Professional Documents

Culture Documents

Impact of GST On Unsold Stock of Pre-Packaged Commodities PDF

Impact of GST On Unsold Stock of Pre-Packaged Commodities PDF

Uploaded by

sridharan0 ratings0% found this document useful (0 votes)

10 views2 pagesOriginal Title

Impact of GST on unsold stock of pre-packaged commodities.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesImpact of GST On Unsold Stock of Pre-Packaged Commodities PDF

Impact of GST On Unsold Stock of Pre-Packaged Commodities PDF

Uploaded by

sridharanCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

Speed Post

WM-10(31)/2017

Government of India

Ministry of Consumer Affairs, Food and Public Distribution

Department of Consumer Affairs

Legal Metrology Division

Krishi Bhawan, New Delhi

Dated: 2017

To,

The Controllers of Legal Metrology,

All States/ UTS

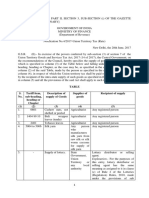

Subject: Impact of GST on unsold stock of pre-packaged commodities -reg.

Sir,

The undersigned is directed to refer to the above mentioned subject and to state that

in exercise of the powers conferred by rule 33(1) of the Legal Metrology (Packaged

Commodities) Rules, 2011, the Central Government hereby permits the manufacturers or

packers or importers of pre-packaged commodities to declare the changed retail sale price

(MRP) on the unsold stock manufactured/ packed/ imported prior to 1* July, 2017 after

inclusion of the increased amount of tax due to GST if any, in addition to the existing retail

sale price (MRP), for three months w.e.f. 1 July 2017 to 30 September, 2017. Declaration

of the changed retail sale price (MRP) shall be made by way of stamping or putting sticker or

online printing, as the case may be, after complying with the following conditions:

(i) The difference between the retail sale price originally printed on the package and the

revised price shall not, in any case, be higher than the extent of increase in the tax if any, or

in the case of imposition of fresh tax, such fresh tax, on account of implementation of GST

Act and Rules.

(i) The original MRP shall continue to be displayed and the revised price shall not overwnte

on it.

(ii) Manufacturers or packers or importers shall make atleast two advertisements in one or

More newspapers in this regard and also by circulation of notices to the dealers and to the

Director of Legal Metrology in the Central Government and Controllers of Legal Metrology in

the States and Union Territories, indicating the change in the price of such packages.

2. Further, it is clarified that under sub-rule (3) of rule 6 of the Legal Metrology (Packaged

Commodities) Rules, 2011 “for reducing the Maximum Retail Price (MRP), a sticker with the

revised lower MRP (inclusive of all taxes) may be affixed and the same shall not cover the

MRP declaration made by the manufacturer or the packer or importer, as the case may be,

on the label of the package”.

3. It is also clarified that any packaging material or wrapper which could not be

exhausted by the manufacturer or packer or importer prior to 1% July, 2017, may be used for

packing of material upto 30" September, 2017 or till such date the packing material or

wrapper is exhausted, whichever is earlier, after making corrections required in retail sale

price (MRP) on account of implementation of G.S.T. by way of stamping or putting sticker or

online printing.

Yours faithfully

(RaQ NT cbne_

beeen

(B. N. Dixit)

Director of Legal Metrology

Tel: 011-23389489/ Fax.-011-23385322

Email: diewm-ca@nicl

Copy to: All Industries/ Industry Associations/ Stake Holders

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- GST Update 161217Document17 pagesGST Update 161217sridharanNo ratings yet

- GST CT 16 2023Document1 pageGST CT 16 2023sridharanNo ratings yet

- GST E-Invoice System - FAQs - Version 1.4 Dt. 30-3-2021Document27 pagesGST E-Invoice System - FAQs - Version 1.4 Dt. 30-3-2021sridharanNo ratings yet

- GST Update 091217Document19 pagesGST Update 091217sridharanNo ratings yet

- GST Update 25.11.2017Document28 pagesGST Update 25.11.2017sridharanNo ratings yet

- GST Update 18.11.2017Document39 pagesGST Update 18.11.2017sridharanNo ratings yet

- GST Update 02.12.2017Document26 pagesGST Update 02.12.2017sridharanNo ratings yet

- Circular CGST 91Document2 pagesCircular CGST 91sridharanNo ratings yet

- Book-Opensuse-Reference Color en PDFDocument537 pagesBook-Opensuse-Reference Color en PDFsridharanNo ratings yet

- Notfctn 40 Central Tax English 2021Document12 pagesNotfctn 40 Central Tax English 2021sridharanNo ratings yet

- 01.02.2019 CGST Rules-2017 (Part-B Forms) PDFDocument372 pages01.02.2019 CGST Rules-2017 (Part-B Forms) PDFsridharanNo ratings yet

- Draft Refund RulesDocument7 pagesDraft Refund RulessridharanNo ratings yet

- CGST Amendment Act 2018Document9 pagesCGST Amendment Act 2018sridharanNo ratings yet

- 01.02.2019 CGST Rules-2017 (Part-A Rules) PDFDocument149 pages01.02.2019 CGST Rules-2017 (Part-A Rules) PDFsridharanNo ratings yet

- Extension of Empanelment of Ayush Hospitals-Centers Under CGHS CS (MA) Rules (August 2019) - IDocument2 pagesExtension of Empanelment of Ayush Hospitals-Centers Under CGHS CS (MA) Rules (August 2019) - IsridharanNo ratings yet

- 51 GST Flyer Chapter40Document16 pages51 GST Flyer Chapter40sridharanNo ratings yet

- Eway Bill Ad ClaDocument1 pageEway Bill Ad ClasridharanNo ratings yet

- Recovery of Tax: (Goods and Services Tax)Document3 pagesRecovery of Tax: (Goods and Services Tax)sridharanNo ratings yet

- Faq Exports 02 08 2017Document1 pageFaq Exports 02 08 2017sridharanNo ratings yet

- Faq Handicrafts 11 08 2017Document1 pageFaq Handicrafts 11 08 2017sridharanNo ratings yet

- Noti Rate Utgst 4 2017Document2 pagesNoti Rate Utgst 4 2017sridharanNo ratings yet