Professional Documents

Culture Documents

New Heritage Doll Company

New Heritage Doll Company

Uploaded by

Kshitij Aggarwal0 ratings0% found this document useful (0 votes)

11 views4 pagesOriginal Title

New Heritage Doll Company (1).xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views4 pagesNew Heritage Doll Company

New Heritage Doll Company

Uploaded by

Kshitij AggarwalCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

New Heritage Doll Company: Capital Budgeting

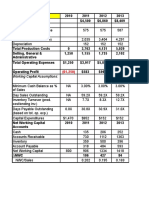

Exhibit 1 Selected Operating Projections for Match My Doll Clothing Line Expansion

2010 2011 2012 2013 2014 2015

Revenue 4,500 6,860 8,409 9,082 9,808

Revenue Growth 52.4% 22.6% 8.0% 8.0%

Production Costs

Fixed Production Expense (excl depreciation) 575 575 587 598 610

Variable Production Costs 2,035 3,404 4,291 4,669 5,078

Depreciation 152 152 152 152 164

Total Production Costs 0 2,762 4,131 5,029 5,419 5,853

Selling, General & Administrative 1,250 1,155 1,735 2,102 2,270 2,452

Total Operating Expenses 1,250 3,917 5,866 7,132 7,690 8,305

Operating Profit (1,250) 583 994 1,277 1,392 1,503

Working Capital Assumptions:

Minimum Cash Balance as % of Sales 3.0% 3.0% 3.0% 3.0% 3.0%

Days Sales Outstanding 59.2x 59.2x 59.2x 59.2x 59.2x

Inventory Turnover (prod. cost/ending inv.) 7.7x 8.3x 12.7x 12.7x 12.7x

Days Payable Outstanding (based on tot. op. exp.) 30.8x 30.9x 31.0x 31.0x 31.0x

Capital Expenditures 1,470 952 152 152 334 361

2016 2017 2018 2019 2020

10,593 11,440 12,355 13,344 14,411

8.0% 8.0% 8.0% 8.0% 8.0%

622 635 648 660 674

5,521 6,000 6,519 7,079 7,685

178 192 207 224 242

6,321 6,827 7,373 7,963 8,600

2,648 2,860 3,089 3,336 3,603

8,969 9,687 10,462 11,299 12,203

1,623 1,753 1,893 2,045 2,209

3.0% 3.0% 3.0% 3.0% 3.0%

59.2x 59.2x 59.2x 59.2x 59.2x

12.7x 12.7x 12.7x 12.7x 12.7x

31.0x 31.0x 31.0x 31.0x 31.0x

389 421 454 491 530

New Heritage Doll Company: Capital Budgeting

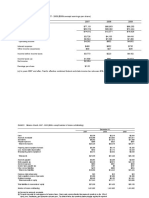

Exhibit 2 Selected Operating Projections for Design Your Own Doll

2010 2011 2012 2013 2014 2015

Revenue 0 6,000 14,360 20,222 21,435

Revenue Growth 139.3% 40.8% 6.0%

Production Costs

Fixed Production Expense (excl depreciation) 0 1,650 1,683 1,717 1,751

Variable Production Costs 0 2,250 7,651 11,427 12,182

Depreciation 0 310 310 310 436

Total Production Costs 0 4,210 9,644 13,454 14,369

Selling, General & Administrative 1,201 0 1,240 2,922 4,044 4,287

Total Operating Expenses 1,201 0 5,450 12,566 17,498 18,656

Operating Profit (1,201) 0 550 1,794 2,724 2,779

Working Capital Assumptions:

Minimum Cash Balance as % of Sales 3.0% 3.0% 3.0% 3.0%

Days Sales Outstanding 59.2x 59.2x 59.2x 59.2x

Inventory Turnover (prod. cost/ending inv.) 12.2x 12.3x 12.6x 12.7x

Days Payable Outstanding (based on tot. op. exp.) 33.7x 33.8x 33.9x 33.9x

Capital Expenditures 4,610 0 310 310 2,192 826

2016 2017 2018 2019 2020

22,721 24,084 25,529 27,061 28,685

6.0% 6.0% 6.0% 6.0% 6.0%

1,786 1,822 1,858 1,895 1,933

12,983 13,833 14,736 15,694 16,712

462 490 520 551 584

15,231 16,145 17,113 18,140 19,229

4,544 4,817 5,106 5,412 5,737

19,775 20,962 22,219 23,553 24,966

2,946 3,123 3,310 3,509 3,719

3.0% 3.0% 3.0% 3.0% 3.0%

59.2x 59.2x 59.2x 59.2x 59.2x

12.7x 12.7x 12.7x 12.7x 12.7x

33.9x 33.9x 33.9x 33.9x 33.9x

875 928 983 1,043 1,105

You might also like

- NHDC SolutionDocument5 pagesNHDC SolutionShivam Goyal71% (24)

- New Heritage Doll Company Case SolutionDocument42 pagesNew Heritage Doll Company Case SolutionRupesh Sharma100% (6)

- New Heritage Doll CompanyDocument12 pagesNew Heritage Doll CompanyRafael Bosch60% (5)

- RESUELTO New Heritage Doll Company Student SpreadsheetDocument13 pagesRESUELTO New Heritage Doll Company Student SpreadsheetDaniel InfanteNo ratings yet

- Group6 - Heritage Doll CaseDocument6 pagesGroup6 - Heritage Doll Casesanket vermaNo ratings yet

- Group-13 Case 12Document80 pagesGroup-13 Case 12Abu HorayraNo ratings yet

- New Heritage DollDocument26 pagesNew Heritage DollJITESH GUPTANo ratings yet

- New Heritage Doll - SolutionDocument4 pagesNew Heritage Doll - Solutionrath347775% (4)

- Ejercicio 7.5Document6 pagesEjercicio 7.5Enrique M.No ratings yet

- New Heritage Doll Company Student SpreadsheetDocument4 pagesNew Heritage Doll Company Student SpreadsheetGourav Agarwal73% (11)

- New Heritage Doll Company Case SolutionDocument31 pagesNew Heritage Doll Company Case SolutionSoundarya AbiramiNo ratings yet

- New Heritage Doll CompanyDocument5 pagesNew Heritage Doll CompanyChris ChanonaNo ratings yet

- New Heritage Doll CompanyDocument11 pagesNew Heritage Doll CompanyLightning SalehNo ratings yet

- New Heritage ExhibitsDocument4 pagesNew Heritage ExhibitsBRobbins12100% (16)

- NHDC Solution EditedDocument5 pagesNHDC Solution EditedShreesh ChandraNo ratings yet

- Case AnalysisDocument11 pagesCase AnalysisSagar Bansal50% (2)

- New Heritage Doll CompanDocument9 pagesNew Heritage Doll CompanArima ChatterjeeNo ratings yet

- New Heritage Doll CoDocument3 pagesNew Heritage Doll Copalmis2100% (5)

- New Heritage SolutionDocument3 pagesNew Heritage SolutionJosé Luis DíazNo ratings yet

- New Heritage DoolDocument9 pagesNew Heritage DoolVidya Sagar KonaNo ratings yet

- Heritage Doll Company Project EvaluationDocument13 pagesHeritage Doll Company Project EvaluationSabyasachi Sahu100% (1)

- PGP Heritage Doll ExcelDocument5 pagesPGP Heritage Doll ExcelPGP37 392 Abhishek SinghNo ratings yet

- Heritage CaseDocument3 pagesHeritage CaseGregory ChengNo ratings yet

- New Heritage Doll Capital BudgetingDocument9 pagesNew Heritage Doll Capital Budgetingpalmis20% (1)

- New Heritage Doll CompanyDocument8 pagesNew Heritage Doll CompanyKDNo ratings yet

- Finance - WK 4 Assignment TemplateDocument31 pagesFinance - WK 4 Assignment TemplateIsfandyar Junaid50% (2)

- Ow To LAY: Finance Simulation: Capital BudgetingDocument10 pagesOw To LAY: Finance Simulation: Capital BudgetingApoorv GuptaNo ratings yet

- New Heritage DollDocument8 pagesNew Heritage DollJITESH GUPTANo ratings yet

- Sampa Video Case ExhibitsDocument1 pageSampa Video Case ExhibitsOnal RautNo ratings yet

- Case Study-New Balance Activity 2Document10 pagesCase Study-New Balance Activity 2Austin Bray100% (1)

- BOEING 7e7Document5 pagesBOEING 7e7EVA Rental AdminNo ratings yet

- Sampa SolnDocument13 pagesSampa SolnAnirudh KowthaNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- Walmart ValuationDocument24 pagesWalmart ValuationnessawhoNo ratings yet

- ACC 309 Final Project Student WorkbookDocument46 pagesACC 309 Final Project Student Workbooknick george100% (1)

- Goldman SachsDocument65 pagesGoldman Sachsinevitablesins0000No ratings yet

- Flash MemoryDocument8 pagesFlash Memoryranjitd07No ratings yet

- Flash Memory, Inc. - Group 8Document1 pageFlash Memory, Inc. - Group 8Bryan MezaNo ratings yet

- Hampton MachineDocument7 pagesHampton MachineMurali SubramaniamNo ratings yet

- Teuer Furniture - Student Supplementary SheetDocument20 pagesTeuer Furniture - Student Supplementary Sheetsergio songuiNo ratings yet

- Group 3-Case 1Document3 pagesGroup 3-Case 1Yuki Chen100% (1)

- Polar Sports X Ls StudentDocument9 pagesPolar Sports X Ls StudentBilal Ahmed Shaikh0% (1)

- Hampton Machine Tool CaseDocument7 pagesHampton Machine Tool Casegunjan19834u100% (1)

- New Heritage Doll Company Capital Budgeting SolutionDocument10 pagesNew Heritage Doll Company Capital Budgeting SolutionBiswadeep royNo ratings yet

- SneakerDocument8 pagesSneakerFelicity YuanNo ratings yet

- Sampa Video: Project ValuationDocument18 pagesSampa Video: Project Valuationkrissh_87No ratings yet

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- New Heritage Doll CompanyDocument4 pagesNew Heritage Doll Companyvenom_ftwNo ratings yet

- APV Vs WACCDocument8 pagesAPV Vs WACCMario Rtreintaidos100% (2)

- Mariott Corp AnalysisDocument14 pagesMariott Corp AnalysisvarjinNo ratings yet

- Flash Memory IncDocument9 pagesFlash Memory Incxcmalsk100% (1)

- Match My Doll Clothing: Working Capital AssumptionsDocument4 pagesMatch My Doll Clothing: Working Capital Assumptionsb_style210No ratings yet

- Heritage Doll CompanyDocument11 pagesHeritage Doll CompanyDeep Dey0% (1)

- Part 1: Estimate Fcfs and Compute NPVS, Irrs, Paybacks, and PisDocument5 pagesPart 1: Estimate Fcfs and Compute NPVS, Irrs, Paybacks, and Pisvenom_ftwNo ratings yet

- Análisis Caso New Heritage - Nutresa LinaDocument27 pagesAnálisis Caso New Heritage - Nutresa LinaSARA ZAPATA CANONo ratings yet

- Corpfin Case 2Document5 pagesCorpfin Case 2rthakkar97No ratings yet

- NHDC-Solution-xls Analisis VPN TIR NHDCDocument4 pagesNHDC-Solution-xls Analisis VPN TIR NHDCDaniel Infante0% (1)

- Tarea Heritage Doll CompanyDocument6 pagesTarea Heritage Doll CompanyFelipe HidalgoNo ratings yet

- Financial Results Up To DateDocument24 pagesFinancial Results Up To DateWilliam HernandezNo ratings yet

- Executive SummaryDocument12 pagesExecutive SummaryShehbaz HameedNo ratings yet