Professional Documents

Culture Documents

My Notes On Candlesticks

Uploaded by

Anonymous AmsYtpC0 ratings0% found this document useful (0 votes)

18 views1 pageHelp with Candlesticks

Original Title

My Notes on Candlesticks

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHelp with Candlesticks

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views1 pageMy Notes On Candlesticks

Uploaded by

Anonymous AmsYtpCHelp with Candlesticks

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

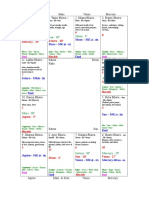

Source: “21 Candlesticks every trader should know” by Melvin Pasternak

The message of candlesticks is most powerful when the markets are at an

extreme, that is when they are overbought or oversold.

no one candlestick should be judged in isolation - patterns consisting of 2 or 3

candlesticks are more reliable than single candle patterns

Candlestick pattern from Thomas Bulkowski’s “Encylopedia of Candlestick Charts”

Reversal in bear (what I want for going long)

The top 5 best candles acting as reversals in bear markets are (based on how often price

reverses, shown as a percentage):

1. Three stars in the South: 100%

2. Breakaway, bearish: 89%

3. Three white soldiers: 84%

4. Three-line strike, bullish: 83%

5. Engulfing, bullish: 82%

Reversal in bull (I do not need as I do cannot short stocks, yet)

The top 5 best candles acting as reversals in bull markets are (based on how often price

reverses, shown as a percentage):

1. Three stars in the South: 86%

2. Three-line strike, bearish: 84%

3. Three white soldiers: 82%

4. Identical three crows: 79%

5. Engulfing, bearish: 79%

Continuations in Bull Market

The top 5 best candles acting as continuations in bull markets are (based on how often

price continues, shown as a percentage):

1. Mat hold: 78%

2. Deliberation: 77%

3. Concealing baby swallow: 75%

4. Rising three methods: 74%

5. Separating lines, bullish: 72%

Continuations: Bear Market

The top 15 best candles acting as continuations in bear markets are (based on how often

price continues, shown as a percentage):

1. Kicking, bearish: 80%

2. Rising three methods: 79%

3. Separating lines, bearish: 76%

4. Deliberation: 75%

5. 13 new price lines: 74%

You might also like

- KarakasDocument20 pagesKarakasAnonymous AmsYtpC100% (1)

- Rasi Nk-Pada Rasi-Lord SC RPDocument3 pagesRasi Nk-Pada Rasi-Lord SC RPSwati Rohan JadhavNo ratings yet

- Marana Karaka Sthana For Different GrahasDocument4 pagesMarana Karaka Sthana For Different GrahasAnonymous AmsYtpCNo ratings yet

- Important Candlestick Patterns - DMDocument1 pageImportant Candlestick Patterns - DMAnonymous AmsYtpCNo ratings yet

- Karakas From JyothiStar Software Check For VeracityDocument7 pagesKarakas From JyothiStar Software Check For VeracityAnonymous AmsYtpCNo ratings yet

- Multiple Time FramesDocument27 pagesMultiple Time FramesAnonymous AmsYtpCNo ratings yet

- Prashna Jyotish Part 1Document279 pagesPrashna Jyotish Part 1Rohit Bose67% (3)

- Atmakaraka or Soul PlanetDocument9 pagesAtmakaraka or Soul PlanetAnonymous AmsYtpCNo ratings yet

- Avasthas of PlanetsDocument15 pagesAvasthas of PlanetsBalasubramanian100% (14)

- Secrets of AshtakavargaDocument78 pagesSecrets of Ashtakavargapowercontrolplus2006816093% (14)

- Graha YuddhaDocument40 pagesGraha YuddhaDejavubysims DejavuNo ratings yet

- Robert Prechter's book on Elliott Wave analysisDocument6 pagesRobert Prechter's book on Elliott Wave analysisAnonymous AmsYtpCNo ratings yet

- According To Shanker AdawalDocument1 pageAccording To Shanker AdawalAnonymous AmsYtpCNo ratings yet

- How To Analyze A ChartDocument1 pageHow To Analyze A ChartAnonymous AmsYtpCNo ratings yet

- Comparing Seven Money Flow Indicator PDFDocument10 pagesComparing Seven Money Flow Indicator PDFshlosh7No ratings yet

- Houses - All About ThemDocument14 pagesHouses - All About ThemAnonymous AmsYtpCNo ratings yet

- The Dignity of Grahas in Vedic AstrologyDocument3 pagesThe Dignity of Grahas in Vedic AstrologyAnonymous AmsYtpC100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)