Professional Documents

Culture Documents

Business 3019, Winter 2006: Case 4 Questions To Answer

Uploaded by

Kudzayi MatekaireOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business 3019, Winter 2006: Case 4 Questions To Answer

Uploaded by

Kudzayi MatekaireCopyright:

Available Formats

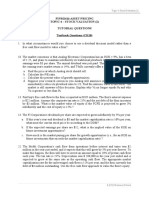

Business 3019, Winter 2006

Case 4

Questions to Answer

1. (20 points) Compute the cash flows expected to be generated by the Pepsico Changchun

Joint Venture and calculate the NPV and IRR of the project. Do not take into account

the concentrate sales from Pepsico here. Use the initial assumptions (this is the base

case).

2. (20 points) Do a sensitivity analysis of the joint venture’s NPV with respect to COGS

and bad debt write off. Show your results on a graph.

3. (20 points) Calculate the project’s NPV and IRR in the following two cases: (i) A

best-case scenario where all revenue projections are 15% higher than the base case and

where bad debt write off is 1% of credit sales, and (ii) a worst-case scenario where all

revenue projections are 15% lower than expected and where bad debt write off is 5%

of credit sales.

4. (20 points) Calculate the NPV of the project when concentrate sales from Pepsico are

included.

5. (5 points) Is the project good? Explain.

You might also like

- FN1024 Chapter 7 Discussion Questions Part 2 - NPV and IRRDocument3 pagesFN1024 Chapter 7 Discussion Questions Part 2 - NPV and IRRduong duongNo ratings yet

- BcvTnl-BMAN30111 Exam Paper 2019-20Document7 pagesBcvTnl-BMAN30111 Exam Paper 2019-20ruoningzhu7No ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- Tutorial 4 QuestionsDocument4 pagesTutorial 4 Questionsguan junyan0% (1)

- FRM 3 EsatDocument0 pagesFRM 3 EsatChuck YintNo ratings yet

- Prepare Freeform Answer For Assessment On Capital Bu..Document2 pagesPrepare Freeform Answer For Assessment On Capital Bu..Clarisse AlimotNo ratings yet

- AFM Test 1Document3 pagesAFM Test 1Syeda IsmailNo ratings yet

- MBALN-622 - Midterm Examination BriefDocument6 pagesMBALN-622 - Midterm Examination BriefwebsternhidzaNo ratings yet

- Measuring Investment Returns: Questions and ExercisesDocument9 pagesMeasuring Investment Returns: Questions and ExercisesKinNo ratings yet

- Chap11 Quiz5 MI2Document15 pagesChap11 Quiz5 MI2lynvuong101299No ratings yet

- Business Project ReportDocument3 pagesBusiness Project ReportNelson NofantaNo ratings yet

- Spreadsheet Case StudyDocument21 pagesSpreadsheet Case StudyAnonymous K8b1TFPyZ100% (1)

- Risk Analysis, Cost of Capital and Capital BudgetingDocument10 pagesRisk Analysis, Cost of Capital and Capital BudgetingJahid HasanNo ratings yet

- Finance Practice 4Document2 pagesFinance Practice 4Puy NuyNo ratings yet

- Engineering Economics, BEIT, EditedDocument2 pagesEngineering Economics, BEIT, EditedYe FengNo ratings yet

- Decision Analisis EconomicoDocument15 pagesDecision Analisis EconomicoYasin Naman M.No ratings yet

- Q Finman2 Capbudgtng 1920Document5 pagesQ Finman2 Capbudgtng 1920Deniece RonquilloNo ratings yet

- Finmkt FinalsDocument6 pagesFinmkt FinalsMary Elisha PinedaNo ratings yet

- Cash Flow EstimationDocument9 pagesCash Flow EstimationXaxxyNo ratings yet

- F9 Specimen Sept 2016-12Document2 pagesF9 Specimen Sept 2016-12rbaambaNo ratings yet

- 2.0 Years 2.6 Years 213,745 34.9% 1.4Document5 pages2.0 Years 2.6 Years 213,745 34.9% 1.4YameteKudasaiNo ratings yet

- Capital Budgeting FM2 AnswersDocument17 pagesCapital Budgeting FM2 AnswersMaria Anne Genette Bañez89% (28)

- Financial PlanningDocument25 pagesFinancial Planningfathir alhakimNo ratings yet

- Bec524 and Bec524e Test 2 October 2022Document5 pagesBec524 and Bec524e Test 2 October 2022Walter tawanda MusosaNo ratings yet

- Tutorial 3 QuestionsDocument3 pagesTutorial 3 Questionsguan junyanNo ratings yet

- Investment Analysis 1Document6 pagesInvestment Analysis 1Zorodzai MuteroNo ratings yet

- Fin 450 Module 2 ProblemsDocument7 pagesFin 450 Module 2 ProblemsPreciousNo ratings yet

- Assignment No. 2 Financial MarketDocument2 pagesAssignment No. 2 Financial MarketEden ZapicoNo ratings yet

- HO No. 1 - Risks, Returns and Capital StructureDocument3 pagesHO No. 1 - Risks, Returns and Capital StructureNath NathNo ratings yet

- Assignment 02Document1 pageAssignment 02Danny Nguyen0% (1)

- Financial Management: Acca Revision Mock 3Document13 pagesFinancial Management: Acca Revision Mock 3krishna gopalNo ratings yet

- 2012Document9 pages2012RuvimboMutengeraNo ratings yet

- Iii Semester Endterm Examination November 2016Document3 pagesIii Semester Endterm Examination November 2016Gautam KumarNo ratings yet

- Fi 2023 24 Chapter 4 Part I - ExercisesDocument9 pagesFi 2023 24 Chapter 4 Part I - ExercisesInês Carvalho CostaNo ratings yet

- Adfm Iii 2015-17Document3 pagesAdfm Iii 2015-17Nithyananda PatelNo ratings yet

- Capital BudgettingDocument9 pagesCapital BudgettingRussel BarquinNo ratings yet

- Chapter 4 - Concept Questions and ExercisesDocument3 pagesChapter 4 - Concept Questions and Exercisesmin - radiseNo ratings yet

- 10.cap+budgeting Cash Flows-1Document20 pages10.cap+budgeting Cash Flows-1Navid GodilNo ratings yet

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- Selected BKM Exercises 1 - v2Document19 pagesSelected BKM Exercises 1 - v2Mattia CampigottoNo ratings yet

- Soalan Webex 3Document2 pagesSoalan Webex 3lenakaNo ratings yet

- Basics in Finance 9 Questions Homework WarmUps Solutions - PITANJ ZA KOLOKVIJUM ISPITDocument13 pagesBasics in Finance 9 Questions Homework WarmUps Solutions - PITANJ ZA KOLOKVIJUM ISPITMiloš MilenkovićNo ratings yet

- Qtouto 1492176702 1Document4 pagesQtouto 1492176702 1Christy AngkouwNo ratings yet

- Unit 22 - Project Feasibility StudiesDocument9 pagesUnit 22 - Project Feasibility StudiesMarlou Felix Suarez CunananNo ratings yet

- Fin370 Myfinancelab Week 3 New 2015Document4 pagesFin370 Myfinancelab Week 3 New 2015G JhaNo ratings yet

- Sample TestDocument2 pagesSample TestAgalievNo ratings yet

- Cost Accounting OMDocument26 pagesCost Accounting OMJohn CenaNo ratings yet

- Finals Manaco2Document6 pagesFinals Manaco2Kenneth Bryan Tegerero Tegio100% (1)

- Iacademy Basicfin: Basic Finance and Financial Management Final RequirementDocument5 pagesIacademy Basicfin: Basic Finance and Financial Management Final RequirementClarisse AlimotNo ratings yet

- Capital Budgeting 1st PartDocument8 pagesCapital Budgeting 1st PartPeng Guin100% (1)

- CF EstimationDocument8 pagesCF EstimationGauri TyagiNo ratings yet

- 2022.03.08 FDM Past Papers and QuestionsDocument24 pages2022.03.08 FDM Past Papers and QuestionsCandice WrightNo ratings yet

- Capital Budgeting - PrestestDocument3 pagesCapital Budgeting - PrestestJade TanNo ratings yet

- 4402 23 08 HW CAPM Alternatives WACCDocument4 pages4402 23 08 HW CAPM Alternatives WACCZack ZhangNo ratings yet

- DuPont QuestionsDocument1 pageDuPont QuestionssandykakaNo ratings yet

- BFIN 3207 - IInvestment Analysis Portfolio Management - Group CATDocument4 pagesBFIN 3207 - IInvestment Analysis Portfolio Management - Group CATMapesa MosesNo ratings yet

- Ex - Scenario and Sensitifity AnalysisDocument3 pagesEx - Scenario and Sensitifity AnalysisSakura Rosella100% (1)

- CHAPTER 10 Without AnswerDocument3 pagesCHAPTER 10 Without AnswerlenakaNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Real World Project Management: Beyond Conventional Wisdom, Best Practices and Project MethodologiesFrom EverandReal World Project Management: Beyond Conventional Wisdom, Best Practices and Project MethodologiesRating: 2 out of 5 stars2/5 (1)

- Project Systems Engineering Management Plan TemplateDocument24 pagesProject Systems Engineering Management Plan TemplateKudzayi MatekaireNo ratings yet

- Conference Article Two ColumnsDocument5 pagesConference Article Two ColumnsIndra KurniawanNo ratings yet

- 1 Student Lifecycle FrameworkDocument10 pages1 Student Lifecycle FrameworkKudzayi MatekaireNo ratings yet

- PorterDocument3 pagesPorterRobinWangNo ratings yet

- Three Fundamental Building Blocks of Profiting From InnovationDocument5 pagesThree Fundamental Building Blocks of Profiting From InnovationKudzayi MatekaireNo ratings yet

- System Availability Rate of Incidence Occurrence Calls Due To Down Time R1 R4Document1 pageSystem Availability Rate of Incidence Occurrence Calls Due To Down Time R1 R4Kudzayi MatekaireNo ratings yet

- Gauss Jordan Method For Solving Systems of Linear EquationsDocument5 pagesGauss Jordan Method For Solving Systems of Linear Equationsciki1100% (2)