Professional Documents

Culture Documents

Accounting Standard (AS) Accounting Standard (AS) - 16 16 G G Borrowing Costs Borrowing Costs

Uploaded by

charrisedelarosaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Standard (AS) Accounting Standard (AS) - 16 16 G G Borrowing Costs Borrowing Costs

Uploaded by

charrisedelarosaCopyright:

Available Formats

Accountingg Standard (AS) -16

Borrowing Costs

By: Mehul Shah

(M) 09723459572

E-mail: info@raseshca.com

Rasesh Shah & Associates

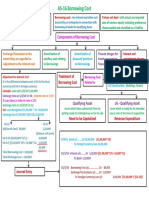

Borrowing Costs

Rasesh Shah & Associates

Borrowing Costs

Borrowing Costs

Interest & Amortization

A ti ti

commitment Exchange

of ancillary costs

charges relating to

Differences*

on Borrowings Borrowings g

Amortisation Finance charges

of Discount for assets

/ Premium acquired on

on Borrowings Finance Lease

*To the extent they are regarded as an adjustment to interest cost

Rasesh Shah & Associates

Q: Exchange Differences When to be treated

as Borrowing Costs?

Ans: To the extent regarded as adjustment to

interest cost.

Adjustment =

Interest on local currency borrowing

Interest on foreign currency borrowing

The adjustment is restricted to amount of

exchange loss on principal due to

devaluation of currency

Rasesh Shah & Associates

Treatment of Exchange Differences

Loan Amount : USD 10,000

Rate of Interest (in U.S.A.) : 8% p.a.

Exchange rate as at 01.04.2005 : Rs. 40 per USD

Exchange rate as at 31.03.2006 : Rs. 45 per USD

Rate of Interest (in India) : 12%

Contd..

Rasesh Shah & Associates

Treatment of Exchange Differences

Computations to be made:

1. Interest for the Period = USD 10,000 x 8% x Rs. 45

= Rs. 36,000/-

2. Increase in liability towards the principal amount

= USD 10

10,000

000 x (45-40)

(45 40)

= Rs. 50,000/-

3 Interest if loan was raised in India

3.

= USD 10,000 x 48 x 12%

= Rs.

s 48,000/-

8,000/

4. Difference (2-1) = Rs. 48,000 Rs. 36,000

= Rs. 12,000/- Contd..

Rasesh Shah & Associates

Treatment of Exchange Differences

Treatment of Exchange Differences of Rs. 50,000/-

Rs. 12,000/- Rs. 38,000/-

To be treated To be capitalised

as borrowing cost to loan obligation

as per AS -16 as per SCH VI

Note: The amount of borrowing costs capitalised during a period should

not exceed the amount of borrowing costs incurred during the period

Rasesh Shah & Associates

Qualifying Assets

D fi iti

Definition:

an asset

that takes substantial period of time

to get ready for intended sale or usage

According to ASI 1, a rebuttable presumption of a

period of 12 months is considered as a substantial period

of time

time.

Qualifying asset may be:

- Fixed assets

- Inventories

Rasesh Shah & Associates

Treatment of Borrowing Costs

Borrowing Costs

Directly attributable

attributable* for:

acquisition

construction

production

p od ction of

Assets

A t other

th th

than

Qualifying Assets

Qualifying assets

Capitalised as part Treated as

of asset revenue expenditure

*that could have been avoided if the expenditure on qualifying assets had not been made

Rasesh Shah & Associates

Criteria for Capitalisation

Criteria

Future Economic Benefits

Reliable Measurement

N t :E

Note Expenses nott ffulfilling

lfilli the

th criteria

it i tot be

b

treated as revenue expenditure

Rasesh Shah & Associates

Borrowings Cost (Interest)

Borrowings Cost

Specifically for Generally but part used

Qualifying Assets for Qualifying Assets

Apply actual Apply weighted

rate of Interest* average rate

t off iinterest*

t t*

Capitalise the Borrowing Costs less interest

income from temporary investments, if any

Rasesh Shah & Associates Rate of interest should be applied on Expenditure

Calculation of Weighted Average Rate of Interest

Illustration

ABC Co. Ltd. undertakes significant expansion program and incurs following capital

expenditure:

Facility Capex Remarks Date Date of

(in Rs.) of Start Completion

Plant I 30 Lacs Specific Borrowing to the June 1, December 31,

extent of Rs.

Rs 22 Lacs 2005 2005

Plant II 20 Lacs Specific Borrowing to the June 1, November 30,

extent of Rs. 8 Lacs 2005 2005

Additional Information:

1. Rs. 20 Lacs , 11% p.a. secured debentures raised on July2004

redeemable in four equal installments commencing July 1, 2005

2. Loan from financial institutions amounting to Rs. 30 Lacs bearing interest

at 14% p.a. obtained for construction of Plant I & II on May 1,2005

3. Rs. 5 Lacs, 14% working capital loan obtained on April 1, 2005 and

repaid Rs. 1 Lac on December 31, 2005. Contd..

Rasesh Shah & Associates

Calculation of Weighted Average Rate of Interest

Solution

A. Calculation of borrowing costs for the year ended on March 31, 2006

1. Secured debentures

= 20,00,000 x 11% x 3 / 12 = 55,000/-

= 15,00,000 x 11% x 9 /12 = 1,23,750/-

2. Loan from financial Institutions

= 30,00,000 x 14% x 11 / 12 = 3,85,000/-

3. Working Capital Loan

= 5,00,000 x 14% x 9 / 12 = 52,500/-

= 4,00,000 x 14% x 3 / 12 = 14,000/-

B

B. Cal lation of a

Calculation average

e age unspecified

nspe ified borrowings

bo o ings outstanding

o tstanding during

d ing the year

ea

1. Secured debentures

= 20,00,000 x 3 / 12 = 5,00,00/-

= 15

15,00,000

00 000 x 9/12 = 11,25,000/-

11 25 000/

2. Secured working capital loan

= 5,00,000 x 9 / 12 = 3,75,000/-

, ,

= 4,00,000 x 3 / 12 =1,00,000/-

, , /

Total (1+2) 21,00,000/- Contd..

Rasesh Shah & Associates

Calculation of Weighted Average Rate of Interest

Solution

C. Calculation of average interest on unspecified borrowings for the year

1

1. Secured debentures

= 20,00,000 x 11% x 3 / 12 = 55,000/-

= 15,00,000

, , x 11% x 9 /12

/ = 1,23,750/-

, , /

2. Working Capital Loan

= 5,00,000 x 14% x 9 / 12 = 52,500/-

= 4,00,000 x 14% x 3 / 12 = 14,000/-

TOTAL (1+2) 2,45,250/-

D. Average interest rate for the year ( C / B )

= (2,45,250 / 21,00,000) * 100 = 11.67%

Contd..

Rasesh Shah & Associates

Interest to be capitalised

Solution

Interest Capitalised

1. Plant I

On specific borrowings: 22,00,000 X 14% X 7 / 12 = 1,79,667/-

On general Borrowings: 8,00,000

8 00 000 x 11.67%

11 67% x 7 / 12 = 54,460/

54 460/-

2

2. Plant II

On specific borrowings: 8,00,000 X 14% X 6 / 12 = 56,000/-

On general Borrowings: 12,00,000 x 11.67% x 6 / 12 = 70,020/-

Rasesh Shah & Associates

Commencement of Capitalisation

Expenditure for the

acquisition

construction

production

of a qualifying asset is being incurred

Conditions Borrowing costs are being incurred

Necessary activities for preparation

of qualifying assets are in progress

Rasesh Shah & Associates

Expenditure on Qualifying Asset

includes

Payment of cash

Transfer of other assets

Assumption of interest bearing liabilities

Expenditure

Progress Payment receivedd

Grant received towards the cost

Should be deducted from expenditure.

Rasesh Shah & Associates

Suspension of Capitalisation

Criteria

Capitalisation to be suspended during

extended periods in which active

development is hampered.

Suspension not to take place in case:

substantial technical & administrative

work is being carried on

temporary delays necessary for

preparation of qualifying assets (seasonal

rains etc.)

etc )

Rasesh Shah & Associates

Cessation of Capitalisation

Criteria

Capitalisation should cease when substantially all the

the activities necessary to prepare the qualifying

asset for its intended use or sale are complete.

Cessation to take place even if:

routine administrative work still continues

minor modifications to property as per users

specifications is to be made

Cessation to take place in part if:

Construction

C i off qualifying

lif i asset is

i completed

l d in

i

parts and a part is capable of being used

separately

Rasesh Shah & Associates

Disclosure Requirements

The financial statements should disclose:

1. the accounting policy adopted for borrowing costs

2. The amount of borrowing costs capitalised

Rasesh Shah & Associates

Disclosure Requirements

Example 2

Name of the Company : NICHOLAS PIRAMAL INDIA LIMITED

Financial Year : 2004-05

Auditors : Price Waterhouse

Notes to Accounts

Interest amounting to Rs. 2.4 Million has been capitalized during the

year in compliance with AS-16.

Rasesh Shah & Associates

Disclosure Requirements

Example 3

Name of the Company : GHCL

Financial Year : 2004-05

Auditors : Jayantilal Thakkar & Co.

Rahul Gautam Divan & Associates

Significant Accounting Policy

Borrowing Costs that are attributable to the acquisition , construction or

production of q

p qualifying

y g assets are capitalized

p as p

part of cost of such

assets. The capitalized rate is the weighted average of the borrowing

costs applicable to the borrowings of the company that are outstanding

during the period. All other borrowing costs are recognized as an expense

in the period in which they are incurred.

Notes to Accounts

Borrowing Costs capitalized during the year Rs. 8.26 Million (Previous Year

R 5.54

Rs. 5 54 Million)

Milli )

Rasesh Shah & Associates

Disclosure Requirements

Example 4

Name of the Company : EIH LIMITED

Fi

Financial

i l Year

Y : 2004-05

2004 05

Auditors : Ray & Ray

Significant Accounting Policy

Borrowing Costs that are attributable to the acquisition / construction

p

of fixed assets are capitalized as part

p of the cost of the respective

p

assets. Other borrowing costs are recognized as expenses in the year

in which they arise.

Notes to Accounts

Interest debited to the Profit & Loss Account is net of interest

capitalized amounting to Rs. Nil (2004 Rs. 233,156,467)

Rasesh Shah & Associates

Thank

You

Rasesh Shah & Associates

You might also like

- Ca Intermediate Study MaterialsDocument23 pagesCa Intermediate Study MaterialsjshashimohanNo ratings yet

- Ind As 23Document6 pagesInd As 23Savin AdhikaryNo ratings yet

- Borrowing CostsDocument17 pagesBorrowing CostsJatin SunejaNo ratings yet

- Valutation by Damodaran Chapter 3Document36 pagesValutation by Damodaran Chapter 3akhil maheshwariNo ratings yet

- UEU Penilaian Asset Bisnis Pertemuan 3Document38 pagesUEU Penilaian Asset Bisnis Pertemuan 3Saputra SanjayaNo ratings yet

- Borrowing Cost: By-Vivek MehndirattaDocument33 pagesBorrowing Cost: By-Vivek MehndirattaTanaka DandiraNo ratings yet

- Interest On Drawings 1Document10 pagesInterest On Drawings 1giennachemparathyNo ratings yet

- Fundamentals QuestionsDocument23 pagesFundamentals Questionsdhanvi1259No ratings yet

- FRS 123 Borrowing Costs PDFDocument4 pagesFRS 123 Borrowing Costs PDFRandy AsnorNo ratings yet

- Capital CostDocument11 pagesCapital CostAdeline XuNo ratings yet

- BORROWING COSTS Supplementary Review MaterialDocument2 pagesBORROWING COSTS Supplementary Review MaterialCaseylyn RonquilloNo ratings yet

- Nas 17 - Ifrs 16 V9Document65 pagesNas 17 - Ifrs 16 V9binuNo ratings yet

- As 16 PDFDocument2 pagesAs 16 PDFRamNo ratings yet

- Cost of Capital 1Document14 pagesCost of Capital 1preshakhurana1026No ratings yet

- As 16: Borrowing Cost: OverviewDocument7 pagesAs 16: Borrowing Cost: OverviewShree Tisai100% (1)

- Seminar Slides 8 PDFDocument28 pagesSeminar Slides 8 PDFcccqNo ratings yet

- Chapter 10 - Capital Budgeting TechniquesDocument20 pagesChapter 10 - Capital Budgeting TechniquesManar AmrNo ratings yet

- Accounting StandardDocument33 pagesAccounting StandardPooja BaghelNo ratings yet

- Material of As 16Document21 pagesMaterial of As 16emmanuel JohnyNo ratings yet

- Cost of CapitalDocument4 pagesCost of Capitalkomal mishraNo ratings yet

- Ind As 23 - SolutionsDocument10 pagesInd As 23 - Solutionssoumya saswatNo ratings yet

- Worksheet On Dissolution of Partnership - Board Exam QuestionsDocument10 pagesWorksheet On Dissolution of Partnership - Board Exam QuestionsAhmedNo ratings yet

- AS 16 Borrowing Cost ThoeryDocument16 pagesAS 16 Borrowing Cost ThoeryBharatbhusan RoutNo ratings yet

- Lecture 24-25-26 15102020Document32 pagesLecture 24-25-26 15102020AmritNo ratings yet

- Cost of Capital PDFDocument37 pagesCost of Capital PDFBala RanganathNo ratings yet

- Chapter 26-Smes Assets (Inventories, Basic Chapter 27 - Smes Assets (Ppe, GovernmentDocument2 pagesChapter 26-Smes Assets (Inventories, Basic Chapter 27 - Smes Assets (Ppe, GovernmentRichard Rhamil Carganillo Garcia Jr.No ratings yet

- 13.8 AS 16 Borrowing CostsDocument8 pages13.8 AS 16 Borrowing CostsAakshi SharmaNo ratings yet

- Adv AnsDocument13 pagesAdv AnsOcto ManNo ratings yet

- Cost of Capital and Investment CriteriaDocument9 pagesCost of Capital and Investment Criteriamuhyideen6abdulganiyNo ratings yet

- Cost of CapitalDocument20 pagesCost of CapitalShiv KothariNo ratings yet

- Borrowing Costs: Indian Accounting Standard (Ind AS) 23Document11 pagesBorrowing Costs: Indian Accounting Standard (Ind AS) 23varshaNo ratings yet

- Set 1 Test No.1 Answer KeyDocument4 pagesSet 1 Test No.1 Answer KeyJOHAN JOJONo ratings yet

- IAS 36 ImpairmentDocument9 pagesIAS 36 ImpairmentDaniyal AhmedNo ratings yet

- Us Gaap Vs Ifrs Property Plant EquimentDocument4 pagesUs Gaap Vs Ifrs Property Plant EquimentgabiNo ratings yet

- ACCA Financial Management: Topic Area: - Investment Appraisal - Part 2 - Supplementary Notes - Practice QuestionsDocument17 pagesACCA Financial Management: Topic Area: - Investment Appraisal - Part 2 - Supplementary Notes - Practice QuestionsTaariq Abdul-MajeedNo ratings yet

- UntitledDocument22 pagesUntitledAayush TareNo ratings yet

- Damodaran - Estimating Cash FlowDocument36 pagesDamodaran - Estimating Cash FlowYến NhiNo ratings yet

- Borrowing CostsDocument8 pagesBorrowing CostsOwlNo ratings yet

- CFAS NotesDocument6 pagesCFAS NotesAngelNo ratings yet

- Class Notes - IFRS 2 Share Based PaymentsDocument14 pagesClass Notes - IFRS 2 Share Based Paymentsmohammadhamzakhan51No ratings yet

- Borrowing Costs: Accounting Standard (AS) 16Document9 pagesBorrowing Costs: Accounting Standard (AS) 16Deepak BhatiaNo ratings yet

- Ias 23 Borrowing CostsDocument4 pagesIas 23 Borrowing CostsIrina BanăNo ratings yet

- Icai CocDocument50 pagesIcai CocHarsha OjhaNo ratings yet

- Introduction To Corporate Finance + TechniquesDocument30 pagesIntroduction To Corporate Finance + TechniquesAsmaa AlsabaaNo ratings yet

- Ipsas 5 Borrowing CostDocument26 pagesIpsas 5 Borrowing Costnemz2593No ratings yet

- Credit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRDocument73 pagesCredit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRHaRa TNo ratings yet

- MFRS123Document23 pagesMFRS123Kelvin Leong100% (1)

- Valpacket 1 SPR 20Document360 pagesValpacket 1 SPR 20set_hitNo ratings yet

- ACCA P4 - Session 1Document20 pagesACCA P4 - Session 1prince senNo ratings yet

- Borrowing Costs SlidesDocument6 pagesBorrowing Costs Slidesgwbadie7No ratings yet

- 5.IAS 23 .Borrowing Cost Q&ADocument12 pages5.IAS 23 .Borrowing Cost Q&AAbdulkarim Hamisi KufakunogaNo ratings yet

- Indian Accounting Standard (Ind AS) 23 Borrowing Costs: ParagraphsDocument11 pagesIndian Accounting Standard (Ind AS) 23 Borrowing Costs: ParagraphsSarathNo ratings yet

- UnlockedDocument45 pagesUnlockedmanojNo ratings yet

- Far 17 Investment PropertyDocument12 pagesFar 17 Investment PropertyTeresaNo ratings yet

- Group NUMBER 4 Probir Sir-1Document43 pagesGroup NUMBER 4 Probir Sir-1Md. Ashraful Islam SaronNo ratings yet

- Valpacket 1 SPR 21Document369 pagesValpacket 1 SPR 21luvie melatiNo ratings yet

- Capital Structure: Abhishek SinhaDocument31 pagesCapital Structure: Abhishek SinhaAbhishek SinhaNo ratings yet

- 5 - Cost of Cap UploadDocument4 pages5 - Cost of Cap UploadMayank RanjanNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Math 9: Submitted To: Richard MarmitaDocument1 pageMath 9: Submitted To: Richard MarmitacharrisedelarosaNo ratings yet

- Life Story of Johann Heinrich Lambert Johann Heinrich Lambert Was A SwissDocument1 pageLife Story of Johann Heinrich Lambert Johann Heinrich Lambert Was A SwisscharrisedelarosaNo ratings yet

- Johann Heinrich LambertDocument1 pageJohann Heinrich LambertcharrisedelarosaNo ratings yet

- Philosophy), Published in 1641, in Which He Provides A Philosophical GroundworkDocument2 pagesPhilosophy), Published in 1641, in Which He Provides A Philosophical GroundworkcharrisedelarosaNo ratings yet

- Life of Albert Einstein: Einstein's Contribution To Mathematics. While Einstein Was Remembered ForDocument2 pagesLife of Albert Einstein: Einstein's Contribution To Mathematics. While Einstein Was Remembered ForcharrisedelarosaNo ratings yet

- Why LiteratureDocument4 pagesWhy LiteraturecharrisedelarosaNo ratings yet

- Republic Act 7192Document3 pagesRepublic Act 7192charrisedelarosaNo ratings yet

- Advance Accounting 2 Chapter 12Document16 pagesAdvance Accounting 2 Chapter 12Mary Joy Domantay0% (2)

- Branch Accounting QuestionDocument1 pageBranch Accounting QuestioncharrisedelarosaNo ratings yet

- IAS 19 and Employee Benefits:: Some Reflections On The Norwegian ExperienceDocument40 pagesIAS 19 and Employee Benefits:: Some Reflections On The Norwegian ExperiencecharrisedelarosaNo ratings yet

- Correspondent BanksDocument4 pagesCorrespondent BankscharrisedelarosaNo ratings yet

- ES 04 CD Assignment No. 4Document1 pageES 04 CD Assignment No. 4charrisedelarosaNo ratings yet

- Sample FsDocument7 pagesSample FscharrisedelarosaNo ratings yet

- Banana Cake Layered: Cake From The PhilippinesDocument2 pagesBanana Cake Layered: Cake From The PhilippinescharrisedelarosaNo ratings yet

- 17 Things You Should Be Doing Right Now To Reduce Outstanding Accounts ReceivableDocument28 pages17 Things You Should Be Doing Right Now To Reduce Outstanding Accounts ReceivablecharrisedelarosaNo ratings yet

- Ignatian Values and PrinciplesDocument5 pagesIgnatian Values and PrinciplescharrisedelarosaNo ratings yet

- College of Agriculture Practicum (Agri 2) : Submitted By: Veloso, Gil Pio MDocument2 pagesCollege of Agriculture Practicum (Agri 2) : Submitted By: Veloso, Gil Pio McharrisedelarosaNo ratings yet

- Cambodia: "Kingdom of Cambodia" Redirects Here. For The Post-Independence Era, SeeDocument7 pagesCambodia: "Kingdom of Cambodia" Redirects Here. For The Post-Independence Era, SeecharrisedelarosaNo ratings yet

- Tax Table If Taxable Income Is: Tax Due IsDocument1 pageTax Table If Taxable Income Is: Tax Due IscharrisedelarosaNo ratings yet

- Best Local Chapter Activity: Official Application FormDocument2 pagesBest Local Chapter Activity: Official Application FormcharrisedelarosaNo ratings yet

- Most Outstanding Local Chapter President: Official Application FormDocument3 pagesMost Outstanding Local Chapter President: Official Application FormcharrisedelarosaNo ratings yet

- Correspondent BanksDocument4 pagesCorrespondent BankscharrisedelarosaNo ratings yet

- Management of Commercial Banking Assignment-Week 2Document15 pagesManagement of Commercial Banking Assignment-Week 2Yogesh KumarNo ratings yet

- Flexible Budget Practical Problems & Solutions - Explanation & DiscussionDocument14 pagesFlexible Budget Practical Problems & Solutions - Explanation & DiscussionahmedNo ratings yet

- Ac4012 Ch1 Accounting ConceptDocument68 pagesAc4012 Ch1 Accounting ConceptYin LiuNo ratings yet

- 505B New Aditya2242Document17 pages505B New Aditya2242gurpNo ratings yet

- WorksheetsDocument2 pagesWorksheetsSarifeMacawadibSaid100% (5)

- NGAS LectureDocument56 pagesNGAS LectureVenianNo ratings yet

- Mutual Fund Private Public Chapter 1 and 3Document34 pagesMutual Fund Private Public Chapter 1 and 3sudhakar kethanaNo ratings yet

- Compilation Notes Financial Statement AnalysisDocument8 pagesCompilation Notes Financial Statement AnalysisAB12P1 Sanchez Krisly AngelNo ratings yet

- Reyes Vs CirDocument3 pagesReyes Vs CirjessapuerinNo ratings yet

- Tax Organizer ShortDocument28 pagesTax Organizer ShortExactCPANo ratings yet

- PAS 12 Accounting For Income TaxDocument17 pagesPAS 12 Accounting For Income TaxReynaldNo ratings yet

- Fabm 1-PTDocument10 pagesFabm 1-PTClay MaaliwNo ratings yet

- (Problems) - Audit of Property, Plant, and EquipmentDocument35 pages(Problems) - Audit of Property, Plant, and Equipmentapatos67% (9)

- HOW TO WRITE A-WPS OfficeDocument13 pagesHOW TO WRITE A-WPS Officeellebautista234No ratings yet

- Weekly Operations Report TemplateDocument19 pagesWeekly Operations Report TemplateIndrama Purba100% (1)

- Business Finance Q4 Module 4Document20 pagesBusiness Finance Q4 Module 4randy magbudhi50% (6)

- Advanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleDocument10 pagesAdvanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleTeneswari RadhaNo ratings yet

- Financial Statement Analysis RatiosDocument4 pagesFinancial Statement Analysis RatiosAmelieNo ratings yet

- Short Term FinancingDocument29 pagesShort Term FinancingAninditaTasneemNo ratings yet

- R32 FIRQ Q-BankDocument8 pagesR32 FIRQ Q-BankparamrajeshjainNo ratings yet

- 101 AssignmentDocument7 pages101 AssignmentDanilo Diniay Jr100% (1)

- Live Better. Ride A Bike!: Forth Cycle Bike Shop & RentalDocument149 pagesLive Better. Ride A Bike!: Forth Cycle Bike Shop & RentalAngel DianoNo ratings yet

- 04 AbstractDocument2 pages04 AbstractSarammaNo ratings yet

- Responsibility Centres: Nature of Responsibility CentersDocument13 pagesResponsibility Centres: Nature of Responsibility Centersmahesh19689No ratings yet

- 2001 Parker Hannifin Annual ReportDocument46 pages2001 Parker Hannifin Annual ReportBill M.No ratings yet

- Comparative Analysis of Measurement After Recognition of Property Plant and EquipmentDocument14 pagesComparative Analysis of Measurement After Recognition of Property Plant and EquipmentMstefNo ratings yet

- Income Tax - 2 AssignmentDocument4 pagesIncome Tax - 2 AssignmentAnkit AgrawalNo ratings yet

- CA CPT WWW - Ca-Gyanguru - inDocument111 pagesCA CPT WWW - Ca-Gyanguru - inHimanshu PurohitNo ratings yet

- Coffeeville: End of Financial Year StatementsDocument5 pagesCoffeeville: End of Financial Year StatementsAndresPradaNo ratings yet

- 162 003Document4 pages162 003Angelli LamiqueNo ratings yet