Professional Documents

Culture Documents

Absorption Vs Variable Costing Exhibit

Uploaded by

dannielle samatha tolentino0 ratings0% found this document useful (0 votes)

16 views8 pagesManagerial acctg

Original Title

Absorption vs Variable Costing Exhibit

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentManagerial acctg

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views8 pagesAbsorption Vs Variable Costing Exhibit

Uploaded by

dannielle samatha tolentinoManagerial acctg

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

Absorption Costing versus Variable Costing

‘You have learned that product costs consist of al the costs incurred in the produc-

tion of a product: direct materials, direct labor, and manufacturing overhead. The

process of classifying all these costs as product costs is referred to as absorption

costing (or full costing). Absorption costing is the cost accumulation method

required by generally accepted accounting principles (GAAP) and by regulatory

bodies such as the Internal Revenue Service. This is the type of costing you have

done in previous chapters.

‘The underlying principle that absorption costing satisfies is the matching

principle, which states that expenses should be matched with the revenues they

generate. You may remember discussing this principle in your financial account-

ing course. Based on the matching principle, all product costs flow through Raw

Materials Inventory, Work in Process Inventory, and Finished Goods Inventory until

the goods are sold. Even though the company may have already paid cash for these

items, the costs are not expensed on the income statement until the inventory has

been sold. For example, the wages paid to direct labor workers are not treated as

an expense at the time the payroll checks are written. Instead, they are charged to

‘Work in Process Inventory so that they will become part of the product's cost.

‘You have learned that some costs are variable and some costs are fixed. You have

also learned that to make predictions about costs and income, you must first separate

costs by their behavior, whether fixed or variable. Any costs that are mixed must be

divided into their fixed and variable components. If inventory unit costs combine

variable costs (typically direct materials, direct labor, and overhead) with fixed costs

(cypically overhead), how can managers make sound decisions? One way is to use

variable costing (or direct costing), in which only variable product costs are accu-

‘mulated in the inventory accounts. In variable costing, fixed manufacturing overhead

is treated as a period expense rather than a product cost, meaning itis expensed in the

period in which iti incurred, Exhibic F3-1 shows how various product cost compo-

nents are accounted for under variable versus absorption costing. As you can see, the

only difference between the two methods isthe treatment of fixed overhead costs.

Cost of

goods gals

statement

|

L Variable costing bs

‘Absorption costing Variable costing

Product Direct materials Direct materials Product

costs Direct labor Direct labor costs:

\Varable manufacturing overhead

Fixed manulacturing overhead

Feeling scenes

ee aceite

_Rostainnievete sors

Fed ealing stporece

Naria nist

en

Income Effects of Variable Costing

Ieshould be clear now that the difference berwcen absorption and variable costing isa

timing difference in the expensing of fixed overhead costs, Of course, changing the tm-

ingofan expense will change reported income. Let's explore these changes using Bradley

“Textile Mill’ cost for jersey fabric, Well look at three scenarios: one in which produc

tion volume and sales volume are equals one in which production volume is greater

than sales volume; and one in which production volume is less than sales volume. The

absorption and variable product costs for a yard of Bradley's fabric are as follows:

Absorption Costing

Direct materials $1.26

Direct labor 0.54

Variable overhead 0.30

Fixed overhead 1.50

Total cost per yard $3.60 $2.10

Absorption Costing versus Variable Costing

You have learned that product costs consist of al the costs incurred in the produc-

tion of a product: direct materials, direct labor, and manufacturing overhead. The

process of classifying all these costs as product costs is referred to as absorption

costing (or full costing). Absorption costing is the cost accumulation method

required by generally accepted accounting principles (GAAP) and by regulatory

bodies such as the Internal Revenue Service. This is the type of costing you have

done in previous chapters.

‘The underlying principle that absorption costing satisfies is the matching

principle, which states that expenses should be matched with the revenues they

generate. You may remember discussing this principle in your financial account-

ing course. Based on the matching principle all product costs flow through Raw

Materials Inventory, Work in Process Inventory, and Finished Goods Inventory until

the goods are sold. Even though the company may have already paid cash for these

items, the costs are not expensed on the income statement until the inventory has

been sold. For example, the wages paid to direct labor workers are not treated as

an expense at the time the payroll checks are written. Instead, they are charged to

‘Work in Process Inventory so that they will become part of the product's cost.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Banking Laws ReviewerDocument26 pagesBanking Laws ReviewerZtirf Nobag83% (6)

- Driscoll J.C. Lecture Notes in Macroeconomics (Brown, 2001) (143s) - GKDocument143 pagesDriscoll J.C. Lecture Notes in Macroeconomics (Brown, 2001) (143s) - GKfirdaus_pranotoNo ratings yet

- Econ 2Document16 pagesEcon 2ediabcNo ratings yet

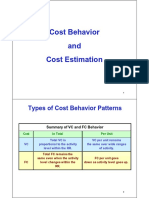

- Cost Behavior and Cost Estimation Cost EstimationDocument13 pagesCost Behavior and Cost Estimation Cost Estimationdannielle samatha tolentinoNo ratings yet