Professional Documents

Culture Documents

Name: Group: Date:: FA2 Managing Financial Records

Uploaded by

Suy Yanghear0 ratings0% found this document useful (0 votes)

7 views2 pagesOriginal Title

EXERCISE1H1.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesName: Group: Date:: FA2 Managing Financial Records

Uploaded by

Suy YanghearCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

FA2 Managing Financial Records

Chap 10 EXERCISE

Lecturer: Christine Colon, ACCA

Name:

Group: Date:

KKONG

The following balances were extracted from the records of K Kong at the end of his first year of

trading:

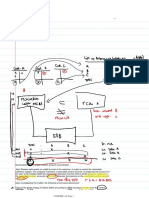

Trial balance as at 31 Decemberr 20X6

Account Debit Credit

$ $

Sales 9,000

Purchases 6,900

Rent 300

Stationery 70

Insurance 50

Fixtures and fittings, cost 700

Receivables 2,500

Payables 900

Cash at bank 1,100

Drawings 1,020

Capital introduced 2,740

12,640 12,640

You are given the following additional information:

(a) Rent was $100 per quarter payable in arrears. The property has been rented since

1 January 20X6.

(b) $10 of the insurance paid covered a period in 20X7.

(c) Goods unsold at 31 December 20X6 had cost K Kong $750.

(d) The fixtures and fittings were expected to last for ten years and would then be

$50. Depreciation is to be on the straight-line basis.

(e) An allowance for receivables of $100 is to be created.

Prepare the statement of profit or loss of K Kong for the year ending 31 December 20X6

and a statement of financial position at that date.

You might also like

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- Exercises - Trial Balance and Final Accounts - PracticeDocument23 pagesExercises - Trial Balance and Final Accounts - PracticeDilfaraz Kalawat79% (38)

- CACell Intermediate Account Full Book-201-250Document50 pagesCACell Intermediate Account Full Book-201-250kalyanikamineniNo ratings yet

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- Drawings 4,500: Financial AccountiDocument3 pagesDrawings 4,500: Financial AccountiShamNo ratings yet

- Week 4 PDF FreeDocument5 pagesWeek 4 PDF FreeM. Gibran KhalilNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsBhuvaneshwari Palani0% (2)

- Adjusting EntryDocument8 pagesAdjusting EntryRaeha Tul Jannat BuzdarNo ratings yet

- Adobe Scan 27-Feb-2023Document9 pagesAdobe Scan 27-Feb-2023SudeepNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Preparing The WorksheetDocument7 pagesPreparing The WorksheetJOSE ANGELO MONTENEGRO HUAMANINo ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Bac 101Document6 pagesBac 101Ishak IshakNo ratings yet

- And Profit and Loss Account and Balance Sheet On 31st December, 2019Document2 pagesAnd Profit and Loss Account and Balance Sheet On 31st December, 2019Prabhleen KaurNo ratings yet

- Accounting Principles AbDocument36 pagesAccounting Principles Absamson mutukuNo ratings yet

- Incomplete Records (Single Entry)Document15 pagesIncomplete Records (Single Entry)Kabiir RathodNo ratings yet

- Assignment Questions For Financial StatementsDocument5 pagesAssignment Questions For Financial StatementsAejaz Mohamed100% (2)

- Adobe Scan 17-Dec-2022Document18 pagesAdobe Scan 17-Dec-2022unnuNo ratings yet

- Activity in FABM 2Document2 pagesActivity in FABM 2CHERIE MAY ANGEL QUITORIANONo ratings yet

- Bakhromov hw2 PDFDocument4 pagesBakhromov hw2 PDFRakhimjon BakhromovNo ratings yet

- Questions On Preparation of Financial Statements 1-4Document4 pagesQuestions On Preparation of Financial Statements 1-4LaoneNo ratings yet

- Sy Final AccountDocument8 pagesSy Final Accountsmit9993No ratings yet

- Balance Sheet With ExplanationDocument2 pagesBalance Sheet With ExplanationTrinadh KNo ratings yet

- Partnership Class ExercisesDocument2 pagesPartnership Class ExercisesPetrinaNo ratings yet

- Practice Questions-IAS-1Document2 pagesPractice Questions-IAS-1Ayyan AzeemNo ratings yet

- TS1307 Financial Reports: Test 2 - Question BookDocument4 pagesTS1307 Financial Reports: Test 2 - Question Bookirma febianNo ratings yet

- Current Liabilities and Warranties p2Document4 pagesCurrent Liabilities and Warranties p2James AngklaNo ratings yet

- Financial Accounting - Tugas 1Document6 pagesFinancial Accounting - Tugas 1Alfiyan100% (1)

- Zimbabwe School Examinations Council: Accounts 7112/1Document4 pagesZimbabwe School Examinations Council: Accounts 7112/1Munashe BinhaNo ratings yet

- Accounting ActivityDocument3 pagesAccounting ActivityKae Abegail GarciaNo ratings yet

- In The Books of Evergreen Sports ClubDocument1 pageIn The Books of Evergreen Sports Clubponnada sairamNo ratings yet

- Financial Statement Assignment 1Document3 pagesFinancial Statement Assignment 1tahasafdari772No ratings yet

- Accounting BusinessDocument11 pagesAccounting BusinessLyndonNo ratings yet

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- Casos de Ajuste.Document9 pagesCasos de Ajuste.Alguien algunoNo ratings yet

- CH 05Document10 pagesCH 05Antonios Fahed0% (1)

- Name of Company: NCB Legal Firm Business Organization: Sole Proprietorship Industry: Service Inventory System: PeriodicDocument12 pagesName of Company: NCB Legal Firm Business Organization: Sole Proprietorship Industry: Service Inventory System: PeriodicNikki100% (1)

- Igcse - Extented Tutoring - 2023 - 2024 - Final AccountsDocument7 pagesIgcse - Extented Tutoring - 2023 - 2024 - Final AccountsMUSTHARI KHANNo ratings yet

- Audit of CashDocument9 pagesAudit of CashEmma Mariz Garcia25% (8)

- General Journal Date Accounts and Explanation Debit CreditDocument6 pagesGeneral Journal Date Accounts and Explanation Debit CreditShaina AragonNo ratings yet

- IA2 Prelims 1 - CLDocument2 pagesIA2 Prelims 1 - CLAdriiiNo ratings yet

- Transactions of NetSolutions - Nov & Dec 2005Document17 pagesTransactions of NetSolutions - Nov & Dec 2005tristan ignatiusNo ratings yet

- Practice Qns - Final AccountsDocument13 pagesPractice Qns - Final Accountscaphoenix mvpaNo ratings yet

- WorkDocument8 pagesWorkshifaanjum7172No ratings yet

- Yemen Secondary School: InstructionsDocument3 pagesYemen Secondary School: InstructionsDaniel fredyNo ratings yet

- Corrected TB CH 2Document1 pageCorrected TB CH 2Birhanu DesalegnNo ratings yet

- Single Entry Ques.Document6 pagesSingle Entry Ques.Garima GarimaNo ratings yet

- Bank AccountingDocument8 pagesBank Accountinggordonomond2022No ratings yet

- ComprehensiveaccountinghwDocument11 pagesComprehensiveaccountinghwapi-348361031No ratings yet

- Books of Lei (Books of The Partnership)Document4 pagesBooks of Lei (Books of The Partnership)Von Andrei MedinaNo ratings yet

- Espiritu, Rachelle Ann I. ABM 11 - St. ThomasDocument8 pagesEspiritu, Rachelle Ann I. ABM 11 - St. ThomasLLOYD ESPIRITUJRNo ratings yet

- Week 4 Solutions PDFDocument4 pagesWeek 4 Solutions PDFchi_nguyen_100No ratings yet

- Nudjpia Far and Afar Solutions - CashDocument5 pagesNudjpia Far and Afar Solutions - CashKyla Artuz Dela CruzNo ratings yet

- Word-Final A - CsDocument12 pagesWord-Final A - CsDibyansu KumarNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Question IA 2 - Topic 4Document2 pagesQuestion IA 2 - Topic 4YAANESHWARAN A/L CHANDRAN STUDENTNo ratings yet

- STUDENT Copy Chapter 1 Review of The Accounting CycleDocument28 pagesSTUDENT Copy Chapter 1 Review of The Accounting CycleKurt Latrell AlcantaraNo ratings yet

- Solutions Exercises Financial AccountingDocument11 pagesSolutions Exercises Financial Accountingddd huangNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Incomplete Records - ActivitiesHDocument10 pagesIncomplete Records - ActivitiesHSuy YanghearNo ratings yet

- Practice Qs Chap 13HDocument4 pagesPractice Qs Chap 13HSuy YanghearNo ratings yet

- Janey Lee AdjDocument2 pagesJaney Lee AdjSuy YanghearNo ratings yet

- Chapter 6 Bank Recon Practice QHDocument3 pagesChapter 6 Bank Recon Practice QHSuy Yanghear100% (1)

- Incomplete Records - ActivitiesHDocument10 pagesIncomplete Records - ActivitiesHSuy YanghearNo ratings yet

- EXERCISE1HDocument6 pagesEXERCISE1HSuy YanghearNo ratings yet

- Name: Group: Date:: FA2 Managing Financial RecordsDocument4 pagesName: Group: Date:: FA2 Managing Financial RecordsSuy Yanghear100% (1)

- Chapter 6 Suspense Practice Q HDocument5 pagesChapter 6 Suspense Practice Q HSuy YanghearNo ratings yet

- Name: Group: Date:: Chap 1 Practice Questions Lecturer: Christine Colon, ACCADocument3 pagesName: Group: Date:: Chap 1 Practice Questions Lecturer: Christine Colon, ACCASuy YanghearNo ratings yet

- G PDFDocument5 pagesG PDFSuy YanghearNo ratings yet

- Group HDocument1 pageGroup HSuy YanghearNo ratings yet

- Bank Reconciliations C1 - Activities CDocument8 pagesBank Reconciliations C1 - Activities CSuy YanghearNo ratings yet

- Name: Group: Date: Chapter Exercise 1 - Preparation of Statement of Profit or Loss From General Ledger AccountsDocument5 pagesName: Group: Date: Chapter Exercise 1 - Preparation of Statement of Profit or Loss From General Ledger AccountsSuy YanghearNo ratings yet

- Group HDocument1 pageGroup HSuy YanghearNo ratings yet

- CAT Swing Dancewear PDFDocument3 pagesCAT Swing Dancewear PDFSuy YanghearNo ratings yet

- Bank Reconciliations - Activities Blyth CDocument4 pagesBank Reconciliations - Activities Blyth CSuy YanghearNo ratings yet

- Chapter 6a QUIZ GDocument3 pagesChapter 6a QUIZ GSuy YanghearNo ratings yet

- Activity 1 - Journal EntriesDocument5 pagesActivity 1 - Journal EntriesSuy YanghearNo ratings yet

- Bank Reconciliations C1 - Activities CDocument8 pagesBank Reconciliations C1 - Activities CSuy YanghearNo ratings yet

- Examiner's Report - FA2 PDFDocument40 pagesExaminer's Report - FA2 PDFSuy YanghearNo ratings yet

- CAT Review Qs PDFDocument4 pagesCAT Review Qs PDFSuy YanghearNo ratings yet

- CAT Capex Opex Exercise 1Document1 pageCAT Capex Opex Exercise 1Suy YanghearNo ratings yet

- C Rita Blake PDFDocument4 pagesC Rita Blake PDFSuy Yanghear100% (1)