- To Activate Road Side Assistance (RSA) Cover, SMS "ACTIVATE POLICY V6054244 " To 9222211100 (Standard SMS Charges Applicable)Document6 pagesTo Activate Road Side Assistance (RSA) Cover, SMS "ACTIVATE POLICY V6054244 " To 9222211100 (Standard SMS Charges Applicable)Ritik BidhuriNo ratings yet

- Lux Travel InsuranceDocument8 pagesLux Travel InsuranceHemant KumarNo ratings yet

- Ghulam Mohi U Din Tax CeDocument1 pageGhulam Mohi U Din Tax Cesinghgurmanan7No ratings yet

- C301149660-Renewal Premium ReceiptDocument1 pageC301149660-Renewal Premium ReceiptsaivenkateswarNo ratings yet

- Policy No. Plan Name Frequency Installment PremiumDocument1 pagePolicy No. Plan Name Frequency Installment PremiumMotilal HembramNo ratings yet

- Great Innovation DetailsDocument1 pageGreat Innovation DetailsPinak VadherNo ratings yet

- Payment Acknowledgement: Policy DetailsDocument1 pagePayment Acknowledgement: Policy DetailsBikram NongmaithemNo ratings yet

- To Renew SMS, REN To 9222211100Document9 pagesTo Renew SMS, REN To 9222211100SK GNo ratings yet

- Policy PremiumDocument1 pagePolicy Premiumdavidgordan0207No ratings yet

- ABSLIFT98612540471680087633017Document1 pageABSLIFT98612540471680087633017nirajanayak90No ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticenielNo ratings yet

- Tata Aia Life InsuranceDocument2 pagesTata Aia Life InsurancekotijbNo ratings yet

- DeliveryOrder 20220914171635Document1 pageDeliveryOrder 20220914171635sukhpreet singhNo ratings yet

- Insurance Premium Payment Certification: E-Policy ServiceDocument2 pagesInsurance Premium Payment Certification: E-Policy ServiceMuntana TewpaingamNo ratings yet

- 80CDocument3 pages80CRajesh AdluriNo ratings yet

- Dear Munish SharmaDocument2 pagesDear Munish SharmaMunish SharmaNo ratings yet

- To Renew SMS, REN To 9222211100Document8 pagesTo Renew SMS, REN To 9222211100Omprakash MeenaNo ratings yet

- Zprmrnot 23764103 16031216Document1 pageZprmrnot 23764103 16031216Kiran KumarNo ratings yet

- Your Policy Details:: Note: 1. The Values Displayed Above Are Exclusive of taxes/GST 2Document2 pagesYour Policy Details:: Note: 1. The Values Displayed Above Are Exclusive of taxes/GST 2sridharanelvagalNo ratings yet

- v8333378 ScheduleDocument8 pagesv8333378 ScheduleNilesh BargudeNo ratings yet

- PIP DocumentDocument103 pagesPIP DocumentShaik SariyaNo ratings yet

- Renewal Premium Receipt: Invoice Number: A150048237100041Document1 pageRenewal Premium Receipt: Invoice Number: A150048237100041Aasiya shadab KhanNo ratings yet

- Policy Proposal 2Document1 pagePolicy Proposal 2Manjunath ShettyNo ratings yet

- Dear Mayoor MehraDocument1 pageDear Mayoor MehramayoorNo ratings yet

- INDIA First Insurance Private Limited 80D DEC 2016Document1 pageINDIA First Insurance Private Limited 80D DEC 2016rushikesh28No ratings yet

- MT0690 - MAX Insurance - Abhishek KhandelwalDocument1 pageMT0690 - MAX Insurance - Abhishek KhandelwalAbhishek KhandelwalNo ratings yet

- PNB MetlifeDocument1 pagePNB MetlifeANTO MATHI0% (1)

- Bajaj Jun 23Document1 pageBajaj Jun 23MAYANK BASUNo ratings yet

- Offlineproposal Aspxmid MzAwMzc3MzUDocument1 pageOfflineproposal Aspxmid MzAwMzc3MzUParveen GodiaNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- Covernote SA716455 1638260687459Document2 pagesCovernote SA716455 1638260687459Prashant PrinceNo ratings yet

- Payment SuccessDocument1 pagePayment SuccessJayant PrasadNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- MGT111 - Module 1Document6 pagesMGT111 - Module 1Cluster 2, Cebu city, Josh C AgustinNo ratings yet

- Study of Retailers SatisfactionDocument83 pagesStudy of Retailers Satisfactionalkanm750100% (1)

- 2018 Bar Question Item No. VIIDocument3 pages2018 Bar Question Item No. VIIElsie Cayetano100% (1)

- Hsmarine OffshoreDocument7 pagesHsmarine OffshoreBoruida MachineryNo ratings yet

- MCQ - Minimum Wages ActDocument29 pagesMCQ - Minimum Wages ActNiraj Pandey82% (17)

- Statistics Notes BBADocument7 pagesStatistics Notes BBATushar Tale100% (1)

- Equitas Small Finance Bank LTDDocument44 pagesEquitas Small Finance Bank LTDSubscription100% (2)

- Chap 2Document5 pagesChap 2Kinfe Dufera GonfaNo ratings yet

- Ethical Issues Surrounding The Hospitality and Tourism Industry in The PhilippinesDocument3 pagesEthical Issues Surrounding The Hospitality and Tourism Industry in The PhilippinesAngela May VersoNo ratings yet

- Unit 1Document26 pagesUnit 1PRASHANTNo ratings yet

- Lecture 1.1 Introduction To Design Thinking CourseDocument26 pagesLecture 1.1 Introduction To Design Thinking Courseyann olivierNo ratings yet

- Precast Construction SeminarDocument30 pagesPrecast Construction SeminarNzar HamaNo ratings yet

- B.inggris Construction Tools FIX 2.0Document12 pagesB.inggris Construction Tools FIX 2.0Tyoo FerdinadNo ratings yet

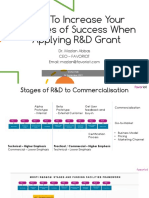

- How To Increase Your Chances of Success When Applying R&D GrantDocument19 pagesHow To Increase Your Chances of Success When Applying R&D GrantMazlan AbbasNo ratings yet

- Status of Philippine ForestsDocument11 pagesStatus of Philippine ForestsReese80% (5)

- 220 1422 1 PBDocument8 pages220 1422 1 PBYenniMardatillahNo ratings yet

- InventoryDocument3 pagesInventorysaiNo ratings yet

- Support Case Manager - HP Support Center PDFDocument3 pagesSupport Case Manager - HP Support Center PDFRama PrajapatiNo ratings yet

- Baghdad History Presentation HandoutDocument5 pagesBaghdad History Presentation HandoutLouie LamNo ratings yet

- Netflix Fourth Quarter LetterDocument13 pagesNetflix Fourth Quarter LetterStuff NewsroomNo ratings yet

- AEGIR-Marine - CompanyDocument2 pagesAEGIR-Marine - CompanyJoel Jeffery SarkarNo ratings yet

- Windows 8.1 SDK LicenseDocument20 pagesWindows 8.1 SDK LicenseJohan VargasNo ratings yet

- Applied Econ Week 5Document4 pagesApplied Econ Week 5Coleen Heart Migue PortonNo ratings yet

- Pestel & Five ForcesDocument42 pagesPestel & Five ForceswarbaasNo ratings yet

- Non Conformance ProcedureDocument3 pagesNon Conformance ProcedureBharamu Patil33% (3)

- E - Business Unit-III, 2020Document15 pagesE - Business Unit-III, 2020Sourabh SoniNo ratings yet

- Sae Ams 5796D 2000 (En) PDFDocument6 pagesSae Ams 5796D 2000 (En) PDFWilliam LooNo ratings yet

- Definition Cad CamDocument5 pagesDefinition Cad CamzanwahidNo ratings yet

- Book Your Branch Visit BDO Unibank, IncDocument1 pageBook Your Branch Visit BDO Unibank, IncMiggy AlicobenNo ratings yet

- A Survey On Network Functions Virtualization For Telecom ParadigmDocument5 pagesA Survey On Network Functions Virtualization For Telecom ParadigmShreya KowadkarNo ratings yet