Professional Documents

Culture Documents

COURSE SYLLABUS-advac 1

Uploaded by

Ayan VicoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

COURSE SYLLABUS-advac 1

Uploaded by

Ayan VicoCopyright:

Available Formats

COURSE OUTLINE

I. Partnership Accounting

a. Basic Considerations and Formation (Chapter 1)

b. Operations (Chapter 2)

c. Dissolution- Changes in Ownership (Chapter 3)

i. By purchase of interest PRELIM

ii. By investment

iii. Withdrawal, retirement or death of a partner

iv. Incorporation of a partnership

d. Liquidation

i. Lump-Sum method (Chapter 4)

ii. Installment Method (Chapter 5)

II. Corporate Liquidation (Chapter 7)

a. Statement of Affairs

b. Deficiency Statement

c. Statement of Realization and Liquidation MIDTERM

III. Joint Arrangements (PFRS 11) (Chapter 6)

a. Joint Operations

b. Joint Venture (Equity Method)

c. Accounting for SME

IV. Revenue Recognition

a. Installment Sales (Chapter 9)

b. Long Term Construction Contracts (Chapter 10) FINALS

c. Franchise Operations (Chapter 11)

d. Consignment Sales

REQUIRED READINGS

Primary Text: Pedro P. Guerrero, Jose F. Peralta

ADVANCED ACCOUNTING : Principles and Procedural Applications (2013 Edition)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Uh09171020 PDFDocument5 pagesUh09171020 PDFAyan VicoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Office of Admissions and Scholarships Document ChecklistDocument4 pagesOffice of Admissions and Scholarships Document ChecklistAyan VicoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Chapter 11 ADVANCED ACCOUNTING SOL MAN GUERRERODocument12 pagesChapter 11 ADVANCED ACCOUNTING SOL MAN GUERREROShiela PilarNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter 5-Advance Accounting (Guerrero)Document23 pagesChapter 5-Advance Accounting (Guerrero)Bianca Jane Maaliw63% (8)

- Accounting and Auditing Laws Rules and Regulations Atty Billy Joe Ivan DarbinDocument57 pagesAccounting and Auditing Laws Rules and Regulations Atty Billy Joe Ivan DarbinAyan Vico100% (3)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- DepEd Division A Monthly Bank ReconciliationDocument1 pageDepEd Division A Monthly Bank ReconciliationAyan VicoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

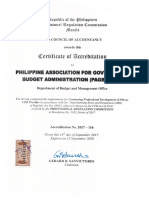

- CPD Accrediation CertificateDocument1 pageCPD Accrediation CertificateAyan VicoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Appendix 4 - Instructions - CKDJDocument1 pageAppendix 4 - Instructions - CKDJPayie PerezNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Annex Q - List of AcronymsDocument6 pagesAnnex Q - List of AcronymsAyan VicoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- COA C2012-003 - Irregular, Unnecessary, Excessive, Extravagant, and Unconscionable ExpensesDocument28 pagesCOA C2012-003 - Irregular, Unnecessary, Excessive, Extravagant, and Unconscionable ExpensesMiguel Reyes100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Management's Responsibility for Financial StatementsDocument1 pageManagement's Responsibility for Financial StatementsJohn Eivor Go OrroNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Table of Contents-Vol 3 PDFDocument1 pageTable of Contents-Vol 3 PDFAyan VicoNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Annex P - Composition of Fund ClustersDocument15 pagesAnnex P - Composition of Fund ClustersAyan VicoNo ratings yet

- Appendix 9D - Instructions - RAODCODocument1 pageAppendix 9D - Instructions - RAODCOTesa GDNo ratings yet

- Appendix 8 - Instructions - RAPALDocument1 pageAppendix 8 - Instructions - RAPALTesa GDNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Appendix 11 - Instructions - ORSDocument1 pageAppendix 11 - Instructions - ORSthessa_starNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Maintain Property Card RecordsDocument1 pageMaintain Property Card RecordsAyan Vico100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Appendix 5 - Instructions - GLDocument1 pageAppendix 5 - Instructions - GLAyan VicoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Appendix 11 - Instructions - ORSDocument1 pageAppendix 11 - Instructions - ORSthessa_starNo ratings yet

- Government Accounting Manual (GAM) For National Government AgenciesDocument2 pagesGovernment Accounting Manual (GAM) For National Government AgenciesPrincess GonzalesNo ratings yet

- RCI Daily Check ReportDocument2 pagesRCI Daily Check ReportTesa GD100% (1)

- Notes To Financial Statements - Annex FDocument44 pagesNotes To Financial Statements - Annex FAyan VicoNo ratings yet

- Real Property Transactions Under The NIRC of 1997 PDFDocument8 pagesReal Property Transactions Under The NIRC of 1997 PDFAyan VicoNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- How To Transfer Real Estate Titles in The PhilippinesDocument3 pagesHow To Transfer Real Estate Titles in The PhilippinesAyan VicoNo ratings yet

- Easement of Right of WayDocument1 pageEasement of Right of WayAyan VicoNo ratings yet

- Government Accounting Manual For NGAsDocument83 pagesGovernment Accounting Manual For NGAsAyan Vico100% (2)

- DV BackDocument1 pageDV BackptsievccdNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Calamity Loan Application Form (CLAF)Document2 pagesCalamity Loan Application Form (CLAF)Ayan VicoNo ratings yet

- Government Accounting for Non-Profit Entities & Specialized IndustriesDocument63 pagesGovernment Accounting for Non-Profit Entities & Specialized IndustriesRachel Sanculi Lustina86% (7)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)