Professional Documents

Culture Documents

Limclm LLoyds

Uploaded by

Sakshi DubeyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Limclm LLoyds

Uploaded by

Sakshi DubeyCopyright:

Available Formats

LONDON MARKET STANDARD CLAIMS MESSAGE

IMPLEMENTATION GUIDE

CLASS FOR LLOYDS

MESSAGES TO BROKERS FROM LPC.

This document sets out the rules relating to messages detailing syndicate responses which will be

sent to brokers in respect of Lloyds claims processed on CLASS.

The document has been based on the ILU section of the London Market Standard Claims

Message Implementation Guide, as last amended 28/10/1993, sections 3.1 to 3.5 inclusive. The

remainder of the document remains unaffected by CLASS for Lloyds.

Please note that what follows is a suggestion for the treatment of Lloyds responses. If any of you

foresee problems with what is proposed or would like to suggest improvements then please

contact the author.

I am mindful of the age of the original message specification documentation. If anything below is

at variance with what you know to be the current situation, then you should assume that the

current situation prevails.

The following is a summary of the differences between Lloyds and ILU messages.

1. CLASS for Lloyds uses the following syndicate response codes:

AUT = authorised (same as ILU)

NAK = not acknowledged (same as ILU)

QUE = queried (no ILU equivalent, roughly equivalent to LIRMA FIL response

REJ = rejected (roughly equivalent to ILU PEN response

2. LCO responses.

The proposal is to treat LCO as a participating syndicate, but with a line of zero

per-cent. The company code for LCO will always be LCO1. For the purposes of the

pilot, LCO is always a follower, but it is possible that in the production version LCO will

sometimes stand-in for the lead.

3. Signing Details.

In the absence of any signing details being sent to CLASS from LPSO systems, messages

to brokers will not include details of claims signings.

4. The transaction Validation Response value sent for query responses will be spaces.

5. CLASS for Lloyds allows up to five lines of leader comment narrative (ILU allows up to

three).

6. The simultaneous reinstatement flag will always be N for Lloyds entries on CLASS

since this feature cannot apply given the absence of links between CLASS and LPSO

systems.

LIMCLM Implementation Guide (last amended 28/10/93) Page 1

LONDON MARKET STANDARD CLAIMS MESSAGE

IMPLEMENTATION GUIDE

7. The following types of entry are not available under CLASS for Lloyds and therefore the

types of message which they generate for ILU will not be sent:

a. Conflict of Interest.

b. Lead Interim Advices.

c. Change of Leader.

d. C.P.A.

e. Salvage Association.

f. Automatic Deletions.

g. Objections.

As I have said above, any queries should be addressed to the author.

John Harrison (L.P.C.) 28th February 2000.

Phone: 01303 854689 (direct line) E-Mail: john.harrison@lpc.uk.com

LIMCLM Implementation Guide (last amended 28/10/93) Page 2

LONDON MARKET STANDARD CLAIMS MESSAGE

IMPLEMENTATION GUIDE

MESSAGES FROM LPC TO BROKERS FOR LLOYDS CLAIMS

ADVICE OF SYNDICATE RESPONSES

This type of message will be sent to advise the broker

of the actions taken by syndicates in response to a

claim.

CHD Claim Header Details

Processing Indicator values are:

Transaction

Type..............................001/002/003/004

Transaction Type Qualifier........001

Transaction Subtype...............not used

Transaction Validation Response...003/004

or spaces

Transaction Type will be set to the value for the type

of transaction to which the response applies.

Transaction Validation Response will be set to '003'

unless any Insurer Response Codes contained in the RES

segments in the message are set to 'REJ' (Rejected).

Then the Transaction Validation Response will be set

to '004'.

The Number of Outstanding Responses will identify the

number of insurers who have not responded.

FTX Free Text

FTX segments will be sent if the Lead Comments

Indicator in the LDR segment is set to 'Y'.

Up to five FTX segments may be sent, with a Text

Subject Code of '010', to provide the Lloyds leader's

comments regarding the claim.

MKT Insuring Market Details

One MKT segment will be sent for each syndicate that

has been selected to note/agree the claim.

Where L.C.O. are involved in the agreement process,

there will also be an MKT segment for L.C.O. The

LIMCLM Implementation Guide (last amended 28/10/93) Page 3

LONDON MARKET STANDARD CLAIMS MESSAGE

IMPLEMENTATION GUIDE

Company Code for L.C.O. will always be LCO1. The

L.C.O. share will always be zero.

ADVICE OF SYNDICATE RESPONSES (Continued)

RES Insuring Market Responses

One RES segment will be sent for each syndicate that

has been selected to authorise a settlement request,

immediately following the MKT to which it relates.

(This includes L.C.O.)

The RES segment will identify the company's response as

one of: AUT for Noted/Authorised

REJ for Rejected

NAK for No Acknowledgement

QUE for Queried

LDR Lloyds Leader Response Details

This segment will be sent immediately following the MKT

and RES segments for the Lloyds leader.

The Simultaneous Reinstatement Indicator will always be

set to N because there are no links between CLASS and

Lloyds own systems which allow the simultaneous

reinstatement function to be applied.

LIMCLM Implementation Guide (last amended 28/10/93) Page 4

LONDON MARKET STANDARD CLAIMS MESSAGE

IMPLEMENTATION GUIDE

UPDATE OF SYNDICATE RESPONSES

This type of message will be sent to update 'NAK'

responses to QUE,'REJ' or 'AUT', QUE responses to

AUT or REJ, or 'REJ' responses to 'AUT'. It will

also reflect any changes which can be made by the

Lloyds leader whilst the authorisation procedure is in

progress, including;

- addition of, or updates to, the Lloyds leader's

comments

- addition of syndicates to the list to authorise

- deletion of syndicates from the list to authorise

The data content of the message will be the same as

described for SYNDICATE RESPONSES in 3.1 above. All

previous data will be repeated.

CHD Claim Header Details

Processing Indicator values are:

Transaction Type ................. 001/002/003/004

Transaction Type Qualifier........ 002

Transaction Subtype............... not used

Transaction Validation Response... 003 / 004

or spaces

RES Insuring Market Responses

The Leading Underwriter can delete a syndicate from the

list of syndicates required to authorise a settlement.

In this case the MKT segment will not include the

relevant syndicate when it comes back to the Broker

(note that a list of all syndicates who have

responded/need to respond will always be returned

within the MKT, with an updated RES segment for each

one to give their current states).

LIMCLM Implementation Guide (last amended 28/10/93) Page 5

You might also like

- LimclmcDocument183 pagesLimclmcSakshi DubeyNo ratings yet

- LimclmeDocument78 pagesLimclmeSakshi DubeyNo ratings yet

- Specific Registration Requirements For Mechanical & Electrical Workhead (Me)Document5 pagesSpecific Registration Requirements For Mechanical & Electrical Workhead (Me)Giang LamNo ratings yet

- 997 Functional Acknowledgment FormatDocument23 pages997 Functional Acknowledgment FormattamtolemolaNo ratings yet

- Comptel Convergent Mediation™: Installation GuideDocument12 pagesComptel Convergent Mediation™: Installation Guidejuanete29No ratings yet

- An-InD-1-004 Diagnostics Via Gateway in CANoeDocument80 pagesAn-InD-1-004 Diagnostics Via Gateway in CANoeUpendra VaddeNo ratings yet

- Daimler Trucks North America LLC: EDI Implementation Guide 861 Receiving AdviceDocument14 pagesDaimler Trucks North America LLC: EDI Implementation Guide 861 Receiving AdviceLuis Clemente ZúñigaNo ratings yet

- FTA - Report - WPT 2014 PDFDocument61 pagesFTA - Report - WPT 2014 PDFJustin SitohangNo ratings yet

- (KRX) Management+Plan+for+Algorithmic+Trading (1) Algorithmic Trading in The KRX Derivatives MarketDocument27 pages(KRX) Management+Plan+for+Algorithmic+Trading (1) Algorithmic Trading in The KRX Derivatives MarketJay LeeNo ratings yet

- WORK CHALLENGES FACED & IMPROVEMENTS SUGGESTED/IMPLEMENTED PPT by H N SharmaDocument8 pagesWORK CHALLENGES FACED & IMPROVEMENTS SUGGESTED/IMPLEMENTED PPT by H N SharmaH100% (1)

- Rogue trading risks and back office trainingDocument5 pagesRogue trading risks and back office training문영진No ratings yet

- WS Coordination: Nurhak Karakaya & Murat ÇavdarDocument25 pagesWS Coordination: Nurhak Karakaya & Murat ÇavdarAnub A NairNo ratings yet

- Estidama Completeness Checklist Design Rating - v11Document2 pagesEstidama Completeness Checklist Design Rating - v11lulu eng100% (1)

- Tele-Communication (Telecom) Terms Glossary and DictionaryDocument188 pagesTele-Communication (Telecom) Terms Glossary and DictionaryRaja ImranNo ratings yet

- EFET CBAM Questions For ClarificationDocument4 pagesEFET CBAM Questions For Clarificationbarb2095No ratings yet

- Process Manual: M1-PM-03-HRDD-B-01Document3 pagesProcess Manual: M1-PM-03-HRDD-B-01SCADA MORESCO-1No ratings yet

- MSC Server Dimensioning: A Interface SignalingDocument64 pagesMSC Server Dimensioning: A Interface SignalingAsaadAdeepNo ratings yet

- CDR COLLECTION DOCUMENTATION FOR EWSD SWITCHDocument11 pagesCDR COLLECTION DOCUMENTATION FOR EWSD SWITCH830139No ratings yet

- Substation Automation Using IEC 61850 StandardDocument5 pagesSubstation Automation Using IEC 61850 Standardkaka_tpNo ratings yet

- CSZ Sfi Standard v4Document7 pagesCSZ Sfi Standard v4Shingirai PfumayarambaNo ratings yet

- E Book On ADC ProductsDocument29 pagesE Book On ADC ProductsSudharani YellapragadaNo ratings yet

- Network Chapter# 20: Transport Protocols Transport Protocols Transport Protocols Transport ProtocolsDocument6 pagesNetwork Chapter# 20: Transport Protocols Transport Protocols Transport Protocols Transport ProtocolsRevathi RevaNo ratings yet

- c352 Troubleshooting GuideDocument54 pagesc352 Troubleshooting Guideroosterman4everNo ratings yet

- Assignment 6-7Document34 pagesAssignment 6-7chamundihariNo ratings yet

- Trade finance steps TLP should have takenDocument1 pageTrade finance steps TLP should have takenakshita ramdasNo ratings yet

- Using The Printed Form of The Standard Conditions of Sale (FDocument12 pagesUsing The Printed Form of The Standard Conditions of Sale (FKnowledge GuruNo ratings yet

- V1000 Control FreeRWDocument9 pagesV1000 Control FreeRWJesús RomeroNo ratings yet

- IEC1107 Protocol Reading for Meter No. 873411060122Document3 pagesIEC1107 Protocol Reading for Meter No. 873411060122मेनसन लाखेमरूNo ratings yet

- RMIS Documentation Addendum - AttachDetach API 072814Document10 pagesRMIS Documentation Addendum - AttachDetach API 072814Sakthivel P100% (1)

- Control WaveDocument306 pagesControl WaveInnocent FabianNo ratings yet

- Emd Draft Doc 1559044 417768 1579358551Document3 pagesEmd Draft Doc 1559044 417768 1579358551ramprat007No ratings yet

- Frequently Asked Questions:: Bca Contractors Registration System (CRS)Document7 pagesFrequently Asked Questions:: Bca Contractors Registration System (CRS)Peter NgNo ratings yet

- TN-4620190912122 Form21B SignedDocument1 pageTN-4620190912122 Form21B SignedMansoor Theen100% (1)

- Strategic Impact of IT in DTH IndustryDocument24 pagesStrategic Impact of IT in DTH IndustrySaurabh GuptaNo ratings yet

- RJ SPDCLDocument8 pagesRJ SPDCLchinnaNo ratings yet

- Unit 4 - Wireless CommunicationDocument8 pagesUnit 4 - Wireless CommunicationZappYNo ratings yet

- GEI-100165 Ethernet TCP-IP GEDS Standard Message Format (GSM)Document30 pagesGEI-100165 Ethernet TCP-IP GEDS Standard Message Format (GSM)Mohamed Amine100% (1)

- Implementation of Turbo Coder Using Verilog HDL For LTEDocument4 pagesImplementation of Turbo Coder Using Verilog HDL For LTEInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Eden Network Proposes Optional Transaction Ordering ProtocolDocument9 pagesEden Network Proposes Optional Transaction Ordering ProtocolUsman AhmadNo ratings yet

- Cbec Mig ExportdeclarationDocument45 pagesCbec Mig ExportdeclarationSameer KhanNo ratings yet

- Analysis of A High-Potential Business: Sqreen: Application Security Management PlatformDocument13 pagesAnalysis of A High-Potential Business: Sqreen: Application Security Management Platformhinaya khanNo ratings yet

- CSV472139 John Deere (Tianjin) 6135B Test ReportDocument296 pagesCSV472139 John Deere (Tianjin) 6135B Test ReportLeoNo ratings yet

- #Ped Lab 03Document24 pages#Ped Lab 03akilaNo ratings yet

- Do not share study notes on messaging appsDocument13 pagesDo not share study notes on messaging appsZappYNo ratings yet

- User Manual For IREPS Reverse AuctionDocument14 pagesUser Manual For IREPS Reverse AuctionVikash Singhi0% (1)

- 03-61968-9 Meter Reading and Control PDFDocument54 pages03-61968-9 Meter Reading and Control PDFIgor SangulinNo ratings yet

- Best Practices For EV Infrastructure Regulations 1219 VEVCDocument2 pagesBest Practices For EV Infrastructure Regulations 1219 VEVCJim HindsonNo ratings yet

- Network Protocols and Communication ExplainedDocument5 pagesNetwork Protocols and Communication ExplainedM1JoeKillerNo ratings yet

- ePDQ DirectLink en OriginalDocument24 pagesePDQ DirectLink en Originalsoleone9378No ratings yet

- DdedemoDocument10 pagesDdedemoNancy LimonNo ratings yet

- NXP SE05x T 1 Over I C Specification: Rev. 1.2 - 10 December 2020 User Manual Company PublicDocument26 pagesNXP SE05x T 1 Over I C Specification: Rev. 1.2 - 10 December 2020 User Manual Company Publicmartin ruppNo ratings yet

- Exhibit 1-Bruce TelecomDocument8 pagesExhibit 1-Bruce TelecomFederal Communications Commission (FCC)No ratings yet

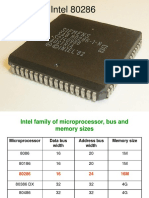

- Intel 80286Document24 pagesIntel 80286Rajesh PatelNo ratings yet

- LimclmdDocument120 pagesLimclmdSakshi DubeyNo ratings yet

- Mocktail Finance: MoktokenDocument14 pagesMocktail Finance: MoktokenUcu AkhirianiNo ratings yet

- Giudance Note On LME Trading SystemDocument4 pagesGiudance Note On LME Trading SystemshivaNo ratings yet

- ISO 8583 A Layman's GuideDocument7 pagesISO 8583 A Layman's GuideFaisal BasraNo ratings yet

- LME Policy On COTRDocument5 pagesLME Policy On COTRAnish ShahNo ratings yet

- Line Slip June 2005Document23 pagesLine Slip June 2005shailen2uNo ratings yet

- SWIFT Standards Category 2 Financial Institution TransfersDocument228 pagesSWIFT Standards Category 2 Financial Institution Transfersliittokivi100% (3)

- LimclmdDocument120 pagesLimclmdSakshi DubeyNo ratings yet

- LimclmaDocument11 pagesLimclmaSakshi DubeyNo ratings yet

- LimclmbDocument34 pagesLimclmbSakshi DubeyNo ratings yet

- LimclmfDocument111 pagesLimclmfSakshi DubeyNo ratings yet

- Gmat Handbook PDFDocument17 pagesGmat Handbook PDFSakshi DubeyNo ratings yet

- TheoryTestCompilation PDFDocument10 pagesTheoryTestCompilation PDFSakshi DubeyNo ratings yet

- MR GMAT Sentence Correction GuideDocument209 pagesMR GMAT Sentence Correction GuideMahtab ChondonNo ratings yet

- TheoryTest Drive PDFDocument10 pagesTheoryTest Drive PDFSakshi DubeyNo ratings yet

- Experience Andamans Standard 5N6D (Winter Special)Document9 pagesExperience Andamans Standard 5N6D (Winter Special)Sakshi DubeyNo ratings yet

- Lbs Portcal2015 Final 0615Document19 pagesLbs Portcal2015 Final 0615Sakshi DubeyNo ratings yet

- 1967 2013 PDFDocument70 pages1967 2013 PDFAlberto Dorado Martín100% (1)

- Teaching Methods in The PhilippinesDocument2 pagesTeaching Methods in The PhilippinesTonee Marie Gabriel60% (5)

- Ndeb Bned Reference Texts 2019 PDFDocument11 pagesNdeb Bned Reference Texts 2019 PDFnavroop bajwaNo ratings yet

- Ms. Rochelle P. Sulitas – Grade 7 SCIENCE Earth and Space Learning PlanDocument4 pagesMs. Rochelle P. Sulitas – Grade 7 SCIENCE Earth and Space Learning PlanEmelynNo ratings yet

- Python operators and data types quizDocument34 pagesPython operators and data types quizATUL SHARMANo ratings yet

- Applsci 13 13339Document25 pagesApplsci 13 13339ambroseoryem1No ratings yet

- Annual Reading Plan - Designed by Pavan BhattadDocument12 pagesAnnual Reading Plan - Designed by Pavan BhattadFarhan PatelNo ratings yet

- Assignement 4Document6 pagesAssignement 4sam khanNo ratings yet

- H2 Physic 2010 A Level SolutionsDocument32 pagesH2 Physic 2010 A Level Solutionsonnoez50% (4)

- Distillation Lab ReportDocument6 pagesDistillation Lab ReportSNo ratings yet

- SOYER Bend Testing Device BP-1Document2 pagesSOYER Bend Testing Device BP-1abdulla_alazzawiNo ratings yet

- Introduction To Human Anatomy & Physiology: Prepared by Mr. Abhay Shripad Joshi Yash Institute of Pharmacy AurangabadDocument18 pagesIntroduction To Human Anatomy & Physiology: Prepared by Mr. Abhay Shripad Joshi Yash Institute of Pharmacy AurangabadMourian AmanNo ratings yet

- Latest Information Technology Trends 2023Document5 pagesLatest Information Technology Trends 2023Salveigh C. TacleonNo ratings yet

- Cse 3003: Computer Networks: Dr. Sanket Mishra ScopeDocument56 pagesCse 3003: Computer Networks: Dr. Sanket Mishra ScopePOTNURU RAM SAINo ratings yet

- Marine Ecotourism BenefitsDocument10 pagesMarine Ecotourism Benefitsimanuel wabangNo ratings yet

- Cambridge English Business Vantage Sample Paper 1 Listening v2Document5 pagesCambridge English Business Vantage Sample Paper 1 Listening v2salma23478No ratings yet

- Creatinine JaffeDocument2 pagesCreatinine JaffeOsinachi WilsonNo ratings yet

- JSMSC - TDv3 6 20Document251 pagesJSMSC - TDv3 6 20Jason20170% (1)

- Lesson Plan in ESPDocument4 pagesLesson Plan in ESPkaren daculaNo ratings yet

- CS Sample Paper 1Document10 pagesCS Sample Paper 1SpreadSheetsNo ratings yet

- Compass 5000.1.12 157605HDocument360 pagesCompass 5000.1.12 157605HApurbajyoti Bora100% (2)

- Alicrite StringDocument4 pagesAlicrite Stringtias_marcoNo ratings yet

- M HNDTL SCKT Imp BP RocDocument2 pagesM HNDTL SCKT Imp BP RocAhmed Abd El RahmanNo ratings yet

- Administration and Supervisory Uses of Test and Measurement - Coronado, Juliet N.Document23 pagesAdministration and Supervisory Uses of Test and Measurement - Coronado, Juliet N.Juliet N. Coronado89% (9)

- FSA&V Case StudyDocument10 pagesFSA&V Case StudyAl Qur'anNo ratings yet

- The Mini-Guide To Sacred Codes and SwitchwordsDocument99 pagesThe Mini-Guide To Sacred Codes and SwitchwordsJason Alex100% (9)

- Fundamentals of Accountancy Business Management 2: Learning PacketDocument33 pagesFundamentals of Accountancy Business Management 2: Learning PacketArjae Dantes50% (2)

- MPU 2232 Chapter 5-Marketing PlanDocument27 pagesMPU 2232 Chapter 5-Marketing Plandina azmanNo ratings yet

- CFPA E Guideline No 2 2013 FDocument39 pagesCFPA E Guideline No 2 2013 Fmexo62No ratings yet

- Assessment of Concrete Strength Using Flyash and Rice Husk AshDocument10 pagesAssessment of Concrete Strength Using Flyash and Rice Husk AshNafisul AbrarNo ratings yet

- The Certified Master Contract AdministratorFrom EverandThe Certified Master Contract AdministratorRating: 5 out of 5 stars5/5 (1)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityFrom EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNo ratings yet

- What Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreFrom EverandWhat Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreRating: 4 out of 5 stars4/5 (2)

- Crash Course Business Agreements and ContractsFrom EverandCrash Course Business Agreements and ContractsRating: 3 out of 5 stars3/5 (3)

- How to Win Your Case in Small Claims Court Without a LawyerFrom EverandHow to Win Your Case in Small Claims Court Without a LawyerRating: 5 out of 5 stars5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- How to Improvise a Full-Length Play: The Art of Spontaneous TheaterFrom EverandHow to Improvise a Full-Length Play: The Art of Spontaneous TheaterNo ratings yet

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetFrom EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNo ratings yet

- Broadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessFrom EverandBroadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessNo ratings yet

- Fundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignFrom EverandFundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignRating: 3.5 out of 5 stars3.5/5 (3)

- How to Win Your Case In Traffic Court Without a LawyerFrom EverandHow to Win Your Case In Traffic Court Without a LawyerRating: 4 out of 5 stars4/5 (5)