Professional Documents

Culture Documents

RR 18-2011 PDF

Uploaded by

princesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RR 18-2011 PDF

Uploaded by

princesCopyright:

Available Formats

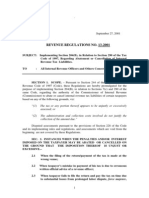

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

September 12, 2011

REVENUE REGULATIONS NO. 18-2011

SUBJECT : Providing Penalties for Violation of the Requirement that Output Tax on the Sale

of Goods and Services Should be Separately Indicated in the Sales Invoice or

Official Receipt

TO : To All Revenue Officials, Employees and Others Concerned

Pursuant to Section 264, in relation to Section 113 (B)(2)(a) and (d) of the 1997 Tax Code, as

amended, this Regulations is promulgated to set the guidelines in the proper invoicing and receipting of

output tax on the sale of goods and services, respectively.

SECTION 1. Scope. All VAT-registered taxpayers who are required under Section 237 of the

1997 Tax Code, as amended to issue sales or commercial invoices or official receipts should separately

bill the VAT corresponding thereto. The amount of the tax shall be shown as a separate item in the

invoice or receipt.

SECTION 2. Penalty. Failure or refusal to comply with the requirement in Section 1 hereof

shall, upon conviction, for each act or omission, be punished by a fine of not less than One Thousand

Pesos (PhP1,000.00) but not more than Fifty Thousand Pesos (Php50,000.00) and suffer imprisonment

of not less than two (2) years but not more than four (4) years.

SECTION 3. Repealing Clause. All existing rules and regulations or parts thereof which are

inconsistent with the provisions of this Regulations are hereby revoked.

SECTION 4. Effectivity. This Regulations shall take effect fifteen (15) days after publication in

any newspaper of general circulation.

(Original Signed)

CESAR S. PURISIMA

Secretary of Finance

Recommending Approval:

(Original Signed)

KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

I-

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- FF Insurance GuideDocument1 pageFF Insurance GuideprincesNo ratings yet

- FTEB - List of Accredited DFFs - 31July2017.PDF - Google DriveDocument1 pageFTEB - List of Accredited DFFs - 31July2017.PDF - Google DriveprincesNo ratings yet

- Revenue Memorandum Circular No. 17-2011Document3 pagesRevenue Memorandum Circular No. 17-2011Orlando O. CalundanNo ratings yet

- Revenue Regulation No. 16-2005Document0 pagesRevenue Regulation No. 16-2005Kaye MendozaNo ratings yet

- RR 18-2011 PDFDocument1 pageRR 18-2011 PDFprincesNo ratings yet

- RR 13-01Document5 pagesRR 13-01Peggy SalazarNo ratings yet

- Cta 3D CV 08556 M 2017jan05 AssDocument9 pagesCta 3D CV 08556 M 2017jan05 AssprincesNo ratings yet

- D. M. Consunji Inc. Vs NLRC: 116572: December 18, 2000: J. Kapunan: First DivisionDocument5 pagesD. M. Consunji Inc. Vs NLRC: 116572: December 18, 2000: J. Kapunan: First DivisionprincesNo ratings yet

- FATCA Agreement Philippines 7-13-2015Document53 pagesFATCA Agreement Philippines 7-13-2015princesNo ratings yet

- BIR: RMO No. 26-2016Document5 pagesBIR: RMO No. 26-2016John DavidNo ratings yet

- C#?J-RTF:"-C : Global Business Holdings, Eb NoDocument10 pagesC#?J-RTF:"-C : Global Business Holdings, Eb NoprincesNo ratings yet

- IPPDocument4 pagesIPPCrisel MaligligNo ratings yet

- Boi Form 501 RegularDocument4 pagesBoi Form 501 RegularprincesNo ratings yet

- Philippine Export Guidebook 2015 EditionDocument105 pagesPhilippine Export Guidebook 2015 EditionprincesNo ratings yet

- Sec Memo 06s2007Document8 pagesSec Memo 06s2007princesNo ratings yet

- SEC Statement - SEC Approves 2015 SRC Rules August 06 2015 PDFDocument2 pagesSEC Statement - SEC Approves 2015 SRC Rules August 06 2015 PDFprincesNo ratings yet

- Manual of Regulations IOD .02.03.16Document96 pagesManual of Regulations IOD .02.03.16RaedenNo ratings yet

- ERD.2.F.001 - Application For Income Tax HolidayDocument3 pagesERD.2.F.001 - Application For Income Tax Holidayprinces100% (1)

- 2012 NLRC Sheriffs' Manual On ExecutionDocument13 pages2012 NLRC Sheriffs' Manual On ExecutionBrian Baldwin100% (1)

- Sec Memo 02, s2009Document1 pageSec Memo 02, s2009princesNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)