Professional Documents

Culture Documents

Mutual Fund Hist

Mutual Fund Hist

Uploaded by

sai sreenivas dattaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mutual Fund Hist

Mutual Fund Hist

Uploaded by

sai sreenivas dattaCopyright:

Available Formats

Created by Unlicensed Version

by

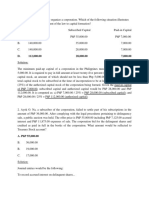

The mutual fund industry in

Unlicense

India started in 1963 with the

d Version

1963

formation of Unit Trust of

India, at the initiative of the

Government of India and

Reserve Bank.

During this period UTI got

delinked from RBI and the

IDBI took over the control

1964-1987

of regulatory and

administrative control in

place of RBI.The first

scheme launched by UTI

was Unit Scheme 1964.

At the end of 1988 UTI

had Rs.6,700 crores of

assets under

management.

Entry ofpublic sector mutual funds

set up by public sector banks like

SBI,CAN BANK ,PNB,INDIAN

1987-1993

BANK,BANK OF INDIA and BANK

OF BARODA.

LIC started its mutual fund in

JUNE1989 and GIC started its

mutual fund in DECEMBER

1990.At the end of 1993,mutual

fund industry had AUM of

RS.47,004 crores.

The erstwhile Kothari

Pioneer (now merged with

Franklin Templeton) was

the first private sector

mutual fund registered in

1993-2003

July 1993.The number of

mutual fund houses went

on increasing, with many

foreign mutual funds setting

up funds in India and also

the industry has witnessed

several mergers and

acquisitions. As at the end

of January 2003, there were

33 mutual funds with total

assets of Rs. 1, 21,805

crores. The Unit Trust of

From 2003 onwards mutual

India with Rs.44, 541

funds industry started growing

crores of assets under

at rapid pace.UTI got bifurcated

management was way

during this time.UTI split up into

ahead of other mutual

two parts,One is the Specified

funds.

Undertaking of the Unit Trust of

since 2003

India with AUM of Rs.29,835

crores as at the end of January

2003, representing broadly, the

assets of US 64 scheme,

assured return & certain other

schemes.The second is the UTI

Mutual Fund Ltd, sponsored by

SBI, PNB, BOB and LIC. It is

registered with SEBI and

functions under the Mutual Fund

Regulations.

assured return and

C re

c erta in othief assured

return and

certain

other ted

Created by Unlicensed Version

You might also like

- Investors Perception Towards Mutual FundsDocument60 pagesInvestors Perception Towards Mutual FundsBe Yourself67% (3)

- Intellectual Property Securitization: Intellectual Property SecuritiesFrom EverandIntellectual Property Securitization: Intellectual Property SecuritiesRating: 5 out of 5 stars5/5 (1)

- Internship ReportDocument70 pagesInternship ReportVishwaMohan50% (2)

- About Mutual Funds IndustryDocument2 pagesAbout Mutual Funds IndustryAbhishek JaiswalNo ratings yet

- History of Mutual Fund in IndiaDocument3 pagesHistory of Mutual Fund in IndiaranvinegiNo ratings yet

- Comparative Analysis of Mutual FundsDocument11 pagesComparative Analysis of Mutual FundsMurari NayuduNo ratings yet

- MF History: First Phase - 1964-1987Document3 pagesMF History: First Phase - 1964-1987vmktptNo ratings yet

- Evolution of Mutual Funds in IndiaDocument6 pagesEvolution of Mutual Funds in Indianikitasharma191919No ratings yet

- Mutul Fund PresentaionDocument14 pagesMutul Fund PresentaionShekhar JainNo ratings yet

- History of Mutual FundDocument2 pagesHistory of Mutual FundArchana VishwakarmaNo ratings yet

- Mutual Fund: Naresh KumarDocument15 pagesMutual Fund: Naresh KumarGaurav DeshmukhNo ratings yet

- Mutual Funds - Concept: Mutual Fund Operation Flow ChartDocument17 pagesMutual Funds - Concept: Mutual Fund Operation Flow ChartAnkit ModaniNo ratings yet

- Mutual Fund Management: A Comparative Study of Public and Private Sector Financial InstitutionsDocument16 pagesMutual Fund Management: A Comparative Study of Public and Private Sector Financial InstitutionsSilversterNo ratings yet

- Second Phase - 1987-1993 (Entry of Public Sector Funds)Document1 pageSecond Phase - 1987-1993 (Entry of Public Sector Funds)Àjãý VērmâNo ratings yet

- A Comparative Study of Mutual Fund Returns and Bank DepositsDocument55 pagesA Comparative Study of Mutual Fund Returns and Bank DepositsVishal MauryaNo ratings yet

- Mutual Funds - ConceptDocument55 pagesMutual Funds - ConceptNeHa VaRunNo ratings yet

- History of The Indian Mutual Fund IndustryDocument5 pagesHistory of The Indian Mutual Fund IndustryhemanthgatlaNo ratings yet

- Submitted By:: Parneet Walia 175 Mba 2Document17 pagesSubmitted By:: Parneet Walia 175 Mba 2Sonal UdawatNo ratings yet

- Mutual Funds IndustryDocument8 pagesMutual Funds IndustryPriyabrat SahooNo ratings yet

- Study of Tax Saving Schemes in Mutual Funds Mba ProjectDocument74 pagesStudy of Tax Saving Schemes in Mutual Funds Mba ProjectSachin Gala33% (6)

- Comparative Analsis On Mutual FundsDocument26 pagesComparative Analsis On Mutual FundsAKKI REDDYNo ratings yet

- Mutual Funds InvestingDocument32 pagesMutual Funds InvestingNaveen KumarNo ratings yet

- Industry: First Phase - 1964-1987Document4 pagesIndustry: First Phase - 1964-1987sayali SawantNo ratings yet

- Mutual FundDocument22 pagesMutual FundManpreet Singh NazNo ratings yet

- Bun Del ADocument1 pageBun Del AKuldeep PateriyaNo ratings yet

- A Comparative Study On Perforrmance of Mutual Fund Products Offered by HDFC & ICICI (Balraj)Document45 pagesA Comparative Study On Perforrmance of Mutual Fund Products Offered by HDFC & ICICI (Balraj)Amazing VideosNo ratings yet

- Concept of Mutual FundsDocument13 pagesConcept of Mutual FundsHemangi Naik KhalasiNo ratings yet

- Mutual FundDocument28 pagesMutual FundAnwar khanNo ratings yet

- Mutual Funds Industry in India: InvestorsDocument5 pagesMutual Funds Industry in India: InvestorskiranchandeyesNo ratings yet

- Icici Project 1Document85 pagesIcici Project 1rahulsogani123No ratings yet

- Financial Institution RegulatorDocument6 pagesFinancial Institution RegulatorAmi TandonNo ratings yet

- Mutual Funds Issues and Challenges-1Document10 pagesMutual Funds Issues and Challenges-1Rohit TiwariNo ratings yet

- BinderDocument1 pageBinderRajni GargNo ratings yet

- First Phase 1964-87Document21 pagesFirst Phase 1964-87bishnoi29_amitNo ratings yet

- Mutual Funds FunctionsDocument75 pagesMutual Funds FunctionsChristopher Paul50% (2)

- Tax Saving Schemes in Mutual FundsDocument75 pagesTax Saving Schemes in Mutual FundsK. SwathiNo ratings yet

- Mutual Find SBIDocument25 pagesMutual Find SBIMäñåň FãłķëNo ratings yet

- Mutual Fund in India UTIDocument70 pagesMutual Fund in India UTIkartik ChauhanNo ratings yet

- Mutual Funds1Document206 pagesMutual Funds1Anjy ChokraNo ratings yet

- 1.1 Introduction To The StudyDocument62 pages1.1 Introduction To The Studymalli aiswaryaNo ratings yet

- Subject: Environment of Financial System: Topic: Schemes of Uti (Unit Trust of India)Document30 pagesSubject: Environment of Financial System: Topic: Schemes of Uti (Unit Trust of India)Sanket SalviNo ratings yet

- Seminar Report On Mutual Fund and Its WorkingDocument13 pagesSeminar Report On Mutual Fund and Its WorkingDev BoseNo ratings yet

- TataDocument45 pagesTataSarika AroteNo ratings yet

- Leela Project 2018Document58 pagesLeela Project 2018Anonymous LbM7i3UaOjNo ratings yet

- Jeeva ProjectDocument8 pagesJeeva ProjectPonmari AppanNo ratings yet

- Project 1Document52 pagesProject 1Anurima BanerjeeNo ratings yet

- FileDocument75 pagesFileAarti Ladda SarafNo ratings yet

- Mutual Fund Investment InternshipDocument69 pagesMutual Fund Investment InternshipSv KhanNo ratings yet

- Fundamentals of Mutual FundsDocument66 pagesFundamentals of Mutual FundsKhushal ThakkarNo ratings yet

- MBA Project ReportDocument49 pagesMBA Project ReportNithya MadanamohanNo ratings yet

- Ishani AnaDocument83 pagesIshani Anaishani bhattNo ratings yet

- What Is A Mutual Fund?Document4 pagesWhat Is A Mutual Fund?Sonali RathiNo ratings yet

- Dhiraj ProjectDocument83 pagesDhiraj ProjectMadhuri KenjaleNo ratings yet

- RIMT Mutual FundDocument63 pagesRIMT Mutual Fundguri_toorNo ratings yet

- MJM0S200747Document2 pagesMJM0S200747Kishan KoliNo ratings yet

- List Template USA-doneDocument27 pagesList Template USA-donenikhilg01No ratings yet

- Emami-Zandu CaseDocument4 pagesEmami-Zandu CasepreetiNo ratings yet

- Title Page Name: Aman Jain Roll No: 10Document35 pagesTitle Page Name: Aman Jain Roll No: 10Aman JainNo ratings yet

- Cyril Amarchand MangaldasDocument4 pagesCyril Amarchand MangaldasKARTIK DABASNo ratings yet

- ATR 72-600 Avianca (HN) 1 - 120Document5 pagesATR 72-600 Avianca (HN) 1 - 120juansebastianrinconpinilla7890No ratings yet

- Guide To Non Operative Financial Holding Companies For New Banks in India PDFDocument32 pagesGuide To Non Operative Financial Holding Companies For New Banks in India PDFvishnu pNo ratings yet

- 162 019Document4 pages162 019Angelli LamiqueNo ratings yet

- 2022 NC Unit Assitance ListDocument8 pages2022 NC Unit Assitance ListMark DarroughNo ratings yet

- Service Manual vt-44 Pro PDFDocument16 pagesService Manual vt-44 Pro PDFjajanayaNo ratings yet

- Ejemplos MúltiplosDocument2 pagesEjemplos MúltiplosFernando QuispeNo ratings yet

- Test Bank For Managerial Accounting 7thDocument7 pagesTest Bank For Managerial Accounting 7thKarlo D. ReclaNo ratings yet

- Ifrs of Growing Importance For Us CompaniesDocument6 pagesIfrs of Growing Importance For Us Companiesisaac2008100% (3)

- Compliance CalendarDocument12 pagesCompliance CalendarAshish MallickNo ratings yet

- Free Proxy ListDocument7 pagesFree Proxy ListRipki PaturohmanNo ratings yet

- BlueFocus Communication GroupDocument2 pagesBlueFocus Communication Groupali kaloytaNo ratings yet

- CAMA 2020 DownloadDocument606 pagesCAMA 2020 DownloadmayorladNo ratings yet

- Chapter 6 Accounting For Bonus Issue and Right IssueDocument26 pagesChapter 6 Accounting For Bonus Issue and Right IssueGregory Django DipuraNo ratings yet

- Board of Directors Corporations: Interlocking Directorate Refers To The Practice of Members of A CorporateDocument2 pagesBoard of Directors Corporations: Interlocking Directorate Refers To The Practice of Members of A CorporateJoel JimenezNo ratings yet

- Mepal LeafDocument8 pagesMepal LeafMuhammadArshadNo ratings yet

- Beams11 ppt09Document19 pagesBeams11 ppt09Mario RosaNo ratings yet

- 1 Corporate Restructuring-IntroductionDocument25 pages1 Corporate Restructuring-IntroductionGarima MadanNo ratings yet

- Chapter 10: Mergers and AcquisitionsDocument23 pagesChapter 10: Mergers and AcquisitionsManan aroraNo ratings yet

- Walmart'S Acquisition of Flipkart: A Showstopper Deal?Document15 pagesWalmart'S Acquisition of Flipkart: A Showstopper Deal?Pratyuosh SrivastavNo ratings yet

- PPP Loans - Southold NY ($150,000-Plus)Document1 pagePPP Loans - Southold NY ($150,000-Plus)RiverheadLOCALNo ratings yet

- Reporting Intercorporate InterestDocument10 pagesReporting Intercorporate InterestArchit AgrawalNo ratings yet

- 2013 Complete Rules and GuidelinesDocument618 pages2013 Complete Rules and Guidelinesrenukashahu100% (2)

- Corporate Financial Strategy Lecture 4Document15 pagesCorporate Financial Strategy Lecture 4AsadvirkNo ratings yet

- ParCor QuizDocument4 pagesParCor QuizJinx Cyrus Rodillo0% (1)

- E-Commerce in India - WikipediaDocument13 pagesE-Commerce in India - WikipediaArvind KumarNo ratings yet

- LIST OF IMIT SAP StudentsDocument10 pagesLIST OF IMIT SAP StudentsAnkita PriyadarsiniNo ratings yet