Professional Documents

Culture Documents

Stamp Duty & Registration Fees Ready Reckoner For The State of Gujarat

Stamp Duty & Registration Fees Ready Reckoner For The State of Gujarat

Uploaded by

Rakshit Tyagi0 ratings0% found this document useful (0 votes)

7 views1 pageThe document outlines the stamp duty and registration fees for sale or conveyance deeds of immovable property in the state of Gujarat. The stamp duty rate is 4.9% of the sale consideration. The registration charge is 1% of the sale consideration, but is waived if the sale is executed in favor of a female buyer or all buyers of a single property are female. Additional registration fees include advocate fees, folio fees of Rs. 10 per page, and index fees of Rs. 50 per copy.

Original Description:

stamp duty rates

Original Title

gujrat

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the stamp duty and registration fees for sale or conveyance deeds of immovable property in the state of Gujarat. The stamp duty rate is 4.9% of the sale consideration. The registration charge is 1% of the sale consideration, but is waived if the sale is executed in favor of a female buyer or all buyers of a single property are female. Additional registration fees include advocate fees, folio fees of Rs. 10 per page, and index fees of Rs. 50 per copy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageStamp Duty & Registration Fees Ready Reckoner For The State of Gujarat

Stamp Duty & Registration Fees Ready Reckoner For The State of Gujarat

Uploaded by

Rakshit TyagiThe document outlines the stamp duty and registration fees for sale or conveyance deeds of immovable property in the state of Gujarat. The stamp duty rate is 4.9% of the sale consideration. The registration charge is 1% of the sale consideration, but is waived if the sale is executed in favor of a female buyer or all buyers of a single property are female. Additional registration fees include advocate fees, folio fees of Rs. 10 per page, and index fees of Rs. 50 per copy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

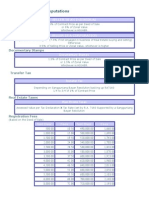

Stamp Duty & Registration Fees Ready Reckoner for The State of Gujarat

Rate of Stamp Duty on Sale/Conveyance Deed of Immovable Property

Basic rate of Stamp duty is 3.50 percent

Surcharge at the rate of 40 percent on basic rate 1.4 percent

Total Stamp duty 4.90 percent

(i.e. Rs. 4.90 for every Rs. 100/- of Sale Consideration or part thereof)

Rate of Registration Chargeson Sale/Conveyance Deed of Immovable Property

Basic rate of Registration Charge is 1.00 percent

(i.e. Rs. 1 for every Rs. 100/- of Sale Consideration or part thereof)

1. Registration charge is not applicable if sale is executed in favour of female buyer

2. For more than one buyer for a single property, all buyers shall be female for availing such waiver of

registration charge.

3. Additional charges are as follows for registration:

a. Advocate fees as per rate from time to time

b. Folio fees of Rs. 10 per page or at the rate as may revised by government from time to time

c. Index fees or Rs. 50 per copy

You might also like

- Guide When Buying Real Estate in The PhilippinesDocument1 pageGuide When Buying Real Estate in The PhilippinesER O'PlaneNo ratings yet

- Extrajudicial Settlement of Estate Rule 74, Section 1 ChecklistDocument8 pagesExtrajudicial Settlement of Estate Rule 74, Section 1 ChecklistMsyang Ann Corbo DiazNo ratings yet

- Transfer Tax (Tax 1)Document5 pagesTransfer Tax (Tax 1)Irdo Kwan100% (1)

- The 2013 Real Estate GuideDocument2 pagesThe 2013 Real Estate GuidebilogskiNo ratings yet

- Steps in Transfer of TCTDocument2 pagesSteps in Transfer of TCTPogi akoNo ratings yet

- How Much Does It Cost To Transfer A Land TitleDocument2 pagesHow Much Does It Cost To Transfer A Land TitleMark Jeson Lianza PuraNo ratings yet

- Brokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableDocument2 pagesBrokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableLaser ArtzNo ratings yet

- Stamp Duty in RajasthanDocument22 pagesStamp Duty in RajasthanPooja MisraNo ratings yet

- Taxes and Costs DefinitivoDocument5 pagesTaxes and Costs DefinitivoEMMANUEL JASON CASASNo ratings yet

- Guide Rent RegardingDocument2 pagesGuide Rent RegardingManjunatha ReddyNo ratings yet

- WhatsNew - Service Charge (GST) - E143467a15Document11 pagesWhatsNew - Service Charge (GST) - E143467a15MD ShakeelNo ratings yet

- Court FeeDocument1 pageCourt Feenimmyvictor121No ratings yet

- How Much Does It Cost To Transfer A Land Title in The PhilippinesDocument5 pagesHow Much Does It Cost To Transfer A Land Title in The PhilippinesDebra BraciaNo ratings yet

- Compilation - Stamp Duty - Lease DeedDocument7 pagesCompilation - Stamp Duty - Lease Deedamicuslegal02No ratings yet

- Guide Buyer SelletDocument2 pagesGuide Buyer SelletengrandyNo ratings yet

- Https WWW - Karnataka.gov - in Karigr Modeldeeds SaledDocument4 pagesHttps WWW - Karnataka.gov - in Karigr Modeldeeds SaledAnonymous 1uGSx8bNo ratings yet

- Local TaxesDocument10 pagesLocal Taxesrocknekennethnicolas49No ratings yet

- Idirect - Brokerage PlansDocument7 pagesIdirect - Brokerage PlansJitenNo ratings yet

- Other Percentage Taxes Transaction/Entity Tax Rate Tax BaseDocument4 pagesOther Percentage Taxes Transaction/Entity Tax Rate Tax BaseClarissa de VeraNo ratings yet

- Taxation On Real Estate TransactionsDocument3 pagesTaxation On Real Estate TransactionsGlynda ChanNo ratings yet

- Key Fact DocumentDocument2 pagesKey Fact DocumentJagiNo ratings yet

- Duty & Fees - Stamp Duty and Registration FeeDocument5 pagesDuty & Fees - Stamp Duty and Registration FeeBoopathy RangasamyNo ratings yet

- Car Finance NotesDocument1 pageCar Finance NotesarqumcNo ratings yet

- Service Charges As Per Rbi GuidelinesDocument10 pagesService Charges As Per Rbi Guidelineskrunal3726No ratings yet

- Basic Real Estate ComputationsDocument4 pagesBasic Real Estate ComputationsEliza Corpuz GadonNo ratings yet

- Percentage Taxes: Line of Business/ Activity Tax Base Tax RateDocument2 pagesPercentage Taxes: Line of Business/ Activity Tax Base Tax RateMae MaupoNo ratings yet

- Trad Free ChargesDocument1 pageTrad Free ChargesanimeshtechnosNo ratings yet

- Tariff SheetDocument2 pagesTariff Sheetsahapdeen haiderNo ratings yet

- Trad Free ChargesDocument3 pagesTrad Free Chargestejasparmar12345678No ratings yet

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaNo ratings yet

- Service ChargeDocument3 pagesService ChargerohanNo ratings yet

- DP Tariff Latest 1500Document1 pageDP Tariff Latest 1500Vinodh KumarNo ratings yet

- Schedule of Charges - Citi Prestige CardDocument2 pagesSchedule of Charges - Citi Prestige CardVarun SidanaNo ratings yet

- Niyo Global SBM CC - SOCDocument1 pageNiyo Global SBM CC - SOCMohit OberoiNo ratings yet

- Click HereDocument2 pagesClick HereRajesh AroraNo ratings yet

- Taxes in The ProvinceDocument2 pagesTaxes in The ProvinceCarla Louise Bulacan BayquenNo ratings yet

- IIFL Z20 - Revised Plan - Product Note - 31st Dec 2020Document2 pagesIIFL Z20 - Revised Plan - Product Note - 31st Dec 2020Piyush JainNo ratings yet

- Zaggle Fee StructureDocument1 pageZaggle Fee StructureVishal TiwariNo ratings yet

- Cash Back Titanium CardsDocument1 pageCash Back Titanium CardsAshutosh SinghNo ratings yet

- Haryana Stamp ActDocument4 pagesHaryana Stamp ActRupali SamuelNo ratings yet

- Retail Ground Floor - Price ListDocument9 pagesRetail Ground Floor - Price Listbigdealsin14No ratings yet

- HDB - Interest Rates and ChargesDocument2 pagesHDB - Interest Rates and ChargesManish PandeyNo ratings yet

- TariffSheet YouthPlanDocument1 pageTariffSheet YouthPlanRahul PatilNo ratings yet

- Authoritative Guide On Real Estate Transfer TaxesDocument37 pagesAuthoritative Guide On Real Estate Transfer TaxesJames ReyesNo ratings yet

- Key Fact Statement CorporateDocument7 pagesKey Fact Statement CorporateRAM MAURYANo ratings yet

- 2020-03-26 Stamp Duty and Registration Fee T NaduDocument5 pages2020-03-26 Stamp Duty and Registration Fee T Naduvganapathy1000No ratings yet

- Transcript Order Non-AppealDocument1 pageTranscript Order Non-Appealkahopper1968No ratings yet

- Niyo Global SBM CC - SOCDocument1 pageNiyo Global SBM CC - SOCAvijit DebnathNo ratings yet

- Apital Alue AX: Capital Value Tax Rules, 1990 Are One of Its Sources. Direct TaxDocument2 pagesApital Alue AX: Capital Value Tax Rules, 1990 Are One of Its Sources. Direct TaxTalha ImtiazNo ratings yet

- Celestial Price SheetDocument1 pageCelestial Price SheetEmani RaghavendraNo ratings yet

- Business and Transfer TaxationDocument5 pagesBusiness and Transfer TaxationElizabeth OlaNo ratings yet

- Transfer Certificate of Land Title in The PhilippinesDocument4 pagesTransfer Certificate of Land Title in The PhilippinesNea QuiachonNo ratings yet

- Preferred AccountDocument2 pagesPreferred AccountaurummaangxinchenNo ratings yet

- GFCBJJVDFBKKDocument1 pageGFCBJJVDFBKKHare KrishnaNo ratings yet

- We Will Be Bringing You A Series of Articles That Discuss Commonly Asked Questions Regarding Real Estate in GeneralDocument2 pagesWe Will Be Bringing You A Series of Articles That Discuss Commonly Asked Questions Regarding Real Estate in Generalmarnil alfornonNo ratings yet

- Brokerage Charges Brochure Part 2061010Document1 pageBrokerage Charges Brochure Part 2061010John Xi Zhen HuanNo ratings yet

- Stamp Duty For ResaleDocument3 pagesStamp Duty For ResaleMilind DandekarNo ratings yet