Professional Documents

Culture Documents

Fundamentals of Accounting MCQs

Uploaded by

Ravi ShankarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamentals of Accounting MCQs

Uploaded by

Ravi ShankarCopyright:

Available Formats

File hostedby educationobserver.

com/forum

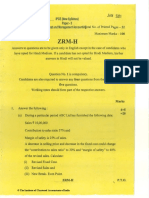

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

Paper2-FundamentalsofAccounting

MultipleChoiceQuestionsonCostAccounting

1. Coststhatchangeinresponsetoalternativecoursesofactionarecalled:

a. Relevantcosts

b. Differentialcosts

c. Targetcosts

d. Sunkcosts

2. ThecostdatapertainingtoProductX ofXLLtd.areasfollows:

Maximumcapacity 30,000units

Normalcapacity 15,000units

Increaseininventory 1,880units

Variablecostperunit `12

Sellingpriceperunit `50

Fixedmanufacturingoverheadcosts `3,60,000

If the profitunder Absorption costingmethod is `1,01,000, the

profitunderMarginalcostingmethodwouldbe

a.`1,46,120

b.`1,23,560

c. `55,880

d.`73,340

[Hint:Fixedcostperunit=`3,60,000/ 15,000units=

`24Profitunderabsorptioncosting=`1,01,000

Adjustmentoffixedmanufacturingoverheadcostsofincreasedinventory=1,880unitsx`24=`

45,120

Profitundermarginalcosting= `1,01,000`45,120=`55,880]

3. The totalcostincurred in theoperationofa

businessundertakingotherthanthecostofmanufacturingandproductionisknownas

a. Directcost

b. Variablecost

c. Commercialcost

d. Conversioncost

4. Considerthefollowingdatafora companyduringthe month ofJune2012

Budgetedhours 4,000

Standardhoursforactualproduction 4,400

Maximumpossiblehoursinthebudgetperiod 4,800

Actualhours 3,800

Theactivity ratioofthecompanyduringthemonthis

a.111%

b.120%

c. 95%

d.117%

[Hint: Activityratio=Standardhoursforactualproduction x 100

Budgetedhours

= 4,440hoursx100 = 111%]

4,000hours

5. Totalunitcostsare

a. Independentofthecostsystem,usedtogeneratethemb.Ne

ededfordeterminingproductcontribution

c.Irrelevantinmarginalanalysisd.Relevantf

orcost-volume-profitanalysis

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page1

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

6. Which of the followingbases is notappropriate for apportionmentof Transportdepartments cost?

a. Cranehours

b. Cranevalue

c. TruckMileage

d. Truckvalue

7. Thecostofobsoleteinventory acquired severalyearsago,to beconsidered ina keep

vs.disposaldecisionisanexampleof:

a. Uncontrollablecost

b.Sunkcost

c.Avoidablecostd.O

pportunitycost

[Hint:Costsofobsoleteinventoryrepresentthesunkcostbecausethecostshavealreadybeenincurred.]

8. Budgetedsalesforthenextyearis5,00,000units.Desiredendingfinishedgoodsinventoryis1,50,000unitsand

equivalentunitsinendingW-I-

Pinventoryis60,000units.Theopeningfinishedgoodsinventoryforthenextyearis80,000units,with50,000equ

ivalentunitsinbeginningW-I-PinventoryHowmanyequivalentunitsshouldbeproduced?

a.5,80,000

b.5,50,000

c.5,00,000

d.5,75,000

[Hint:Usingproductionrelatedbudgets,unitstoproduceequalsbudgetedsales+desiredendingfinishedg

oodsinventory+desiredequivalentunitsinendingW-I-Pinventorybeginningfinishedgoodsinventory

equivalentunitsinbeginningW-I-Pinventory.Therefore,inthiscase,unitstoproduceisequalto5,00,000+

1,50,000+60,00080,000 50,000=5,80,000.

9. Iftheassetturnoverandprofitmarginofacompanyare1.85and0.35respectively,thereturnoninvestmen

tis

a.0.65

b.0.35

c. 1.50

d.5.29

[Hint:Returnoninvestment=AssetturnoverxProfitmargin=1.85x0.35=0.65]

10. Acompanyiscurrentlyoperatingat80%capacitylevel.Theproductionundernormalcapacitylevelis1,50,

000units.Thevariablecostperunitis`14

andthetotalfixedcostsare`8,00,000.Ifthecompanywantstoearnaprofitof

`4,00,000,thenthepriceoftheproductperunitshouldbe

a.`37.50

b.`38.25

c. `24.00

d.`35.00

[Hint:Totalfixedcost -

`8,00,000Expectedprofit

-

`4,00,000Variablecostat80

%level

(80%x 1,50,000unitsx `14) - `16,80,000

Totalprice - `28,80,000

Perunitprice at80%level=(`28,80,000 /1,20,000units)=`24.00.]

11. Considerthefollowingdatapertainingtotheproductionofa companyfora

particularmonth:Openingstockofrawmaterial ` 11,570

Closingstockofrawmaterial ` 10,380

Purchaseofrawmaterialduringthemonth

`1,28,450Tot

almanufacturingcostchargedtoproduct

`3,39,165Fac

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page2

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

toryoverheadsareapplied attherateof45%ofdirectlabourcost.

Theamountoffactory overheadsapplied toproductionis

a.` 65,025

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page3

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

b.` 94,287

c. ` 95,020

d.`1,52,624

[Hint:Rawmaterialused=Op.Stock+PurchasesCl.Stock

=`11,570+`1,28,450`10,380 = `1,29,640

Manufacturingcost =Rawmaterialused+Directlabour+Factoryoverhead

`3,39,165 =`1,29,640+Directlabour+45%ofDirectlabour

1.45Directlabour

=`2,09,525D

irectlabour =`1,44,500

Theamountoffactoryoverhead=45%of`1,44,500=`65,025.]

12. Thebudgetedannualsales

ofafirmis`80lakhsand25%ofthesameiscashsales.Iftheaverageamountofdebtorsofthefirm

is`5lakhs,theaveragecollectionperiodofcreditsalesmonths.

a.1.50

b.1.00

c. 0.50

d.1.75

[Hint:Total annualsales=`80lakhs

Totalcash sales=25%of80lakhs.=20

lakhs.Totalcreditsales =75%of80 lakhs=60lakhs

Averageamountofdebtors=5lakhs=1monthsaveragecreditsales.Therefo

re,averagecollectionperiodis1month.]

13. IftheminimumstocklevelandaveragestocklevelofrawmaterialA are4,000and9,000units

respectively,findoutitsreorderquantity.

a. 8,000units

b. 11,000units

c. 10,000units

d. 9,000units

[Hint:Averagestocklevel =Minimumstocklevel+Reorderquantity9,000units

=4,000units+Reorderquantity

Reorderquantity=9,000units4,000units

Reorderlevel =5,000units/ 0.5 =10,000units]

14. Aworkerhasatimerateof`15/hr.Hemakes720unitsofcomponent(standardtime:5minutes/unit)inaweek

of48hours.HistotalwagesincludingRowanbonusfortheweekis

a.`792

b.`820

c. `840

d.`864

[Hint:Standardtime= 5timesx720units =60hours

60minutes

Timetaken =48 hrs.

Timesaved =12hrs.

TotalearningofaworkerunderRowanplan

= (48 hrs.x`15)+(12 hrs. x48hrs.x`15)

60hrs.

=`720+`144 = `864

15. A companymaintainsamarginofsafetyof25%onitscurrentsalesandearnsaprofit

of`30lakhsperannum.If thecompanyhasa profitvolume(P/V)ratioof40%,itscurrentsalesamountto

a. `200 lakhs

b. `300 lakhs

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page4

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

c. `325 lakhs

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page5

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

d. Noneoftheabove

[Hint:Marginofsafety = Profit/P/VRatio

= 30/0.40= `75lakhs

0.25 of sales = `75 lakhs

Hence,Sales = 75/0.25= `300lakhs]

16. Salefortwoconsecutivemonths,ofacompanyare`3,80,000and`4,20,000.Thecompanysnetprofitsforthes

emonthsamountedto`24,000and`40,000respectively.Thereisnochangeincontribution/salesratioorfixe

dcosts.Thecontribution/salesratioofthecompany is

a.1/3b.

2/5

c.

d. Noneoftheabove

[Hint:Contribution/sales =Increaseinprofit/Increaseinsales

= (40,00024,000)/(4,20,0003,80,000)

=16,000/40,000= 2/5]

17. A Limitedhasfixedcostsof`6,00,000 perannum.It manufacturesasingle productwhichit sellsfor

`200 per unit.Itscontribution to sales ratio is 40%. ALimiteds break-evenin units is

a.7,500

b.8,000

c. 3,000

d.1,500

[Hint:Break-evenunits= Fixedcost/contributionperunit

= `6,00,000/40% of`200

= 7,500]

18. ThecurrentliabilitiesofAkashLtd.is`30,000.Ifitscurrentratiois3:1andQuickratiois1:1,thevalueofstock-in-

tradewillbe

a.`20,000

b.`30,000

c. `60,000

d.Insufficientinformation

[Hint:CurrentRatio = CurrentAssets = 3:1

CurrentLiabilities

CurrentAssets = `30,000 x3 = `90,000

QuickRatio = QuickAssets = 1:1

QuickLiabilities

Liquidassets = `30,000 x1 = `30,000

Hence,valueofstock-in-trade:CALA = `(90,00030,000)

= `60,000]

19. Ifthecapacityusageratioofaproductiondepartmentis90%andactivityratiois99%thentheefficiencyratio

ofthedepartmentis

1. 100%

2. 120%

3. 110%

4. 105%

[Hint:Efficiencyratio(ER) = Std.hr.ofproductionActualhrs.

Activityratio(AR) = Std.hrs.forproductionBudgetedhrs.

Capacityratio (CR) = Actualhrs.Budgetedhrs.

Hence,ER= AR/CR = 99%/90% = 110%]

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page6

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

20. Intwoconsecutiveperiods,salesandprofitwere`1,60,000and`8,000respectivelyinthefirstperiodand`1,80,

000and`14,000respectivelyduringthesecondperiod.Ifthereisnochangeinfixedcostbetweenthetwoperi

odsthenP-Vratiomustbe

1. 20%

2. 25%

3. 30%

4. 40%

[Hint:Changeinprofit =

P/VRatioChangei

nsales

= 14,000

8,0001,80,000

160,000

= 6,000

20,000

= 0.30or30%]

21. HorizonLtd.ManufacturesproductBMforlast5years.Thecompany maintainsamarginofsafety

of37.5%withoverallcontributiontosalesratioof40%.Ifthefixedcostis`5lakh,theprofitofthecompany is

a. `24.00laks

b. `12.50lakh

c. ` 3.00lakh

d. NoneofA,B,C

[Hint:Break evensales= `5 lakhs0.40= `12.50lakhs

Totalsales = 12.50. = `20.00

lakhs(10.375)

Hence theprofitofthecompany:`20lakhx 0.375x0.40= `3.00 lakhs]

22. Thecost-volume-

profitrelationshipofacompanyisdescribedbytheequationy=`8,00,000+0.60x,inwhichxrepresentssalesr

evenueandyisthetotalcostatthesalesvolumerepresentedbyx.Ifthecompanydesirestoearnaprofitof20

%onsales,therequired saleswillbe.

a.`40,00,000

b.`35,50,000

c. `24,00,000

d.`20,00,000

[Hint:Variablecost=60%,therefore,contributiontosalesratio=40% (P/Vratio)

Companystargetprofit20%insales,therefore,revisedcontributionwhichcoversonlyfixedcost=40%-

20%=20%.

Requiredsales=fixedcost/revisedcontribution =`8,00,000/20%=`40,00,000.]

23. ABCLtd.ishaving400workersatthebeginningofthe year and500workers

attheendoftheyear.Duringtheyear20workersweredischargedand15workerslefttheorganization.During

theyearthecompanyhasrecruited65workers.Ofthese,18workerswererecruitedinthevacanciesofthosel

eaving,whiletherestwereengagedforanexpansionscheme.Thelabourturnoverrateunderseparationm

ethodis:

a.22.20%

b.7.78%

c. 4.00%

d.14.40%

[Hint:Average number ofworkers=(400 +500)/2 = 450

Separationmethod

= No.ofseparationsduringtheperiod x

100Averagenumberofworkersduringtheperiod

=20+15x 100450

=7.78%]

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page7

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

24. Oneofthemostimportanttoolsincostplanningis:

a. Directcost

b. CostSheet

c. Budget

d. MarginalCosting.

25. Economiesanddiseconomiesofscaleexplainwhythe:

a. Short-runaveragefixedcostcurvedeclinessolongasoutputincreases.

b. Marginalcostcurvemustintersecttheminimumpointofthefirm'saveragetotalcostcurve.

c. Long-runaveragetotalcostcurveistypicallyU-shaped.

d. Short-runaveragevariablecostcurveisU-shaped.

26. Whichofthefollowingisnotarelevantcost?

a. Replacementcost

b. Sunkcost

c. Marginalcost

d. Standardcost.

27. Whichofthefollowingisanaccounting record?

a. BillofMaterial

b. BinCard

c. StoresLedger.

d. Allofthese.

28. Thefixed-variablecostclassificationhasaspecialsignificanceinpreparationof:

a. FlexibleBudget

b. MasterBudget

c. CashBudget

d. CapitalBudget

29. Inputinaprocessis4000unitsandnormallossis20%.Whenfinishedoutputintheprocessisonly3240units,ther

eisan:

a. Abnormallossof40units

b. Abnormalgainof40units

c. Neitherabnormallossnorgain.

d. Abnormallossof60units.

30. Idlecapacityofaplantisthedifferencebetween:

a. Maximumcapacityandpracticalcapacity

b. Practicalcapacityandnormalcapacity

c. Practicalcapacityandcapacitybasedonsalesexpectancy

d. Maximumcapacityandactualcapacity.

31. WhenP/Vratiois40%and salesvalueis`10,000,thevariablecostwillbe

a.`4000

b.`6000

c. `10000

d.VariableCostcannotbecalculatedfromdatagiven.

32. Theforexcomponentof imported materialcostisconverted

a. Attherateonthedateofsettlement

b. Attherateonthedateoftransaction

c. Attherateondateofdelivery

d. Noneoftheabove.

33. Maximumpossibleproductivecapacityofaplantwhennooperatingtimeislost, isits

a. Practicalcapacity

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page8

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

b. Theoreticalcapacity

c. Normalcapacity

d. Capacitybasedonsalesexpectancy

[Hint:Theoreticalcapacityisthedenominator-

levelconceptthatisbasedonproducingatfullefficiencyallthetime.,

Practicalcapacity is adenominator-levelconcept

thatreducesthetheoreticalcapacitybyunavoidableoperatinginterruptionssuchasscheduledmaintena

ncetime,shutdownsforholidaysandsoon.

Normalcapacitymeasuresthedenominatorlevelintermsofdemandfortheoutputoftheplant.Normal

capacity utilizationis aconcept based on the level of capacity utilizationthat specifies

theaveragecustomerdemandoveratimeperiod,thatincludesseasonal,cyclicalandtrendfactors.]

34. Whenproductionisbelowstandardspecificationorqualityandcannotberectifiedbyincurringadditional

cost,itiscalled

a. Defective

b. Spoilage

c. Waste

d. Scrap

[Hint :(1)Spoiledgoods-

goodsthatdonotmeetproductionstandardsandareeithersoldfortheirsalvagevalueordiscarded;(2)Def

ectiveunits-

goodsthatdonotmeetstandardsandaresoldatareducedpriceorreworkedandsoldattheregularorared

ucedprice;(3)Waste-materialthatislostinthemanufacturingprocessbyshrinkage,evaporation, etc.;

and(4)Scrap-by-productofthemanufacturingprocessthathasaminormarketvalue.]

35. CAS 8requireseachtypeofutility tobe treated as

a. Separatecostobject

b. Notpartofcostasnotincludeinmaterial

c. Notpartofcostastheydo notformpartofproduct

d. Treatedasadministrativeoverheads.

36. Sellinganddistributionoverheaddoesnotinclude:

a. Costofwarehousing

b. Repackingcost

c. Transportationcost

d. Demurragecharges.

37. Whenovertimeisrequiredformeetingurgentorders,overtimepremiumshouldbe

a. ChargedtoCostingProfitandLossA/c

b. Chargedtooverheadcosts

c. Chargedtorespectivejobs

d. Noneoftheabove.

[Hint:When costisincurredforspecifiedjob,thecostshouldbechargedtothatjobonly.]

38. Exchangelossesorgainsafterpurchasetransactioniscompleteistreatedas

a. Productcost.

b. Overheadcost.

c. Purchasecost.

d. Financecost

39. Sellingpriceperunit`15.00;DirectMaterialscostperunit`3.50;DirectLabourcostperunit`4.00VariableOver

headperunit`2.00;Budgetedfixedproductionoverheadcostsare`60,000perannumchargedevenly

acrosseachmonthoftheyear.Budgetedproductioncosts are

30,000unitsperannum.WhatistheNetprofitperunitunderAbsorptioncostingmethod.

a.` 9.50

b.`15.00

c. `11.50

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page9

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

d.`3.50

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page10

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

40. Whichofthefollowingcostislinkedwiththecalculationofcostofinventories?

a. Productcost

b. Periodcost

c. Bothproductandperiodcost

d. Historicalcost

41.

If,Sales=`800,000Markupr

ate=25%ofcost

WhatwouldbethevalueofGrossprofit?

a.`200,000

b.`160,000

c. `480,000

d.`640,000

42. Whichofthefollowingis TRUEwhenpieceratesystem isusedforwagedetermination?

a. Underthismethodofremunerationaworkerispaidonthebasisoftimetakenbyhimtoperformthework

b. Underthismethodofremunerationaworkerispaidonthebasisofproduction

c. Therateisexpressedintermsofcertainsumofmoneyfortotalproduction

d. Therateisnotexpressedintermsofcertainsumofmoneyfortotalproduction

43. Thesalaryoffactory clerk is treatedas:

a. Directlaborcost

b. Indirectlaborcost

c. Conversioncost

d. Primecost

44. AverageconsumptionxEmergencytimeisaformulaforthecalculationof:

a. Leadtime

b. Re-orderlevel

c. Maximumconsumption

d. Dangerlevel

45. EOQisapointwhere:

a. Orderingcostisequaltocarryingcost

b. Orderingcostishigherthancarryingcost

c. Orderingcostislesserthanthecarryingcost

d. Totalcostismaximum

46. Aworkerispaid`0.50perunitand

heproduces18unitsin7hours.Keepinginviewthepieceratesystem,thetotalwagesoftheworkerwouldbe

:

a.18 x0.50 = `9

b.18 x7 =`126

c. 7 x 0.5 =`3.5

d.18 x7x0.50 = `63

47. Whenclosingstockisovervaluate,whatwoulditseffectonprofit?

a. Cannotdeterminedwithgivenstatement

b. ItwillIncreasetheprofit

c. Itwilldecreasetheprofit

d. Noeffectonprofit

48. A firmsells bagsfor`14 each.Thevariablecost for eachunitis`8. Whatisthecontributionmarginperunit?

a. `6

b.`12

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page11

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

c. `14

d.`8

49. Whichofthefollowingis NOTtrue?Asmallcompany'sbreakevenpoint:

a. Occurswhereitsrevenueequalsitsexpenses

b. Shows entrepreneursminimumlevel ofactivity requiredtokeep thecompany in operation

c. Isthepointatwhichacompanyneitherearnsaprofitnorincursaloss

d. Totalcontributionmarginequalstotalvariableexpenses

50. KellerCo.sellsasingleproductfor`28perunit.Ifvariablecostsare65%ofsalesandfixedcoststotal`9,800,the

break-evenpointwillbe:

a. 15,077units

b. 18,200units

c. 539units

d. 1,000units

51. IfBLimited

showsrequiredproductionof120casesofproductforthemonth,directlaborpercaseis3hoursat`12per

hour.Budgeted laborcosts forthemonth should be:

a.`1,360

b.`1,440

c. `4,320

d.`5,346

52. Whichofthefollowingisaprocessbywhichmanagersanalyzeoptionsavailabletosetcoursesofactionbyt

heorganization?

a. Heuristicsmethod

b. Decisionmaking

c. TheDelphitechnique

d. Systematicerror

53. Whichofthefollowingisnottrueaboutdifferentialcosts?

a. Itisabroaderconceptthanvariablecostasittakesintoaccountadditionalfixedcostscausedbymana

gementdecisions

b. Withthepassageoftimeandchangeinsituation,differentialcostswillvary

c. Thedifferenceincostbetweenbuyingthemfromoutsideormaketheminthecompanyisdifferentialco

st,irrelevantfordecisions

d. Theyareextraorincrementalcostscausedbyaparticulardecision

54. WhichoneofthefollowingistheTraditionalapproachfor costing?

a. Contributionapproach

b. Absorptioncostingapproach

c. Decisionmakingapproach

d. Marginalcostingapproach

55. Whatwouldbethemarginofsafetyratiobasedonthefollowinginformation?Salespr

ice =`100perunit

Variablecost =`25perunit

Fixed cost =`50perunit

a. 25%

b. 33.333%

c. 66.666%

d. 75%

56. If:

Costofopening

finishedgoods`2,000Costof goodsto be

produced`6,000Operatingexpenses`1,00

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page12

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

0.

BoardofStudies,Institute ofCostAccountantsofIndia(StatutoryBodyunderan ActofParliament) Page13

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

Whichofthefollowingisthecostofgoodsavailableforsale?

a.`8,000

b.`4,000

c. `7,000

d.`9,000

57. AhmedCorporationhassalesof`500,000fortheperiod.Thesellingexpensesareestimatedas12%ofsales.Th

egrossprofitfortheperiodisamountingto `150,000.

Calculatetheamountofsellingexpensesfortheperiod?

a.`60,000

b.`45,000

c. `90,000

d.`210,000

58. Whichofthefollowing wouldbeconsideredtobeaninvestmentcentre?

a. Managershavecontrolovermarketing

b. Managershaveasalesteam

c. Managershaveasalesteamandaregivenacreditcontrolfunction

d. Managerscanpurchasecapitalassetsandaregivenacreditcontrolfunction

59. WhichofthefollowingwouldNOT leadtoanincreasein netcashflow?

a. Largersalesvolume

b. Highersellingprice

c. Reducedmaterialcost

d. Chargingoflowerdepreciation

60. AllofthefollowingarefeaturesofarelevantcostEXCEPT:

a. Theyaffectthefuturecost

b. Theycauseanincrementincost

c. Relevantcostisasunkcost

d. Theyaffectthefuturecashflows

61. Whichofthefollowing statementisTRUEabouttherelevantcost?

a. Itisasunkcost

b. Itisanopportunitycost

c. Itdonotaffectthedecisionmakingprocess

d. Allcostsarerelevant

62. Indecisionmakingallcostsalready incurredinpastshould alwaysbe:

a. Ignored

b. Considered

c. Partiallyignored

d. Partiallyconsidered

63. WhichofthefollowingstatementisTRUEabouthistoricalcost?

a. Itisalwaysrelevanttodecisionmaking

b. Itisalwaysirrelevanttodecisionmaking

c. Itisalwaysanopportunitycost

d. Itisalwaysrealizablevalue

64. Incostaccounting,unavoidablelossischargedtowhichofthefollowing?

a. Factoryoverheadcontrolaccount

b. Workinprocesscontrolaccount

c. Marketingoverheadcontrolaccount

d. Administrationoverheadcontrolaccount

65. MerrickDifferentialPieceRatePlanbasedon pieceratesisfixed.

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page10

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

a. Two

b. Three

c. Four

d. Five

66. Whichofthegivenis(are)themethod(s)ofmeasurementofLaborTurnover?

a. Separationmethod

b. Fluxmethod

c. Replacementmethod

d. Allofthegivenoptions

67. Whatwillbetheimpactofnormallossontheoverallperunitcost?

a. Perunitcostwillincrease

b. Perunitcostwilldecrease

c. Perunitcostremainunchanged

d. Normallosshasnorelationtounitcost

68. WhichofthegivenunitscanneverbecomepartoffirstdepartmentofCostofProductionReport?

a. Unitsreceivedfromprecedingdepartment

b. Unitstransferredtosubsequentdepartment

c. Lostunits

d. Unitsstillinprocess

69. Detailsoftheprocessforthelastperiodareasfollows:

Putintoprocess 5,000kg

Materials `2,500

Labor `700

Productionoverheads 200%of labor

Normallossesare10%ofinputintheprocess.Theoutputfortheperiodwas4,200Kgfromtheprocess.Therewa

snoopeningandclosingWork-in-process.Whatweretheunitsofabnormalloss?

a. 500units

b. 300units

c. 200units

d. 100units

70. ABCCompanymakesasingleproductwhichitsellsfor`20perunit.Fixedcostsare`75,000permonthandpro

ducthasaprofit/volumeratioof40%.Inthatperiodactualsaleswere`225,000.

Required:CalculateABCCompanyBreakEvenpointin`

a.`187,500

b.`562,500

c. `1,500,000

d.Noneofthegivenoptions

71. AllofthefollowingarethefeaturesoffixedcostsEXCEPT:

a. Althoughfixedwithinarelevantrangeofactivitylevelbutarerelevanttoadecisionmakingwhenitisavo

idable.

b. Althoughfixedwithinarelevantrangeofactivitylevelbutarerelevanttoadecisionmakingwhenitisincr

emental.

c. Generallyitisirrelevant

d. Itisrelevanttodecisionmakingunderanycircumstances

72. Atypicalfactory overheadcostis:

a. Distribution

b. Internalaudit

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page11

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

c. Compensationofplantmanager

d. Design

73. Anaveragecostisalsoknownas:

a. Variablecost

b. Unitcost

c. Totalcost

d. Fixedcost

74. Period costsare:

a. Expensedwhentheproductissold

b. Includedinthecostofgoodssold

c. Relatedtospecificperiod

d. Notexpensed

75. WhilecalculatingtheEOQ,numberofordersiscalculatedby:

a. Dividingrequiredunitbyorderedquantity

b. Multiplyingtherequiredunitswithorderedquantity

c. Multiplyingtheorderedquantitywithcostperorder

d. Multiplyingtherequiredunitswithcostperorder

76. Whichofthefollowingbestdescribepieceratesystem?

a. Theincreasedvolumeofproductionresultsindecreasedcostofproduction

b. Theincreasedvolumeofproductioninminimumtime

c. Establishmentof fairstandardrates

d. Higheroutputisaresultofefficientmanagement

77. ThetermCostapportionmentisreferredto:

a. Thecoststhatcannotbeidentifiedwithspecificcostcenters.

b. Thetotalcostoffactoryoverheadneedstobedistributedamongspecificcostcentersbutmustbe

dividedamongtheconcerneddepartment/costcenters.

c. Thetotalcostoffactoryoverheadneedstobedistributedamongspecificcostcenters.

d. Noneofthegivenoptions

78. Whichofthefollowinglossisnotincludedaspartofthecostoftransferredorfinishedgoods,butrathertreated

asa period cost?

a. Operatingloss

b. Abnormalloss

c. Normalloss

d. Non-operatingloss

79. HydeParkCompanyproducessprocketsthatareusedinwheels.Eachsprocketsellsfor`50andthecompa

nysellsapproximately400,000sprocketseachyear.Unitcostdatafortheyearfollows:

Directmaterial `15

Directlabor `10

Othercost: Fixed Variable

Manufacturing `5 `7

Distribution `4 `3

Required:Identifytheunitcostofsprocketsunderdirectcosting

a.`44

b.`37

c. `32

d.`35

80. Whenproductionisequaltosales,whichofthefollowingisTRUE?

a. Nochangeoccurstoinventoriesforeitheruseabsorptioncostingorvariablecostingmethods

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page12

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

b. Theuseofabsorptioncostingproducesahighernetincomethantheuseofvariablecosting

c. Theuseofabsorptioncostingproducesalowernetincomethantheuseofvariablecosting

d. Theuseofabsorptioncostingcausesinventoryvaluetoincreasemorethantheywouldthoughtheuseo

fvariablecosting

81. Sellingpriceperunitis`15,totalvariablecostperunitis`9,andtotalfixedcostsare`15,000of

XIT .WhatisthebreakevenpointinunitsforXIT ?

a. 3,000units

b. 1,000units

c. 1,667units

d. 2,500units

82. Whileconstructing aBreakevenchart, thegap

betweensaleslineandvariablecostlineshowswhichofthefollowing?

a. Fixedcost

b. Breakevenpoint

c. Contributionmargin

d. Variablecost

83. AllofthefollowingcomposecostofgoodssoldEXCEPT:

a. Rawmaterial

b. Labor

c. Capital

d. Factoryoverhead

84. AmountofDepreciationonfixedassetswillbefixedinnatureifcalculated underwhichof

thefollowingmethod?

a. Straightlinemethod

b. Reducingbalancemethod

c. Someofyear'sdigitsmethod

d. Doubledecliningmethod

85. WhichofthefollowingisNOT arelevantcosttodecisionmaking?

a. Opportunitycosts

b. Relevantbenefits

c. Avoidablecosts

d. Sunkcosts

86. WhatwouldbetheattitudeofthemanagementintreatingSunk costsindecisionmaking?

a. Aperiodicinvestmentofcashresourcesthathasbeenmadeandshouldberelevantfordecisionmakin

g

b. Itisapastcostwhichisnotdirectlyrelevantindecisionmaking

c. Managementwilltreatitasvariablecosteachtimeindecisionmaking

d. Noneofthegivenoptions

87. Mr.AslamisrunninghisownpersonalFinancialservicesbusiness.Hehasbeenofferedajobforasalaryof`45,

000permonthwhich hedoesnotavailed.`45,000willbeconsideredas:

a. SunkCost

b. Opportunitycost

c. Avoidablecost

d. Historicalcost

88. Whichof the givencostdoes notbecomethe partof cost unit?

a. Advertisingexpenses

b. Directlaborcost

c. Factoryoverheadcost

d. Costofrawmaterial

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page13

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

89. BudgetedFactoryoverheadattwoactivitylevelsisasfollowsfortheperiod.

Activitylevel Budgetedfactory overhead

Low 10,000 Hours `40,000

High 50,000 Hours `80,000

Required:Identify variableratewiththehelp ofabovementioned data.

a. `4.00perhour

b. `1.60perhour

c. `1.00perhour

d. `2.00perhour

90. WhichofthegivencostisNOT requiredtoprepareCostofProductionReport?

a. Periodcost

b. Materialcost

c. Labourcost

d. Factoryoverheadcost

91. Identify theFOHrateon thebasisofmachinehour?

Budgetedproductionoverheads `2,80,000

Actualmachinehours 70,000 hours

Actualproductionoverheads `2,95,000

a.`4.00

b.`4.08

c. `4.210

d.`4.35

92. WhichofthegivenwillNOTbeincludedforthecalculationofequivalentunitsofmaterialunderweightedaver

agecostingmethod?

a. Openingworkinprocessunits

b. Closingworkinprocessunits

c. Unitcompletedandtransferredout

d. Noneofthegivenoptions

93. Thebasicassumptionmadeindirectcosting with respecttofixedcostsisthat

a. Fixedcostisacontrollablecost

b. Fixedcostisaproductcost

c. Fixedcostisanirrelevantcost

d. Fixedcostisaperiodcost

94. ThelittleRockCompanyshowsBreakevensalesis`40,500andBudgetedSalesis`50,000.IdentifytheMargin

ofsafetyratio?

a. 19%

b. 81%

c. 1.81%

d. Requiredmoredatatocalculate

95. Amachinecost`60,000fiveyearsago.Itisexpectedthatthemachinewillgeneratefuturerevenueof40,000.

Alternatively,themachinecouldbescrappedfor`35,000.Anequivalentmachineinthesameconditioncost

38,000tobuy now.

Required:Identify therealizablevaluewiththehelp ofgivendata.

a.`60,000

b.`40,000

c. `35,000

d.`38,000

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page14

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

96. Costoffinishedgoodsinventoryiscalculatedby:

a. Deductingtotalcostfromfinishedgoodsinventory

b. Multiplyingunitsoffinishedgoodsinventorywiththecostperunit

c. Dividingunitsoffinishedgoodsinventorywiththecostperunit

d. Multiplyingtotalcostwithfinishedgoodsinventory

97. Assumingnoreturnsoutwardsorcarriageinwards,thecostofgoodssoldwillbeequalto:

a. OpeningstockLesspurchasesplusclosingstock

b. Closingstockpluspurchasesplusopeningstock

c. Saleslessgrossprofit

d. Purchasesplusclosingstockplusopeningstockplus directlabor

98. Allofthefollowingareessentialrequirementsofagoodwage systemEXCEPT:

a. Reducedlaborandoverheadcosts

b. Reducedperunitvariablecosts

c. Increasedproduction

d. Increasedoperatingcosts

99. Profitunderabsorption costingwillbehigherthanundermarginalcostingif:

a. Producedunits>Unitssold

b. Producedunits<Unitssold

c. Producedunits=Unitssold

d. Profitcannotbedeterminedwithgivenstatement

100. GoodJobPlcmakesoneproductwhichsellsfor`80perunit.Fixedcostsare`28,000permonthandmarginalc

ostsare`42perunit.Whatsaleslevelinunitswillprovideaprofitof `10,000?

a. 350units

b. 667units

c. 1,000units

d. 1,350units

101. CostvolumeProfitanalysis(CVP)isabehaviorofhowmanyvariables?

a. 2

b. 3

c. 4

d. 5

102. Ifthesellingpriceandthevariablecostperunitbothdecreaseat10%andfixedcostsdonotchange,whatisth

eeffectonthecontributionmarginperunitandthecontributionmarginratio?

a. Contributionmarginperunitandthecontributionmarginratio bothremainsunchanged

b. Contributionmarginperunitandthecontributionmarginratiobothincreases

c. Contributionmarginperunitdecreasesandthecontributionmarginratioremainsunchanged

d. Contributionmarginperunitincreasesandthecontributionmarginratioremainsunchanged

103. AllofthefollowingaretrueEXCEPT:

a. Profit+Fixedcost+Variablecost=Sales

b. Profit+Fixedcost=SalesVariablecost

c. ContributionmarginFixedcost=Profit

d. Profit+Fixedcost=Sales+Variablecost

104. Ajobneeds3,000actuallaborhourstobecompleted.Itisexpectedtherewillbe25%idletime.Ifthewagerat

eis`12.50perhour, whatisbudgeted laborcostforthejob?

a.`26,000

b.`37,500

c.`50,000

d.`42,000

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page15

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

105. Acompanyhasbudgetedsalesof`48,000,breakevensalesof`35,000andactualsalesof`

40,000duringaparticularperiod.Whatwillbethemarginofsafety?

a.`8,000

b.`13,000

c. `5,000

d.`21,000

106. Whichofthefollowing productcostisIncluded inprimecostand conversion cost?

a. Directlabor

b. Manufacturingoverhead

c. Directmaterial

d. WorkinProcess

107. Machinelubricantusedonprocessingequipmentinamanufacturingplantwouldbeclassifiedasa

a. Periodcost(manufacturingoverhead)

b. Periodcost(Selling,General&Admin)

c. Productcost(manufacturingoverhead)

d. Productcost(Selling,General&Admin)

108. Whichofthefollowingcostswould NOT bea periodcost?

a. Indirectmaterials

b. Administrativesalaries

c. Advertisingcosts

d. Sellingcosts

109. WhichofthefollowingisCORRECTtocalculatecostofgoodsmanufactured?

a. Directlaborcostsplustotalmanufacturingcosts

b. Thebeginningworkinprocessinventoryplustotalmanufacturingcostsandsubtracttheendin

gworkinprocessinventory

c. Beginningrawmaterialsinventoryplusdirectlaborplusfactoryoverhead

d. Conversioncostsandworkinprocessinventoryadjustmentsresultsincostofgoodsmanuf

actured

110. WhilecalculatingtheEOQ,carryingcostistakenasthe:

a. %ageofunitcost

b. %ageoforderingcost

c. %ageofannualrequiredunits

d. Totalunitcost

111. If,Wagerate`100/hrWo

rking hours 8

hoursShiftallowance`5

00Totalpaywillbe:

a.`800

b.`500

c. `1,300

d.`300

112. Whichcostswillchangewithanincreaseinactivity withintherelevantrange?

a. Unitfixedcostandtotalfixedcost

b. Unitvariablecostandtotalvariablecost

c. Unitfixedcostandtotalvariablecost

d. Unitfixedcostandunitfixedcost

113. Thetermcostallocationisdescribedas:

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page16

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

a. Thecoststhatcanbeidentifiedwithspecificcostcenters.

b. Thecoststhatcannotbeidentifiedwithspecificcostcenters.

c. Thetotalcostoffactoryoverheadneedstobedistributedamongspecificcostcenters.

d. Noneofthegivenoptions

114. OverappliedFOHwillalwaysresultwhenapredeterminedFOHrateisappliedand:

a. Productionisgreaterthandefinedcapacity

b. Actualoverheadcostsarelessthanbudgeted

c. Budgetedcapacityislessthannormalcapacity

d. ActualoverheadincurredislessthanappliedOverhead

115. Thedifferenceovertheperiodoftimebetweenactualandapplied

FOHwillusuallybeminimalwhenthepredetermined overheadrateisbasedon:

a. Normalcapacity

b. Designedcapacity

c. DirectLaborhours

d. Machinehours

116. Thecostthatissubjecttoactualpaymentorwillbepaid forinfutureiscalled:

a. Fixedcost

b. Stepcost

c. Explicitcost

d. Imputedcost

117. UnderperpetualInventorysystemtheInventoryistreatedas:

a. Assets

b. Liability

c. Income

d. Expense

118. Duringtheyear60,000unitsputintoprocess.55,000unitswerecompleted.ClosingWIPwere25,000units,40

%completed.Howmuchtheequivalentunitsofoutputwouldbeproduced?

a. 25,000units

b. 10,000units

c. 65,000units

d. 80,000units

119. Thecomponentsoftotalfactory costare:

a. DirectMaterial+DirectLabor

b. DirectLabor+FOH

c. PrimeCostonly

d. PrimeCost+FOH

120. TheFIFOinventorycostingmethod (whenusinga perpetualinventory

system)assumesthatthecostoftheearliestunitspurchasedisallocatedinwhichofthefollowingways?

a. Firsttobeallocatedtotheendinginventory

b. Lasttobeallocatedtothecostof goodssold

c. Lasttobeallocatedtothe endinginventory

d. Firsttobeallocatedtothecostofgoodssold

121. Whichofthefollowingisconsideredasbasicsystemsof remuneratinglabour?

a. Timeratesystem

b. Pieceratesystem

c. Halseypremiumplan

d. Bothtimerateandpieceratesystem

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page17

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

122. YouarerequiredtocalculatenumberofunitssoldofABCFansCompanyforthefirstquarterof

theyearwiththehelpofgiveninformation.

Inventoryopening

Finishedgoods(100fans) ` 43,000

Directmaterial `2,68,000

Inventoryclosing

Finishedgoods(200fans) Notknown

Directmaterial `1,67,000

Noofunitsmanufactured 567units

a. 300units

b. 767units

c. 467units

d. 667units

123. CostofmaterialconsumedunderLIFOcosting method

is`6,000.ConversionCostis`16,500.1,000unitsoftheproductweremanufactured

outofwhich800@`30unitssold.Therewerenobeginningandendinginventoriesofworkinprocessandfinish

edgoods.

Required:Calculateperunitcostwiththehelpofgiveninformation.

a.`22.50

b. `16.50

c.`6.00

d. `28.13

124. Overtimepremiumwhichispaidtodirectlaborischargedtowhichofthefollowingheadincaseofnormal

circumstances?

a. Workinprocessaccount

b. Entireproduction

c. FactoryoverheadCostaccount

d. Sellingcontrolaccount

125. WhichofthefollowingfunctionsarefulfilledbyGoodsReceivedNote?

i.Providesinformationtoupdatetheinventoryrecordsonreceiptofgoods

ii. Provides informationto checkthequantityon the suppliers invoice

iii.Providesinformationtocheckthepriceonthesuppliersinvoice

a. (i)only

b. (i)and (ii)only

c. (i)and (iii)only

d.(ii)and (iii)only

126. Calculatetotalsalaryreceivedwiththegivendata.Sala

ry `5000

PerPiececommission 10

%perpieceUnitsold 700 pieces

Priceperpiece

`10

a. `5,100

b. `5,000

c.`5,600

d.`5,700

127. Whichofthegivenstatementis CORRECT forIndirectLabor?

a. Itischargedtofactoryoverheadaccount

b. Itischargedtoworkinprocess

c. Itisentireproduction

d. Itischargedtoadministrativeexpenses

128. Aproductionworkerpaid

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page18

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

salaryof`700permonthplusanextra`5foreachunitproducedduringthemonth.Thislaborcostisbestdescrib

edas:

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page19

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

a. Afixedcost

b. Avariablecost

c. Asemivariablecost

d. Astepfixedcost

129. Givendatathat:

Work in ProcessOpeningInventory Rs.20,000

Work in ProcessClosing Inventory Rs.10,000

FinishedgoodsOpeningInventory Rs.30,000

FinishedgoodsClosingInventory Rs.50,000

Costofgoodssold Rs.1,90,000

Whatwillbethevalueofcostofgoodsmanufactured?

a.`200,000

b.`210,000

c. `220,000

d.`240,000

130. ClosingbalanceofworkInProcess(WIP)ispartof:

a. Assetsa/c

b. Expensesa/c

c. Liabilitya/c

d. Owners equity a/c

131. Whichofthegivenis CORRECTforaccountingentryofclosingbalance ofWorkInProcess(WIP)?

a. WIPa/cDrandInventorya/cCr

b. Inventorya/cDrand WIPa/cCr

c. WIPa/c Drandpayrolla/cCr

d. ThereisnoaccountingentryforclosingbalanceofWIP

132. Accountingentry ofclosingbalancecanberecorded for:

a. Incomea/candExpensesa/c

b. Liabilitya/cand Ownersequity a/c

c. Asseta/c andLiabilitya/c

d. Liabilitya/candExpensesa/c

133. Identifyunitstransferredoutwiththehelpofgivendata:

Units

Unitsstillinprocess(100%material,75%conversion)

4,000

Lostunits 2,000

Unitsstartedinprocess 50,000

a. 6,000units

b. 44,000units

c. 52,000units

d. 56,000units

134. Youarerequiredtoidentifyhowmanygoodunitswereoutputsfromtheprocess.

Units

Unitsputinprocess 4,000

Lostunits 500

Unitsinprocess 200

a. 3,300units

b. 4,000units

c. 4,200units

d. 4,500units

135. Themeasureablevalueofanalternativeuseofresourcesisreferredtoas:

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page20

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

a. Anopportunitycost

b. An imputedcost

c. Asunkcost

d. Noneofthese

136. Aquantitativeexpressionofmanagementobjectivesisan:

a. Organizationalchart

b. Managementchart

c. Budget

d. Noneofthese

137. Acostcenteris:

a. Aunitofproductioninrelationto whichcostsareascertained

b. Alocationwhichisresponsibleforcontrollingdirectcosts

c. Anylocationordepartmentwhichincurscost

d. Noneofthese

138. Atbreak-evenpointof400unitssold thevariablecostswere`400and thefixed costs

were`200.Whatwillbethe401unitssoldcontributing toprofitbeforeincometax?

a.`0.50

b.`1.00

c. `1.50

d.Noneofthese

139. Inconsideringa

specialordersituationthatwillenableacompanytomakeuseofcurrentlyidlecapacity,whichofthefoll

owingcostwillbeirrelevant:

a. Depreciation

b. Directlabour

c. Variablefactoryoverhead

d. Noneofthese

140. Afixedcost:

a. Maychangeintotalwhensuchchangeisnotrelatedtochangesinproduction

b. Willnotchangeintotalbecauseitisnotrelatedtochangesinproduction

c. Isconstantperunitforeachunitofchangeinproduction

d. Maychangeintotal,dependingonproductionwiththerelevantrange

141. Allthegivenstatementsregarding job costsheetsareincorrectEXCEPT:

a. Jobcostsheetshowsonlydirectmaterialscostonthatspecificjob

b. Jobcostsheetmustshowthesellingcostsassociatedwithaspecificjob

c. Jobcostsheetmustshowtheadministrativecostsassociatedwithaspecificjob

d. Jobcostsheetshowsdirectmaterialscost,directlabourcostandfactoryoverheadcostsassociatedwit

haspecificjob

142. Whatwouldbetheeffectonthecostofadepartment incaseofnormalLoss

a. Decreased

b. Increased

c. Noeffect

d. Increasetothe%ageofloss

143. Expensessuchasrentanddepreciationofabuilding areshared byseveraldepartmentstheseare:

a. Indirectexpenses

b. Directexpenses

c. Jointexpenses

d. Alloftheabove

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page20

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

144. IfunderappliedFOHis closed tocostofgoodssold,thejournalentry is:

a. DR Costof goods sold..CRFOH control

b. DRFOHcontrol....CRCostof goodssold

c. DR FOHcontrol....CRProfit% lossaccount

d. Noneofthese

145. Re-orderquantity 3600units

Maximum consumption ... 900 units

perweekMinimum consumption....300 units

perweekRe-orderperiod..5 weeks

Basedonthisdata Re-orderlevelis:

a. 4500units

b. 3900units

c. 1200units

d. Noneofthese

146. Thetimelagbetweenindentingandreceivingmaterialis called:

a. Leadtime

b. Idletime

c. Stockouttime

d. Noneofthese

147. AcreditbalanceremaininginFOHControlaccountiscalled:

a. Over-appliedoverhead

b. Under-appliedoverhead

c. Actualoverhead

d. Noneofthese

148. Directmaterialcostplusdirectlabourcostiscalled:

a. Primecost

b. Conversioncost

c. Productcost

d. Allofthese

149. Productivitymeans:

a. Theabilitytoproduce

b. Allunitsproduced

c. Goodunitsproduced

d. Noneofthese

150. Asegmentofthebusinessthatgeneratesboth revenueand costiscalled:

a. ProfitCenter

b. CostCenter

c. Costdriver

d. Allofthese

151. Primecostiscalculatedasunder:

a. ManufacturingCost/CostofGoodsSold

b. DirectMethodplusfactoryoverheads

c. Directlabour+DirectMaterial

d. Noneofthese

152. ProcessCostisverymuchapplicablein:

a. ConstructionIndustry

b. PharmaceuticalIndustry

c. Airlinecompany

d. Noneofthese

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page21

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

153. WhichofthefollowingisnotafunctionofCostAccounting?

a. Costascertainment

b. Planningandcontrol

c. Decision-making

d. Externalreporting

154. Acostis:

a. Asacrifice

b. Releaseofsomething

c. Measureofconsumptionofresources

d. Alloftheabove

155. Costinformationfacilitatesmanyimportantdecisionsexcept:

a. Introductionofaproduct

b. Whethertomakeorbuy

c. Retentionofprofit

d. Explorationofanadditionalmarket

156. ManagementAccountingseekstoservethepurposeofmanagementtorunabusinessmoreefficientlyand

thususesthetechniquesof:

a. FinancialAccounting

b. CostAccounting

c. MathematicsandStatistics

d. Alloftheabove

157. Inprocess costing,each producing departmentisa:

a. Costunit

b. Costcentre

c. Investmentcentre

d. Salescentre

158. Marketinginvolvesthefollowingexcept:

a. Designing

b. Selling

c. Publicity

d. Distribution

159. Administrationspanacrossalltheupstream,mainstreamanddownstreamactivitiesofafirm,suchas:

a. Design,researchanddevelopment

b. Production

c. Marketing

d. Alloftheabove

160. When10,000ending unitsofwork-in-processare30%completedastoconversion,itmeans:

a. 30%oftheunitsarecompleted

b. 70%oftheunitsarecompleted

c. Eachunithasbeencompletedto70%ofitsfinalstage

d. Eachoftheunitsis30%completed

161. Whichofthefollowingisnota method ofcosting ?

a. Marginalcosting

b. Jobcosting

c. Processcosting

d. Operatingcosting

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page22

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

162. Whichofthefollowingisnota techniqueofcosting ?

a. Absorptioncosting

b. Standardcosting

c. Multiplecosting

d. Marginalcosting

163. Costcanbeclassifiedaccording to:

a. Elements

b. Functions

c. Behavior

d. Alloftheabove

164. WhichofthefollowingisTRUEregardingtheuseofblanketrate?

a. Theuseofa singleblanketratemakestheapportionmentofoverheadcostsunnecessary

b. Theuseofasingleblanketratemakestheapportionmentofoverheadcostsnecessary

c. Theuseofasingleblanketrate makestheapportionmentofoverheadcostsuniform

d. Noneofthegivenoptions

165. Thefunctionalclassificationofcostsincludethefollowingexcept:

a. Primecost

b. Productioncost

c. Administrationcost

d. Marketingcost

166. Whichofthefollowingisnotincludedintheadministrationcost?

a. Salariesofgeneralofficestaff

b. Salariesofforemen

c. Officesuppliesandexpenses

d. Postage,stationary,telephoneetc.

167. Acostunitis:

a. Thecostpermachinehour

b. Costperlabourhour

c. Aunitofproductionorserviceinrelationtowhichcostsareascertained

d. Ameasureofworkoutputinastandardhour

168. Primecostis:

a. Thetotalofdirectcosts

b. Allcostsincurredinmanufacturingaproduct

c. Thematerialcostofaproduct

d. Thecostofoperatingadepartment

169. Costofsalesis:

a. Totalcostsincurredinproduction,administrationandmarketingfunctions

b. Workscostplusadministrationoverheads

c. Aggregateofworks,administrationandmarketingoverheads

d. Primecostsplusmarketingoverheads

170. Variablecostsareconventionally deemedto:

a. Beconstantperunitofoutput

b. Varyperunitofoutputasproductionvolumechanges

c. Beconstantintotalwhenproductionvolumechanges

d. Vary,intotal,fromperiodtoperiodwhenproductionisconstant

171. Fixed costs :

a. Varyintotalasproductionvolumechangeswithinagivenrange

b. Remainconstantintotalbutvaryperunitwhenproductionvolumechanges

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page23

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

c. Remainconstantperunitasproductionvolumechanges

d. Varyintotalwhenproductionvolumedoesnotchange

172. Costswhichdonotfluctuateasthelevelofactivity changeswithinagivenrangeare:

a. Relevantcosts

b. Opportunitycosts

c. Mixedcosts

d. Fixedcosts

173. Whichofthefollowingisnotanexampleofsemi-variablecosts?

a. Telephoneexpenses

b. Maintenanceexpensesofmachines

c. Salaryoftheworksmanager

d. Depreciationexpenses

174. ThefollowinginformationwastakenfromSmartCompanysaccountingrecordsfortheyearended

March31,2013:

`

Increaseinrawmaterialsinventory 15,000

Decreaseinfinishedgoodsinventory 35,000

Rawmaterialspurchased 4,30,000

Directlabourpayroll 2,00,000

Factoryoverhead 3,00,000

Freight 45,000

There was noworkin processinventoryatthe beginningor endof the year.Smarts2,000costof

goodssoldis:

a.`9,50,000

b.`9,65,000

c. `9,75,000

d.`9,95,000

Question175-177 are basedon the following information pertainingto ABCCompanys

manufacturingoperations:

Inventories 3/1/2013 3/31/2013

` `

Directmaterials 36,000 30,000

Work-in-process 18,000 12,000

Finishedgoods 54,000 72,000

AdditionalinformationforthemonthofMarch2013 `

Directmaterialspurchased 84,000

Directlabourpayroll 60,000

Directlabour rate perhour 7.50

Factoryoverhead rateperdirectlabourhour 10.00

175. ForthemonthofMarch2013,primecostwas:

a.`90,000

b.`1,20,000

c. `1,44,000

d.`1,50,000

176. ForthemonthofMarch2013,conversioncostwas:

a.`90,000

b.`1,40,000

c. `1,44,000

d.`1,70,000

177. ForthemonthofMarch2013,costofgoodsmanufactured was:

a.`2,18,000

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page24

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

b.`2,24,000

c. `2,30,000

d.`2,36,000

178. Thecostofrentforamanufacturingplantisa:

Primecost Productcost

a. No Yes

b. No No

c. Yes No

d. Yes Yes

179. Propertytaxesona manufacturingplantareanelementof:

Conversioncost Periodcost

a. Yes No

b. Yes Yes

c. No Yes

d. No No

180. Thefixedportionofthesemi-variablecostofelectricityofamanufacturingplantisa:

Periodcost Productcost

a. Yes No

b. Yes Yes

c. No Yes

d. No No

181. Variousmethodsareusedforpricingmaterialsused.Costpricemethodsare:

a. Specificprice

b. Firstinfirstout

c. Lastinfirstout

d. Alloftheabove

182. Averagepricemethodsofpricingmaterialsissuesarederivedfromcostprices.Theyincludethefollowin

gexcept:

a. Simpleaverage

b. Basestock

c. Weightedaverage

d. Movingaverage

183. Incaseofriseinpricelevels,themostsuitablemethodforvaluingmaterialsissuedis:

a. LIFO

b. FIFO

c. Simpleaverage

d. Weightedaverage

184. TheFIFOassumptionofcostflowwhenappliedinaperiodofrisingprices:

a. Overstatesprofitandclosingstock

b. Overstatesprofitandunderstatesclosingstock

c. Overstatesprofitandshowsclosingstockatcurrentprices

d. Understatesprofitandoverstatesclosingstock

185. Inarepeateddistributionmethod:

a. Eachservicedepartmentinturndoesnotre-allocateitscoststoalldepartments

b. Eachservicedepartmentinturnandre-allocatesitscoststoalldepartments

c. Eachservicedepartment inturnandallocatesitscoststoalldepartments

d. Onlyoneservicedepartmentinturnandre-allocatesitscoststoalldepartments.

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page25

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

[Hint:Repeateddistributionmethod:Thismethodtakeseachservicedepartmentinturnandre-

allocatesitscoststoalldepartmentswhichbenefit.]

186. The cost of goodssoldwas `2,40,000. Beginning andendinginventorybalanceswere`20,000and

`30,000,respectively.Whatwastheinventoryturnoverratio?

a. 8.0times

b. 12.0times

c. 7.0times

d. 9.6times

[Hint:Inventoryturnoverratio=CGS/Averageinventoryinvent

oryturnoverratio=240000/25000=9.6times

averageinventory=openinginventory+closinginventory/2]

187. Where----------------isequal,thatpointiscalledEconomicorderquantity.

a. Orderingcost

b. Carryingcost

c. Orderingandcarryingcost

d. Perunitordercost

188. Lossbyfireisanexampleof:

a. NormalLoss

b. AbnormalLoss

c. IncrementalLoss

d. Cannotbedetermined

189. Themainpurposeof costaccounting is to :

a. Maximizeprofits

b. Helpininventoryvaluation

c. Provideinformationtomanagementfordecisionmaking

d. Aidinthefixation ofsellingprice

190. Wheretheapplied FOHcostisless thanthe actualFOH costitis:

a. Unfavorablevariance

b. Favorablevariance

c. Normalvariance

d. Budgetedvariance

[Hint: When theappliedcost islesserthantheactualcostitisunfavorablevariance.]

191. Whichofthefollowingiscorrect?

a. Unitssold=Openingfinishedgoodsunits+Unitsproduced Closingfinishedgoodsunits

b. UnitsSold=Unitsproduced+Closingfinishedgoodsunits -Openingfinishedgoodsunits

c. Unitssold=Sales+Average unitsoffinishedgoodsinventory

d. Unitssold=Sales-Averageunitsoffinishedgoodsinventory

192. Whichofthe following itemsof expenseareto beadd inFOHcost ?

a. Rentoffactory+Headofficerent+salariestofactorywatchman

b. Rentoffactory+factorylightingbill+Directorssalaries

c. Rentoffactory+factorylightingbill+Factoryemployeessalaries

d. Headofficerent+Factorypropertytax+Factorysmall tools

193. If,Grossprofit=`40,000GPMargin=20%ofsalesWhatwillbethevalueofcostofgoodssold?

a.`160,000

b.`120,000

c. `40,000

d.`90,000

[Hint:Costofgoodssold= Grossprofit (absoluteamount)x80%/20%]

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page26

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

194. Takingstepsforthefreshpurchaseofthosestockswhichhavebeenexhaustedandforwhich

requisitionsaretobehonoredinfuture isaneasyexplanationof:

a. Overstocking

b. Understocking

c. Replenishmentofstock

d. Acquisitionofstock

195. NetIncomebeforeInterestand taxisalsocalled:

a. OperatingIncome/Profit

b. GrossProfit

c. MarginalIncome

d. OtherIncome

196. Whichofthefollowingisindirectcost?

a. Thedepreciationofmachinery

b. Theovertimepremiumincurredatthespecificrequestofacustomer

c. Thehireoftoolsforaspecificjob

d. Allofthegivenoptions

197. Inwhichofthefollowing centerFOHcostNOTincurred?

a. ProductionCenter

b. ServiceCenter

c. GeneralCostCenter

d. HeadOffice

198. Whichofthefollowingisconsideredasbasicsystems ofremuneratinglabor?

a. Timeratesystem

b. Pieceratesystem

c. HalseyPremiumplan

d. Bothtimerateandpieceratesystem

199. Netsales=Salesless:

a. Salesreturns

b. Salesdiscounts

c. Salesreturns&allowances

d. Salesreturns&allowancesandsalesdiscounts

200. Anorganistationsold4000unitsandhaveclosingfinishedgoods3500unitsandopeningfinishedgoodsunits

were1000.Thequantityofunitsproduced wouldbe:

a. 7500units

b. 6500units

c. 4500units

d. 8500units

[Hint:Numberofunitsmanufactured/produced=unitssold+closingbalanceoffinishedgoodsunits-

openingbalanceoffinishedgoodsunits

numberof unitsproduced/manufactured=4000+3500-1000=6500]

201. Astoreledgercardissimilartothe .

a. Stockledger

b. Bincard

c. Materialcard

d. Purchaserequisitioncard

202. Whichofthefollowingelementmustbetakenintoaccountwhilecalculatingtotalearningsofaworkerunder

differentincentivewageschemes?

a. Rateperunit

b. Unitsofproduction

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page27

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

c. Extratimetakenbyemployeetocompletetheproduction

d. Numberofworkersemployed

203. Thejournalentry ofpurchaseofstock underperiodicinventory system wouldbe?

a. InventorytoCash

b. CashtoPurchases

c. PurchasestoInventory

d. Noneofthegivenoptions

204. ClosingworkinprocessInventoryoflastyear:

a. IstreatedasOpeninginventoryforcurrentyear

b. Isnotcarriedforwardtonextyear

c. Becomeexpenseinthenextyear

d. ChargetoProfit&Lossaccount

205. Salesare`4,50,000.Beginningfinishedgoodswere`23,000.Endingfinishedgoodsare`30,000.Thecostofgo

odssoldis`3,00,000.Whatisthecostofgoodsmanufactured?

a. ` 323,000

b. ` 330,000

c. ` 293,000

d.Noneofthegivenoptions

206. Whiletransportingpetrol,a littlequantitywillbeevaporated;suchkindoflossistermedas:

a. NormalLoss

b. AbnormalLoss

c. Itisincrementalloss

d. Itcannotbeabnormalloss

207. Thecostofelectricity billofthefactory istreatedas:

a. Fixedcost

b. Variablecost

c. Stepcost

d. Semi variablecost

[Hint:SemiVariable Cost:Itisalsoknownasmixedcost.Itisthe

costwhichispartfixedandparvariable.Itisinfactthemixtureof bothbehaviors.

Examplesinclude:Utilitybillsthereisafixedlinerentpluschargesforunitsconsumed.

Salesmanssalarythereisafixedmonthlysalarypluscommissionper unitssold.]

208. Acostcentre is:

a. Aunitofproductorserviceinrelationtowhichcostsareascertained

b. Anamountofexpenditureattributabletoanactivity

c. Aproductionorservicelocation,function,activityoritemofequipmentforwhichcostsareaccum

ulated

d. Acentreforwhichanindividualbudgetisdrawnup

209. Costaccountingdepartmentprepares thathelpsthem inpreparingfinalaccounts.

a. Costsheets

b. Costofgoodssoldstatement

c. CostofproductionReport

d. Materialrequisitionform

210. WhenFOHisunderappliedand chargedtoNetProfit,thetreatmentwould be:

a. Underapplied Addnetprofit

b. UnderappliedLessnetprofit

c. UnderappliedLessoperatingexpense

d. Noneofthegivenoptions

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page28

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

211. Weightedaveragecostperunitiscalculatedbywhichofthefollowingformula?

a. Costofgoodsissued/numberofunitsissued

b. TotalCost/TotalUnits

c. Costofgoodsmanufactured/closingunits

d. Costofgoodssold/totalunits

212. Buyerproduced20,000unitsandtheirtotalfactorycostwas`450,000,othercostlikepropertytaxonfactory

buildingwas`10,000included inthatcosttillyearended thecostofperunitwouldbe:a.`22.5

b.`23.5

c. `.24.5

d.`26.5

[Hint:Costperunit=Costofgoods manufactured/Numberofunitsmanufactured]

213. Astandard rateispaid totheemployeewhenhecompleted hisjob:

a. Intimelessthanthestandard

b. Instandardtime

c. Intimemorethanstandard

d. Bothinstandardtimeandmorethanthestandardtime

214. Storeinchargeafterreceivingthematerialasperthegoodsreceivednote,placesthematerialatitslocation

andmakesanentry in_ .

a. BinCard

b. StoreLedgerCard

c. StockLedger

d. Noneofthegivenoptions

215. Ifopeninginventoryofmaterialis`20,000andclosinginventoryis`40,000.theAverageinventoryamountwill

be:

a.`40,000

b.`30,000

c. `20,000

d.`10,000

[Hint: AverageInventory=OpeningInventory+ClosingInventory/2]

216. PVCCompanyhasorderingquantity10,000units.Theyhavestoragecapacity20,000units,theaverageinve

ntorywouldbe:

a. 20,000

b. 5,000

c. 10,000

d. 25,000

[Hint:Averageorderingquantity=OrderingQuantity/2]

217. AllIndirectcostischarged/record inthehead of

a. Primecost

b. FOHcost

c. Directlaborcost

d. Noneofthegivenoptions

218. Under/OverappliedFOHcostcanbeadjustedinwhichofthefollowing:

a. EntireProduction

b. CostofGoodsSold

c. NetProfit

d. Allofgivenoptions

219. ThedangerLevelcanbecalculated?

a. AverageconsumptionxLeadtimetogeturgentsupplies

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page29

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

b. NormalconsumptionxLeadtimetogeturgentsupplies

c. MaximumconsumptionxLeadtimetogeturgentsupplies

d. MinimumconsumptionxLeadtimetogeturgentsupplies[Hint:D

angerLevel= AverageconsumptionxEmergencytime]

220. NelsonCompanyhasfollowingFOHdetail.

Budgeted(`) Actual(`)

ProductionFixed overheads 36,000 39,000

ProductionVariableoverheads 9,000 12,000

Directlaborhours 18,000 20,000

a. Underappliedby`1,000

b. Over appliedby`1,000

c. Underappliedby`11,000

d. Over appliedby`38,000

221. FactoryOverheadcostincludes :

a. FactoryRent

b. PropertyTax

c. SalariesofFactoryClerk

d. Allofthegiven

222. Whichofthefollowingcannotbeusedasabaseforthedeterminationofoverheadabsorptionrate?

a. Numberofunitsproduced

b. Primecost

c. Conversioncost

d. DiscountAllowed

223. Costofgoodssold`30,000,openingInventory`9,000,Closinginventory`7,800.Whatwastheinventoryturnov

erratio?

a. 3.57times

b. 3.67times

c. 3.85times

d. 5.36times

[Hint:Inventoryturnoverratio=Costofgoodssold/Averageinventory]

224. FOHappliedrateofRs.5.60permachinehour.DuringtheyeartheFOHtoRs.275,000and48,000machinehour

swereused.Whichoneoffollowingstatementiscorrect?

a. Overheadwasunder-appliedbyRs.6,200

b. Overheadwasover-appliedbyRs.6,200

c. Overheadwasunder-appliedbyRs.7,200

d. Overheadwasover-appliedbyRs.7,200

225. CostaccountingconceptsincludeallofthefollowingEXCEPT:

a. Planning

b. Controlling

c. Sharing

d. Costing

226. arefuturecoststhateffectthecurrentmanagementdecision.

a. SunkCost

b. StandardCost

c. RelevantCost

d. IrrelevantCost

[Hint:Relevantcostiswhichchangeswithachangeindecision.Thesearefuturecoststhateffectthecurrent

managementdecision.]

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page30

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

227. Whichofthefollowingcostsispartoftheprimecostformanufacturingcompany?

a. Costoftransportingrawmaterialsfromthesupplierspremises

b. Wagesoffactoryworkersengagedinmachinemaintenance

c. Depreciationoftruckusedfordeliveriestocustomers

d. Costofindirectproductionmaterials

228. Directmaterialopeninginventoryaddnetpurchasesiscalled

a. Materialconsumed

b. Materialavailableforuse

c. Totalmaterialpurchased

d. Materialendinginventory

229. Whichofthefollowingistobecalledproductcost?

a. Materialcost

b. Laborcost

c. FOHcost

d. Allofthegivenoptions

230. ABlanketRateis:

a. Asingleratewhichusedthroughouttheorganizationdepartments

b. Adoublerateswhichusedthroughouttheorganizationdepartments

c. Asinglerateswhichusedindifferentdepartmentsoftheorganization

d. Noneofthegivenoptions

[Hint:Ablanketabsorptionrateisasinglerateofabsorptionusedthroughoutanorganizations

productionfacilityandbaseduponitstotalproductioncostsandactivity.]

231. AllofthefollowingarecharacteristicsofGroupBonusSchemeEXCEPT:

a. Astandard timeissetforthecompletionofajob

b. Ifthetimetakenisgreaterthanthetimeallowed,theworkersinthegroupreceivetimewages

c. Ifthetime takenislessthanthetimeallowed,thegroupreceivesabonusontimesaved

d. Ifthetimetakenisgreaterthanthetimeallowed,theworkersinthegroupreceivetimedeductionsforext

rahours

232. Whichofthefollowingbestdescribesthemanufacturingcosts?

a. Directmaterials,directlaborandfactoryoverhead

b. Directmaterialsanddirectlabor

c. Directmaterials,directlabor,factoryoverhead,andadministrativeoverhead

d. Directlaborandfactoryoverhead

233. HighlaborturnoverisNOTdesirablebecause:

a. Itdenotestheinstability ofthelaborforce

b. Itisanindicationof highlaborcost

c. Itshowsfrequentchangesinthelaborforce

d. Allofthegivenoptions

234. Manufacturingentitiesclassifiedtheinventoryinwhichofthreekinds?

a. Materialinventory,WIPinventory,Finishedgoodsinventory

b. Materialinventory,purchasedgoodinventory,WIPinventory

c. Materialinventory,purchasedgoodinventory,Finishedgoodsinventory

d. WIPinventory,Finishedgoodsinventory,purchasedgoodinventory

235. Whichofthefollowingiscorrectformaximumlevel?

a. Reorderlevel(MinimumconsumptionxLeadtime)+EOQ

b. (MaximumconsumptionxLeadtime)(MinimumconsumptionxLeadtime)+EOQ

c. [(Maximumconsumption-Minimumconsumption)Leadtime]+EOQ

d. Allofthegivenoptions

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page31

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

236. Inventoryturnoverratiocanbecalculatedasfollow?

a. Costofgoodssold/Averageinventory

b. Grossprofit/Averageinventory

c. Costofgoodssold/sale

d. Costofgoodssold/Grossprofit

237. ThecomponentofFactory overhead areasfollow

a. Directmaterial+Indirectmaterial+Directexpenses

b. Indirectmaterial+Indirectlabor+Othersindirectcost

c. Directmaterial+Indirectexpenses+Indirectlabor

d. Directlabor+Indirectlabor+Indirectexpenses

238. Overtimethatisnecessary inordertofulfillcustomerordersiscalled:

a. Avoidableovertime

b. Unavoidableovertime

c. PremiumOvertime

d. Flextime

239. TheProcessofcostapportionmentiscarried outsothat:

a. Costmaybecontrolled

b. Costunitgatheroverheadsastheypassthroughcostcenters

c. Wholeitemsofcostcanbechargedtocostcenters

d. Commoncostsaresharedamongcostcenters

240. Taylor'sDifferentialPieceRatePlanuses-----------piecerates.

a. Three

b. Two

c. Four

d. Five

241. UnderHalseypremiumplan,iftheemployeecompleteshisjobinlessthanthestandardtimefixedforthejob

,heisgiven:

a. Onlywagesfortheactualhourstaken

b. Wagesfortheactualhourstakenplusbonusequaltoonehalfof thewageofthetimesaved

c. Wagesfortheactualhourstakenplusbonusequaltoonethirdofthewageofthetime saved

d. Onlythebonusequaltoonehalf ofthe time saved

242. IncreaseinmaterialInventorymeans:

a. Theendinginventoryisgreaterthanopeninginventory

b. Theendinginventoryislessthanopeninginventory

c. Bothendingandopeninginventoriesareequal

d. Cannotbedetermined

243. Working hoursoflaborcanbecalculated withthehelpofallexcept:

a. Smartcard

b. Timesheet

c. Clockcard

d. Storecard

244. Amountofnetpurchasecanbecalculatedasfollow

a. Purchaseof

directmaterialaddtradediscountlesspurchasereturnaddcarriageinwardlessothermaterialhand

lingcost

b. Purchaseof

directmateriallesstradediscountladdpurchasereturnaddcarriageinwardlessothermaterialhandli

ngcost

c. Purchaseofdirectmateriallesstradediscountlesspurchasereturnlesscarriageinwardaddotherm

aterialhandlingcost

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page32

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

d. Purchaseofdirectmateriallesstradediscountlesspurchasereturnaddcarriageinwardaddotherm

aterialhandlingcost

245. AllofthefollowingaretermsusedtodenoteFactoryOverheadsEXCEPT:

a. Factoryburden

b. Factoryexpenses

c. Manufacturingoverhead

d. Conversioncosts

246. Reductionof laborturnover, accidents, spoilage,wasteandabsenteeismarethe resultsof

whichofthefollowingwageplan?

a. Piecerateplan

b. Timerateplan

c. Differentialplan

d. Groupbonussystem

247. Costswhichareconstantforarelevantrangeofactivityandrisetonewconstantleveloncethatrangeexcee

ded iscalled:

a. Afixedcost

b. Avariablecost

c. Amixedcost

d. Astepcost

248. Costofgoodssoldcanbecalculatedasfollow

a. CostofgoodsmanufacturedAddOpeningfinished

goodsinventoryLessClosingfinishedgoodsinventory

b. CostofgoodsmanufacturedLessOpeningfinishedgoodsinventoryLessClosingfinishedgoodsi

nventory

c. CostofgoodsmanufacturedLessOpeningfinishedgoodsinventoryAddClosingfinishedgoodsi

nventory

d. Costofgoodsmanufactured

AddOpeningfinishedgoodsinventoryAddClosingfinishedgoodsinventory

249. If,COGS=`70,000GPMargin=30%ofsalesWhatwillbethevalueofSales?

a.`200,000

b.`66,667

c. `100,000

d.`62,500

[Hint:Sales=30000*100%/30%=`100,000]

250. Annualrequirementis7800units;consumptionperweekis150units.Unitprice`5,ordercost`10perorder.Carr

yingcost`1perunitandleadtimeis3week,TheEconomicorderquantitywouldbe.

a. 395units

b. 300units

c. 250units

d. 150units

251. Whatwillbetheimpactofnormallossontheoverallperunitcost?

a. Perunitcostwillincrease

b. Perunitcostwilldecrease

c. Perunitcostremainunchanged

d. Normallosshasnorelationtounitcost

252. Alphacompanypurchased amachineworthRs 200,000 inthelast year. Nowthatmachine can

beuseinanewprojectwhichcompanyhasreceivedthisyear.Nowthecostofthatmachineistobecalled:

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page33

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

a. Projectcost

b. Sunkcost

c. Opportunitycost

d. Relevantcost

253. FOHabsorptionrateiscalculated by thewayof :

a. EstimatedFOHCost/Directlaborhours

b. EstimatedFOHCost/Noofunitsproduced

c. EstimatedFOHCost/PrimeCost

d. Allofthegivenoptions

254. Whichofthefollowingis/arenotassociated withordering costs?

a. Interest

b. Insurance

c. Opportunitycosts

d. Allofthegivenoptions

255. UnderperpetualInventory system attheendoftheyear:

a. Noclosingentrypassed

b. Closingentrypassed

c. Closingvaluefindthroughclosingentryonly

d. Noneoftheabove.

256. TheHinoCorporationhasabreakevenpointwhensalesare`160,000andvariablecostsatthatlevelofsalesar

e`100,000.

Howmuchwouldcontributionmarginincreaseordecrease,ifvariableexpensesdroppedby`20,000?

a. 37.5%.

b. 60%.

c. 12.5%.

d. 26%

[Hint:Sales=160,000;VC=100,000;CM=60,000

Contributiontosalesratio(C/Sratio)=ContributionMarginin`/Salesin`

60,000/160,000=0.375

0.375*100=37%Ne

wVC=80,000,

Sales=160,000C

M=80,000

Contributiontosalesratio (C/Sratio)=ContributionMarginin`/Salesin`

80,000/160,000=0.5=50%Ri

seinCM=(37.5-50)=12.5]

257. Theshortrunisatimeperiodinwhich:

a. Allresourcesarefixed.

b. Thelevelofoutputisfixed.

c. Thesizeoftheproductionplantisvariable.

d. Someresourcesarefixedandothersarevariable

258. Opportunitycostisthebestexampleof:

a. SunkCost

b. StandardCost

c. RelevantCost

d. IrrelevantCost

259. Thecomponentsoffactoryoverheadareasfollows:

a. Directmaterial+Indirectmaterial+Directexpenses

b. Indirectmaterial+Indirect labor+Othersindirectcost

c. Directmaterial+Indirectexpenses+Indirectlabor

d. Directlabor+Indirectlabor+Indirectexpenses

BoardofStudies,Institute ofCostAccountantsofIndia (StatutoryBodyunderan ActofParliament) Page34

File hostedby educationobserver.com/forum

PAPER2:FUNDAMENTALSOFACCOUNTING(SYLLABUS2012)_MCQ

260. ThetermMaximumlevelrepresents:

a. Themaximumstocklevelindicatesthemaximumquantityofanitemofmaterialwhichcanbeheldinst

ockatanytime.

b. Themaximumstocklevelindicatesthemaximumquantityofanitemofmaterialwhichcannotbeheldi

nstockatanytime.

c. Theaveragestocklevelindicatesthemaximumquantityofanitemofmaterialwhichcanbeheldinsto

ckatanytime.

d. Theavailablestocklevelindicatesthemaximumquantityofanitemofmaterialwhichcanbeheldinsto

ckatanytime.

261. TheFIFOinventorycostingmethod (whenusingaperpetualinventory

system)assumesthatthecostoftheearliestunitspurchasedisallocatedinwhichofthefollowingways?

a. Firsttobeallocatedtotheendinginventory

b. Lasttobeallocatedtothecostof goodssold

c. Lasttobeallocatedtothe endinginventory

d. Firsttobeallocatedtothecostofgoodsold

262. Afirm Usesitsowncapital or Usesitsowner'stimeand/orfinancialresourcesbothareexamplesof

a. ImplicitCost

b. ExplicitCost

c. SunkCost

d. RelevantCost

[Hint:Acostthatisrepresentedbylostopportunityintheuseofacompany'sownresources,excludingcash

Theseareintangiblecoststhatarenoteasilyaccountedfor.Forexample,thetimeandeffortthatanownerp

utsintothe maintenanceofthecompanyratherthanworkingonexpansion]

263. IfDirectMaterial=12,000;DirectLabor=8000andotherDirectCost=2000thenwhatwillbethePrimeCost?

a. 12000

b. 14000

c. 20000

d. 22000

264. Wage,Rent&Materialsareexamplesof:

a. ImplicitCost

b. ExplicitCost

c. DirectCost

d. ManufacturingCost

[Hint:Abusinessexpensethatiseasilyidentifiedandaccountedfor.Explicitcostsrepresentclear,obviouscas

houtflowsfromabusinessthatreduceitsbottom-lineprofitability.Thiscontrastswithless-

tangibleexpensessuchasgoodwillamortization,whicharenotasclearcutregardingtheireffectsonabusin

ess'sbottom-linevalue

Goodexamplesofexplicitcostswouldbeitemssuchaswageexpense,rentorleasecosts,andthe

costofmaterials that go intothe productionofgoods.With these expenses,itiseasy to

seethesourceofthecashoutflowandthebusinessactivitiestowhichtheexpenseisattributed]

265. Aninvestorinvestsinstockexchangeheforegoestheopportunitytoinvestfurtherinhishotel.Theprofitwhich

theinvestorwillbegettingfromthehotelis .

a. Opportunitycost

b. PeriodCost

c. ProductCost

d. HistoricalCost

[Hint:1.Thecostofanalternativethatmustbeforgoneinordertopursueacertainaction.Putanotherway,th

ebenefitsyoucouldhavereceivedbytakinganalternativeaction.

2.Thedifferenceinreturnbetweenachoseninvestmentandonethatisnecessarilypassedup.Sayyouinves

tinastockanditreturnsapaltry2%overtheyear.Inplacingyourmoneyinthe