0% found this document useful (0 votes)

1K views14 pagesElliott Wave - Basic PDF

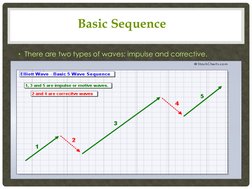

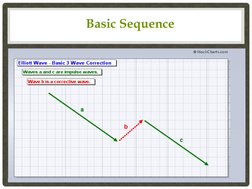

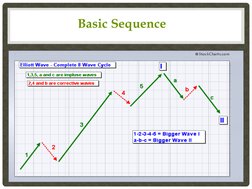

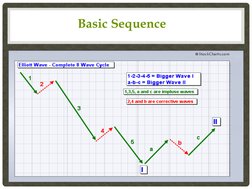

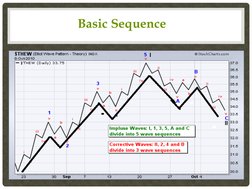

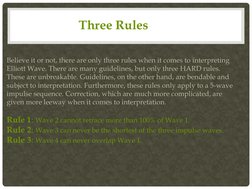

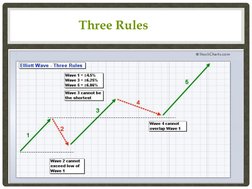

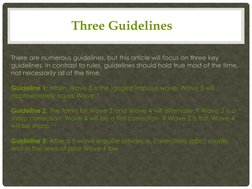

The Elliott Wave Theory is a technical analysis method used to forecast stock market movements. [1] It divides market behavior into recurring patterns of bullish and bearish waves. [2] There are only three hard rules for interpreting waves: Wave 2 cannot retrace more than 100% of Wave 1, Wave 3 must be the longest impulse wave, and Wave 4 cannot overlap Wave 1. [3] Guidelines and Fibonacci ratios provide additional analysis of wave relationships. Mastering the theory takes experience but can provide an important tool for traders when applied with dedicated software.

Uploaded by

BasseyMilesAttihCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views14 pagesElliott Wave - Basic PDF

The Elliott Wave Theory is a technical analysis method used to forecast stock market movements. [1] It divides market behavior into recurring patterns of bullish and bearish waves. [2] There are only three hard rules for interpreting waves: Wave 2 cannot retrace more than 100% of Wave 1, Wave 3 must be the longest impulse wave, and Wave 4 cannot overlap Wave 1. [3] Guidelines and Fibonacci ratios provide additional analysis of wave relationships. Mastering the theory takes experience but can provide an important tool for traders when applied with dedicated software.

Uploaded by

BasseyMilesAttihCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd