Professional Documents

Culture Documents

JB Pritzker Tax Returns

Uploaded by

Zoe Galland0 ratings0% found this document useful (0 votes)

8K views13 pagesJB Pritzker Tax Returns

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJB Pritzker Tax Returns

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8K views13 pagesJB Pritzker Tax Returns

Uploaded by

Zoe GallandJB Pritzker Tax Returns

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 13

JB

JBPRITZKER.COM

Attached are the state and federal tax return summaries for JB Pritzker from 2014 through 2016.

‘* In 2014, J8 Pritzker paid federal taxes at a rate of 37.3%, in 2015 he paid federal taxes at

a rate of 24.3% and in 2016 he paid federal taxes at a rate of 27.7%.

‘* Between 2014 and 2016, trusts benefitting JB Pritzker paid an additional $24.95 million

in Illinois taxes and $128.97 million in federal taxes.

‘© JB Pritzker has made $15.3 million in personal charitable donations and his Foundation

has made charitable donations of $53.8 million over that same period of time.

JB FORGOVERNOR | POBOXA3801 | CHICAGO, ILLINOIS 60590

PAD FOR BY JB FOR GOVERNOR]

£1040 us. naivituat income tox acum” [2016]

foes eee 2H ey ore moms neeing

Your tat nare anda arame Yor caer

JAY ROBERT berrzKer

ia jae, seuss team me wT Yast ame Spee srs nt mre

MARY_KATHRYN RITZKER

ome fess (umber nd ste. you Fave 3.0. ox sos isco Tim

Ss

iy manent oa 2 ee orb an coms oe a

Foren countyrane Foren roneiatelcuny Feri petal cade | “Sion

You se

Fiing Status) Tmo 7 TT wad ernonsad rth ausng parson). rt aaltyng

2 (EE) veri ig nt (eve tony oe hancore) person's oh ut no your dgener ent isnrs

ceckeny 8 CD) arising sarah ss’ Save fanehere

pric nd til an ne, 5 ova wider ath pene ca

Hong LI Youre someone in dim you ona cpendn, do wt rok boxts or

Exomptions 'y [E] se a

{onan —— Stee “peer SES

Feat aster ees me ae

THEODORA _K PRITZKER RUGHTER x

mee tweniar DONALD _NPRITZKER (ON x

pens sa

eet et

Shoschee Be I

Tea narra ein canes

Income 7 Wot, sali, tps et. ach Form(s) W-2 7

Tecable iran Ain Soho Baus | 173,950.

prcerfomy) 2 THtAMPL tot Bo ate anes 8,964./P a

Heeetrte) ox. ona aves tach Sedalia s|_ 1,001,273.

Stach Forme,” baled dons ow | “914,799. /P ajemer 11

WaGand 19 Taxbleretund ero oft olen sediecl naam mes SMTP T__ STMT 9. | 67,886.

{O99 tax

aan 11 Almory rst. 11

12 sins oreo ss. tach Sede Co EZ | 1,412,403.

riyuganor 9a ess Ath Sete Denied tard cake Ot 85,064.

Daawort 14 Oe gains o esses). tach Fem 4737 . 1 =1,380-

Elections, 16 IRA deibutons 18 ‘Tass amount 10

18 Ponsons andansites 16s ‘Toate amount 19

17 Rental esa, rats, prterstip,S aperaone, ss Atach Sched E 7 | 13,189,177.

48 Famiecomeo (oss) Azo ScheddeF a

18 Unsnoloymetcompensaton 8

208 Sooal act ones 00 Toate amount 202

21° Otter noone. tte sndarount_ SEE STATEMENT 6 2 50,440.

22_Combin te sours hf right ann er tes 7 ough 24 TS ou >

28 Edesor pence 28

Adjusted 24 Sactmanrerena TREN Minas

Gross 25a sings acount eectn. tach Farm 860 [es

Income 28 Movig pana. tech 3903 [ae

27 Daivtbe part s-emponment tax Aah ene SE 2 30,022.

28 Sebeplyed SEP, SIMPLE, and eal pans ‘8

23 _Sat-esployed hath nsrnce eceton ra 26,652.

Party on ary thes of savings 30

S318 Alimony pid Repent SoD te

32 A cetucton 2 |

38 Suie ion ners eduction 8

4 Tina es Ata Form 8917 M

35 Domai produion acivins tutor. iso Fern 8909 | 971,737.

9 Aadtnes 23 rough 35 as |_1,028, 411.

wom use $7 _Swtactne 3 om ae 72, ths yo sled ges come p [an [147950 445.

LHA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Ferm 10600)

doo CA oy

fenvoog JAY ROBERT & MARY KATHRYN PRITZKER a rt

Tax and 35 Anooal tion ae 37 adjusted gostacome)

| 10,950,446.

Grodits sea cna { Ll vow mer bomdevestnarya 1652, [—] Sind} Toles

Sem] tL Ctpoemebombene nnary2. tse, Joina J} eatee > ans

Jgzcence Lo Hye sesamin ova pst omor ou wen ada ce 8

Fershe, a0 memuedcetaons (tom i oo add ect tt mr)

ces 41 Site atomina 8

cs" | 42 Exempt, Ine 3s $1580 oes, rly F400 by the number ca ie 66 tari, seas.

49. Toxdle Income, Subtract 2m 1 ies moran eter -2-

40 5,263,562,

* [a [9,686,884

a oO.

43 | 9,686,884.

uc] 3592-397.

M4 Tex Check any tom: a] Fors) 8814 »[] Form ear ol]

45 Auenatv sina, Atach Form 6251, 2

46: seas avane pr x rarepaymant Aah Fm 6962

7 ‘ibis 468,500

o.

rm

mm

| 3,592,397.

48 Foren tax cred Ate Form 116i ecured

nena

« 14,362.

{0 Eovaton rds om Form #263 ne 19

4 Raienet cong corte cat Asn fam 680° BE

eae

ate

asowanee | 49. crestor ctaand epncent crenata 200) [ab

fae, | te caseeore mas Sov te ra

EE 8, Reson energy cree. Aaeh For 505.

$4 Oneoettsromfom: aX} 2010 oC Janets

rm 306s

55 Ades trough 4. Thus eo your ia eae

Sune 5 rom ne 7.1 35 no a

187-Slrenpoyront tx. Ath Shatl E

14,668.

3577,723

50,042.

Other — se Uvepred sail stay and Meare tx omFarre al] 4t87 oJ e910

‘Taxes 69 Avion tx on Rs, ter qed retramet pln, es Atach Farm S28 equred

604 Howes eeployment twa rom SeRGUEH : "

Festi bomabujer ced paymant Ach Frm $5 eau

‘61 Hoa core ncvduat responsibly (see instvuctons) Fuller coverage (XE)

‘e2 Tease trom: 2 [X] form 9959 > (X] Form 8960. «

EGREEEEE

502,586.

5 2osesimae expomens and smowt ape tos ism

Tair Be Eames acane rac) Se

Sale [tonal conatpayeeton Let

‘aor eet. ch Sed?

et pramium x et fete Frm 6952 ioe

a |

ek

7140, 35"

STATEMENT 15

‘oneal th request recs tte

000, 000.

ces sce secuiyand ter VARTA will

Croat tata taxa ful tach

Grams nasa C200 »

haxzsese

Adis 64 55,8 and 67 rou 73. These ae your ttl pms "

8,019,801.

Rotana rs tne 74s ve wan in 9, et Ie 63 rome 74 Tis he amet you veal

ween 17 Amount of

‘Amount ~7e amoanyou one, Subract ne 74 rom tine 63. Fer deta on how pay, see intrusions

You Owe _75_ tstintedtxcpenly (see nsructons) Lae

Tit Patty "fo you vant stow aor parton diese he etn wi he RS (se rstutos)

Ne ‘me

rf

ra

Ta, 7 idee tah imi Er

Fy a (Ea

! EPEC

: EH

ee ST

3,879,444.

Preparer | I |: 0 72072

‘one You cannon wi one cn nar

W fala hrrorney

eli2[1_Housswrrs feos

ro) om

a _

Uso Only “ronerons DELOT TS TAK LLP

180 EAST BROAD STREET

fice sigesy_Fveasine COLUMBUS, OH 43215

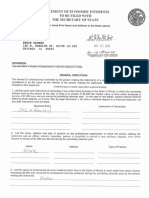

Tlinois Department of Revenue

2016 Form IL-1040

Individual Income Tax Return or tor iscalyeer ending

Ove 80% of taxpayers le electronical [ts sy and you wil got your refund fasta. itty incl. gov

‘Step 1: Personal Information

JAY ROBERT PRITZKER

MARY KATHRYN PRITZKER

—

CHICAGO, IL 60606

structions)

rhoveenots f

Step 2: 1 Federal asieted gross nome rm your fecera Form 1040, Line 37; 70404, Line 21; or {Whole dors ony

income 100962, Line 4. 4___14,950,446 00

2 Federal tncoxempt intorest and dividend income fom your federal Fem 1040 or 10404,

Line 8b; oF federal Form 1040E2. 2 8,964 9

3. Other adcitons, Attach Schad 3 501,303 00

4 Total income, Add Lines 1 through 3, 4 15,460,713 09

Stop 3: 5 sooialSecunty benofts and certah retoment plan income

Base teceived if included in Line 1. Attach Page 1 of federal return. 5 20

trcome © icisitcoms Tax overpayment neues eal Form 100, Line 10. 8 67,886 00

g 7 Other subtractions. Attach Schedule M. 7 630,571 00

; Checkit Line 7 nudes ary amount rem Schecuie 12886. []

5 8 Add Lines 5, 6, and 7. This is the total of your subtractions, 8 698,457 oo

g 9 itinois base income, Subtract Line 6 trom Line 4. 9 14,762,255 oo

g Step 4 10 a Number of exemptions tiom your federal return. (A. x 52.175 a__8,700 00

& Exemptions —D- itsamcn can chim yeuas a dependenseehsvucions, x $2,175. b 0

3 © check e& orate [_] You+ [_]Speuse = Xx $1,000 © 00

i 4 Checkitiogay ind: [—] You + [] Spoueo = x $3,000 d 0

Exemption allowance, Add Lines a through d, 10 8,700 00

f SOPH: 11 sizer: Net income Sudtact ne 10 rome, tp Line 12 11__14,753,556 09

Net 12. seresdeis and pat yearresdents:

Ineome heck the boxthat arp to you uring 20t6 [] Nonesidont [—] Partyearrsidnt, and

‘ntr ho tlinoisbaze income trom Sen. NR. Attach Sch. NAL 12

Fiscal ler see instructions before completing Step 6. Galondar-yar filers continue to Line 13.

A Tex 18 posiderts: Multy ne 11 by 3.75% (0378), Cannot be les tran 20

x Nonresidents and part-year residents: Ener x om Schedule NA 19_____ 553,258 0

g 14. Rocepture of investment tax cedis. Attach Schedule 4255, 14

7 15. Inoome tax. Add Lines 19 ard 14. Cannct be les than ar. 15 353,258 00

Income tax pai to another tte while a lini odo

{Attach Schedule CR. 18 87,916 00

Property tax and K-12 education expense cre noun kom

‘SchedulaICR. Attach Schedule ICR 7 500 00

‘Crect amount fom Schedule 1299-C. Attach Schedule 12990, 18 5,051 0

‘Add Lines 16, 17, and 18, Tiss the total cf your cre,

‘Cannot exceed the tax amount on Line 16 19 96,467 o

‘Tex after nonrefundable credit, Subtract Line 19 rom Line 16. 20 456,791 09

Ao paoe 177)

1: 28x saan onze

2016 It loyo

21 Taxeter nonrtundable cris om Page 1, Line 20, 21 456,791 09

‘Step 6: 22. Househols employment tax. See instuctns. 22 9

‘omer 23 Use taxon intemet, mal oda, o ther euro late purchases rom

‘Taxes UtWorksheet er UT Table nthe instructions. Do natieave Hank, 23. 0 09

24 cangatdonle Ut of Medel Cait PlotProgrm Act Suctargs 24 2

25 Total Tax, Add Unes 21,22, 23, nd 24 2 456,791 00

Step 9: 28 itolsincome Tax withels. attach a W2 and 1099forns, 28g

Payments 27 Estimated payments rom Fos 1040. and S054,

and Including ary overpayment applied rom apo year eta. ca 728,960 09

Refundable 28. Passthvough witiheldng payments, Attach Schedule K-1P or -T,2B 9

CCrecit 29. Eamed tncome Credit om Schedule ICR. Attach Schedule 0A, 29 re

‘30 Tota! payments and rotundable creat. Add Lines 26 though 29. wo 728,960 99

Stop 10: 31 overpayment. Une 30s greater than Line 25, subtract Le 25 fom Une 30, at 272,169 00

Resutt 92. Underpayment. Line 21s greater than Lin 9, substact Line 20 fom Lne 25. 32. 0

Step 11: 33 Latepayment penalty for underpayment of estinated tax 33,

UUnderpayment a Chockifat least twothids of your federal gress income i ftom fang.

‘of Estimated Check your your spouse ae 85 or oer and permanenty

Tex Penaty Ing in afursng home.

‘and Donations ¢ Check yourinceme was not received evenly sing the your and you

‘annuatized your Inoome on Form 2210. Attch Form 2210.

Chock t you war nat required to fle annals naval ncome Tax

Sener

ieee ee, % :

35° Total pencity and donations. /«¢ Lines $3 and 34, 36 20

Se eB aE aeilcsmeenn saci

ea ee rer emer ane a

Ne gy ART Ee an emcee a

sma 3 monte trees

CB w ie information below ityou check this box.

Houag number TH checking or [J savings

iene

LD. tints fycintcveat income Texretund debit card

To paper cinecis

39° Amount to be apptied to estimated tax. Subtract Line S7 from Line 36. See instructions. 39. 272,169 09

40 ttyou have an underpayment on Line 32, add Lines $2 and 35, OF

eae ee

Ce ee et a z

‘Step 13: I state that Ihave examined this «-" ‘to the bent ot wy knowladad Kk Ate con 7

Sed ° * WER. wale

Dste Lr i (wl

ThirdParty CE) Check, and complete the designee's name and phone number below, o low another person to discuss this etum and any

Desinse raise ances aby oped ons oun wn is nos Dereon of Renn

Seeerrnneomeere ooo

Hae pamentercoe, mat: F] Woommentencees, na

==] ose oeparren or revenue ull page ogni

SnD eereae Sener

Fed #, moon A

er oA,

£1040 us. iaivicu income tox reum™ [2015]

Your ist ane andi trae Tr at or we

JAY ROBERT. RITZRER

ira jartreum, speusdetratrane andi | Lastname Sees ca ew nas

MARY KATHRYN PRITZRER, a

Home aiess(ranber and are, WyouTavea P.0. box, se wetrueton FAUT Tune sweiness om

Sra Taco oT

CHICAGO, IL 60606

anaemia a aaa aa ea

Fung Statue? Co Soe 7 Test theo oh apne te alia

2 CX) Married ting jointy (evan t only ane had income) person is & child but not your dependent, enter this child's

hack nty 3 (| Mamied tng separately. Ent spouse's SSW abou ‘rame nore.

ane box. T= aid ul game are, 5 [1] ouaitying widomfer wih dependant chia

Ba ‘Yourselt, If someone cen claim you as a dependent, do not check box 63 aw FE

Exemptions" [3C] spovee } ene

ny arma _ | Peon ease

‘THEODORA_K-PRTTORER DAUGHTER x

‘more than four DONALD N PRITZKER 30N_ xX

‘check hare b> [—)

Total nero eamptens canes

income 7 Wages, sabes ts ee Aacn Formys) W-2

4 Taxable intrest ich Schade 8 requ

1 Tacexert interest Oo nat incon ne 82 a 31,863.

Wionee’ aia St Ordnary dens. tach Suc Bit requred 1,492,118.

atueoime” 4 Geddes wo 1463, 406.

jan 10° Table refunds, credits, ores sean acl eo aes 9.

wacminneg, 11 Altonyrstves i

12 Business income or (ss). Attach Schou € or CZ [2 [2,475,948

Hyeusenay "aot gain or (os). Aah Shac ifr. no ead cho here > fs 525,779

ee 14 Oth gin or (see) tach Ferm 4797 4 =66.

Seeinsvuctons, 162 IRA distributors 158 9 Teale amount 18

‘8a sins and annuities ‘ea ‘Taxable amount, cs

‘7 Real real estate, royals, parrersip,Scrpealons, Fuss, el Ataeh Schedule E a | 5,887,336.

18 Farm ncomeo: os) tach Sede F 6

18 Unemployment compensation 18

204 Soil secuy benefits 08 1 Taraeunaunt 208

21° ihe income List pe and amount

22__Combine te amounsin he fr ht clan fo nes 7 rough 2, TH ow gal income Bln | 10,523, 687

mn :

24 Siena Rrrn es cama MN ease yy |

28 Heath savings acount atic. tach Farm 68 ra HH

28 Moving exmnss. Aad For 3803 [ae

27 Datta pat ot a-empioment a Ath See 2 41,390.

28 Sef-enpoyed SEP, SINPLE, are ques plans 28

28 Saamployed eat nance cesta FA 23,984.

30. Peralyon ery wihdawa et :90008 onan 30

{14 Almay fad b Recents 998 be sta

32 A dttcion cee 22

38 Stunt oan intrest dedcton 8

‘Titman tes. tach Form 0917 soee rm

35 Domesteposucton acts decor Af 8883 35 483,686.)

36 Adeline 29 hough 35 Las] 549,060

57 _supvastoe 35 rom in 22 This yer adj grove income » Tal 3,978,627.

Lia For Disclosure, Privacy Act and Paperwork Reduction Act Notice, see soparate instructions. Form 1040 co)

feowoono JAY ROBERT & MARY KATHRYN PRITZRER a ru

Tax and 95 Arottiam neg add goss teow)... eaprernaaeeaaie [5,578 627.

Grocite sox cue { [1 Yourerbombetne nay, 151, oes) Tate

it | Horne vastom bxirednany2, 151, [Jind J ciated. > ate

Ls tye spices onasepute rena yoowees dalstiutsie, doce |... > 306 TI |e

1 naz detuctan (tom Seed ory ctandad eden (oe eRe) wo | 3,013,987.

41 StH 4 aM 8 - 6.960.640.

42 xenpts, in 318 154350 oes, oy $400 by te numbers 6 Cera eit

43 Toe coe, 5nea iee <2o ne [—Jovame (10688 ol

unetis el

lee

1,315,000,

EF eRe

[

€

3,203,472.

777,051.

Refund 15 tine 74ic more tantee 63, beat a6 rote Thi iste smut yOu eI sera. [2

> bo wwe L) csing [sions Bre

Arca 75 ede your 206 estinate TTT, O51

‘Amount —76 Amano ve Se ne 74am ine Ft now oy, ae

eeonas, Mepl are Norbit ou eo

AY yor yet aa asunder eR (ern

Designee

tongs

ee

Use Only “ewmsnace DELOZ: :

‘180 EAST BROAD STREET

SEL eases » COLUMBUS, OF 43215

Iifinois Department of Revenue

2015 Form IL-1040

Individual Income Tax Return or forfiscalyear ending

(ver 80% of taypa yes fle lecroricaly. is eos) and you wil got your elu fater. Vis te. no gov.

‘Step 1: Personal Information

JAY ROBERT PRITZKER

MARY KATHRYN PRITZKER

CHICAGO, IL 60606

© Fitog status (09 nstuctons)

single orneas ornousenals OK] Marea tingjonty — ] Marios rg soparataly — ]_welowed

Dcheckit you or your spouse ae @ itary veteran and want your name and adcress shared with the nos

Department of Veterans Al [iver [1 spouse

Stop 2 1 Federal dusted gross income fom your US. 140, Ine 87; US, 10408, neat or {Whole dallas ont

Income U.S 104082, Line 4 1__9,974,627 oo

2. Federaly texoxomp interest an! cvdend incom fom your U.S, 1040 or TO40A, Line Bb;

or US. 104082 2 31,863 00

other sddtions. attach Schacle 3 349,427 00

4 Total income. Ad Lines 1 tough 410,955,917 0

Step 3: 5 social Secuty benefits and eran rttemont plan income

Base received nclugedin Line 1. Attach Fage 1 offederalretum. 5 oo

Income 6 tino Income Tax overpayment included MUS. 1040, LIne 10. 8

j 7 other subractons. Attach Schedulo Mt. 7 553,801 0

‘Check if Line 7 inckades any amount ‘rom Schedule 1239-6. [_]

E 8 AddLinesS, 6, and, Tiss the otal of your subtacions 8 $53,801 0

a 9 Minois base income, Subtract Lin 8 thom Lin 9_ 10,402,116 00

J Step 4 10 a Numborotoxemetons trom yourfederaletun, A X §2.1s0 @__8, 600 09

g Fxemptions —-itsemeone can ctim yeuas adapandert, see intuetons. __ X s2,te0 Bb

3 © checkif6s orcido, [You + [_] Spouo = — x $1,000 € 09

4 4d checkitlogatybind: (You + [] spouse = __ x $3,000 d m7

3 Exemption sllowance. Add Lines a though & TB, 600

Step 5: 11 pesdents: Netincome, Subtract Line 10 fem Lin 9. si Line 12 11__ 10,393,516 09

Net 12. Nonresidents and partyear residents

fncome ‘Check the box that applies to you during 2016 [—] Nonresident [_] Partyear resident, and

‘enter the lineis age income fom Sch, NR, Attach Seh, NR, 12 9

A St°P G13. festsents; Multiply Line 11 by 3.75% (0878) Cannot be less than ero.

3 Tm Nonesiten's and partyearreizents: Ent th tax trom Schedule NR 13

389,757 09

3 14. Recoptrofrvoutmect ox crate, Nach Scho 4256 ‘4 2

5 15 tnoome tax Add Lines 18 and 14. Cannot be os than zo 15 389,757 00

§ Step 7: 16 Income tax pid to another sate while an fines resident.

PToxAter Attach Schadte CR. 16 102,980 0

Non 17 Propedy taxand K-12 education axpence exe amount fom

refundable Schedule ICR. Attach Schedule ICR, 7 500 00

FP Sredts 18 credit amount tom Schedule 12896. Attach Schedule 1269.0. 18 106,237 00

i 19 Add Linas 16,17, and 18. hiss te total of your ered,

‘Cannot oxcees the tax amount 6 Linas. 19 209,717,

7 20 Taxatter nonrefundable erect. Subtract Line 19 fom Line 16 20, 180,04

cares” Tee | MMMM

Pio AB MK

~ Le 72

21 Tacatternonretindabe credits rom Page 1, Ube 20, a 180,040 00

Step 8: 22 Houstots employment tax See istuctons, 22 0

tw 23. Usetac nine, mal over, o other outotte purchase rom

‘Taxes UT Worksheet of UT Tablo in the Instructions, Do notleave blank. 23 0

24 compart et fede Camabs Plot Progam dt Scape 24 0

25 Total Tax, Add Lines 21, 22, 25, and 24, as 180,040 09

Step St 29. motsincome Tax wennes. tach alW2ané 1099fems, 28 0

Payments 27 Estimated pants om Farms I-O4OES sr 654,

ana Ihcudng ary overpayment spied fomapwioryeareum. —-97__ 340,250 09

Refundable 28. Pase¥vough wioldg payments. Atoch Schade KTP ee K17.28 2

Groat 29. Eamedincome Godt tom Seneewe ICR Ataeh ScheduelCR, 29 0

80 Totalpayente and reuneabe cre, AS Lies 26 D¥oUgh 29. 37__ 340,250 oo

Step 10: 31 overpayment. Lina 30 s greater than Line 25, subtract LIne 25 fom Line 30. at 160,210 09

ecu 82 Underpayment. I Line 25 rater than Lne $0, subwect Le 30 em Uno 25. 2

Stop 11: 39 Latepayment pena forundemayment of etnsed tax 3

Underpayment a Check at lest tothe of your fede! gross come om farming C=]

‘of Estimated b Checkilyoucr your spoute are 6S role and peemarany

‘Tax Penalty ‘ving in a nursing home. o

‘and Dopations & Checklyeoricome wasnt recsived avn dug the yer and you

anntaad your income on Frm 210. Mach Form L221. o

4 Check you were not equ to fan incendie Tax

retum in the previous tae yer, o

‘84 Volenurychartabla donations. Attach Schedule. 34 Py

35. Totalpenaty nd donations. Ad Line 33 and 34, s oa

‘Stop 12 96 i1yeunaveenoverpayment onLine 31 and ths amounts rete than

Refund or Une 95, subtract Ling 95 from Lino $1. This is your remaining everpeyment. 36 160,210 9

‘Amount You 87 Arount fom Line 98 ou want refundod i you Check one box on Line 38 Sevinewuciona, 37 009

owe ‘38 choose torecee my uns ty

7 erect deposit - Compisio the information below if vou check this box.

‘Routing number. LJ checking or LJ savings

‘count number

tro mareuat meow Tox etn debi cord

CO paparcheck

‘39 Amount to be applied to estimated tax, Subtract Line 37 trom Line 38. See instructions. 39, 160,210 00

40 ityou have an underpayment on Line 32, add Lines 32 and 36, OF

\fyouhave an overpayment on Line 31 ani ariount sas than ne,

subs Ure 3 fom Line 3. Tiss the amount you owe. Se insctns 40

Slap TE naey

Sion and

Date

onions

TrirdPary oy Seshadri shen hn wt rp ean nce pi nan ai MY

Designe

aapge name sep Dusgnoepsorenane

1059-3 [7 1 you are unable to obtain your Form 1090-G from our webelt, you may chock the box to receive a paper 1099-G form next year.

leformaton |Wevilmal you'a 1000 form lyou mot he erara requiring vs to asu0 ono to you

ta» payment encose, mall to: payment enclosed, nal

MLO DEPARTMENT OF REVENUE |LLuwo's DEPARTMENT OF REVENUE

pa SPAINGRELD 62719-0001 SPAINGFIeLO I oe7Re-O00t

i Ey em COIL

etapa 29

$1040 us. insivies income rx return” [ZO 1A) ase sare |nstniy snsamanennnnoc

ne bo 8 104 urate a Zolaears See soporte nats

our eet ame ang ae Tessa wero

JAY ROBERT PRITZEER

Ifa intel, spouse's fratrane anda | Last nae Trane clea une?

MARY KATHRYN lPRITZKBR

Fe aes (aber ens T you fave abo, see svoclons Tp a:

CHICAGO, IL 60606

Foran uty ane Fora poviconnaooTy Foreign posal coe

= (vou spouse

1 ‘Single 4 LT iead of household (with qualitying person} Wthe qualitying

Fling Status 2 FE) tard ng joint (even ony one neces) person edu ou depend en i chi

checkony 8 CD Nene ting separate. Ent pases SV atove tae er,

motor ang ulnune ee, > 5 J ouaiyg wide nih penta

= someone co com yout Gaennt Go raTche orb See a

Gogeaniapce Sere (ae

Tensons sera on pln Sees e

TH RA TZ KER \UGHTER. Kn Gevhettene

L iartord DONALD “NW PRITZKER ;ON x —

infers an —

check here D> [—)

iar segs ced,

Tneome 7 Wits es es es Ata Fm 7

Toate ret Asan Seheade 8 teauree : e

‘tach Form(s) ‘Tuxenemptintersot, Do net inctudadn ne 8a ob 2,404.

MEERA, on orsnay ends. tue Sted antec a 82,773.

attach Forms. ‘Qualifed dividends vue LD 53,077.)

Loe ‘Taxable refunds, erodits, or offsets of state and local income taxes. STMT IT STMT. 10 124,796.

wus ‘Amory and 1"

unease oe) tach shoo Car CE2 te] 2,728,355,

ttyeu dg not Capital gain ar (loss). Attach Schedule D i raquired, If not requred, check hore. > fe =3,000,

awe (tna guns or (losses), Atach Form 4797 u 57.

Eebestustons. 184 RAGsirbitors 1 Tabanan 1

1 Penson nd ents 168 2 Ta aroun, 18

17 Revie est, oats, paroershis Scars Pans, ee Ata Seba ere

18 Fermincome ars), Roch SchedUeF ro

419 Unemployment canpersaton n

ate Sct ery anes, ie ‘Tae amount Daw

21° ober hcom.Lst oanéaount-_ SEE_STATEMENT 10 [1000007

22__Contine te routs inte aright Sunn ras 7 rough 2. THe sour wagons | ez | 3,206,735

78 Eas opie 2

Adjusted 24 scan Macht iie ofa bss Selenb in ase a

Gross 25 Hat avg account deat, tac arm 8868 28

Income 26 Neving expenses. Atacn Form 3503, 28

27 Deduct part of sel-empioyment tax. Attach Schedule SE_ a 45,101.

{28 Sebemplyed SEP, SIMPLE, an uid ans 2 ;

29 Se-nolye etn surane dean 29 1,746,

40. Perabyon ety winoal ct svngs 20

S18 Anon pad b Race SN Be 318

32 RA detuton - 2

3 Suserton meat ction =

{Tuten andes, Aton Form 8917 u

35. Domestic production activities ¢eduetion. Attach Form 8903 35 1233,

38 Add nes 20 ou 35 % 69,080.

gu 37 _subeat ine 35 rm na 3s radi gies cons » Gr sa37 655

Form 04D gota

|LHA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see seperate Instruction

fem woao JAY ROBERT & MARY KATHRYN PRITZKER a Fue 2

ax and 88 Anoun tom ine 37 (abd (OREO) encore a au [ SB] 3,137,655.

Gredits son cuck { [_] voawers bor before Jamar, 1959, ind. | Total see

te {spouse vas bom bt amary, 1950, (Jateg, J ebecked > sta

your spouse temzes ona separate eum eryouweré acuta chesthae be 280

GD tanizd deducna om Sched A) or yourtandrd dds (te marr) a 274,660.

4 Subtactine4otrom ne38 . " = af 062 595.

42. Exomplons. ln 38s $152,525 is, rly 8,850 by th uber oni arise, seinsk | AD =

48, ‘Temdle come, Soba» 42 tor fine i 421 mre than le Ae , ie PLY

M4 Tex Chek tary ores] forme)o64 Ll rom care oLX) 1294 BA «| 1,072,526.

45 -Atenatvemiskna tn AtaChFOMBZEN nna, [PO

485 aess vac rich ox eet rpeymentAschFom 662 oS

. | LUTE 56.

AT RODS 44,818

48 Fongntax creat Sic Farm 1B treweed

49 Cred forohd and dependent ar sparen, ach Form 2441

0 Educator rete rom Form 8683, tn 19, =

51 Retremect savings contbutns cet. Asch Form 6880”.

52 Chidtx cred Ataeh Sched 8612 eure...

5 esenal enay crass, Ata For 9695, * Ls

54 OhrcrogtstomForm: eK] 3800 CK) sant ef] 4

(5 Aid tines 48 trou 54. These ae your tt eres

‘58 Sobel ne to ina 7. ine 51s ar tne

iT” uel ment Aah Sctucla SE ~

Other $4. Unreported soca security and Meckars tax rom Fare: a —) 4137 66619

Taxes 59 Aton tecon ks, oer quate retrenant plas. buh For 5328 Hreque

a Housshol empyment aes FOMSCMUEH an

Fist-Sme homebuyer ero repaynnt, Mach Frm 545 iregured

aan

14,585]

ao

81, ‘Heatn ave: inal respon (see inctns) ——Fulyearcaverpe Gd . at

62 Teestrom: «(X) Formass9 bLK] Form se6o of] inst; enser code(s) STATEMENT 17 _ [oz 3,081.

= 13 Ans Sthog Tin your tle waa bf] TTT aad

a a |

5 251m te py nd mow apltion 28 en ag | S18, 598 *

tna pray ont am 5

tpn rom eee et

1 ona weg ems

1 or xno BK or

Fe coatiredet rent cit tt

78 Gestetom Farm: «L]2020 b_Iuueet lime

74_Add lines 64,65, 56a, and 67 through 73. These ave your total payments

Fetand Ie te sn tatnateth nae ne Stone1Tis he orn ol

fli youn tse. ome tng ee

Bt me eam Ll ee ol

1 eae area eg lene shims

Haroun Wheat pseee buted tot eh Pra no Sbohetes —LD

Youu Shire _79_tatimated taxpenaty[s00instwotons) 1 | |

| 1,516,696.

75 345,072.

Tes

"PAR you wat anabe pasonb das is an wih 0 FS est Te

Desunse” fn eo ay in

Dorteptenacir

ART

Use Only “nutename PDE D ie

180 EAST BROAD STREET moe

BI. __reversno COLUMBUS, OH 43215

iingis Department of Revenue

2014 Form IL-1040

Individual Income Tax Return or tor sca! year e

‘Step 1: Personal Information eae

JAY ROBERT PRITZKER

MARY KATHRYN PRITZKER

CHICAGO, IL 60606

© Fling status (ae hetnctens)

Single orhead of household CK] Manoa ting jortly —[—] anied ring separately — (] widowed

Check your your spouse ar anitay veteran and want your name and ads shared wth te Minis

Deparment ofVolwans ers} You] Spouma

Step 2:1 Fodtraladhistd gross neome fers your US. 1040, Line 97: U.S. 1D40A Une 21; er (Whe datas oni

Income US. 104082, Lin 1___3,137, 655 99

2 Feceraty tex oxerot intrest and dividend aome rm your US. 1040.0" 1040A, Lin Bb;

or US. 104082. 2 2,404 oo

3. Cthor atone. tach Schaco 3528 09

4 Total income, Adétines 1 tough. 4__ STE, 587 09

Step 3: 5 Social Securty bane and carta retkomsnt plan ncome

Beso ‘received cided in Lina 1. Attach Paget of federal tum. 5 09

Imcome & iinols Income Tax overpayment cluded in US. 1040, Le {0.6 00

i 7 ote subtractions. Attach Schede Mt 7 ay

z ‘Chock if Line 7 lncludes eny amount tram Scnecuie 1299. [—] i yi

5 8 Add Les 5,8, and 7. This the total your subtractons ey 1230, 715 00

3 9 Minois bese income, Subtract Line 8 from Line 4. 97 ZIT, B72 00

JF Step 4 10 a number of exemptions from your fedora rotum. 200} *

Exemptions —b itsoneene cin chim you asa doende ee ncn mans

3 © checki65 ocaier, Le] vou + to] Spouse Suoe has

i 1 checkienay bint: J] You + (I spouse 0) 4.500

Exemption allowance, Aad Lines ath g jp t 3-500

i Ai Lines a through ¢ oe i

11 esidonts: Net income. Sustract Line 10 from Line 8. Sfp Line 12. 11! 2,905,372 9

12 Nonresidents and part-yoar residents:

‘Check the box that applies to you during 204 [—] Nonresident [—] Partyear resident, anc

enter the tinois base Income from Sch, NA. Altech Goh. NAL 12 29

A Step E13. posisenta: Muliplyine 11 by 5% (05), Cannot be less then 20°0.

2 tax Nonresaets and pat-yarreldrts:_Ertrthe tax rom Schade NA 13 145,269 9

3 44 recapture of wosnert tax oes, Atach Sched 256, 14 0

5 15 Incomotax. Ac Lines 13 and 4, Cannot be es than ao. 18___ 145,265.

F Stop 7: 46 incon a pio rater sae he naa ene

TaxAtter —_Altach Schedule CR, 16 oo

B Nom 17 Property taxand K12 educaten expense crt aneunt om

i ‘refundable ‘Schedule ICR. Attach Schedule ICR, 7 500 09

© Credits 18 Credit amount rom Schedule 1296C. Attach Schedule 12096. 18 Tad, 769 09

f 18 Add Linos 16, 17, and 18. This isthe total of your erecta,

7 Cont exceed the tax aeunt on Line 15. 19 145,269 0

20 Tax after nonrefundable credits. Subtract Line 19 fom Line 15. 20. Dc

‘nope rae

vo: 20x S45

Tact: orga res mPa. 20 a 020

22 Household employment tx See irstvetors. 2 0

23. Uso tox on ntomat, mal order, cr other outokstate purchases rom

UT Wirkaheet or UT Tabi nthe lstructions. oot lave blank, 23 0.0

26 CompossonteUsa ct Medi Canabis Plot Progam Act Sucherge 26

25 Total Tax. Ad Unes 21,22, 23, nd 24 TT

Stop 9: 26 tinols Income Tax withheld, Attach at W'2 and 1009 forms. 28 20

Payments 27” Estimated payments rom Forms I-1040E8 wn #08,

ond Including any overpayment apa rem por yor rtm a 50,000 90

FRotuncable 28 Pasetwvough oily tax payments Attach Scho K.P OKT, 2B 2

Grecit 29. Ewmad Income Cra om Schadule IR, Attach Scuethis CR. 29 22

20 Total payments and rotundable erect. Add Lnes 28 through 29 30. 50,000 09

‘Step 10: 31 Overpayment If Lin 30s greater then Lino 25, surat Une 25 frm Line 90. a 50,000 09

Rosult 32. Underpayment Lino 25's groatr thn Lin 6, eubtract Une 90 fem ine 26. 32. 2

Stop 11: 33. Latepayment panaty for underpayment estatec tax 33

Unsorpeymant a Check atleast werthids of your federal rats incomes fom fering, CT

‘of Estimated ‘Check i you or your spouse are BS or oder and peminenty

‘Tox Penalty ving n a rural home, Oo

‘and Donations © Check If your Income was not recelved avely curing th yar and you

_annuallzed your incame on Form 1L:2210. Attach Form 1L:2210. a

(reo yeu ware not required tof an nas indoor Tx

‘turn nthe previous tax yea.

4 Veluntarychattabe donations. Attach Schedule 3

35. Tota ponlty and donatine, Ace Linen 3 and 34 3,

Step 12: 96 Ityounave an overeyment on Line und tis amounts greeter than

Rots or Une 95, subtract Line 3 rom Line 3. Tiss your renaling overpeyment, sa __50..000.m9

‘Amount You 87 Amount rom Una 35 you war! refunded to you. Check ene box cn Line $8. Seeinetuctions. 97

Owe 38 {choos torsiaherry roan y

‘Step 13:

‘Signand

Date

“Tard Party

Destanee

hematin blow

F itinoe invest Income Vax rotund debit ard

CX pepe chook

‘38 Amount tobe applied to estimated tax, Subtract Lne37 fom Line 36.Seelnstvctina. 30)

440. it youhave anunderpeyment on Line 82, add Lines &2 and 35. OF

you have anoverpeyment on Line 31 and tis amounts ee than Line 25,

subtract Line 91 om Lina 25, Thi ae amount you owe. See Instructions. +0

[eafetererener

Parnes) Soper eerroe

cigggte nam wore eee wy oro een

Form 4099-6) 1 you are unable to obtain your Form 1090-G from our webs, you may check the box to recelve a paper 100% form next year.

tntormation We wilmal you a 1003 farm Ifyou reat heer requling us tongue ono fo you.

tno payment orclses, mal: psyrontesloed, malt:

ILLINOIS DEPARTUENT OF REVENUE ‘urs oePaRTucuT oF neveNUE

PAMGPILD IL E27 1-0001 ‘BpmINGRELD I eeat-0oat

rapa 2 09 oR,

moo ATEN

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- A World-Class City: Executive SummaryDocument26 pagesA World-Class City: Executive SummaryZoe GallandNo ratings yet

- Burke Complaint FiledDocument38 pagesBurke Complaint FiledSteve Warmbir100% (2)

- A World-Class City: Executive SummaryDocument26 pagesA World-Class City: Executive SummaryZoe GallandNo ratings yet

- SpeechDocument14 pagesSpeechZoe Galland100% (1)

- Labor Force Recovery Has Varied by Race, Ethnicity, With Starkest Differences For BlacksDocument8 pagesLabor Force Recovery Has Varied by Race, Ethnicity, With Starkest Differences For BlacksZoe GallandNo ratings yet

- 2018-0625 CUS Public PresentationDocument38 pages2018-0625 CUS Public PresentationAnn DwyerNo ratings yet

- Emanuel Budget ProposalDocument2 pagesEmanuel Budget ProposalZoe GallandNo ratings yet

- 401 N Wabash DocumentDocument7 pages401 N Wabash DocumentZoe GallandNo ratings yet

- Letter To Chicago BearsDocument3 pagesLetter To Chicago BearsZoe GallandNo ratings yet

- UnitedDocument8 pagesUnitedZoe GallandNo ratings yet

- Signed Roskam Letter To TreasuryDocument1 pageSigned Roskam Letter To TreasuryZoe GallandNo ratings yet

- Gov. Bruce Rauner's 2018 Statement of Economic InterestDocument11 pagesGov. Bruce Rauner's 2018 Statement of Economic InterestMitch ArmentroutNo ratings yet

- Illinois DebtsDocument26 pagesIllinois DebtsZoe GallandNo ratings yet

- Kennedy - Form 1040 - 2017 - FederalDocument2 pagesKennedy - Form 1040 - 2017 - FederalZoe GallandNo ratings yet

- Pearson Family Foundation v. University of ChicagoDocument21 pagesPearson Family Foundation v. University of ChicagoThe Chicago Maroon100% (1)

- Summary Results of Phase 2Document65 pagesSummary Results of Phase 2Zoe Galland100% (2)

- Kennedy Policy DocumentDocument25 pagesKennedy Policy DocumentZoe GallandNo ratings yet

- DocumentDocument17 pagesDocumentZoe Galland100% (2)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)