Professional Documents

Culture Documents

Money Gram Case Study

Uploaded by

Precious Sanchez0 ratings0% found this document useful (0 votes)

305 views1 pageA case study about money gram .

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA case study about money gram .

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

305 views1 pageMoney Gram Case Study

Uploaded by

Precious SanchezA case study about money gram .

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

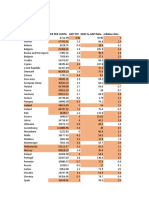

{EM lobl Cater for rarer Anatios

Case Anal ysis 6: MoneyG am

Internati onal

International

Company Background

‘The MoneyGram brand is recognized throughout the

World 8 a leading global payment services company.

The diverse array of products and services we offer

enables consumer and businesses to meke payments

and transfer money around the world. From New York

to Russia or London to India - in more than 197

‘countries - MoneyGraris money transfer service

moves money quickly and easily around the world.

The payment services aso help businesses operate

more efficiently and cost effectivay. We offer our

Products and services to consumers end businesses

through a worldwide network of agents and financial

institution customers.

Ted Bridenstine, systems development menager at

MoneyGram—a leading global payment services

‘company—underscores the importance of fraud

detection with the story of a 100-yeer old grandmother

who had contacted MoneyGram after receiving a call

thet _her grandson had been rested and needed

US$2,500 for bail.

Behind the scenes, MoneyGram's fraud detection

system flagged the transaction as suspicious. Analysts

determined thet it was likely pert of a telephone scam

and a MoneyGram representaive contacted the

‘customer to l@t her know that the wire had been

stopped and her money was being refunded. Worried

‘bout her grandson's safety, she threatened to take her

business dsewhere if MoneyGram didn’t wire the

money. The company representative implored the

women to contact a farily member and verify the

story.

" She called beck three days Iter in teers to thenk the

‘representative personally,” recalls Bridenstine. “She

did verify thet it was a fraud. She lives on Social

‘Security and could not fford to lose money. The call

was emotiond and heartwarming.”

Working with IBM ad Alpine Consulting,

MoneyGram has gained dea visbility into the

trensaction history of each customer end insight into

“who's who’, "who knows whom?’ and “who does

hat?’ as it analyzes money transfers. The company’s

new fraud prevention system (known as the Global

Compliance project during implementation) helps stop

fraud in its tracks and reduces the overdl time and

Work required to respond to new regulatory mendates,

‘such as new requirements for International Automated

(Clearing House Transactions.

‘The gystem scans each transaction looking for signs of

fraxd and identifies suspicious or _ high-risk

transactions based on established criteria If fraud is

detected, the system derts analysts, who place the

‘transaction on hold until a representative can confirm

‘whether the transection is legitimate or fraudulent. If

fraud is detected, the company refunds the money to

the sender.

(Once accurate identity is established, the system can

determine whether people are, or ever have been,

related in any way and apply complex event

processing to evaluate all transactions of the entity and

‘of associated entities. The rules engine dso provides

the business logic to alert staff when a transaction or

the aggregation of specific customer's transactions

‘exceeds a specific threshold. Additionally, the solution

gives MoneyGram the ability to respond quickly to

new and different kinds of frauds. For instance, in

2010, MoneyGram noticed thet fraudsters were

receiving transactions in Calfomia in ealy

Noverber 2010, MoneyGram analysts added a rule to

the system thet flagged transactions above a certain

dollar amount sent to California That simple change

Prevented USS1.7 rrillion in suspected fraudulent

transactions in just three months, “We can now react

within hous or minutes, changing rules oF

implementing new rules, if an enelyst identifies @ new

pattem of behavior,” says Bridenstine.

This new flexibility is helping the company increase

customer satisfaction and stay a step chead of

fraudsters. Consumer complaints of fraud in January

2011 compared to Jenuary 2010 dropped 72 percent,

with the “most significant reductions in Canada,

Nigeria, the United States, and the United Kingdom.

From February 2010 to January 2011, the anti-fraud

technology accounted for a 40 percent increase in

18

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Bana2 PointersDocument1 pageBana2 PointersPrecious SanchezNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Data Warehousing WorkShopDocument14 pagesData Warehousing WorkShopPrecious SanchezNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Information System: An Accountant's Perspective: Accounting Information Systems 9e James A. HallDocument29 pagesThe Information System: An Accountant's Perspective: Accounting Information Systems 9e James A. HallshierylNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- SQL Quiz On Bana 2Document3 pagesSQL Quiz On Bana 2Precious SanchezNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 4 Attitudes Values and EthicsDocument5 pages4 Attitudes Values and EthicsPrecious SanchezNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Calculus Excel FinaleDocument2 pagesCalculus Excel FinalePrecious SanchezNo ratings yet

- Chap 1 - Concepts of Policy and Stratregic ManagementDocument24 pagesChap 1 - Concepts of Policy and Stratregic ManagementPrecious SanchezNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Cost Behavior PowerpointDocument50 pagesCost Behavior PowerpointPrecious SanchezNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- BANA101 1st Case StudyDocument1 pageBANA101 1st Case StudyPrecious SanchezNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- 1 2 3 4 5 6 7 Spots N CF PV Factor PV 1 4 N 2+n 4 6Document1 page1 2 3 4 5 6 7 Spots N CF PV Factor PV 1 4 N 2+n 4 6Precious SanchezNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Quiz No. 2 30 Points EssayDocument3 pagesQuiz No. 2 30 Points EssayPrecious SanchezNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Ikea Fraud AnalysisDocument2 pagesIkea Fraud AnalysisPrecious SanchezNo ratings yet

- Chapter 6 Performance Review and Appraisal - ReproDocument22 pagesChapter 6 Performance Review and Appraisal - ReproPrecious SanchezNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- 10 Countries With Country Analysis AppliedDocument5 pages10 Countries With Country Analysis AppliedPrecious SanchezNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- America Industry and Company AnalysisDocument49 pagesAmerica Industry and Company AnalysisPrecious SanchezNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)