0% found this document useful (0 votes)

77 views5 pagesJournal Entries and Financial Statements

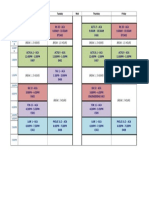

1) The document contains journal entries for a government agency from January to December recording various transactions including income, expenses, subsidies, and asset purchases.

2) At the end, closing entries are made to close income and expense accounts to the revenue and expense summary account, and that account is closed to the accumulated surplus account.

3) A pre-closing statement of financial position is presented showing the agency's assets of over $500 million in cash accounts and $750,000 in prepaid items as of December 31, 2016.

Uploaded by

Arvin Glen BeltranCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

77 views5 pagesJournal Entries and Financial Statements

1) The document contains journal entries for a government agency from January to December recording various transactions including income, expenses, subsidies, and asset purchases.

2) At the end, closing entries are made to close income and expense accounts to the revenue and expense summary account, and that account is closed to the accumulated surplus account.

3) A pre-closing statement of financial position is presented showing the agency's assets of over $500 million in cash accounts and $750,000 in prepaid items as of December 31, 2016.

Uploaded by

Arvin Glen BeltranCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd