Professional Documents

Culture Documents

Area of Research: Submitted by

Area of Research: Submitted by

Uploaded by

Abdul SaqibOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Area of Research: Submitted by

Area of Research: Submitted by

Uploaded by

Abdul SaqibCopyright:

Available Formats

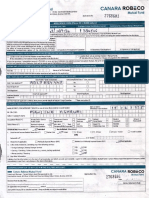

Area of Research

Submitted by:

ABDUL SAQIB MMS173047

Submitted to:

Sir, S.M.M. Raza Naqvi

Emerging financial markets, Financial literacy and investment

decisions

Over the recent years, financial landscape has been continuously changing with the introduction

of new financial products in the emerging financial markets. it is difficult for a common man to

understand these financial products and the risks and rewards associated to such financial products.

Thus, for understanding such risks and rewards associated to the financial products minimum level

of financial literacy and awareness of such financial products is must. The financially literate

individual analyzes risks and rewards of financial products and make rational decisions. Further,

the Pakistani financial market is underdeveloped so there is more possibility that the illiterate

investors may be cheated by the sales persons of financial products. Low levels of financial literate

people face problems with issues relating to personal finance such as savings, borrowings,

investments, retirement planning etc. Financial education increases people awareness and

understanding of financial products and associated risks and rewards. Thereafter, the current

research will focus on how salaried individual make their retirement, insurance and saving plans

on the basis of their awareness level and financial literacy. Basically, women are more conservative

than men while investing and are risk avoiders. The current study will further check the association

of financial literacy with investment behavior of salaried individuals. As we mentioned Pakistani

financial market is not efficient thus what procedures and techniques could be used to improve

financial literacy that contribute to rational financial decisions.

You might also like

- 2016 1098-MORT MORTGAGE 4868 WellsFargoDocument2 pages2016 1098-MORT MORTGAGE 4868 WellsFargoJay EvansNo ratings yet

- Special Purpose Vehicle (SPV)Document10 pagesSpecial Purpose Vehicle (SPV)Daksh TayalNo ratings yet

- Personal Financial PlanningDocument21 pagesPersonal Financial PlanningAparna PavaniNo ratings yet

- Stocks Sstrategies and Common Sense - DR D-EbookDocument76 pagesStocks Sstrategies and Common Sense - DR D-EbookCarlos Treseme100% (1)

- BHP Billiton CaseDocument30 pagesBHP Billiton CaseMonjurul Hassan100% (2)

- Milton Friedman, Anna J. Schwartz. The Great Contraction, 1929-33 P9Document14 pagesMilton Friedman, Anna J. Schwartz. The Great Contraction, 1929-33 P9kirchyNo ratings yet

- Portable Alpha - Philosophy, Process & PerformanceDocument14 pagesPortable Alpha - Philosophy, Process & PerformanceChDarwinNo ratings yet

- FA FS Front Arena 4.2Document2 pagesFA FS Front Arena 4.2Joanne ChungNo ratings yet

- R.K Gandhi-Valuation of Leasehold Properties For Lessor OR Lessee PDFDocument31 pagesR.K Gandhi-Valuation of Leasehold Properties For Lessor OR Lessee PDFRajiv SahniNo ratings yet

- Impact of Financial Literacy, Financial Knowledge, Moderating Role of Risk Perception On Investment DecisionDocument20 pagesImpact of Financial Literacy, Financial Knowledge, Moderating Role of Risk Perception On Investment Decisiondahiman khan100% (2)

- Summary of Michael M. Pompian's Behavioral Finance and Wealth ManagementFrom EverandSummary of Michael M. Pompian's Behavioral Finance and Wealth ManagementNo ratings yet

- INVESTMENT AVENUES BLACK BOOK UpgradedDocument71 pagesINVESTMENT AVENUES BLACK BOOK UpgradedJack DawsonNo ratings yet

- Finacial LiterncyDocument48 pagesFinacial LiterncyKiranNo ratings yet

- Sakina LotiaDocument22 pagesSakina LotiaEldorado OSNo ratings yet

- Impact of Financial Literacy On Investment Behavior and Consumption BehaviourDocument17 pagesImpact of Financial Literacy On Investment Behavior and Consumption BehaviourFadhil ChiwangaNo ratings yet

- Behavioral Finance How Psychological Factors can Influence the Stock MarketFrom EverandBehavioral Finance How Psychological Factors can Influence the Stock MarketRating: 5 out of 5 stars5/5 (1)

- A STUDY On Financial Literacy Among Youths in MumbaiDocument57 pagesA STUDY On Financial Literacy Among Youths in Mumbaibhanushalidhruv590% (1)

- Future of MobilityDocument32 pagesFuture of MobilityOlayinka OlanrewajuNo ratings yet

- 156-Article Text-297-2-10-20191012Document12 pages156-Article Text-297-2-10-20191012Hải VũNo ratings yet

- SSRN Id2727890Document20 pagesSSRN Id2727890amirhayat15No ratings yet

- SSRN Id2727890Document20 pagesSSRN Id2727890Hoang OanhNo ratings yet

- Awareness and Perception of Investors To PDFDocument14 pagesAwareness and Perception of Investors To PDFakshayNo ratings yet

- Gambler Control Small Investor in Capital Market. How Can Protect Them From This Situation? - Based On Last 5 Years' DataDocument8 pagesGambler Control Small Investor in Capital Market. How Can Protect Them From This Situation? - Based On Last 5 Years' DataMD.MOKTARUL ISLAMNo ratings yet

- Financial Literacy & Investment Decisions of Indian InvestorsDocument15 pagesFinancial Literacy & Investment Decisions of Indian InvestorsSnow Gem100% (2)

- Sustainability 14 13454Document25 pagesSustainability 14 13454Shubham RajNo ratings yet

- Newproject 160624075440Document120 pagesNewproject 160624075440હિરેનપ્રફુલચંદ્રજોષીNo ratings yet

- A Study On Investment Avenues For Investor With Special Reference To Business People at Tiruvannamalai TownDocument36 pagesA Study On Investment Avenues For Investor With Special Reference To Business People at Tiruvannamalai TownShruti HarlalkaNo ratings yet

- Research PaperDocument6 pagesResearch PaperSidNo ratings yet

- The Impact of Financial Literacy On Investment Decisions: With Special Reference To Undergraduates in Western Province, Sri LankaDocument18 pagesThe Impact of Financial Literacy On Investment Decisions: With Special Reference To Undergraduates in Western Province, Sri LankaRITESH SHINDENo ratings yet

- RM Assignment 1 8 SYBBA Div D-1Document8 pagesRM Assignment 1 8 SYBBA Div D-1NAMYA ARORANo ratings yet

- C061 - Basan - Chapter 1Document6 pagesC061 - Basan - Chapter 1liberace cabreraNo ratings yet

- (Draft) Lit ReviewDocument16 pages(Draft) Lit ReviewHoang OanhNo ratings yet

- Money MattersDocument8 pagesMoney MattersNitin JindalNo ratings yet

- Project ReportDocument78 pagesProject Reportsharvaripatil4303No ratings yet

- September 2020 NewsletterDocument30 pagesSeptember 2020 NewsletterAnonymous FnM14a0No ratings yet

- 35 81 1 PBDocument26 pages35 81 1 PBharryNo ratings yet

- Risk Taking Ability of Young InvestorsDocument9 pagesRisk Taking Ability of Young InvestorsVidhiNo ratings yet

- Central University of South Bihar: Project-TopicDocument13 pagesCentral University of South Bihar: Project-TopicDHARAM DEEPAK VISHWASHNo ratings yet

- Financial Literacy On Gen ZDocument82 pagesFinancial Literacy On Gen Zdionwins9No ratings yet

- A Report On Merchant Banking and Portfolio Management Rules: A Comparison of Bangladesh and IndiaDocument49 pagesA Report On Merchant Banking and Portfolio Management Rules: A Comparison of Bangladesh and IndiaYeasir ArafatNo ratings yet

- Financial Literacy Initiatives by Various Regulatory InstitutionsDocument5 pagesFinancial Literacy Initiatives by Various Regulatory InstitutionsarcherselevatorsNo ratings yet

- Chapter 1 Wong GRPDocument34 pagesChapter 1 Wong GRPApril ManjaresNo ratings yet

- Dropout ResearchDocument39 pagesDropout ResearchMax LopezNo ratings yet

- The Effect of Self Monitoring in The Relationship Between Financial Literacy, Herding, and Risk Tolerance With Investment DecisionsDocument7 pagesThe Effect of Self Monitoring in The Relationship Between Financial Literacy, Herding, and Risk Tolerance With Investment DecisionsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Martino Et Al. FinaaalDocument49 pagesMartino Et Al. FinaaalJean FelixNo ratings yet

- Master Thesis (Chap 1)Document16 pagesMaster Thesis (Chap 1)Nishan V JainNo ratings yet

- Investors Perception On InvestmentDocument22 pagesInvestors Perception On InvestmentBothuka ShoheNo ratings yet

- Statistics Assignment: Batch 2021 - 23 Name of Program (PGDM)Document27 pagesStatistics Assignment: Batch 2021 - 23 Name of Program (PGDM)Kartikey MishraNo ratings yet

- Indian Equity MarketDocument59 pagesIndian Equity Marketjitendra jaushikNo ratings yet

- Amulya Tybbi ProjectDocument179 pagesAmulya Tybbi Projectvpriyasingh57No ratings yet

- 1 SM PDFDocument16 pages1 SM PDFmbapritiNo ratings yet

- Financial Literacy Affects Financial Behavior Through Financial Attitude As An Intervening VariableDocument5 pagesFinancial Literacy Affects Financial Behavior Through Financial Attitude As An Intervening VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impactof Financial Literacyand Investment Experienceon RisktoleranceandinvestmentdecisionsDocument7 pagesImpactof Financial Literacyand Investment Experienceon RisktoleranceandinvestmentdecisionsHussain khawajaNo ratings yet

- Review Literature - 01 (12 Files Merged)Document12 pagesReview Literature - 01 (12 Files Merged)Obaid AhmedNo ratings yet

- Islamic FinDocument34 pagesIslamic Finess_ayNo ratings yet

- Financial Literacy The Case of PolandDocument17 pagesFinancial Literacy The Case of PolandCarlo CalmaNo ratings yet

- 01 Title MergedDocument225 pages01 Title MergedRuben ChristopherNo ratings yet

- A Study On Financial Literacy Among Students of Thane SuburbsDocument51 pagesA Study On Financial Literacy Among Students of Thane Suburbskolekardhruva99No ratings yet

- 05 Chapter 1Document14 pages05 Chapter 1hardikbhuva2804No ratings yet

- Jurnal Akuntansi AKTIVA, Vol. 2, No. 1, April 2021: Astuti Anggraini Yulita Zanaria Sri Retnaning RahayuDocument11 pagesJurnal Akuntansi AKTIVA, Vol. 2, No. 1, April 2021: Astuti Anggraini Yulita Zanaria Sri Retnaning RahayuRamadhini WNo ratings yet

- 1.1. Identification of ProblemDocument45 pages1.1. Identification of ProblemAditya AgarwalNo ratings yet

- What Specific Work Is An Excellent Illustration of A Behavioral Finance Risk Perception Study?Document15 pagesWhat Specific Work Is An Excellent Illustration of A Behavioral Finance Risk Perception Study?Seetha ManiNo ratings yet

- Research Papers On Behavioral Finance in IndiaDocument7 pagesResearch Papers On Behavioral Finance in Indiafzgzygnp100% (1)

- Investigating The Efficiency of GCC Banking Sector An Empirical Comparison of Islamic and Conventional BanksDocument22 pagesInvestigating The Efficiency of GCC Banking Sector An Empirical Comparison of Islamic and Conventional BanksNaumankhan83No ratings yet

- Findings MutDocument16 pagesFindings MuttouffiqNo ratings yet

- An Exploratory Study To Check The Impact of COVID 19 On Investment Decision of Individual Investors in Emerging Stock Market GROUP 4Document3 pagesAn Exploratory Study To Check The Impact of COVID 19 On Investment Decision of Individual Investors in Emerging Stock Market GROUP 4Keana Cassandra TobiasNo ratings yet

- Navigating Investor Behavior: Insights from Behavioral FinanceFrom EverandNavigating Investor Behavior: Insights from Behavioral FinanceNo ratings yet

- Swot MatrixDocument3 pagesSwot Matrixkarenmae intangNo ratings yet

- 522 Economic AnalysisDocument6 pages522 Economic AnalysisimtiazbscNo ratings yet

- Comparitive Study ICICI & HDFCDocument22 pagesComparitive Study ICICI & HDFCshah faisal100% (1)

- 2 Can ManishaDocument6 pages2 Can ManishaApurv DixitNo ratings yet

- The World's Largest 500 Asset Managers - Joint Study With Pensions & Investments - October 2020Document56 pagesThe World's Largest 500 Asset Managers - Joint Study With Pensions & Investments - October 2020alexNo ratings yet

- Quiz 4Document1 pageQuiz 4Jaypee BignoNo ratings yet

- LIC S Market Plus - 512L238V01Document9 pagesLIC S Market Plus - 512L238V01Sharath KotaNo ratings yet

- Hasfhi Rahmat - Tugas Ke-4Document4 pagesHasfhi Rahmat - Tugas Ke-4syuhayudaNo ratings yet

- Axis Bank-FrechargeDocument5 pagesAxis Bank-FrechargeAmanNo ratings yet

- South Africa Fact SheetDocument4 pagesSouth Africa Fact SheetHoang NamNo ratings yet

- Question 1: Explain Black Whastcholes Model and Show That It Satisfies Put Call Parity ?Document8 pagesQuestion 1: Explain Black Whastcholes Model and Show That It Satisfies Put Call Parity ?arpitNo ratings yet

- 01 - Principles of FinanceDocument50 pages01 - Principles of FinanceBagusranu Wahyudi PutraNo ratings yet

- ESCALONA MAY E - ASSIGNMENT - World Bank, IMF, and ADBDocument4 pagesESCALONA MAY E - ASSIGNMENT - World Bank, IMF, and ADBMa YaNo ratings yet

- Kotak Mahindra BankDocument7 pagesKotak Mahindra BankRajendra VermaNo ratings yet

- Theory of Finance (Shingo Goto)Document4 pagesTheory of Finance (Shingo Goto)Jaime Tiburcio CortésNo ratings yet

- House Rent Vs Buy AnalysisDocument6 pagesHouse Rent Vs Buy Analysisg ssdNo ratings yet

- CI Regular PracticeDocument2 pagesCI Regular PracticeboostoberoiNo ratings yet

- Reading 40 Analysis of Active Portfolio Management - AnswersDocument28 pagesReading 40 Analysis of Active Portfolio Management - Answerstristan.riolsNo ratings yet

- Return On Invested Capital: Disaggregation of Profit MarginDocument8 pagesReturn On Invested Capital: Disaggregation of Profit MarginmohihsanNo ratings yet

- Assignment On Private Company Vs Public Company in eDocument5 pagesAssignment On Private Company Vs Public Company in eSaravanagsNo ratings yet

- Capital Investments: Unicorn USD FTSE/JSE Listed PortfolioDocument1 pageCapital Investments: Unicorn USD FTSE/JSE Listed PortfoliodoogNo ratings yet