Professional Documents

Culture Documents

Crc-Ace BLT 1st Pre-Board May2014

Crc-Ace BLT 1st Pre-Board May2014

Uploaded by

Philip Castro0 ratings0% found this document useful (0 votes)

93 views13 pagesCRC

Original Title

Crc-Ace Blt 1st Pre-board May2014

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCRC

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

93 views13 pagesCrc-Ace BLT 1st Pre-Board May2014

Crc-Ace BLT 1st Pre-Board May2014

Uploaded by

Philip CastroCRC

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 13

MoinT FC. Vilaroman Bide. #73 P. Campa St cor Espana, 227 aan

yitaroman dg: #73 Ps err nanin cor Diego Siang, Baguio ity # (074442

Branch: Budel BION Vor add: ere_ace@yanon

May 2014 BATCH

BUSINESS LAW & TAXATION )

FIRST PRE-BOARD EXAMINATION skET BEB JAN. 30, 2074; 10:30AM -12:30PM

INSTRUCTIONS: Select the comect answer for each of the following ques!

Ieentby Shading the corresponding letter of your choice on the answer sh

ALLOWED. Use Ponicl No. 2 only.

1, Thru some mistake on the part ofthe bank personnel, Bonnie was given Php

This situation will be governed by the provisions of the law on:

‘A. Contracts ‘C. Obligations

B. Quasi-delicts D. Quasi-contracts

2. Bong obliged himself to give Biboy a specific car on Jan. 14, 2014, stipulating that Bong is liable even if

the thing 1s lost due to fortuttous event and without the need of a demand. On due date, the car got lost

due to fortuitous event. Which is correct? ~*

‘A. The obligation is extinguished due fortuitous event

B, Biboy can compel Bong to deliver another car

CC. Biboy can require another person to deliver a car with expenses chargeable to Bong

1D. Obligation is not extinguished but converted into monetary. consideration

3, 1* STATEMENT ~ Ifthe obligation consists of delivering determinate things, the creditor fas 3 real right

ver its accessions and accessories even though they may not have been mentioned in the agreement.

3” STATEMENT ~ bevessories are anything produced spontaneously or through human labor

A. 1 statement is true, 2 statement false C. Both statements are false

B, 1% statement false, 2” statement true D. Both statements are true

4. The condition that some event happen at @ determinate time shail the obligation as soon as the

time expires or if it has become indubitable that the event will not take place.

A. Extinguish B, Suspend °C, Give rise to . Toll

5, 1% Statement ~ The obligation to finish a case study Is an example of a real obligation

2° Statement ~ The stipulation in the contract to the effect that the debtor should remain as a servant in

tthe house and in the service of her creditor so long as she had not pald her debt, is valid

A. False, faise 5 C. True, true :

B, True, false D: False, true

6. This is an obligation with a resolutory condition:

Til give you P10,000 if you pass the October 2014 CPA board examination

Til give you my car now, but should you fall in any of your subjects, your ownership will cease and

it will be mine again

1 give you P10,000 on Christmas day of 2014

Tli give you P10,000 if A dies of heart attack

7. Atoy granted a loan of 100,000 to Bitoy guaranteed by a mortgage executed over the car of Bitoy. The

obligation is due for payment on December 31, 2013. On June 26, 2013 the car was totally destroyed by

typhoon Toners”, i on m ly 6 2ois Atoy will demand payment of the loan:

edema id. The obligation Is one with i

oa domanc ol te bev. Th 9 one with a definite date for payment and until that date

B. The cemang wil not be valid. The obigation was lost through a fortuitous event and the obligation was

© The demand

The deme ed valid. The obligation became due at once because the guaranty was lost through @

D, The demand is valid. The obligation became due

at once because from the tenor benefit, the credit

given the right to demand performance even before the due date stipulated. . ners

8, Which of the following illustrates resol

‘A. A will support B until end of 2010 eee patio?

'R Awil support B if C will marry B

tions. Mark only one answer for each

‘ect provided. STRICTLY NO ERASURES

10,000 instead of Php9,000.

po =>

a

u

+ Fust Pre-board Exandaotion may 2014 Batch BUSINESS LAW § TAXATION

r 480" peys an obligation that has prescribed:

z mat towing It has Prescribed, Ason can recover on the ground of solutio inde!

‘mowing it has prescribed but still voluntarily paid, Ason cannot recover for this would be a case of

mature! obfigation

A Bom Lard 2are true C. Only 2 Is tue

5. Oniy dis tue D. Both 1 and 2 are false

A, 5 and C are jomntly indebted to X in the amount of P30,000,00. Before due date, A becomes insolvent.

‘on due date, X can collect:

25,000.09 from B, and P15,000.00 from C.

2,003.99 from B, and P10,000.00 from C.

[000.00 from B, or P20,000.00 from C.

,090.09 from B, or P30,000.00 from C.

pom

Eorgheng promised to give his laptop to Bing. Before actual delivery but after Bing demanded for the

‘seme, the mobile phone was lost through a fortuitous event. Which of the following is correct?

AL The opligation is extinguished without any liability at all,

&. Sings not allowed to recover from Bongbong.

Song sho.td gWve Bingbing another of object which is of the same kind

©. Songs obliged to give an equivalent value of the phone plus damages.

Aovie promised to sell her house and fot in Cebu to Bubbles if the latter decides to live in Cebu. This

coligation s wth

AL Mixed condition. . Casual condition.

& Potessuive condition, D. Resolutory condition,

herseff to give to Berta her car on January 1, 2014 to be delivered on July 1, 2014. There

very until July 10, 2014 when the car was totally destroyed by an accidental fire. In this

The obligation is extinguished by the fortuitous event

ksr.c Should give Berta another car.

D. The opiigation will be converted to a monetary one plus damges

Aroe promised her dog to Baby on Jan 1, 2014 to be delivered on June 30, 2014. The dog gave birth to

D.a3eS white in possession of Angel. In this case:

L Ange! is extitied to the puppies as they were born while the dog is in her possession

2 2 He puppies were born on June 30, 2014 or after, Baby is entitled to them

3. I the puppies were bon before June 30, 2014, Angel is entitled to them

A Only 1 and 2 are correct C. Only 1 and 3 are correct

8. Oniy 2 and 3 are correct D. Only 3 is correct

Using te seme facts as given above, supposing the dog was sold by Angel to Baby?

‘L Argd is entitied to the puppies as they were bom while the dog is in her possession

Z B25y is entitied to the puppies as the buyer is entitled to the fruits from perfection of the contract of

se

A oth Land 2 are true C. Only 2 is tue

B. Only Lis tue D. Both 1 and 2 are false

re Gy rot to recover what has voluntary been paid although payment was no longer required:

A Géi obigation . natural obligation

B. moral obligation D. solutio indebiti

Bex 's obliged to deliver to Bert a specific Apple Mac Pro laptop. The parties stipulated that Alex could

ceiver 2 specific Acer Transformer laptop as a substitute, Before due date and white Alex has not

commuriceted to Bert whether he would deliver the Apple Laptop or the Acer Laptop, the Acer

‘Transformer laptop was lost due to Alex’s fault. In this case:

A. Kiex's obliged to pay damages to Bert without any obligation to dellver the Apple laptop.

2. Kiex is stil obliged to deliver the Apple Laptop with damages.

C. Alexis still obliged to deliver the Apple Laptop but without obligation to pay damages.

4 CRO-ACE: Fist Pre-board Examination -May 2024 Batch BUSINESS LAW § TAXATION

2a.

29.

30,

3.

32.

33,

34,

35,

36,

37.

0. Alex Is obliged to pay damages to Bert or to deliver the Acer laptop at his option.

1* STATEMENT ~ A contract is the result of the conformity of wills of the parties

2™ STATEMENT — A quasi-contract is an implied contract

A. 1 statement is true, 2 statement false C. Both statements are faise

B, 1* statement false, 2% statement true D, Both statements are tue

Delay on the part of the creditor to accept the performance of an existing obligation

‘A. compensatio morae C. dolo incidente

B. mora silvend! D. mora accipiendi

1* Statement - Mora causante entities the person against whom it was employed the right to seek The

annulment of the contract as fraud is one of the vices of consent.

2° Statement - Responsibility arising from fraud is demandable in all obfigations. Any waiver of an accio7

for fraud is void.

A. Both statements are false. C. First false, second true.

B. Both statements are true. D. First true, second false.

When Berting voluntarily takes charge of the neglected business of Buboy without the latter's authorty

Where reimbursement must be made for necessary and useful expenses, there is a:

A. Quasi-delict C. Negotiorum Gestio

B. Quasi-contract D. Solutio indebiti

D Is obliged to give C a house and lot if C will not marry X within one year. Which of the following

statements is Incorrect?

A. D's obligation becomes demandable if the one-year period expires without C having married X.

B, D's obligation becomes demandable if X dies before the one-year period expires without C having

martied X.

D's obligation Is extinguished if C marries X within the one-year period.

D. _ D's obligation is demandable if C marries X within the one-year period,

Whilch of the following combinations of conditions will render an obligation void?

‘A. Suspensive — potestative (creditor)

8. Suspensive — potestative (debtor)

C. Relsolutory — potestative (creditor)

1D. Resolutory ~ potestative (debtor)

‘The juridical necessity to give, to do or not to do refers to:

‘A. Social obligation

8, Civil obligation.

C. Moral obligation.

©. Natural obligation.

‘Anday bound herself to deliver to Barbie the party gown she is supposed to wear on the celebration of

her 18" birthday on Jan 1, 2014. Anday failed to deliver hence:_

‘A. she has already incurred in delay

B. she will be excused by the happening of a fortuitous event

C. there was no delay because there was no demand

D. she must be sued by Jenny to claim damages

"I will begin supporting you from the time Gloria dies of heart attack" is an example of an obligation with

a

A. suspensive period . _resolutory period

B, _suspensive condition D. _resolutory condition

Tort is:

A. Quasi-contract C. Negotiorum gestio

B. Quasi-delict D. Solutio indebiti

38.

39.

al

42,

43.

44,

45.

46.

a,

DRO ACE: Flrck Pre hnard Gramination May 2574 Baton

BuSNESS LY TAXATION

Culpa contractual ig different from culpa acuillana in >= . vcnmnnely

A. Invculpa aquilana there is a preexisting obligation, while culos contractal ers DOE

B. Mh lps contractual the source of eis ‘we peas: f conve, in ofze aquliane

source of obligation Is the negligence of te defercart 2

cI culpa contractual the negigerce i stsarcie and romcmrert Of 8 cotres oa

amniiana, the negigence is incicartal to tie performace f 2° GONTAT

1D. There tg @ negligent act or omission in culg2 contractual ard cane in culpa aquilers

Negligence Is distinguished from fraud:

A. Responsibility arising therafrom is demandable

B. Waiver of an action to enforce liability may De waived

C. Liability may be reduced by the courts

D. There is deliberate intention to cause damage or prejudice

May the sult fled by @ passenger who was hurt against the operator of a public utility vehice SiH prosper

even Ifthe diver was acquitted by the court?

A. Yes, provided he can prove the negligence of the drver.

B. No, this will constitute double jeopardy which s vidatve of the Constaution

No, the acquittal means thet the guilt of the accused was not proven Dy proof beyond reasonable

doubt . |

D. Yes, Itis sufficient for him to prove the existence of the contract of carriage and the injuries suffered.

Which of the following obligations will not be extinguished by toss or destruction of a thing due?

A, When the thing is lost before the debtor has incurred in de'ay

8, When the obligation is to deliver a car with plate number ABC 123

C. When the thing Is last without the Fauit of the debtor

1D. When the obligation is to deliver a brand new biack apple iphone 4gs_

Whan the delivery of a specific thing is subject to a suspensive condition and it is improved at the

expense of the debtor:

A, The debtor shall acquire the right over the thing.

B, The creditor shall have the right to enjoy the thing as well as its fruits. 2

C. The crecitor shall enjoy the improversent only after the payment of just compensation.

1D. The debtor shall have no other right than that granted to the usufructuary

When the fulfilment of the condition depends upon the sole will of the:

‘A. debtor but It Is resolutory, the obligation is void

8, debtor but it Is suspensive, the obligation is valid

©. creditor even If it is suspensive, the obligation is valid.

D. debtor, it is always void

‘The receipt of the principal by the creditor, without reservation with respect to the interest, shail give rise

tar

‘A. conclusive presumption that said interest has been paid

8. disputable presumption that the creditor is paid as to the principal amount

C. conclusive presumption that the creditor is not paid as to the principal amount

1D. disputable presumption that said interest has been paid

‘An action for the rescission of contracts entered into by debtors to defraud creditors.

A. accion publiciana . accion pauliana

B, accion quanti minoris D. accion redhibitoria,

‘Andoy owes Bltoy P500,000.00 payable on December 31, 2014, Which of the following is correct?

A. If Anday dies before December 31,2014, the obligation is extinguished

8. _ If Andoy dies before December 31,2014, Bitoy can collect from the heirs of Andoy.

. IF Bitoy dies, his heirs can recover from Andoy.

D. If both Andioy and Bitoy die, the heirs of Bitoy can collect from the heirs of Andoy.

Ifa borrower lends the object to a third person, or saves yperty Instead borrowed,

‘shall be llable even In case of fortuitous event, because em pcpatyf ee ies

‘A. The nature of the obligation requires the assumption of risk.

B, The parties have expressly stipulated such liability,

szr mB Page $ of 12

CRE-ACE: First Pre-board Exanination -May 2014 Baten BUSINESS LAW § TAXATION

C. The law expressly so provides.

D. He is automatically guilty of legal delay

the debtor shall lose such benefit in the

48, If the period was established for the benefit of the debtor,

a re unless he gives a guaranty or security for the debt.

8: He cos no rh era ae mpaed rough fis own fu

D. He attempts to abscond

in an obigation to give subject toa period or condition, the obigation to deliver arises

arrives or the concition Papper oo do it, a specific performance case against

49, _ 1% statement ~

to do something fails

from the moment the term

2" statement - If a person obligated

him will prosper.

A Both statements are false. C. First false, second true,

B. Both statements are true. D. First true, second false.

gainst a thief, the car he stole was lost through an accidental

During the pendency of the criminal case a:

fire, this will result to:

"A extinguishment of the obligation because an accidental fre is always a fortultous event.

B. extinguishment of the obligation because all persons can avail of the remedies provided by law

C extinguishment of the civil obligation because the value of the car will be converted into the number

of days the thief will serve in prison. 1

D. lability of the accused to pay the price of the car as the obligation will not be extinguished because

the obligation proceeds from a criminal offense.

51. Chief Justice Marshall sald that the power to tax involves the power to destroy while Chief Justice Holmes

aintains that the power to tax is not the power to destroy. Which among the following statements does

not reconcile the two seemingly inconsistent opinions?

"A-The imposition of @ valid tax could not be judicially restrained merely because it would prejudice

taxpayer's property.

B. The power to tax could not be the subject of compensation and set-off.

C.An illegal tax could be judicially deciared invalid and should not work to prejudice a taxpayer's

property.

D. Chief Justice Marshall's view refers to a valid tax while the Chief Justice Holmes’ view refers to an

invalid tax.

52. That there should be no improper delegation of the legislative authority to tax is:

A. A principle of sound tax system.

B. A constitutional limitation on the power of taxation.

. An inherent limitation on the power of taxation.

D. Both a constitutional and Inherent limitations on the power of taxation.

53. Inheritance tax is imposed on the privilege to:

A. Transfer property inter vivos.

8B, Transfer property mortis causa,

54. Which among the following distinguishes an estate tax from other Kinds of taxes that are presently

Imposed under the provisions of the NIRC of 1997?

A. It Is a tax imposed on the privilege to transfer property ownership.

8. Itisa tax that is imposed upon gratuitous transfers.

C. Itis a tax that is imposed upon the net value of the properties that are transferred.

D. Itis a tax that Is Imposed only upon the death of a person.

|

‘55. Donor’s tax Is img i "

A. Tranter property teres.

B. Transfer property mortis causa,

C. Receive property inter vivos.

D. Receive property mortis causa.

C. Receive property inter vivos.

D. Receive property mortis causa.

Ti ve

ORC-ACE: First Pre-board Examination ~May 2014 Batch BUSINESS LAW § TAXATION

56, Statement 1. Symbiotic relations Is the reason why the government could impose taxes on the incomes of

Tesident citizens derived from sources outside the Philippines,

‘Statement 2, Jurisdiction Is the reason why citizens must provide support to the State so that latter could

continue to give protection.

A. Both statements are true.

B. Both statements are false.

€. Only statement 1 is correct but not statement 2.

D, Only statement 2 is correct but not statement 1.

57. Noynoy died leaving several parcels of land, Before the properties are distributed to his heirs, the tax to be

paid is known as:

A. Donor’s tax.

B. Inheritance tax.

C. Estate tax.

D. Transfer tax.

58. Your two co-reviewees are engaged In a discussion as to what are included in the inherent limitations on

the power of taxation. They decided to make you their referee In order to enlighten them on which of the

following Is generally not included among the inherent limitations. What should you choose from among

the following?

‘A. Double taxation

B. Recognition of comity

€. No improper delegation of the legislative authority to tax.

©. The taxing power should only be exercised within the territorial boundaries of the taxing authority.

59. A tax does not meet the public purpose limitation if it:

A. Is for the welfare of the nation or greater portion of the population.

B. Affects the areas as a community rather than as individuals.

GIs for the benefit principally of limited subjects or objects.

D. Is designed to support the services of government for some of its recognized objects.

60. Among the nature of taxation Is that It Is an inherent power being an attribute of sovereignty. Which

‘among the following Is not among its manifestation as such inherent power?

‘A. Courts not Issue an injunction to enjoin the collection of taxes.

8, There should be no improper delegation of the power to tax.

, Taxes may be imposed even without a constitutional grant.

D. The State has the right to select the subjects and objects of taxation,

61. Consider the following statements:

I. The power of taxation involves the promulgation of rules.

Il. The State has the power to impose taxes even without a constitutional

ant.

nt Tees are based’ upon the lifeblood theory.

JV, There should be no improper delegation of the power ta tax.

Choose the correct answer from among the following choices:

A. Statements I and II are both manifestations of taxation being legislative in nature.

B, Statements II and IV are both manifestations of taxation being legislative in nature.

C. Statements I and IV are both manifestations of taxation being inherent in nature.

©. Statements If and III are both manifestations of the inherent nature of taxation.

62. The NIRC of 1997 imposes different kinds of taxes on dispositions of property. These are VAT, OPT, excise

taxes, estate taxes, donor's taxes, etc, Which among the following transactions would be subject to a

transfer tax?

A. Sales of articles that are exempt from the VAT.

8. Sale of cigars and cigarettes by a wholesaler.

C. Sale of an automobile for less than an. adequate and full consideration.

D. Sale of shares of stock that are listed and traded at the local stock exchange.

+ CRO-ACE: First Pre-boavdl Examination -May 2014 Batch BUSINESS LAW § TAXATION

63, A person may be imprisoned for:

‘A. Non-payment of a poll tax.

B. Fallure to pay a debt.

C. Non-payment of his income tax.

D. Failure to pay his community tax.

64. Transfer tax is a tax imposed on the privilege to transfer property ownership:

A. Through a will.

B. Mortis causa.

. Inter vivos.

D. Gratuitously.

ial lot with a BIR determined zonal valuation of P1 million. In 2013 he sold the same to Y

¢ for Pl millon subject to the condition that while X Is still alive he shall be allowed to use part of the

Property as a garage for whatever personal car he would own but limited only to one car. The proper taxes

attendant to the sale were paid, X died In 2014, What should be the treatment of the value of the

Sah jot in the preparation of the estate tax return,

i incuce ne * retained the right to enjoy a portion of the property which right ends with his death,

8. Include because there is no showing in the problem that the title to the property was already

transferred to Y.

C. Exclude because there was a bona fide sale of the residential lot for sufficient and adequate

consideration.

©. Exclude because the execution of the deed of sale and the payment of the taxes effectively deprived X

of ownership over the property.

586. Which among the following transfers of property, by trust or otherwise, during the lifetime of the

transferor is not included as part of a deceased transferor’s gross estate?

‘A. When the deceased transferor has reserved to himself the power to alter, amend, revoke or terminate

the transfer and such power is relinquished in contemplation of the transferor's death,

5. Where the deceased transferor has reserved for himself the power to determine who could alter,

amend, revoke or terminate the transfer and such power is relinquished In contemplation of the

transferor’s death.

C. Where the deceased transferor had made the transfer through a bona fide sale and for adequate

consideration but he has made a reservation of the power to alter, amend, revoke or terminate the

transfer prior to his death.

D. Where the deceased transferor had made the transfer but he has reserved for himself the enjoyment

thereof subject to his death to any change by himself or in connection with any other person could

alter, amend, revoke or terminate the transfer and such power is relinquished In contemplation of the

transferor’s death.

57-A Filipino citizen died abroad leaving the following properties: house and lot in Texas, USA; shares of stock

Benen figuel Corporation and PHILEX, both local companies; bank deposits in New York CIty and in the

Fark of te Philippine Islands in Makati; a Toyota Camry sedan registered in the name of his con aged 21

Years. He was buried in Manila and expenses were incurred to bring the remains home and for his funeral,

‘Which among the above properties should be excluded from his estate tax return?

‘A. The house and lot in Texas, USA.

8. The shares of stock in San Miguel Corporation,

C. The bank deposits in New York City,

D. The Toyota Camry sedan.

58, Who amang the following donees is considered a stranger for

e purposes of donor's taxation,

A. A first cousin of the donor, C. The donor’s great grandchild,

'B. The brother of the donor's father. D. The mother of the donor's spouse.

69. Who among the following is not a stranger for of donor's taxati

‘A. The donor's father-in-law, pegcbarbeetairs tyne

C. The donoi’s great grandfather.

8. The donor's step mother. D. The husband of the donor's sister.

ees a

1 CRC-ACE: First Pre-voard Examination -May 201+ Batch Business LAW, area a

70. An American citizen was @ permanent resident of the Philippines. He died in Mlaml, Florida. He ie a

shares of Meralco; 2 condominium unitat the Twin Towers Buang ot Pasi Het Mantel

USA; a lease contract over , USA, >

SE ee eng ni ts shall be excluded In the Estate Tax Retum to be filed with the BIR’

‘A. The value of the Florida, USA condominium,

B. The value of the Pasig, Metro Manila condominium.

C. The value of the house and lot located in California, USA.

D, The value of the 10,000 Meralco shares.

TILA Chinese citizen met an accident and died while visiting the Philippines. Which among the following

properties are to be included as part of his gross estate for Philippine tax purposes?

A. His house and lot in China, .

B. Acondominium unit In California, U.S.A.

C. Shares of stock in Philippine Long Distance Telephone Company (PLDT).

D. Accident insurance issued by a Philippine insurance company payable to his wife.

jes: in

‘An American domiciled in South Aftica, died in 2014. He left the following properties: a. 2 rest house

72 a yida, USA; b. a vila In Switzerland; c. shares of stock in (1) Hong Kong Corporation; (2) San igual

Brewery, a Philippine corporation; (3) An American Corporation operating in and with office at Makati, &

“Time deposits with PNB; e. Philippine Treasury bills; f. Lease contract over his Manhattan apartment least

to the Philippine consulate. Which of the following properties forms part of his gross estate in the

Philippines?

A. The lease contract.

B. The shares of stock in the American corporation.

C. The rest house in Florida, USA. :

D. The villa in Switzerland,

73. Jose Ortiz owns 100 hectares of agricultural land planted with coconut trees. He died on May 30, 2014,

Prior to his death, the government, by operation of law, acquired under the Comprehensive Agrarian

Reform Law all his agricultural lands except five (5) hectares. Upon the death of Ortiz, his widow asked

you how she will consider the 100 hectares of agricultural land In the preparation of the estate tax return.

What advice will you give her?

A, Exclude the 100 hectares because Jose Ortiz did not have any interest in the said property at the time

of his death,

B. Include the 100 hectares in the estate tax return but deduct the same property as deemed taken for

public use, -

. Include only the five (5) hectares which were retained because this is the extent of the interest that

Jose Ortiz had in the said property at the time of his death.

D. Exclude the 100 hectares because these are properties that were taken for public use by operation of

law.

74.\Villar, a real estate dealer, sold a piece of land for a selling price of P800,000 on installment basis. The

and was acquired by Villar a year ago for P500,000, exclusive of VAT. The terms of the sale are:

Downpayment ~ April 2014 100,000

Installment due — Oct. 2014 100,000

Installment due ~ April 2015 200,000

Installment due - Oct. 2015 > 200,000

Installment due - April 2016 200,000

‘The VAT output tax for 2014 amounts to:

‘A. P96,000 B, P 24,000 C. P12,000 _D. None of these

75. Assume the same facts in No. 74, except that the down payment

amounted to P300,000. The VAT output tax for 2014 amounts tor ne NStaiment payment In 2014

‘A. 96,000 B. P 36,000 C. P304,000 —-D. None of these

76. During the current calendar year, Jekell has the followin zi

1 1g transactions:

jon 2 Donated @ P150,000 diamond ring to his adopted son who Is getting married on March 15 of the

Mar. 15 Sold his motorbike valued at P500,000 for P200,000 to his uncle.

1 CRC-ACE: First Pre-board Exaratnation ~ may 2044 Batch BUSINESS LAW § TAXATION

‘Apr. 15 Sold his residential house to Fatman, his best friend, for P1,500,000. The falr market value of

the residential house at the time of sale was P2,000,000.

Jun. 15 Donated P100,000 to Makati City for public purpose and P50,000 to his sister who graduated

from Ateneo, :

“The aggregate taxable net gifts for the current calendar year to:

Relatives Stangers Relatives Stangers

A. P490,000 P600,000 C. P500,000 500,000

8. P490,000 © ©. P500,000 °

77. The gross sales/receipts of Philex for the year are as follows:

From grocery store = : P1,500,000

From sale of gold to BSP : 419,500

ot 500,000

From'passenger jeepneys —- i

Which of the following statements is correct?

A, Philex is required to register for VAT because the basis for registration Is the total gross sales/rec«

‘of 2,419,500,

|B. Philex may elect to register for VAT because his annual gross sales/receipts as the basis for registration

~amount to only P1,919,500.

. Philex may elect to register for VAT because his annual gross sales/receipts as the basis for registration

amount to only P1,500,000.

D. None of the above.

78."X" Corporation took a Keyman insurance on the life of Its President, Mr. Rodel Cruz, designating Mr. Cruz’

wife as its revocable beneficiary. In the event of death of Mr. Cruz, will the insurance proceeds form part

of the gross estate of Mr. Cruz?

A. Yes because Mrs. Cruz was designated as a revocable beneficiary.

B. No because the premium was not paid by Mr. Cruz.

. Yes because the insurance proceeds form part of the benefits of Mr. Cruz enjoyed by him as an

‘employee of "X” Corporation.

No because Mr, Cruz had no interest in the proceeds at the time of his death hence this Is not property

that he transferred at the time of his death.

79. When Procopio died, he left an estate valued at P10 million. His Heirs spent P700,000 for all the funeral

services rendered by St. Peter Memorial Chapel, Including the expenses attendant to the wake, the coffin,

cremation: services and the um where his ashes were placed, 'P300,000 out of the P700,000 funeral

expenses were shouldered by friends and relatives. Which among the following amounts may be deducted

from his gross estate for funeral expenses?

A. P500;000 B. P700,000 c.P400,000 .P200,000

80. An American citizen who is a permanent resident of the Philippines died while on a vacation in his place of

birth in the United States. Which one of the following is a valid deduction from his gross estate?

‘A, Estate taxes paid in the Philippines. :

B. Income tax paid on income earned and received after his death.

CC. Unpaid income taxes on salaries received by him before his death.

. Real property taxes on his Quezon City condominium due after his death.

81. Vanishing deduction is availed of by taxpayers to:

A. Correct his accounting records to reflect the actual deductions made.

B, Reduce his gross income.

. Reduce his output value-added tax liability.

D. Reduce his gross estate.

82, Gary died in April, 2012 leaving all his properties to his only son Martin. Gary left no creditors. Martin

promptly executed an affidavit of self-adjudication, paid the proper estate taxes and had the properties

titled in his name. In August, 2014 Martin died leaving as his only heirs, his two surviving children. If

vanishing deduction finds application what percentage of the value of the properties Martin Inherited from

Gary should be allowed as a deduction?

A. 20% B. 40% C. 60% D.80%

'

u

ERC-ACE: First Pre-board Examination -May 2014 Bateh

BUSINESS LAW § TAXATION

83. In which among the following Instances Is the filling of an estate tax return a requirement?

t of the estate tax.

‘A. The gross value of the estate is P100,000 and Is exempt from the payment a

B. The gross value of the estate exceeds P100,000 but is below P200,000 and is exempt from the

Payment of the estate tax.

. The gross value of the estate does not exceed 200,000 and is exempt from the payment of the estate

tax,

D. The gross value of the estate exceeds P200,000 but is exempt from the payment of the estate tax.

84. A died in June 2014 in LA, California, her last residence and domicile. She left properties consisting of

i f the

ff stocks in BMC, Inc., a company organized and existing under the laws of

Phipgtnes wh penlpel office at Makati, MM, The estate tax due on said shares were correspondingly

id to the state of California.

"For Phlipine estate tax purposes what should be the tax treatment of the estate tax paid to the state of

California?

A. The California estate taxes are allowed to be deducted from A's gross estate.

B, Since there is no showing of reciprocity then the California estate taxes should not be considere

determining the Philippine estate tax,

. The amount of the California estate taxes are allowed to be deducted from the Philippines estate tax

that Is due from A’s estate,

D. Since the California estate taxes have already been pald there Is no need anymore to pay Philippine

estate taxes.

85. The commissioner of Internal Revenue may grant an extension of time for the payment of the estate tax or

any part thereof, in case the estate is settled through the courts for a period not exceeding

‘A. Two (2) years from grant of the extension.

B. Two (2) years from the settlement of the estate,

C. Five (5) years from the settlement of the estate.

D. Five (5) years from the grant of the extension,

86. A, an individual, sold to B, his brother-in-law, his residential lot with a market value of P1,000,000 for

600,000. A’s cost in the lot is P100,000. B is financially capable of buying the lot. What tax should be

imposed and collected from A as a result of the transaction:

‘A. Final capital gains tax. . Real Property tax.

B. Donor's tax. D. Tax on the transfer of real property.

87. Which among the following is subject to the payment of the donor's tax?

AA general renunciation of a surviving spouse in his/her share in the inheritance of the deceased spouse.

8. A general renunciation by the surviving spouse of his/her share in the conjugal partnership of gains

upon its liquidation as a result of the death of the other spouse.

€. Aremuneratory donation where there is a legally demandable obligation.

©. Donation made outside the Philippines by a non-resident alien of property located outside of the

Philippines,

‘Questions €8 to 92 are based on the following:

AVAT-registered trader has the following transactions:

Sales of goods to private entities, net of 12% VAT P 2, 500,000

Purchases of goods sold to private entities, gross of 12% VAT 896,000

Sales to a government owned corporation (GOCC), het of 12% VAT 1, 000,000

Purchases of goods sold to GOCC, net 12% VAT 700,000

88. How much is the withholding VAT?

A. P 120,000 B. P 96,000 c. P50,000 D. None of the choices

‘89. How much Is the standard Input tax?

A. P 120,000 —B. P-96,000 C._ P50,000 D. None of the choices

90. What is the treatment of the excess actual input VAT attributable to sales to GOCC

‘A. Input tax credit —_B. Expense or cost C._Income D. None of the choices

91. How much Is the creditable input tax on sale to private entities?

A. P 176,000 B. P 96,000 Cc. P70,000 D None of the choices

92. How much is the VAT payable?

‘A. P 244,000 B. P 204,000 C. P 120,000 D. None

BUSINESS LAW § TAXATION

t to be sold or disposed of fora

to B upon the expiry of that

the fair market value of

and the BIR zonal

LCROLACE: First Pre-board Exavatnation -May 2044 Batch

93. died in 2004 leaving a will which directed all real estate owned by him Oo!

period of 10 years after his death and ordered that the property be given.

Period, Zn 2004, the estate left by A had a BIR zonal value ‘of P500,000. In 2014,

pelt estate increased to P2,500,000. It was declared for taxation tn 2014 for P1,500,000

valuation was P3,000,000. 2

What value should be used for the purpose of estate taxation

‘A. P3,000,000

B. 1,500,000

C. 2,500,000

©. P 500,000

04.0n 30 June 2012, X took out a life Insurance policy on his own life in the amount of P2,000,000. The

cratums were paid from his separate property. He designated his wife, Y 95 irrevocable beneficiary to

Pr 000,000 and his son 2, to the balance of P1,000,000 but, in the latter designation, reserving his right to

Foo ener another, On 01 September 2014, X dled and his wife and son went to the Insurer to

seat the proceeds of Xs fe Insurance palicy. Are the proceeds of the insurance to form part of the gross

estate of X?

estat oe proceeds would not form part of X's gross estate. The insurance company is obligated tO Pay

to the named beneficiaries, thus no part of the proceeds should appertain the X's estate,

B. All of the proceeds would form part of x's gross estate. The premiums were paid from the separate

property of X hence the insurance proceeds are also part of his separate property subject to estate tax.

‘The proceeds though would not be taken from the named beneficiaries. :

. Only the proceeds that were pald to the son would form part of X's gross estate. X retained an

“incdent of ownership” In the insurance when he retained the right to revoke the designation of his

son as beneficiary.

. Only 2 portion of the insurance proceeds that appertain to his wife should form part of X's gross esta\e.

‘The insurance proceeds pald to the wife forms part of the conjugal partnership property hence X's

share should appertain to his estate.

Questions 95 to 100 are based on the following information:

‘On February 14, 2014, Kabisa died leaving the following:

Exclusive properties P 2, 000,000

Conjugal real properties 2, 500,000

Funeral expenses (40% unpaid) 122,000

Judicial expenses (20% unpaid 2/27/15) 60,000

Unpaid mortgage on inherited property 30,000

Notes payable (1/2 notarized) 80,000

Claims against insolvent person (50% collectible) 400,000 "2

Proceeds of life insurance (Beneficiary ~ estate, irrevocable) 100,000 »

Medical expenses (1/2 paid) 300,000 :

‘Additional information: :

The exclusive property had a FMV of P500,000 when inherited 2 ¥% years ago with P80,000 unpaid

ge.

95. Based on the above data, the total conjugal property Is:

A, P 2,500,000 8, P 2,600,000 C. P3,000,000 D. P.2,900,000

96. The total exclusive property is:

A. P-2,000,000 B. P 2,400,000 €. P3,000,000 D.

97. The total ordinary conjugal deduction is: ate

A, P.662,000 B, 410,000 C. P310,000 _D, P 350,000

8. The total ordinary exclusive deduction (excluding vanishing deduction) is:

A. P80,000 B. P 30,000 C. P50,000 D. P-60,000

99. The amount of vanishing deduction is * "

A. P-450,000 B._P 410,000 C. P246,240 =D. P 430,500

100, The total amount of special deduction is:

A. P 1,300,000 B. P 1,150,000 ¢. P 1,000,000 0. 1,500,000

mrs/rdm/reh

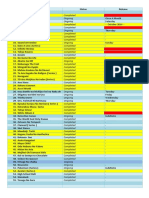

‘Answers / Solutions

‘CPA Pre-Board Exam in Taxation

set

a/B

51/60 B 56/59 C 61/53 0 66/70 A 71/66 C 76/80 © ae 7

£8 ser 9 62/58 «67/7 C«72/78«D 77/81 sofas A

Sao 8 Sues ¢ 63/55 A 68/72 B 73/94 C 78/82 C saver Ae

34/56 B goes | eas7 C6973 «74/93 ~D (79/83 0 84/

55/58 A coer ¢ 65/67 :D «70/65 gn ax 9% yor a* yo

as ast 3% os ax ya vx 3% Os a> gs

ite an ya ay oan on gn au aw yu ae qn

2 ae ao oan 300 ya ae 90 ya ao oc

ae ya az] ve oval ao ga au ao ye awe 9a

aq on on am oyna au ou Qu ogh an ve oqn

dg las SWwWXa CHVOE-Bud Lsuld

wor ooyerigare”D0 29pe (tuo

Osbt Zp (oO) & Aap onSeg “BveNS arg 209 RiaeN 207‘ PMY RURR

HED SEZ J 1059 See (20) &

eyuen “Sond ‘euedt3s J00 75 wAUED i £22 “fptg vewO-AN'D 4E UE

JOOS MaLsaY YD [CUOISSAJOLY ay,L

Ewer

HOLA PhO2 AV

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Law On Sales - Cpar (Answers)Document10 pagesLaw On Sales - Cpar (Answers)Philip CastroNo ratings yet

- Understanding The Flow - ReceiptsDocument3 pagesUnderstanding The Flow - ReceiptsPhilip CastroNo ratings yet

- Ap 7708Document6 pagesAp 7708Philip CastroNo ratings yet

- Book of OpticsDocument3 pagesBook of OpticsPhilip CastroNo ratings yet

- Cyber TrackerDocument2 pagesCyber TrackerPhilip CastroNo ratings yet

- 1st YearDocument3 pages1st YearPhilip CastroNo ratings yet

- Anime StatusDocument2 pagesAnime StatusPhilip CastroNo ratings yet

- Reaction PaperDocument13 pagesReaction PaperPhilip CastroNo ratings yet

- Sacrament of Holy OrdersDocument18 pagesSacrament of Holy OrdersPhilip CastroNo ratings yet

- Inventory Sales Accounts Receivable PurchasesDocument4 pagesInventory Sales Accounts Receivable PurchasesPhilip CastroNo ratings yet

- DocxDocument25 pagesDocxPhilip Castro67% (3)

- Master of AccountingDocument5 pagesMaster of AccountingPhilip CastroNo ratings yet

- Audit CupDocument5 pagesAudit CupPhilip CastroNo ratings yet

- Group 1 - Booming Population Leader: Tan, Maria Fatima O Secretary: Villamor, Mariella LoisDocument2 pagesGroup 1 - Booming Population Leader: Tan, Maria Fatima O Secretary: Villamor, Mariella LoisPhilip CastroNo ratings yet

- Atq - 1Document7 pagesAtq - 1Philip CastroNo ratings yet

- Auditing Theory-250 Questions - 2016Document24 pagesAuditing Theory-250 Questions - 2016Philip CastroNo ratings yet

- Latin Terms PDFDocument2 pagesLatin Terms PDFPhilip CastroNo ratings yet