Professional Documents

Culture Documents

Tata India Tax Savings Fund One Pager December 2015

Uploaded by

genxarmyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata India Tax Savings Fund One Pager December 2015

Uploaded by

genxarmyCopyright:

Available Formats

Think Of Us Before You Invest

INDIA TAX SAVINGS FUND

(An Open-ended Equity Linked Saving Scheme

(ELSS) for residents with a lock-in period of 3 years)

This product is suitable for investors who are seeking*:

Long Term Capital Appreciation.

An equity linked savings scheme (ELSS) Investing predominantly in Equity

& Equity related instruments.

*Investors should consult their financial advisors if in doubt about whether

the product is suitable for them.

Mutual Fund investments are subject to market risks,

read all scheme related documents carefully.

PRODUCT DETAILS WHY TATA INDIA TAX SAVINGS FUND?

Inception : March 31, 1996 The 3 year lock-in period allows the Fund Manager to take long term

call on stocks not withstanding short term volatility in the market for

Benchmark Index : S&P BSE Sensex exploiting true wealth creation potential of stocks

Lock In & Tax Savings : Lock-in of 3 Years and Tax Savings u/s Blend of both 'Value' and 'Growth' style of investing in one portfolio

80C of the Income Tax Act, 1961 across market capitalization segments

Entry Load : NIL Focus on well managed, good quality, fundamentally strong

companies with above average growth prospects

Exit Load : NIL (compulsory lock-in for 3 years)

WHO SHOULD INVEST & WHY

ABOUT THE FUND

Investors with moderate to aggressive risk prole with an

Tata India Tax Savings Fund (erstwhile Tata Long Term Equity Fund), is investment horizon of 3 years or more

a diversied equity fund which intends to generate long term capital

Investors seeking deduction of up to Rs. 1.5 lacs allowed u/s 80C of

appreciation by investing in equity and equity related instruments. The

Income Tax Act, 1961

Fund also provides tax benet by way of deduction u/s 80C of Income

Tax Act, 1961. The Fund hence, offers a combination of benet of tax Over 19 Years of performance track record across multiple bull &

saving along with benets of potential capital appreciation bear cycles

opportunities over 3 years or more.

CURRENT PORTFOLIO STRATEGY

INVESTMENT APPROACH The portfolio is aligned to current market dynamics and focuses on

Actively Managed Diversied Equity Fund stocks with strong fundamentals and high earnings visibility

The investment is spread across 20 industries with top 3 industries

Portfolio consisting of fundamentally strong companies with contributing ~38%

high growth potential across sectors

The top 3 industries in the portfolio are Banks, Pharmaceuticals and

No Market Capitalization Bias Software

Minimum 80% Investment in Equity & Equity related securities Scheme has diversied portfolio of 47 stocks. Large Cap stocks

account for about 56% of the portfolio with balance 35% in Mid cap

Top Down Portfolio Strategy stocks and 9% in small cap stocks

Portfolio seeks opportunities based on overall macro- Top 10 stocks form ~32% of the portfolio

economic and sector strategy Around 93% of the total scheme corpus is invested in stocks and

Actively seeks valuation & tactical opportunities created by remaining in cash and cash equivalent

company specic, industry specic and market specic

developments.

TOP 10 HOLDINGS (As on 30th November, 2015)

Issuer Name % of NAV

Stock Picker's Delight ' - Well Researched and Growth Oriented

companies HDFC Bank Ltd 5.57

Key attributes for stocks in the portfolio will be following: Infosys Ltd 3.78

Jet Airways Ltd 3.48

Good Management Quality

Axis Bank Ltd 3.47

Strong Business Models Bharat Electronics Ltd 2.78

High Efciency of Capital Use HCL Technologies Ltd 2.75

Earnings Visibility Kajaria Ceramics Ltd 2.60

Tata Consultancy Services Ltd 2.60

Diligent Risk Management

KNR Construction 2.58

Rigorous monitoring of Parameters like Liquidity, Sectoral Wabco India Ltd 2.38

exposure etc

Total of Top 10 Holdings 31.99

ABOUT EQUITY LINKED SAVING SCHEME

Lowest Lock-in of 3yrs TOP 10 SECTOR ALLOCATION (As on 30th November, 2015)

Equity Linked Saving Scheme (ELSS) offer lowest lock-in period of 3 Finance 3.62

years when compared with other tax savings investment options

Auto 4.68

currently available

Cement 4.69

No Capital Gains Tax

Industrial Products 4.91

ELSS have a lock-in period of 3 years and hence returns generated

Construction 5.17

on the ELSS attracts zero capital gains tax, as long term capital

gains from equity investments is tax free in the hands of investors. Consumer Non Durables 5.72

Also dividends if any, are also exempt from tax in the hands of Transportation 5.97

investor Software 9.12

Potential for higher returns Pharmaceuticals 9.75

Predominantly invests in equity & equity related instruments which Banks 18.94

have potential for higher returns though with a relatively higher risk

0.00 5.00 10.00 15.00 20.00

Contact Your Financial Advisor

You might also like

- Bastar Maoism and Salwa JudumDocument7 pagesBastar Maoism and Salwa JudumgenxarmyNo ratings yet

- Map AdilabadDocument1 pageMap AdilabadgenxarmyNo ratings yet

- Amenity VehicleDocument11 pagesAmenity VehiclegenxarmyNo ratings yet

- Adilabad DemographyDocument2 pagesAdilabad DemographygenxarmyNo ratings yet

- Surrender Policy 2015 PDFDocument10 pagesSurrender Policy 2015 PDFgenxarmyNo ratings yet

- Leave Rules GuideDocument30 pagesLeave Rules GuideSachin PatelNo ratings yet

- Sanjeev Sanyal The Ocean of CHDocument275 pagesSanjeev Sanyal The Ocean of CHgenxarmy100% (6)

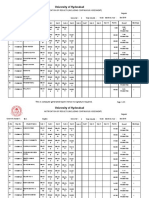

- University of Hyderabad: Notification of Results (Including Continuous Assesment)Document5 pagesUniversity of Hyderabad: Notification of Results (Including Continuous Assesment)genxarmyNo ratings yet

- 1 7460617 PDFDocument23 pages1 7460617 PDFgenxarmyNo ratings yet

- Naxalism & IndiaDocument19 pagesNaxalism & IndiaIrfan Pathan100% (1)

- Oruxmapsmanual enDocument82 pagesOruxmapsmanual engenxarmyNo ratings yet

- National Integration and Communal Harmony: See Discussions, Stats, and Author Profiles For This Publication atDocument15 pagesNational Integration and Communal Harmony: See Discussions, Stats, and Author Profiles For This Publication atgenxarmyNo ratings yet

- Benefits by StategovtDocument6 pagesBenefits by StategovtgenxarmyNo ratings yet

- Notice-Implementation of Central KYC (CKYC)Document1 pageNotice-Implementation of Central KYC (CKYC)Rachel WilliamsNo ratings yet

- Armed Forces Special Powers Act1958Document4 pagesArmed Forces Special Powers Act1958Saurav DattaNo ratings yet

- 1419942666439RESULT AIiTS-2 CLASS XIDocument8 pages1419942666439RESULT AIiTS-2 CLASS XIgenxarmyNo ratings yet

- Economics - Civilsdaily SimpleDocument99 pagesEconomics - Civilsdaily SimplegenxarmyNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Welcome To Finance 254: Corporate Financial ManagementDocument18 pagesWelcome To Finance 254: Corporate Financial Managementjhj01No ratings yet

- S&P/BVL Peru Indices: MethodologyDocument32 pagesS&P/BVL Peru Indices: MethodologyPertenceaofutebolNo ratings yet

- Auditing Notes - Chapter 4Document13 pagesAuditing Notes - Chapter 4Future CPA100% (6)

- Remittance Form for Overseas TransferDocument5 pagesRemittance Form for Overseas TransferPrabhu KnNo ratings yet

- Abacus Securities V AmpilDocument4 pagesAbacus Securities V AmpilThameenah ArahNo ratings yet

- Commodities As An Asset ClassDocument7 pagesCommodities As An Asset ClassvaibhavNo ratings yet

- Toyota SEO CaseDocument13 pagesToyota SEO CaseSo DeNo ratings yet

- Module 7 QuestionDocument21 pagesModule 7 QuestionWarren MakNo ratings yet

- Dr. Kumar Financial Market & Inst1Document40 pagesDr. Kumar Financial Market & Inst1Aderajew MequanintNo ratings yet

- Comparative Analysis of Public and Private Sector Mutual FundsDocument59 pagesComparative Analysis of Public and Private Sector Mutual FundsAayush PasawalaNo ratings yet

- IntermediateDocument139 pagesIntermediateabdulramani mbwanaNo ratings yet

- Investing in Small Cap Stocks Explained (Definition, Indexes, Strategy, Risks & FTSE ExampleDocument10 pagesInvesting in Small Cap Stocks Explained (Definition, Indexes, Strategy, Risks & FTSE ExampleJulian KrujaNo ratings yet

- Lusardi (2014) PDFDocument40 pagesLusardi (2014) PDFLala Tree LoveNo ratings yet

- Basics of Stock Market NotesDocument16 pagesBasics of Stock Market NotesNeha PawarNo ratings yet

- F9 - Mock A - QuestionsDocument15 pagesF9 - Mock A - Questionsshahidmustafa429No ratings yet

- Interim Order - Cell Industries LimitedDocument16 pagesInterim Order - Cell Industries LimitedShyam SunderNo ratings yet

- Cost of Capital and Capital Budgeting AnalysisDocument8 pagesCost of Capital and Capital Budgeting AnalysisEunice BernalNo ratings yet

- Para-Banking ActivitiesDocument14 pagesPara-Banking Activitiesneeteesh_nautiyalNo ratings yet

- Ratio Analysis of Lucky CementDocument22 pagesRatio Analysis of Lucky CementSaqib ChaudaryNo ratings yet

- Indiabulls Power IPO: 2. DB Realty LTD (DBRL)Document4 pagesIndiabulls Power IPO: 2. DB Realty LTD (DBRL)D Attitude KidNo ratings yet

- Chapter 16 - Technical AnalysisDocument10 pagesChapter 16 - Technical AnalysisNaweera AdnanNo ratings yet

- Intermediate Financial Management 11th Edition Brigham Test BankDocument20 pagesIntermediate Financial Management 11th Edition Brigham Test Banknicholasyoungxqwsbcdogz100% (34)

- AppleDocument7 pagesAppleLife saverNo ratings yet

- INTRODUCTIONDocument15 pagesINTRODUCTIONSagar NatuNo ratings yet

- Integrated Accounting Course II Module 15Document4 pagesIntegrated Accounting Course II Module 15Lui100% (3)

- Ckyc & Kra Kyc FormDocument27 pagesCkyc & Kra Kyc Formwww.sandeepmazumder1234567890No ratings yet

- Short Term Trading Strategies That Work by Larry Connors and Cesar AlvarezDocument61 pagesShort Term Trading Strategies That Work by Larry Connors and Cesar Alvarezgerry_strohl84% (31)

- Nglish Lus: Assignments inDocument60 pagesNglish Lus: Assignments inDipika PoojNo ratings yet

- Nubank: Valued at US$25bn in A Series G Raise of US$400mn IPO Ever CloserDocument5 pagesNubank: Valued at US$25bn in A Series G Raise of US$400mn IPO Ever CloserFelipe AreiaNo ratings yet

- Working Capital QuestionnaireDocument5 pagesWorking Capital QuestionnairePriNcess Asma0% (1)