Professional Documents

Culture Documents

COM1 - Commodities 1 - Case Tutorial

COM1 - Commodities 1 - Case Tutorial

Uploaded by

Moon CooperCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

COM1 - Commodities 1 - Case Tutorial

COM1 - Commodities 1 - Case Tutorial

Uploaded by

Moon CooperCopyright:

Available Formats

Commodities 1

BP Canada Energy Trading

Case Tutorial

Introduction

The Commodities case is a trading case that tests a traders ability to react to fundamental news

releases and understand how that news will affect the price of an asset. This case uses a simple

commodity, natural gas, and introduces random demand and supply shocks that will cause the price of

it to fluctuate throughout a trading session. Traders are expected to use these news releases with a

simple pricing model to compute expected settlement prices for each months contract. Traders can

then compare their computed estimates with the market prices and generate profits by capturing

perceived discrepancies between the actual value and market value of the asset.

Trading, Information, and Strategy

The key drivers behind the value of the natural gas contracts are the monthly supply and usage of

natural gas. The difference between these two factors can conveniently be characterized as the

amount of gas stored (or drawn from storage). When we compare the difference between the

amounts that we expect to store versus the amount that we actually store, we get a storage shortfall (a

negative storage shortfall would be excess storage).

The final settlement price of a Natural gas contract, for a given month m, is defined in the case as:

Where;

,

This equation is extremely simple. It states that the final price of the natural gas contract is equal to

the expected price (given in the table below), plus the storage shortfall (you forecast and then it is

eventually revealed) divided by the standard deviation of the shortfall (also given in the table below).

Given Data:

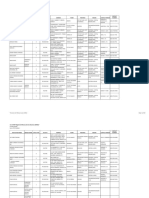

July August September

Expected NG Supply 2000 1980 1940

Expected NG Usage 1760 1620 1520

Expected NG Stored 240 360 420

Expected NG in Storage 6840 7200 7620

(at the end of the month)

Actual NG Supply

Actual NG Usage

Actual NG Stored To be released during the trading case

Actual NG in Storage

Storage Shortfall/Excess

Standard Deviation 90 70 60

Expected Price $6.00 $5.80 $6.00

*There is 6600 NG in storage on Jun 30th.

Rotman School of Management

http://rit.rotman.utoronto.ca

Page 1 of 4

V 1.1

Commodities 1

BP Canada Energy Trading

Case Tutorial

Intuition:

If no news happens in an entire month of July - the expected amount of supply is realized, the

expected usage is realized, the result is that the expected amount of gas goes into storage. There is

no storage shortfall. Result:

We can substitute all of the known (given) values, as well as the realized shortfall of 0.

Our result:

The final settlement price for July is $6.00 because nothing happened to change the supply or usage

(and as a result, the storage shortfall) of Natural Gas in July.

Advanced Situation:

Lets assume that a natural gas pipeline were to be shut down for maintenance, causing producers to

shut down 50 BCF of natural gas production (supply) for the month. (Consider a simple scenario

where if the pipeline is turned off, those companies that use the pipeline to ship their production will

also have to shut down their production of natural gas.)

Result:

We can substitute all of the known (given) values, as well as the realized shortfall of 50.

Expected supply for July = 2000 BCF. Actual supply due to pipeline maintenance is 1950 BCF

Expected usage for July = 1760 BCF. Actual usage is 1760 BCF (nothing happened to affect usage!)

Expected storage for July = 240 BCF. Actual = 1950 1760 = 190 BCF.

Realized Shortfall = Expected Actual = 50

Our result:

Rotman School of Management

http://rit.rotman.utoronto.ca

Page 2 of 4

V 1.1

Commodities 1

BP Canada Energy Trading

Case Tutorial

As a result of the pipeline shutdown, there was less natural gas supplied to the market. Since there

were no usage shocks, the amount that was left over and stored was only 190 BCF instead of the

expected 240. Hence, the drop in supply caused the price to increase from $6.00 to $6.55.

Weekly Data:

In RIT, actual values are released on a weekly basis - that is, every 2.5 minutes the actual data for

Week 1 (2, 3, 4) is released. The actual data shows the amount of natural gas supplied, used, and

stored. The case assumes no intra-month seasonality which means that if gas supplies for July are

expected to be 2000 BCF, one could expect each weeks supply in July to be 500 BCF.

You should use the weekly numbers to help refine your estimates for the monthly supply and usage.

For example, the base scenario for July is 500 BCF per week. If after week 1, the data is released

and 525 BCF were supplied, you can assume, without any other data, that the months supply will

probably be around 2025 BCF (assume that each following month will be as expected, unless there is

news to indicate otherwise.) You can do the same for the usage and storage results. One way to

think about it is as follows:

After week 1 release:

Expected Supply Expected Usage Actual Supply Actual Usage

Week 1 500 440 525 440

Week 2 500 440 A D

Week 3 500 440 B E

Week 4 500 440 C F

July 2000 1760 525 + A + B + C 440 + A + B + C

Your July supply is actually made up of 4 variables: each weeks supply. Likewise your July usage is

made up of 4 variables: each weeks usage. As time passes and these figures are released, fewer

variables are used to calculate the total months supply & usage. Week 4s values are reported prior

to the end of trading so there is a brief time when you will know the exact settlement price and still be

able to trade.

Storage Shortfalls & Surpluses Persist:

If the amount of natural gas stored in July is below expectations, one can also expect August and

September storage to also be below expectations. Total storage in a given month is equal to the

amount in storage the previous month plus the amount stored this month.

Consider the following example:

There is 6600 in storage on June 30th (prior to the case)

The market expects 240 BCF to be stored in July, July total storage should be 6840.

The market expects 360 BCF to be stored in August, August total storage should be 7200.

Rotman School of Management

http://rit.rotman.utoronto.ca

Page 3 of 4

V 1.1

Commodities 1

BP Canada Energy Trading

Case Tutorial

If theres a supply shock in July, and only 190 BCF are stored, the final July storage number will be

6790. Furthermore, if August storage meets expectations of 360BCF, the final August total storage

number is 7150, still below the expectation.

The intuition behind this result is that a supply/usage shock to a single month will also affect all other

months. The amount of the effect will be different, because the sensitivity to the natural gas shortfall

for each month (standard deviation) is different.

Trading

So far the focus has been on modeling and calculating the value of the months natural gas contract

based on the supply and usage for the month. How does one turn it into a trading strategy?

The simplest trading strategy is to compare the expected natural gas settlement price (the one that

you have calculated based on the news that youve received) to the market price, and to purchase

contracts when they are undervalued and sell them when they are overvalued.

The second way is to trade a calendar spread by taking an opposite position on another months

contract to hedge your trade. For example, if you think that July is undervalued, you can purchase the

July contract and then short sell the September contract. If unforeseen news events happen, which

cause prices to unexpectedly fall, your September hedge contract will help offset your losses on your

long July position. If nothing happens, your July contract will eventually settle (hopefully at the higher

price that you forecast) and you can remove your hedge.

Rotman School of Management

http://rit.rotman.utoronto.ca

Page 4 of 4

V 1.1

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Annotated BibliographyDocument3 pagesAnnotated BibliographyMatthewMilewskiNo ratings yet

- Sustainable Supply Chain ManagementDocument3 pagesSustainable Supply Chain ManagementInternational Journal of Innovative Science and Research Technology0% (1)

- State Bank of India: All Revision / Corrigenda Will Be Hosted Only On The Bank's Above Mentioned WebsitesDocument4 pagesState Bank of India: All Revision / Corrigenda Will Be Hosted Only On The Bank's Above Mentioned Websitesdebnathsuman91No ratings yet

- Srabonti Ghosh (181-226-801) Intern Report (AVL)Document117 pagesSrabonti Ghosh (181-226-801) Intern Report (AVL)Nafis MahmudNo ratings yet

- Tax Practice Set 3Document3 pagesTax Practice Set 3Russel RuizNo ratings yet

- Management of Financial DerivativesDocument35 pagesManagement of Financial DerivativesGaurav Kumar100% (1)

- Competitor Analysis: Square PharmaceuticalsDocument5 pagesCompetitor Analysis: Square PharmaceuticalsShoaib HussainNo ratings yet

- Income TaxationDocument31 pagesIncome TaxationrjpogikaayoNo ratings yet

- Btled He Final ExamDocument8 pagesBtled He Final ExamVignette San AgustinNo ratings yet

- Auditing Theory by Wiley Testbank 1Document87 pagesAuditing Theory by Wiley Testbank 1Liam Jacque LapuzNo ratings yet

- Session 10 (Role of The Regulatory Framework - SEBI, TRAI, RBI and Role of Board of Directors Corporate Governance - The Indian Scenario.)Document11 pagesSession 10 (Role of The Regulatory Framework - SEBI, TRAI, RBI and Role of Board of Directors Corporate Governance - The Indian Scenario.)Shubham Jaiswal (PGDM 18-20)No ratings yet

- New - Delhi SouvenirDocument52 pagesNew - Delhi SouvenirDavid ThomasNo ratings yet

- OD427572718507061100Document1 pageOD427572718507061100Mithilesh KumarNo ratings yet

- Bestbuy Turn Around StrategyDocument13 pagesBestbuy Turn Around StrategyRajendra Yadav100% (1)

- Lecture Notes - Structured Problem Solving Using Frameworks - IDocument30 pagesLecture Notes - Structured Problem Solving Using Frameworks - Isudeepvmenon100% (1)

- 2013-12 - The Balanced Scorecard PDFDocument30 pages2013-12 - The Balanced Scorecard PDFAmit JainNo ratings yet

- The In-Depth Guide To Reading A Value Line Research Report PDFDocument24 pagesThe In-Depth Guide To Reading A Value Line Research Report PDFAlvaro Ramirez QNo ratings yet

- Management Concepts: An Overview: Dr. Jamil AnwarDocument35 pagesManagement Concepts: An Overview: Dr. Jamil AnwarXecicNo ratings yet

- Global Marketing: How Do Standardise and Customise The Products Globally?Document7 pagesGlobal Marketing: How Do Standardise and Customise The Products Globally?RajaRajeswari.LNo ratings yet

- Internationalisation Process of SMEDocument162 pagesInternationalisation Process of SMEKeyur DesaiNo ratings yet

- Powering Nigeria For The FutureDocument36 pagesPowering Nigeria For The FuturemayorladNo ratings yet

- FINA2004 Unit 4Document11 pagesFINA2004 Unit 4Taedia HibbertNo ratings yet

- DonationsDocument1 pageDonationsSamrat MazumderNo ratings yet

- The Great Debate On The Soviet Industria PDFDocument4 pagesThe Great Debate On The Soviet Industria PDFApollo MoirangthemNo ratings yet

- 2012 Index of Economic FreedomDocument483 pages2012 Index of Economic FreedomJose Carbonell SanchezNo ratings yet

- Chapter 19 Futures, Forwards and Swap MarketsDocument15 pagesChapter 19 Futures, Forwards and Swap Marketssamspeed7No ratings yet

- Product Design and Development Unit 2 MCQ's ON Product Development - Technical and Business ConcernsDocument8 pagesProduct Design and Development Unit 2 MCQ's ON Product Development - Technical and Business Concernschiku khadeNo ratings yet

- Business Plan For Plastic in Ethiopia DoDocument38 pagesBusiness Plan For Plastic in Ethiopia DofekadeNo ratings yet

- Percentage Practice Worksheet 1 Item 4932Document2 pagesPercentage Practice Worksheet 1 Item 4932Ahmed NurulNo ratings yet

- MSBsDocument538 pagesMSBsEvangeline VillegasNo ratings yet