Professional Documents

Culture Documents

Format Computation of Employment Income Section 13 (1) (A)

Uploaded by

fifieshafika0 ratings0% found this document useful (0 votes)

15 views1 pageformat

Original Title

Employment Income

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentformat

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageFormat Computation of Employment Income Section 13 (1) (A)

Uploaded by

fifieshafikaformat

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

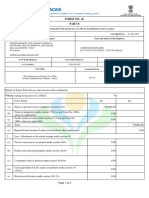

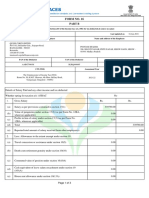

FORMAT

Computation of Employment Income

Section 13(1)(a)

Salary, Bonus, Gratuity, Fees, Entertainment Allowances, etc A

Section 13(1)(b)

Benefit-in-kind B

Section 13(1)(c )

Value of assessable accommodation

30% of 13(1)(a) or

Define value (unfurnished accommodation) *(which ever lower)

3% of 13(1)(a) (for accommodation provided in a hotel) C

Section 13(1)(d)

Unapproved fund ONLY employers portion D

Section 13(1)(e )

Compensation for loss of employment (after schedule 6 exemption) E

GROSS EMPLOYEMET INCOME

Less: Deductible expenses

Subscription G

Rent paid to employer (restricted to C) H

Entertainment expenses claimed (restricted to allowances received) I J

STATUTORY INCOME K

You might also like

- Form 16 20-21 PartbDocument3 pagesForm 16 20-21 PartbTEMPORARY TEMPNo ratings yet

- Form 16 TDS certificate summaryDocument3 pagesForm 16 TDS certificate summaryniranjansankaNo ratings yet

- Clhps7458a Partb 2019-20Document3 pagesClhps7458a Partb 2019-20Gurudeep singhNo ratings yet

- Aljpn5103d Partb 2022-23Document3 pagesAljpn5103d Partb 2022-23Md shamirNo ratings yet

- Afipg9432r Partb 2023-24Document4 pagesAfipg9432r Partb 2023-24SUPERINTENDENT WOMEN ITI JAMMUNo ratings yet

- FormDocument4 pagesFormUtkarsh GurjarNo ratings yet

- Computation of income from salary for AY 2013-14Document2 pagesComputation of income from salary for AY 2013-14Vinay WadhwaniNo ratings yet

- Abhay Singh Payslip Sep 2023Document3 pagesAbhay Singh Payslip Sep 2023abhay singhNo ratings yet

- FORM 16 CERTIFICATEDocument3 pagesFORM 16 CERTIFICATEBB StudioNo ratings yet

- JUNE 2021 PAYSLIPDocument3 pagesJUNE 2021 PAYSLIPamitNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- FTVPS3817J Partb 2022-23Document3 pagesFTVPS3817J Partb 2022-23Jasvinder SolankiNo ratings yet

- 112029X - 2022 For 16 Part BDocument3 pages112029X - 2022 For 16 Part BMeetanshi AggarwalNo ratings yet

- Aakpe0936f Partb 2020-21Document4 pagesAakpe0936f Partb 2020-21Mahendar ErramNo ratings yet

- Tds 2021-1-4Document4 pagesTds 2021-1-4varun mahajanNo ratings yet

- Direct Tax Law S 2019Document5 pagesDirect Tax Law S 2019jewankarpournimaNo ratings yet

- Akapr6662d Partb 2020-21Document3 pagesAkapr6662d Partb 2020-21defencerajkumarraiNo ratings yet

- Signed By:Bulusu Samba Murthy Reason:Security Reason Location:Mumbai Signing Date:16.07.2020 18:41Document8 pagesSigned By:Bulusu Samba Murthy Reason:Security Reason Location:Mumbai Signing Date:16.07.2020 18:41Aviral SankhyadharNo ratings yet

- FORM No. 16: Name and Address of The Employee Name and Address of The EmployerDocument6 pagesFORM No. 16: Name and Address of The Employee Name and Address of The EmployerRavi KattruNo ratings yet

- Form 16 TDS certificate summaryDocument3 pagesForm 16 TDS certificate summarykumar reddyNo ratings yet

- Alvpc7596b Partb 2021-22Document4 pagesAlvpc7596b Partb 2021-22Vinay GuptaNo ratings yet

- PAYSLIP DETAILSDocument3 pagesPAYSLIP DETAILSamitNo ratings yet

- Adbpu6308h Partb 2023-24Document4 pagesAdbpu6308h Partb 2023-24SUPERINTENDENT WOMEN ITI JAMMUNo ratings yet

- ACFrOgDrfk9wT 7y1 fbRMiv4xjP7hNTGwqfzNJ1G27r3eTgtVDid9F7RrBmpGFgcOsGtPT0J6IIB0RUl JaXR7YG0rDWVbPsPWL0 - H4w111trlgzjhfck669j7oooo PDFDocument3 pagesACFrOgDrfk9wT 7y1 fbRMiv4xjP7hNTGwqfzNJ1G27r3eTgtVDid9F7RrBmpGFgcOsGtPT0J6IIB0RUl JaXR7YG0rDWVbPsPWL0 - H4w111trlgzjhfck669j7oooo PDFAmitNo ratings yet

- Form 16Document4 pagesForm 16Premeshor LaishramNo ratings yet

- Form 16Document5 pagesForm 16Sandeep PrinceNo ratings yet

- BDBPN8990F Partb 2022-23 PDFDocument4 pagesBDBPN8990F Partb 2022-23 PDFgopal cNo ratings yet

- Aqcpd7787k Partb 2020-21Document4 pagesAqcpd7787k Partb 2020-21Addl. C. E. FZOKNo ratings yet

- Form 16 - IT DEPT TCS Eserve Part B - 20222023Document3 pagesForm 16 - IT DEPT TCS Eserve Part B - 20222023Suraj KumarNo ratings yet

- Form No. 16: Part BDocument4 pagesForm No. 16: Part BVithlesh PetroleumNo ratings yet

- Form 16 Salary CertificateDocument3 pagesForm 16 Salary CertificatePratik MeswaniyaNo ratings yet

- FRE31713 - Form16 - Part B - FY 2022 23 - AY 2023 24Document3 pagesFRE31713 - Form16 - Part B - FY 2022 23 - AY 2023 24Deum degOnNo ratings yet

- PAYSLIP Nov-2022 - NareshDocument3 pagesPAYSLIP Nov-2022 - NareshDharshan RajNo ratings yet

- US Internal Revenue Service: f5500sc - 2003Document3 pagesUS Internal Revenue Service: f5500sc - 2003IRSNo ratings yet

- Abrph5659n Partb 2021-22Document3 pagesAbrph5659n Partb 2021-22foni123No ratings yet

- PART B (Annexure) Details of Salary Paid and Any Other Income and Tax DeductedDocument2 pagesPART B (Annexure) Details of Salary Paid and Any Other Income and Tax DeductedFuture ArtistNo ratings yet

- Bmypp3076q Partb 2021-22 1Document4 pagesBmypp3076q Partb 2021-22 1KALIA PRADHANNo ratings yet

- A MukherjeeDocument3 pagesA MukherjeeBrahmankhanda Basapara HIGH SCHOOLNo ratings yet

- FORM 16 CERTIFICATEDocument3 pagesFORM 16 CERTIFICATEDebesh KuanrNo ratings yet

- Payslip Sep-2022 NareshDocument3 pagesPayslip Sep-2022 NareshDharshan RajNo ratings yet

- IncomeTax - Computation - DOMPXXXXXK-Sakshi Kakkar-AT-0201-2021Document1 pageIncomeTax - Computation - DOMPXXXXXK-Sakshi Kakkar-AT-0201-2021deepanshu sapraNo ratings yet

- Panduan Mengisi Form EA 2019Document8 pagesPanduan Mengisi Form EA 2019Dianna RedzuanNo ratings yet

- Ajppm3616g Partb 2022-23Document3 pagesAjppm3616g Partb 2022-23niel doriftoNo ratings yet

- CHLPR4183D Partb 2023-24Document4 pagesCHLPR4183D Partb 2023-24JMLNo ratings yet

- Form 16 Fy 19 20 Part BDocument3 pagesForm 16 Fy 19 20 Part BMilind MoreNo ratings yet

- Form 16 - TCS Part BDocument4 pagesForm 16 - TCS Part BSai SekharNo ratings yet

- Form No. 16: Part BDocument4 pagesForm No. 16: Part Bvirajsonawane22No ratings yet

- Aavpv5058l Partb 2023-24Document3 pagesAavpv5058l Partb 2023-24ankushNo ratings yet

- Gtlpd1974e Partb 2022-23Document4 pagesGtlpd1974e Partb 2022-233 AM FactsNo ratings yet

- Form 16 Salary CertificateDocument3 pagesForm 16 Salary CertificateDeeptimayee SahooNo ratings yet

- Form 16 Salary CertificateDocument3 pagesForm 16 Salary CertificateAshish BhartiNo ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- Hhaps6093h Partb 2020-21Document3 pagesHhaps6093h Partb 2020-21Siva Kumar SNo ratings yet

- Form 16-Part B - 2020-2021Document3 pagesForm 16-Part B - 2020-2021Ravi S. SharmaNo ratings yet

- BSBPG6820L Partb 2020-21Document3 pagesBSBPG6820L Partb 2020-21Arun PVNo ratings yet

- Rent Receipt Tarak.Document3 pagesRent Receipt Tarak.Tarak ReddyNo ratings yet

- DQQPK6242H - 2023-24 2Document4 pagesDQQPK6242H - 2023-24 2Annu SharmaNo ratings yet

- Acgpd0388n Partb 202122Document3 pagesAcgpd0388n Partb 202122David Raj ArapallyNo ratings yet

- BBJPS2377D Partb 2023-24Document4 pagesBBJPS2377D Partb 2023-24Ajay GokulNo ratings yet

- Appendix 3 PoliPDDocument1 pageAppendix 3 PoliPDfifieshafikaNo ratings yet

- Inflation (Macro)Document16 pagesInflation (Macro)fifieshafikaNo ratings yet

- Introduction To Microeconomics, E201Document248 pagesIntroduction To Microeconomics, E201Al Beirão100% (6)

- Unemployment (Macro)Document6 pagesUnemployment (Macro)fifieshafikaNo ratings yet

- Introduction To Microeconomics, E201Document248 pagesIntroduction To Microeconomics, E201Al Beirão100% (6)

- Introduction To Microeconomics, E201Document248 pagesIntroduction To Microeconomics, E201Al Beirão100% (6)

- MicroeconomicsDocument8 pagesMicroeconomicsfifieshafika100% (1)

- Manufacturing Company IBA CalculationDocument4 pagesManufacturing Company IBA CalculationfifieshafikaNo ratings yet

- Introduction To Microeconomics, E201Document248 pagesIntroduction To Microeconomics, E201Al Beirão100% (6)

- Audit - Suitable Procedure (Receiveable)Document3 pagesAudit - Suitable Procedure (Receiveable)fifieshafikaNo ratings yet