Professional Documents

Culture Documents

DEMONITISATION - Its Effect On Indian Economy

Uploaded by

chetanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DEMONITISATION - Its Effect On Indian Economy

Uploaded by

chetanCopyright:

Available Formats

DEMONITISATION

OVERVIEW:

Demonetization of currency means discontinuity of the particular currency from

circulation and replacing it with a new currency.

In the current context it is the banning of the 500 and 1000 denomination currency notes

as a legal tender.

The governments stated objective behind the demonetization policy are as follows;

1. an attempt to make India corruption free

2. to curb black money

3. to control escalating price rise

4. to control escalating price rise

5. to make people accountable for every rupee they possess and pay income tax

return

6. an attempt to make a cashless society and create a Digital India.

The government has taken few steps in this direction much before its November 8, 2016

announcement.

1. urged people to create bank accounts under Jan Dhan Yojana. As on August 30,

it has opened 30.09 crore accounts and the money kept in these accounts are Rs

65,800 crore

2. the government initiated the Income Disclosure Scheme 2016 a tax declaration of

the income and had given October 30, 2016 deadline for this purpose. Through

this method, the government was able to mop up a huge amount of undeclared

income.worth 65,250 crore.

The demonetization policy is being seen as a financial reform in the country but this

decision is fraught with its own merits and demerits

Facts and Figures:

A total of Rs 15.44 trillion worth of Rs 500 and Rs 1,000 currency notes were withdrawn.

These notes constitute 86.9% of the value of total notes in circulation at that time.

the estimated value of the currency that returned to system at Rs 15.28 trillion or close to 99% of the

currency notes demonetised

acc. To The Reserve Bank of Indias annual report:

I. about 89 million pieces of the 1,000 note (value of 8,900 crore) didnt come

back. To put that in perspective, in the previous year, 6,326 million pieces of

1,000 notes valued at 6,32,600 crore were in circulation

II. The Reserve Bank of India (RBI) spent a whopping Rs 7,965 crore to print new currency

notes from July 2016 to June 2017, a jump of 133 per cent against Rs 3,421 crore in the

same period of the previous year

III. The number of returns filed as on August 5, 2017 have registered a rise of 24.7% compared to

a growth rate of 9.9% in the previous year.

IV. The total number of returns (electronic plus paper) filed during the entire fiscal year 2016-17

was 5.43 crore which is 17.3% more than the returns filed during fiscal year 2015-16.

V. For 2016-17, 1.26 crore new taxpayers (return filers plus non-filers making tax payments) were

added to the tax base (till June 30, 2017).

VI. 19% growth in direct tax collections. Collection of advance tax under personal income tax

showed a growth of about 41.79% over the corresponding period in 2016-2017; collection of

self-assessment tax under personal income tax showed a growth of 34.25%.

According to the income tax department, the number of e-returns of individual taxpayers filed till August

5 increased to 2.79 crore from 2.22 crore filed during the corresponding period of last year, registering

an increase of about 57 lakh returns, or 25.3%.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Planning A House PDFDocument21 pagesPlanning A House PDFchetanNo ratings yet

- General Act of The Algeciras The Affairs of Morocco 2Document26 pagesGeneral Act of The Algeciras The Affairs of Morocco 2Bilal Yusef El Abdullah Bey100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Article 1243-1253Document6 pagesArticle 1243-1253Estoryahe'ng HeartNo ratings yet

- BSP Banking LawDocument47 pagesBSP Banking LawroytanladiasanNo ratings yet

- 01g Extinguishment of Obligations - CasesDocument22 pages01g Extinguishment of Obligations - CasesjorementillaNo ratings yet

- Tibajia V CA DigestDocument2 pagesTibajia V CA Digestjodelle11100% (2)

- Supply, Delivery, Installation, Testing and Commissioning of Electrical Installation Works PDFDocument151 pagesSupply, Delivery, Installation, Testing and Commissioning of Electrical Installation Works PDFkuldeep singhNo ratings yet

- OBLIGATIONS AND CONTRACTS ReviewerDocument22 pagesOBLIGATIONS AND CONTRACTS ReviewerArianne Grace AberdeNo ratings yet

- Bouncing Checks LawDocument29 pagesBouncing Checks LawRowena Imperial Ramos67% (3)

- OBLI Chapter 4 Extinguishment of Obligation PDFDocument16 pagesOBLI Chapter 4 Extinguishment of Obligation PDFOpenbetaNo ratings yet

- Demonetization and Its Impact On Indian EconomyDocument67 pagesDemonetization and Its Impact On Indian EconomyAkshit MalhotraNo ratings yet

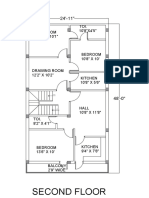

- Typical Floor Plan 1ST, 2ND & 3RDDocument1 pageTypical Floor Plan 1ST, 2ND & 3RDchetanNo ratings yet

- Possible Reasons For Low ParticipationDocument5 pagesPossible Reasons For Low ParticipationchetanNo ratings yet

- Block-B Ground Floor Plan Ground Floor Plan: UP Lift 4'6"X7'0"Document1 pageBlock-B Ground Floor Plan Ground Floor Plan: UP Lift 4'6"X7'0"chetanNo ratings yet

- Mumty: Block-B Section at R-R Block-B Section at S-SDocument1 pageMumty: Block-B Section at R-R Block-B Section at S-SchetanNo ratings yet

- Block-B Section at X-X: Over Head Water Tank Lift RoomDocument1 pageBlock-B Section at X-X: Over Head Water Tank Lift RoomchetanNo ratings yet

- SF PDFDocument1 pageSF PDFchetanNo ratings yet

- Vocab 28Document4 pagesVocab 28chetanNo ratings yet

- Balance Sheet:: Transaction 1: First We Have To Segregate The Amount of Land and Building As Land Is NonDocument3 pagesBalance Sheet:: Transaction 1: First We Have To Segregate The Amount of Land and Building As Land Is NonchetanNo ratings yet

- Action Plan Group 1-2Document2 pagesAction Plan Group 1-2chetanNo ratings yet

- ResumeDocument2 pagesResumeNirmanyu JamwalNo ratings yet

- Designing Work Organizations: Organization Design of Techno Electronics LimitedDocument15 pagesDesigning Work Organizations: Organization Design of Techno Electronics LimitedchetanNo ratings yet

- Academic Details: Saurabh GuptaDocument3 pagesAcademic Details: Saurabh GuptachetanNo ratings yet

- Competitors+business PlanDocument6 pagesCompetitors+business PlanchetanNo ratings yet

- Sample Resume4Document2 pagesSample Resume4chetanNo ratings yet

- Consumer Behavior Analysis of ParachuteDocument2 pagesConsumer Behavior Analysis of ParachutechetanNo ratings yet

- Costs Option 1 Option 2 Option 3 Total Cost Option - Month MatrixDocument13 pagesCosts Option 1 Option 2 Option 3 Total Cost Option - Month MatrixchetanNo ratings yet

- Rainer Weiss Barry Barish Kip Thorne: PhysicsDocument6 pagesRainer Weiss Barry Barish Kip Thorne: PhysicschetanNo ratings yet

- Paper Money A Chinese Invention.......Document3 pagesPaper Money A Chinese Invention.......bookfreakNo ratings yet

- Ceza DatoDocument29 pagesCeza DatoTommy DoncilaNo ratings yet

- Demonetization ProjectDocument8 pagesDemonetization ProjectFloydCorreaNo ratings yet

- BANKCIRCULARDocument4 pagesBANKCIRCULARMugilanNo ratings yet

- Analysis - Cryptocurrenies 2021Document22 pagesAnalysis - Cryptocurrenies 2021drdoomNo ratings yet

- Tender Schedule Interior Works Union Bank of India Collectorate Branch Jagtial Ro KarimnagarDocument54 pagesTender Schedule Interior Works Union Bank of India Collectorate Branch Jagtial Ro KarimnagarashokNo ratings yet

- NIL Notes - PremidtermsDocument9 pagesNIL Notes - PremidtermsCzarina Lynne YeclaNo ratings yet

- 5 New Central Bank ActDocument32 pages5 New Central Bank ActCathNo ratings yet

- Maharashtra Natural Gas LTDDocument113 pagesMaharashtra Natural Gas LTDrafikul123No ratings yet

- Civil Affairs Handbook Belgium Section 5Document171 pagesCivil Affairs Handbook Belgium Section 5Robert ValeNo ratings yet

- S. I. 142 of 2019 Reserve Bank of Zim (Legal Tender) Regulations, 2019 - 1Document2 pagesS. I. 142 of 2019 Reserve Bank of Zim (Legal Tender) Regulations, 2019 - 1Shadrach SitholeNo ratings yet

- Criminal Law 2 Latest LectureDocument15 pagesCriminal Law 2 Latest LectureRicel CriziaNo ratings yet

- Nov 5Document66 pagesNov 5dollyccruzNo ratings yet

- A Brief History of MoneyDocument50 pagesA Brief History of MoneyRenz Lorenz100% (1)

- TenderDocument149 pagesTenderSnehal SakhareNo ratings yet

- Monetary Economics-Unit 1Document62 pagesMonetary Economics-Unit 1Amanda RuthNo ratings yet

- Demonetization-A Boon or BaneDocument6 pagesDemonetization-A Boon or BanearcherselevatorsNo ratings yet

- CRYPTOCURRENCYDocument5 pagesCRYPTOCURRENCYCLINT SHEEN CABIASNo ratings yet

- Cryptocurrencies in India (Laws and Policies)Document16 pagesCryptocurrencies in India (Laws and Policies)AKASH CHOUDHARYNo ratings yet

- Blank 9Document11 pagesBlank 9shaira doctorNo ratings yet