Professional Documents

Culture Documents

Commercial Real Estate Valuation Model1

Uploaded by

cjsb99Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commercial Real Estate Valuation Model1

Uploaded by

cjsb99Copyright:

Available Formats

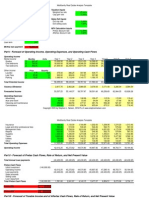

Commercial Real Estate Valuation and Financial Feasibility

ASSUMPTIONS

Annual Gross Rent, first year 3,000 250 Renda

Vacancy and Collection factor 10%

Operating Expenses, first year 420 300 Condominio

Annual % change in rent 3.0% 120 IMI

Annual % change in expenses 1.0% 420

Loan to Value ratio 50.0%

Stated Annual Interest rate 2.0%

Loan Term (years) 20

Percent of price in improvements 60.0%

CPI Annual Increase 3.0%

After tax, Real Discount rate 8.0%

Cap Rate assumed at date of sale 7.0%

Transaction costs as % of sales price 9.0%

Cap Rate at Purchase 7.0%

DEFINED VARIABLES Source

Recovery period (years) 10 Omnibus Budget Reconciliation Act of 1993

Income tax rate (Corporate) 25.0% IRS - Varies based on taxable income

Capital Gains tax rate 25.0% IRS - Varies based on income tax bracket

Property Valuation: $ 32,571.43

ECONOMIC VALUES, CALCULATED BY MODEL

Loan Amount 16,286

Equity Required 16,286

Mortgage Loan Constant 6.12%

DECISION ANALYSIS FACTORS

year 0 1 2 3 4 5 6 7 8 9 10 11

Real Cash Flow to Owner (16,286) 1,247 1,261 1,276 1,290 1,304 1,317 1,331 1,343 1,356 20,094 0

Present Value of Real Cash Flow (16,286) 1,154 1,081 1,013 948 887 830 776 726 678 9,307 0

NPV of Real Cash Flow: $ 1,116.82

After Tax Real Internal Rate of Return: 8.97%

PROFORMA INCOME STATEMENT

year 0 1 2 3 4 5 6 7 8 9 10 11

Annual Gross Rental Income na 3,000 3,090 3,183 3,278 3,377 3,478 3,582 3,690 3,800 3,914 4,032

Vacancy and Collection Losses na (300) (309) (318) (328) (338) (348) (358) (369) (380) (391) (403)

Effective Rental na 2,700 2,781 2,864 2,950 3,039 3,130 3,224 3,321 3,420 3,523 3,629

Operating Expenses na (420) (424) (428) (433) (437) (441) (446) (450) (455) (459) (464)

Net Operating Income na 2,280 2,357 2,436 2,518 2,602 2,689 2,778 2,870 2,965 3,064 3,165

Interest Expense na (326) (312) (299) (285) (270) (256) (241) (226) (211) (195) (179)

Depreciation (cost recovery) na (1,954) (1,954) (1,954) (1,954) (1,954) (1,954) (1,954) (1,954) (1,954) (1,954) (1,954)

Taxable Income na 0 90 183 279 377 478 583 690 801 914 1,031

Income Tax Liability na 0 (23) (46) (70) (94) (120) (146) (173) (200) (229) (258)

Net Income After Tax na 0 68 137 209 283 359 437 518 600 686 774

Developed by Questor Consulting LLC (561) 417-5515

PROFORMA CASH FLOW STATEMENT

year 0 1 2 3 4 5 6 7 8 9 10 11

Annual Gross Rental Income na 3,000 3,090 3,183 3,278 3,377 3,478 3,582 3,690 3,800 3,914 4,032

Vacancy and Collection Loses na (300) (309) (318) (328) (338) (348) (358) (369) (380) (391) (403)

Effective Rental na 2,700 2,781 2,864 2,950 3,039 3,130 3,224 3,321 3,420 3,523 3,629

Operating Expenses na (420) (424) (428) (433) (437) (441) (446) (450) (455) (459) (464)

Net Operating Income na 2,280 2,357 2,436 2,518 2,602 2,689 2,778 2,870 2,965 3,064 3,165

Debt Service na (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) na

Income Tax Liability na 0 (23) (46) (70) (94) (120) (146) (173) (200) (229) na

Equity Dividend (cash to owner) na 1,284 1,338 1,394 1,452 1,512 1,573 1,636 1,702 1,769 1,839 na

Down Payment/Reversion (16,286) na na na na na na na na na 25,166 na

Total Cash Flow to Owner (16,286) 1,284 1,338 1,394 1,452 1,512 1,573 1,636 1,702 1,769 27,005 na

Purchasing Power Adjustment na 103% 106% 109% 113% 116% 119% 123% 127% 130% 134% na

Real Cash Flow to Owner (16,286) 1,247 1,261 1,276 1,290 1,304 1,317 1,331 1,343 1,356 20,094 na

MORTGAGE LOAN AMORTIZATION SCHEDULE

year 0 1 2 3 4 5 6 7 8 9 10 11

Balance Owed, beginning of year 16,286 15,615 14,932 14,234 13,523 12,798 12,058 11,303 10,533 9,748 8,946

Annual Mortgage Payment 996 996 996 996 996 996 996 996 996 996 996

Interest Portion of Payment (326) (312) (299) (285) (270) (256) (241) (226) (211) (195) (179)

Amortization of principal 670 684 697 711 726 740 755 770 785 801 817

Balance Owed, end of year 15,615 14,932 14,234 13,523 12,798 12,058 11,303 10,533 9,748 8,946 8,129

ANALYSIS OF REVERSION ON SALE

Net Operating Income Projected, Year After Sale (Year 11) 3,165

Cap Rate At Sale Date 7.00%

Capitalized Value (Sale Price) 45,209

Transaction Cost (4,069)

Net Sales Price 41,140

Book Value At Sales Date (cost-dep) (13,029)

Capital Gain ( Net Price - BV) 28,112

Capital Gains Tax 7,028

Mortgage Balance Owed 8,946

Reversion in nominal dollars to owner at sales date 25,166

Developed by Questor Consulting LLC (561) 417-5515

You might also like

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- Project Management – an Artificial Intelligent (Ai) ApproachFrom EverandProject Management – an Artificial Intelligent (Ai) ApproachNo ratings yet

- Real Estate Investment AnalysisDocument25 pagesReal Estate Investment AnalysisKulbhushan SharmaNo ratings yet

- Valuation of Income Properties and Investment Analysis PDFDocument46 pagesValuation of Income Properties and Investment Analysis PDFophelia yimNo ratings yet

- The Cost of Doing Business Study, 2022 EditionFrom EverandThe Cost of Doing Business Study, 2022 EditionNo ratings yet

- Ultimate Financial ModelDocument33 pagesUltimate Financial ModelTulay Farra100% (1)

- Commercial Real Estate - Case Study Apr 2020Document2 pagesCommercial Real Estate - Case Study Apr 2020alim shaikhNo ratings yet

- Business Plan Real EstateDocument6 pagesBusiness Plan Real EstateBoammaruriNo ratings yet

- Real Estate Investment AnalysisDocument1 pageReal Estate Investment AnalysisJoelleCabasaNo ratings yet

- Custom Redevelopment Model - Built From Scratch For Mixed Use Retail, Office, Multifamily.Document37 pagesCustom Redevelopment Model - Built From Scratch For Mixed Use Retail, Office, Multifamily.Jonathan D SmithNo ratings yet

- Real Estate ModelDocument56 pagesReal Estate ModelPrateek Agrawal100% (3)

- REPE Case 02 Boston Office Value Added AcquisitionDocument282 pagesREPE Case 02 Boston Office Value Added AcquisitionDavid ChikhladzeNo ratings yet

- Chapter 18. Lease Analysis (Ch18boc-ModelDocument16 pagesChapter 18. Lease Analysis (Ch18boc-Modelsardar hussainNo ratings yet

- 50 13 Pasting in Excel Full Model After HHDocument64 pages50 13 Pasting in Excel Full Model After HHcfang_2005No ratings yet

- Example Real Estate ProjectDocument28 pagesExample Real Estate Projectlfrei003100% (1)

- Commercial Real Estate Valuation Model1Document6 pagesCommercial Real Estate Valuation Model1Sajib JahanNo ratings yet

- Guidelines For Real Estate Research and Case Study Analysis: January 2016Document129 pagesGuidelines For Real Estate Research and Case Study Analysis: January 2016dzun nurwinasNo ratings yet

- Real Estate Pro FormaDocument19 pagesReal Estate Pro FormaDarrell SaricNo ratings yet

- Keck Seng Investments - Heller House Investment Memo - 4-7-16Document36 pagesKeck Seng Investments - Heller House Investment Memo - 4-7-16Marcelo P. LimaNo ratings yet

- Case 8-Group 16Document14 pagesCase 8-Group 16reza041No ratings yet

- Real Estate ModelDocument13 pagesReal Estate Modelgiorgiogarrido667% (3)

- Directions For Using The Model:: Capital ExpendituresDocument204 pagesDirections For Using The Model:: Capital Expenditureschintandesai20083112No ratings yet

- Market AnalysisDocument35 pagesMarket AnalysisbtittyNo ratings yet

- Financial Model of Zynga IPODocument76 pagesFinancial Model of Zynga IPOJack Macharla100% (1)

- Retail Sales Model ValuationDocument220 pagesRetail Sales Model ValuationsaundersrealestateNo ratings yet

- Real Estate Investment AnalysisDocument25 pagesReal Estate Investment AnalysisHarpreet Dhillon100% (1)

- REFM 2-Day Intensive Session - Sept 2010 LADocument20 pagesREFM 2-Day Intensive Session - Sept 2010 LAbkirschrefmNo ratings yet

- Distribution Waterfall - Four ExamplesDocument14 pagesDistribution Waterfall - Four ExamplesShashankNo ratings yet

- Financial Management C11 P11Document4 pagesFinancial Management C11 P11lynusannNo ratings yet

- Objectives of Project Finance ModelsDocument86 pagesObjectives of Project Finance ModelsAlavaro Jaramillo100% (1)

- Financial Model Flow ChartDocument1 pageFinancial Model Flow ChartTallal Mughal100% (1)

- Finance (Final Final) Real EstateDocument131 pagesFinance (Final Final) Real EstateJohn Paul Chua100% (1)

- Real Estate Modeling Quick Reference ReaDocument7 pagesReal Estate Modeling Quick Reference ReaKaren Balisacan Segundo RuizNo ratings yet

- Project Finance Advanced Modeling - Trinidad & TobagoDocument4 pagesProject Finance Advanced Modeling - Trinidad & TobagoThe Vair CompaniesNo ratings yet

- Financial ModelDocument22 pagesFinancial ModelRobert MascharanNo ratings yet

- Mezzanine Debt Benefits and DrawbacksDocument8 pagesMezzanine Debt Benefits and DrawbacksDhananjay SharmaNo ratings yet

- Brigade Metropolis Investment MemoDocument20 pagesBrigade Metropolis Investment Memoicasanova23No ratings yet

- Financing and Investing in Infrastructure Week 1 SlidesDocument39 pagesFinancing and Investing in Infrastructure Week 1 SlidesNeindow Hassan YakubuNo ratings yet

- Property Investment Assumptions AnalysisDocument6 pagesProperty Investment Assumptions AnalysisFahad KhanNo ratings yet

- DT Financial ModelDocument179 pagesDT Financial Modelrranjan27No ratings yet

- Financial ModellingDocument12 pagesFinancial Modellingalokroutray40% (5)

- Merger ModelDocument3 pagesMerger Modelcyberdevil321No ratings yet

- Busines Plan Real Estate InvestDocument10 pagesBusines Plan Real Estate Investopenid_JpMT3dV9No ratings yet

- 01 23 19 Catalina IM Catalina Entitlement Fund PDFDocument52 pages01 23 19 Catalina IM Catalina Entitlement Fund PDFDavid MendezNo ratings yet

- Mezzanine DebtDocument2 pagesMezzanine DebtIan Loke100% (1)

- Toys R Us LBO Model BlankDocument34 pagesToys R Us LBO Model BlankCatarina AlmeidaNo ratings yet

- RE 01 12 Simple Multifamily Acquisition SolutionsDocument3 pagesRE 01 12 Simple Multifamily Acquisition SolutionsAnonymous bf1cFDuepPNo ratings yet

- Real Estate Investing Profit Analysis SheetDocument1 pageReal Estate Investing Profit Analysis SheetCredit Builder83% (6)

- Intermediate Excel For Real EstateDocument109 pagesIntermediate Excel For Real Estateda_yt_boi100% (3)

- Real Estate ModelsDocument14 pagesReal Estate ModelsderoconNo ratings yet

- Real Estate FinancingDocument29 pagesReal Estate FinancingRaymon Prakash100% (1)

- Real Estate Financial Modeling Training BrochureDocument21 pagesReal Estate Financial Modeling Training Brochurebkirschrefm50% (6)

- How To Calculate The IRR - A ManualDocument34 pagesHow To Calculate The IRR - A Manualkees16186189No ratings yet

- Lbo W DCF Model SampleDocument43 pagesLbo W DCF Model SamplePrashantK100% (1)

- Top 21 Real Estate Analysis Measures & Formulas PDFDocument3 pagesTop 21 Real Estate Analysis Measures & Formulas PDFDustin HumphreysNo ratings yet

- Mit Commercial Real Estate Analysis and Investment Online Short Program BrochureDocument9 pagesMit Commercial Real Estate Analysis and Investment Online Short Program BrochureTino MatsvayiNo ratings yet

- Bank of America Mortgage Settlement DocumentsDocument317 pagesBank of America Mortgage Settlement DocumentsFindLaw100% (1)

- Analyzing Hershey Company's Strategic Position Using BCG, IE, and Grand Strategy MatricesDocument2 pagesAnalyzing Hershey Company's Strategic Position Using BCG, IE, and Grand Strategy MatriceslionalleeNo ratings yet

- 163019-375293 20191231 PDFDocument6 pages163019-375293 20191231 PDFAmran KeloNo ratings yet

- Value Added StatementDocument6 pagesValue Added StatementPooja SheoranNo ratings yet

- SeptemberDocument202 pagesSeptembermohanrajk879No ratings yet

- Bank Regulations and SupervisionDocument6 pagesBank Regulations and SupervisionYashna BeeharryNo ratings yet

- Greenlam IndustriesDocument8 pagesGreenlam Industriesvikasaggarwal01No ratings yet

- Compound Interest FormulaDocument21 pagesCompound Interest FormulaFrancis De GuzmanNo ratings yet

- Chase 1099int 2013Document2 pagesChase 1099int 2013Srikala Venkatesan100% (1)

- China's Growing Online Interior Design Platform MarketDocument2 pagesChina's Growing Online Interior Design Platform MarketSon HaNo ratings yet

- Description: S&P/BMV Total Mexico Esg Index (MXN)Document7 pagesDescription: S&P/BMV Total Mexico Esg Index (MXN)tmayur21No ratings yet

- Sunil Sangwan Report On Capital BudgetDocument28 pagesSunil Sangwan Report On Capital BudgetRahul ShishodiaNo ratings yet

- Charges: Askari Sarparast Falak Family TakafulDocument4 pagesCharges: Askari Sarparast Falak Family TakafulArslan AliNo ratings yet

- Fin 254 SNT Project Ratio AnalysisDocument29 pagesFin 254 SNT Project Ratio Analysissoul1971No ratings yet

- Afar Final ReviewerDocument13 pagesAfar Final ReviewerHillary Canlas100% (1)

- Solution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDocument18 pagesSolution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDeanBucktdjx100% (35)

- Kashato Practice SetDocument53 pagesKashato Practice SetLolli PopNo ratings yet

- Financial Risk Management - WikipediaDocument4 pagesFinancial Risk Management - WikipediaPranay JaipuriaNo ratings yet

- Final Project 16 March-1Document38 pagesFinal Project 16 March-1jupiter stationeryNo ratings yet

- Galapagos Offering Memorandum Acquisition NotesDocument522 pagesGalapagos Offering Memorandum Acquisition NotesKetul SahuNo ratings yet

- Capital BudgetingDocument7 pagesCapital Budgetingmiss independentNo ratings yet

- Jobs Dated 031118Document5 pagesJobs Dated 031118api-244053115No ratings yet

- Accounting Details: Quality Costs - Types, Analysis and PreventionDocument7 pagesAccounting Details: Quality Costs - Types, Analysis and PreventionTuba KhanNo ratings yet

- Session 6 SlidesDocument24 pagesSession 6 SlidesJay AgrawalNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnAman AnandNo ratings yet

- Hilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Document2 pagesHilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Shelvya ReeseNo ratings yet

- Role of Sebi - As A Regulatory AuthorityDocument4 pagesRole of Sebi - As A Regulatory Authoritysneha sumanNo ratings yet

- Lesson 17 PDFDocument36 pagesLesson 17 PDFNelwan NatanaelNo ratings yet

- DuPont analysis assignmentDocument5 pagesDuPont analysis assignmentআশিকুর রহমান100% (1)

- Bill Gates Profile and Milestone AchievementsDocument72 pagesBill Gates Profile and Milestone AchievementsvaibhavNo ratings yet