Professional Documents

Culture Documents

Union Cabinet Today Approved The Plan To Sell Government

Union Cabinet Today Approved The Plan To Sell Government

Uploaded by

jujujuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Union Cabinet Today Approved The Plan To Sell Government

Union Cabinet Today Approved The Plan To Sell Government

Uploaded by

jujujuCopyright:

Available Formats

Union Cabinet today approved the plan to sell government's 51 per cent stake in state-refiner HPCL BSE 0.

74 %

to explorer ONGC BSE -0.21 %.

The HPCL-ONGC deal is a major step towards India's efforts to build a mega company that can compete with

global majors. Below are the main reasons why the deal is important for the country:

1. Mergers and consolidation of state-owned companies are the only way to create an oil giant. HPCL-ONGC

deal is the first step towards that goal. It will pave way for further consolidation. The government might ask IOCL

to acquire the smaller Oil India.

2)State-run oil PSUs consolidated into a single major company will create economies of scale and have higher

capacity to bear risks, improved margins and more efficiency.

3) Consolidation in oil sector is a globally acknowledged practice. International oil giants such as ExxonMobil and

Royal Dutch Shell too have consolidated exploration, refining and retail operations. HPCL is a refining company

while ONGC is an oil explorer. Consolidation of different operations will give ONGC control over value chain

leading to strengthening of balance sheets.

4) A bigger Indian oil company will be able to better withstand the volatility in the global oil market.

The domestic companies are increasingly scouting for overseas assets in a bid to protect themselves from

volatility in crude prices. A bigger company will have better bargaining power.

5) The HPCL-ONGC deal will help the government meet more than a third of its divestment target for the current

financial year without losing control over the company. The disinvestment target is of Rs 72,500 crore and the

deal is valued at nearly Rs 28,000 crore.

HPCL is likely to take over Mangalore Refinery and

Petrochemicals Ltd (MRPL) to bring all the refining assets of

ONGC under one unit.

ONGC currently owns 71.63 percent of MRPL while HPCL has

16.96 percent stake in it.

HPCL controls India's 11 percent refining capacity through its

three plants, which can process 276,000 barrels of oil per day.

The Rs 30,000 crore that ONGC shells out for HPCL stake "will

reduce the flexibility of ONGC's books to acquire or develop

upstream assets", they note. It has to be remembered that

ONGC already has Rs 56,000 crore debt on its books.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Authority Letter For Attending TenderDocument1 pageAuthority Letter For Attending Tendersribalajicyber100% (3)

- Piping System Diagram in Engine RoomDocument63 pagesPiping System Diagram in Engine RoomSamrat KothariNo ratings yet

- Aramco Questionnaire Form - NESGTDocument8 pagesAramco Questionnaire Form - NESGTrajsogNo ratings yet

- 2023 07 International Factors Release 11Document44 pages2023 07 International Factors Release 11teobrenda7No ratings yet

- Halliburton Graduate Trainee Recruitment For Engineers in Port Harcourt, May 2012Document4 pagesHalliburton Graduate Trainee Recruitment For Engineers in Port Harcourt, May 2012Okolo EboesNo ratings yet

- Daily Cutting Coal Pit Kgu 30 Agustus 2022Document1 pageDaily Cutting Coal Pit Kgu 30 Agustus 2022Dian Ramadhan ArifinNo ratings yet

- 2016 Oil Gas Industry Annual Report 2 PDFDocument92 pages2016 Oil Gas Industry Annual Report 2 PDFUmar OmarNo ratings yet

- Companies Attending This Year2014 Coal TransDocument32 pagesCompanies Attending This Year2014 Coal TransSivaramanNo ratings yet

- Proses Pembuatan LPG: Extraction Plant Dan Fractionation Plant PT. Perta Samtan GasDocument23 pagesProses Pembuatan LPG: Extraction Plant Dan Fractionation Plant PT. Perta Samtan GasBagas JuniarNo ratings yet

- Deepwater Training Seminar Presented ToDocument36 pagesDeepwater Training Seminar Presented ToSergio Jesus MarquezNo ratings yet

- NAL KPI Production 2008Document6 pagesNAL KPI Production 2008Andry Depari100% (1)

- 02 Rig List February 2016Document17 pages02 Rig List February 2016ifebrianNo ratings yet

- ICG Consulting, IranDocument23 pagesICG Consulting, IranShashi BhushanNo ratings yet

- Deep Water Exploration & Development in IndonesiaDocument21 pagesDeep Water Exploration & Development in IndonesiaScriptlance 2012No ratings yet

- Referal Books Foe Petroelum PeDocument3 pagesReferal Books Foe Petroelum Pesaran kumarNo ratings yet

- Holding Subholding Structure - v2Document18 pagesHolding Subholding Structure - v2RickNo ratings yet

- Nandipur Power ProjectDocument2 pagesNandipur Power ProjectShahzaib Anwar OffNo ratings yet

- Status Ccs Project Database Current 17 07 2017Document1 pageStatus Ccs Project Database Current 17 07 2017hanantas11No ratings yet

- Sapa Group - Shape Magazine # 2 - Aluminium / AluminumDocument24 pagesSapa Group - Shape Magazine # 2 - Aluminium / AluminumsapagroupNo ratings yet

- Thermal Power Plants in India Geography Notes For UPSCDocument3 pagesThermal Power Plants in India Geography Notes For UPSCzahid afzal thokerNo ratings yet

- Industrial X-Ray & Allied Radiographers (I) Pvt. LTDDocument1 pageIndustrial X-Ray & Allied Radiographers (I) Pvt. LTDABHIJEETNo ratings yet

- Siklus PLTU Kalbar 3Document1 pageSiklus PLTU Kalbar 3Heyu PermanaNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument10 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- Global CCS Projects Map 1Document8 pagesGlobal CCS Projects Map 1aurembiaixNo ratings yet

- Soal Latihan Spe Undip/Soal-soalDocument3 pagesSoal Latihan Spe Undip/Soal-soalEster SiagianNo ratings yet

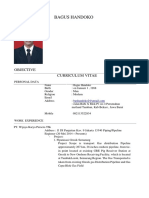

- CV Bagus Handoko-2021 For MedcoDocument4 pagesCV Bagus Handoko-2021 For Medcobagus handokoNo ratings yet

- Energy CrisisDocument17 pagesEnergy CrisisraojahnzaibNo ratings yet

- Department of Energy (Philippines)Document97 pagesDepartment of Energy (Philippines)Bo DistNo ratings yet

- 39 Reference Lists enDocument16 pages39 Reference Lists enRajesh RadeNo ratings yet

- Paginas para Busqueda de Trabajo PetroleroDocument9 pagesPaginas para Busqueda de Trabajo PetroleroAngel AponteNo ratings yet