Professional Documents

Culture Documents

Ompany Is Building A Waste Heat Recovery

Uploaded by

panjoshiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ompany Is Building A Waste Heat Recovery

Uploaded by

panjoshiCopyright:

Available Formats

ompany is building a waste heat recovery-based power plant of 10- mw capacity in Ras (Rajasthan)...

Shree Cement (SCL), the Bangur-owned Rs 2,200 crore Kolkata-based firm, which runs the largest single-location

integrated cement factory in northern India, will invest Rs 550 crore in the current fiscal.

The company is building a waste heat recovery-based power plant of 10- mw capacity in Ras (Rajasthan) with an outlay of

Rs 250 crore. In addition, it is expanding its clinker capacity by one-million tonne per annum (MTPA) in Rajasthan, along

with associated split grinding capacity for a total outlay of Rs 300 crore. Shree Cement managing director HM Bangur told,

“The power plant is expected to begin operations in August 2009 while the clinker capacity is to be commissioned in the

next two years.” “Once the waste heat recovery-based power plant starts functioning, Shree Cement will save Rs 15 lakh

per day,” Mr Bangur added. The company also has expansion plans in Libya, Israel, Sudan and has sent a few key people

to survey these markets.

Shree Cement has a capacity to produce eight MTPA of cement annually at its plant in Rajasthan. The company gets the

bulk of its business volumes by catering to Rajasthan, Punjab, Haryana, Western UP and Uttaranchal. Apart from these,

it's spending around Rs 15 crore on marketing to tap villages in Rajasthan, Punjab and Haryana.

The company aims to cover more than 700 villages with a population of above 3,000 this fiscal. Another 2,000 villages

would be mapped within the next fiscal. Prabhudas Lilladher Research analyst Kamlesh Bagmar said in a note that

existing sector dynamics won't allow cement companies to raise prices.

However, the recent softening of pet coke prices would aid the company in containing pressure witnessed during the

quarter.

Another analyst said that Shree Cement's market share is the highest in the Delhi market, which is the prime market in the

NCR region. In Haryana, the

company's share is higher than Grasim Industries and Ambuja. One of Shree Cement's major credentials is its cost

management practices, which has enabled it to operate at margins (44%), which are comparable to its bigger peers such

as ACC, Gujarat Ambuja and Ultratech.

The company's June shipments rose 27.67% to 609,000 tonne from 477,000 tonne a year earlier. Total shipments

between April to June 2008 rose 26.42% to 1.77 million tonne, from 1.40 million tonne a year ago.

India's cement industry is expanding capacity to meet increasing demand. The industry plans to invest around Rs 50,000

crore in order to increase production from 165 million tonne to about 275 million tonne over next two to three years.

You might also like

- Project Report On Cement IndustryDocument25 pagesProject Report On Cement IndustryKripal Rathore67% (6)

- End of Well ReportDocument6 pagesEnd of Well Reportvengurion100% (1)

- Rak Ceramics To Invest 600 CR To Set Up Tile Plant (9Th May 2010)Document2 pagesRak Ceramics To Invest 600 CR To Set Up Tile Plant (9Th May 2010)arit19No ratings yet

- India CementsDocument5 pagesIndia CementsAnkita AgarwalNo ratings yet

- Shree EditiedDocument12 pagesShree EditiedRateek SharmaNo ratings yet

- Shree EditiedDocument12 pagesShree EditiedRateek SharmaNo ratings yet

- Shree Cement - IBEFDocument3 pagesShree Cement - IBEFnandhini chokkanathanNo ratings yet

- Madras Cements CaseDocument3 pagesMadras Cements CaseKavipriya KarunakaranNo ratings yet

- Cement 04102005Document7 pagesCement 04102005ShubinNo ratings yet

- Ultra Tech Final 2007Document16 pagesUltra Tech Final 2007pvinayakamNo ratings yet

- Board of Directors: Shree CementDocument5 pagesBoard of Directors: Shree CementChandan AgarwalNo ratings yet

- Birla Corp To Invest Rs 2Document2 pagesBirla Corp To Invest Rs 2gvishva86No ratings yet

- Shree CementDocument30 pagesShree Cementsushant_vjti17No ratings yet

- Cement ProjectDocument3 pagesCement ProjectPonnoju ShashankaNo ratings yet

- CementDocument2 pagesCementJobin DevasiaNo ratings yet

- Birla Corporation Pat at Rs 319.88 Crores: Press Release 28 April 2011Document2 pagesBirla Corporation Pat at Rs 319.88 Crores: Press Release 28 April 2011Sk Irfanul HaqueNo ratings yet

- Prism Cement Limited: Investor Update Feb 2014Document5 pagesPrism Cement Limited: Investor Update Feb 2014abmahendruNo ratings yet

- Project Final - India CementsDocument73 pagesProject Final - India Cementsabhisekparija86% (7)

- Shree Cement (SHRCEM) : Strong Growth VisibilityDocument13 pagesShree Cement (SHRCEM) : Strong Growth VisibilitygirishrajsNo ratings yet

- Assignment: Macroeconomic & Business EnvironmentDocument10 pagesAssignment: Macroeconomic & Business EnvironmentHimanshu ShekharNo ratings yet

- Shree Cement LTD.: Credit Analysis & Research LimitedDocument7 pagesShree Cement LTD.: Credit Analysis & Research LimitedlalitsharmachoklattyNo ratings yet

- Recent Trends in Cost AccountingDocument4 pagesRecent Trends in Cost AccountingSumit pattanaik100% (3)

- Acc Cement: 36.htmlDocument8 pagesAcc Cement: 36.htmlsiddharthgargNo ratings yet

- Industry Analysis Cement IndustryDocument13 pagesIndustry Analysis Cement IndustrySalma Pazhayillath50% (2)

- Acc CementDocument60 pagesAcc Cementsahib21No ratings yet

- G.S. Petropull Company (GSPC)Document2 pagesG.S. Petropull Company (GSPC)HarshikaNo ratings yet

- Century Textile IndustriesDocument22 pagesCentury Textile IndustriesKothapatnam Suresh BabuNo ratings yet

- Hongshi Cement CaseDocument7 pagesHongshi Cement CasePravin Sagar ThapaNo ratings yet

- Investor Update Oct 2012Document5 pagesInvestor Update Oct 2012abmahendruNo ratings yet

- Skoda May Start Exports From India With Rapid Sedan: AutomotiveDocument5 pagesSkoda May Start Exports From India With Rapid Sedan: AutomotivePravi DubeyNo ratings yet

- Cement: Market OverviewDocument3 pagesCement: Market OverviewBunty JiNo ratings yet

- Industry Background: Cement Industry in IndiaDocument4 pagesIndustry Background: Cement Industry in IndiaShahib ZadNo ratings yet

- Organizational Culture - Final ProjectDocument85 pagesOrganizational Culture - Final ProjectMBA19 DgvcNo ratings yet

- Binani Cement Research ReportDocument11 pagesBinani Cement Research ReportRinkesh25No ratings yet

- Coal Miner Bets On Steel Mills To Boost Profit - Corporate India - BloombergDocument3 pagesCoal Miner Bets On Steel Mills To Boost Profit - Corporate India - BloombergNasrul SalmanNo ratings yet

- Study On Recruitment and Selection ProcessDocument122 pagesStudy On Recruitment and Selection ProcessSmartydr100% (1)

- Business Marketing Report FinalDocument17 pagesBusiness Marketing Report FinalAkanksha ChhabraNo ratings yet

- GACL Holcim AllianceDocument4 pagesGACL Holcim Alliancesudakshina100No ratings yet

- Saint Gobain Glass Coming FutureDocument1 pageSaint Gobain Glass Coming FutureShailendra KelaniNo ratings yet

- Shree Cement LTD.: Summer Training ProjectDocument29 pagesShree Cement LTD.: Summer Training ProjectJain Ronak100% (1)

- Analysis of The Indian Cement IndustryDocument19 pagesAnalysis of The Indian Cement Industryashish sawantNo ratings yet

- BangurDocument76 pagesBangurshubhamNo ratings yet

- Prism Cement Investor Update May 2014Document5 pagesPrism Cement Investor Update May 2014abmahendruNo ratings yet

- Analysis of India Cement LTD 2011Document19 pagesAnalysis of India Cement LTD 2011Kr Nishant100% (1)

- Zuari Cement To Set Up A 3.23 MNT Cement Plant in Gulbarga, KarnatakaDocument2 pagesZuari Cement To Set Up A 3.23 MNT Cement Plant in Gulbarga, KarnatakaZuari Cement LimitedNo ratings yet

- Know More About Ultratech CementDocument3 pagesKnow More About Ultratech CementAnkit KaleNo ratings yet

- Early - News May 1-15Document9 pagesEarly - News May 1-15Pradeep AhireNo ratings yet

- B2B Assignment Section C Group 3Document8 pagesB2B Assignment Section C Group 3PON VINOTHANNo ratings yet

- Introduction To The IndustryDocument5 pagesIntroduction To The Industrytarika88No ratings yet

- Hindustan Copper Ltd.Document23 pagesHindustan Copper Ltd.Pooja NarwaniNo ratings yet

- Market Structure in Indian Cement IndustryDocument7 pagesMarket Structure in Indian Cement IndustryrajyalakshmiNo ratings yet

- Company Production Installed Capacity Net Profit (2008-2009) (Rs Lakhs)Document4 pagesCompany Production Installed Capacity Net Profit (2008-2009) (Rs Lakhs)Jimit ShahNo ratings yet

- Hero Honda 2Document1 pageHero Honda 2Bala JiNo ratings yet

- Financial Position of Ultra Tech: Financials-Q4FY07Document4 pagesFinancial Position of Ultra Tech: Financials-Q4FY07rahulpatel27No ratings yet

- Financial PerformanceDocument71 pagesFinancial PerformanceTshering Choden Lachungpa50% (2)

- A Project Report Submitted To: Market Survey of Consumer Perception About Cement IndustryDocument36 pagesA Project Report Submitted To: Market Survey of Consumer Perception About Cement Industryriteshgautam77No ratings yet

- Organisation Culture - Ultra TechDocument85 pagesOrganisation Culture - Ultra Techkhayyum0% (1)

- Merger Report of Rassi2Document6 pagesMerger Report of Rassi2meenakshiagg1988No ratings yet

- Prakash Industries LTDDocument10 pagesPrakash Industries LTDrahuljain.srspl100% (2)

- Scaling New Heights: Vizag–Chennai Industrial Corridor, India's First Coastal CorridorFrom EverandScaling New Heights: Vizag–Chennai Industrial Corridor, India's First Coastal CorridorNo ratings yet

- Helmholtz CoilDocument6 pagesHelmholtz CoilFieraru Ionut RaduNo ratings yet

- EIR 221 Prac 3 Guide 2017Document5 pagesEIR 221 Prac 3 Guide 2017mpaka felliNo ratings yet

- Interrelated Function Bio MolecularDocument2 pagesInterrelated Function Bio MolecularAlifah SyarafinaNo ratings yet

- Slide AssignmentDocument9 pagesSlide AssignmentWan Madihah MahmodNo ratings yet

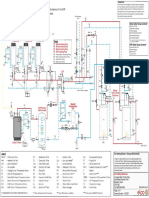

- 3 TRIGON XL 1 CHP 1 Buffer LLH 1 VT Heating Circuit 2 Gemini CalorifiersDocument1 page3 TRIGON XL 1 CHP 1 Buffer LLH 1 VT Heating Circuit 2 Gemini Calorifiersadyro12No ratings yet

- Lecture 3: Component Models (Contd... ) : Lecturer: Dr. Vinita Vasudevan Scribe: Shashank ShekharDocument5 pagesLecture 3: Component Models (Contd... ) : Lecturer: Dr. Vinita Vasudevan Scribe: Shashank ShekharAniruddha RoyNo ratings yet

- Dwelling PresentationDocument1 pageDwelling PresentationAliciaB2No ratings yet

- Furnace Oil ProjectDocument16 pagesFurnace Oil ProjectRohit PNo ratings yet

- Preview 2006+ASHRAE+HANDBOOKDocument8 pagesPreview 2006+ASHRAE+HANDBOOKashraf haniaNo ratings yet

- Wiring Digram For ACDocument3 pagesWiring Digram For ACahmed HOSNYNo ratings yet

- 1 - LAGEN - Page I - XIIDocument13 pages1 - LAGEN - Page I - XIISumantri HatmokoNo ratings yet

- GIS Specification 170 - 245 KV ELK14 - Rev01 - To CustomerDocument41 pagesGIS Specification 170 - 245 KV ELK14 - Rev01 - To CustomerwaqarNo ratings yet

- 03 Item 220 (Salwico NS-AOHS) Incl 221 and 222Document3 pages03 Item 220 (Salwico NS-AOHS) Incl 221 and 222AlexDorNo ratings yet

- Rupsha Power Plant PDFDocument19 pagesRupsha Power Plant PDFHossain Mohammad MahbubNo ratings yet

- 029 - Madho Ram v. Secretary of State (143-151)Document9 pages029 - Madho Ram v. Secretary of State (143-151)Vinay Kumar KumarNo ratings yet

- Thermoelectric Power Generator - TEG30 12V 2.5A M-English PDFDocument3 pagesThermoelectric Power Generator - TEG30 12V 2.5A M-English PDFTenomiNo ratings yet

- UCMP Unit 1Document16 pagesUCMP Unit 1Sreedhar ReddyNo ratings yet

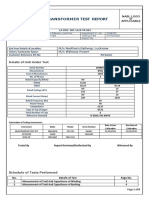

- Transformer Test Report: LA DOC. NO: LA-R-TR-003Document8 pagesTransformer Test Report: LA DOC. NO: LA-R-TR-003mayur dhandeNo ratings yet

- Catalogue Bzi GBDocument15 pagesCatalogue Bzi GBdenis_alexNo ratings yet

- John Zink Company Overview Markets Served TODD Products & Technologies Case StudiesDocument21 pagesJohn Zink Company Overview Markets Served TODD Products & Technologies Case Studieshamid vahedil larijaniNo ratings yet

- Mahavir Swami Collage of Pollytechnic, Surat: "Automobile Carburettor"Document40 pagesMahavir Swami Collage of Pollytechnic, Surat: "Automobile Carburettor"Ayush BanerjeeNo ratings yet

- DVR Board Common Problems and Solutions-TTB Vision Co.Document4 pagesDVR Board Common Problems and Solutions-TTB Vision Co.TTB VisionNo ratings yet

- LIFTCALC 30aDocument101 pagesLIFTCALC 30aareks30% (1)

- Completion Fluids Displacement and Cementing SpacersDocument18 pagesCompletion Fluids Displacement and Cementing SpacersAnonymous JMuM0E5YONo ratings yet

- Co2 Components-ServvoDocument1 pageCo2 Components-ServvorizaNo ratings yet

- Lab Report On Climate ChangeDocument3 pagesLab Report On Climate ChangecmsbballNo ratings yet

- Unit V - Metrology and Instrumentation NotesDocument34 pagesUnit V - Metrology and Instrumentation NotesmanisekNo ratings yet

- GDI 14 - Exploration Aff - Lundeen-Langr-PointerDocument213 pagesGDI 14 - Exploration Aff - Lundeen-Langr-PointerGabrielj348100% (1)

- Aa5tb Magnetic Loop v1Document9 pagesAa5tb Magnetic Loop v1api-3839541No ratings yet