Professional Documents

Culture Documents

Financial Strategies Under Discrete Time Models (Examples)

Uploaded by

theodor_munteanuOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Financial Strategies Under Discrete Time Models (Examples)

Uploaded by

theodor_munteanuCopyright:

Financial strategies and discrete time models

Author: Theodor Munteanu (15 oct 2020)

Problem 1.

Suppose the current price per share of AMAZON is 𝑆0 = 3322$.

The interest rates are 0% and the up and down factors at each step are estimated at 𝑢 = 1.015 and 𝑑 =

0.995.

a. Find the probability that a bull call spread with strikes 𝐾1 = 3250, 𝐾2 = 3390 will be a

profitable one, if the lifetimes of the composing options is 1 year. We assume that the share

price follows a binomial model (in our case will result 4 periods).

b. What is the probability that a butterfly spread would yield a negative profit, if the option

expiries are 6 months each. The strike prices are 𝐾1 = 3300, 𝐾2 = 3325, 𝐾3 = 3350$.

Problem 2: (Probability of exercising a butterfly strategy, when options are European/American)

What is the probability of a butterfly strategy of 3 calls on stock ABC with price 𝑆0 = 120 euros being

exercised, if the strike prices are 𝐾1 = 110, 𝐾2 = 125, 𝐾3 = 130 and option’s lifetime is 𝑇 = 6 𝑚𝑜𝑛𝑡ℎ𝑠

if we assume that the model of the price per share that follows is binomial with 2 periods in the

following cases:

a. All options are European

b. The options with 𝐾1 = 110, 𝐾3 = 130 are American but the second option is European?

c. All options are American?

We assume that the annualized volatility is 𝜎 = 20%.

Problem 3: (Binomial model for European option value when dividend is announced)

Suppose a stock has the value 𝑆0 = 100$ and a European call option is written for a lifetime of 9 months

and having strike 𝐾 = 110$. The underlying implied annual volatility is 𝜎 = 30% (without considering

dividends). A dividend is announced in 4 months, equal to 3$ which is given once a year. The annual

interest rates are assumed to be all 2% (flat term structure of benchmark risk-free rates, continuous

compounding).

a. What is the call option price if we use binomial model?

b. How does the dividend affect the call option value?

Solutions:

Problem 1:

a. The bull call spread is profitable if its payoff is greater than the initial cost.

We must therefore find the price of the bull call spread (long position on lower strike call option, short

position on the higher strike call option).

𝑒 𝑟Δ𝑡 −𝑑 1−0.995

The risk neutral probability is 𝑝 = 𝑢−𝑑

= 1.015−0.095 = 0.25

3525 3456 3388 3321 3256

𝑆𝑇 : ( )

0.3% 4.68% 21.09% 42.18% 31.64%

𝑐(𝑆0 , 𝑢, 𝑑, 𝑇 = 1 𝑦𝑟𝑠, 𝑁 = 4, 𝐾1 = 3250, 𝑟 = 0%) = 72

𝑐 (𝑆0 , 𝑢, 𝑑, 𝑇 = 1 𝑦𝑟𝑠 , 𝑁 = 4, 𝐾1 = 3390, 𝑟 = 0%) = 3.642 so the cost is 𝐼𝐶0 = 72 − 3.642 = 68.358

0, 𝑆𝑇 < 3250

So the payoff which is: 𝜙(𝑆𝑇 ) = {𝑆𝑇 − 3250, 𝑆𝑇 ∈ (3250,3390) has to be higher than 68.358 so the

140, 𝑆𝑇 > 3390

probability required is 𝑃(𝑆𝑇 > 3318.358) = 𝑃(𝑆𝑇 ∈ (𝑆0 𝑢4 , 𝑆0 𝑢3 𝑑, 𝑆0 𝑢2 𝑑2 , 𝑆0 𝑢𝑑3 )) = 1 −

𝑃 (𝑆𝑇 = 𝑆0 𝑑4 ) = 1 − 0.3164

b. The initial cost of the butterfly is 𝑐(𝐾1 = 3300; 𝑇 = 0.5 𝑦𝑟𝑠) − 2𝑐 (𝐾2 = 3325; 𝑇 = 0.5 𝑦𝑟𝑠) +

𝑐 (𝐾3 = 3350; 𝑇 = 0.5 𝑦𝑟𝑠) = 0

0, 𝑆𝑇 < 3300

𝑆𝑇 − 3300, 𝑆𝑇 ∈ (3300,3325)

𝜙(𝑆𝑇 ) = { ≥ 0 ⇔ 𝑆𝑇 ∈ 𝑅+

3350 − 𝑆𝑇 , 𝑆𝑇 ∈ (3300,3325)

0, 𝑆𝑇 > 3350

The required probability is therefore 100% = 1.

Problem 2:

At least one option should be exercised in order for the strategy to be activate so we seek 𝑃 (𝑆𝑇 > 110)

1 1

𝜎√ −𝜎√

The up and down factor are: 𝑢 = 𝑒 4

= 1.1051, 𝑑 = 𝑒 4

= 0.9048

The risk-neutral probability is 𝑝 = 0.4705

a. If all options are European, we need 𝑃 (𝑆2 > 110).

𝑆 𝑢2 = 146.56 𝑆0 𝑢𝑑 = 120 𝑆0 𝑑2 = 98.2476

But 𝑆2 : ( 0 )

𝑝2 2𝑝(1 − 𝑝) (1 − 𝑝)2

The desired result is 𝑃 (𝑆𝑇 > 110) = 𝑝2 + 2𝑝(1 − 𝑝) = 72.43%

b. Because we have no dividends, and the options are calls, it is not optimal to exercise early these

options. Therefore the result is identical with b.

Problem 3:

There are two methods of finding the price.

Method 1: Using the annualized continuous yield

3

The annual dividend yield is 𝑦𝑎𝑛𝑛 = 100 = 0.03. If we convert this to continuous yield we have that 1 +

𝑦𝑎𝑛𝑛 = 𝑒 𝑦𝑐𝑜𝑛𝑡 ⇒ 𝑦𝑐𝑜𝑛𝑡 = log(1 + 𝑦𝑎𝑛𝑛 ) = log (1.03)

𝑆0

We use the adjusted volatility: 𝜎𝑎𝑑𝑗 = 𝜎 ⋅ 𝑆 −𝑟𝑡𝐷 = 30.89%

0 −𝐷𝑒

Now, the up-factor would be, 𝑢 = 𝑒 𝜎𝑎𝑑𝑗 √Δ𝑡 = 1.1672 and 𝑑 = 0.8567 and the risk-neutral probability

𝑒 (𝑟−𝑞)Δ𝑡 −𝑑

of the stock going up is 𝑝 = 𝑢−𝑑

=47.92%

The possible values in 3 periods are: 𝑆0 𝑢3 , 𝑆0 𝑢, 𝑆0 𝑑, 𝑆0 𝑑3 = 159.01,116.72,85.67,62.88.

Out of these, only the first two values give favorable option exercise action and the probabilities of

being exercised are 𝑝 3 and 𝐶31 𝑝2 (1 − 𝑝) =0.11 and 0.3587 respectively.

So the option value is 𝐸 (max(𝑆𝑇 − 𝐾, 0)) = (𝑆0 𝑢3 − 𝐾)+ ⋅ 𝑝3 + (𝑆0 𝑢 − 𝐾)+ ⋅ 3𝑝2 (1 − 𝑝) +

(𝑆0 𝑑 − 𝐾, 0)+ ⋅ 𝑝(1 − 𝑝)2 + (𝑆0 𝑑3 − 𝐾)+ = 49.01 ⋅ 𝑝3 + 6.72 ⋅ 3𝑝2 (1 − 𝑝) = 5.36 where 𝑥 + =

max (𝑥, 0)

Method 2: Using adjusted stock value on the binomial tree

𝒂𝒅𝒋

𝑺𝟎 = 𝑆0 − 𝐷𝑒 −𝑟𝑡𝐷 =97.0199

𝜎𝑎𝑑𝑗 = 30.92%

0.3092

𝑢 = 𝑒 𝜎𝑎𝑑𝑗 √Δ𝑡 = 𝑒 2 = 1.1671, 𝑑 = 0.8567

𝑒 𝑟Δ𝑡 −𝑑

𝑝= 𝑢−𝑑

= 0.4775

We apply now the final step from method 1 by replacing 𝑆0 with 𝑆0𝑎𝑑𝑗 .

We obtain the result 5.89.

REMARK: We obtain different results because in the first method, the dividend adjustment does not

take into account the timing, while the second method uses the timing.

REMARK2: The larger the dividend, the cheaper should be the call option, because the expected value

of the underlying asset price will be lower, hence its probability of surpassing the level 𝑲.

You might also like

- Challenging Quality Scoring Models On Asset Allocation Strategies of EquitiesDocument14 pagesChallenging Quality Scoring Models On Asset Allocation Strategies of Equitiestheodor_munteanuNo ratings yet

- Using Machine Learning For Probability of DefaultDocument6 pagesUsing Machine Learning For Probability of Defaulttheodor_munteanuNo ratings yet

- Superreplication Cost of Derivatives Under Discrete Time Models RiskDocument55 pagesSuperreplication Cost of Derivatives Under Discrete Time Models Risktheodor_munteanuNo ratings yet

- Merton Model For Credit Risk and Stochastic CalculusDocument5 pagesMerton Model For Credit Risk and Stochastic Calculustheodor_munteanuNo ratings yet

- How Much Is A Smile Worth in An Exotic World of Equities?Document18 pagesHow Much Is A Smile Worth in An Exotic World of Equities?theodor_munteanuNo ratings yet

- Proba Finance Interview QuestionsDocument1 pageProba Finance Interview Questionstheodor_munteanuNo ratings yet

- Strategic Asset Allocation Using ESG & Credit ScoreDocument12 pagesStrategic Asset Allocation Using ESG & Credit Scoretheodor_munteanuNo ratings yet

- Quantitative Credit Risk Management ExamDocument4 pagesQuantitative Credit Risk Management Examtheodor_munteanuNo ratings yet

- Implied Risk Premia and Factor AllocationDocument54 pagesImplied Risk Premia and Factor Allocationtheodor_munteanuNo ratings yet

- Double Barrier Options PricingDocument3 pagesDouble Barrier Options Pricingtheodor_munteanuNo ratings yet

- Cheapest To Deliver BondDocument3 pagesCheapest To Deliver Bondtheodor_munteanuNo ratings yet

- French Language Build-UpDocument32 pagesFrench Language Build-Uptheodor_munteanuNo ratings yet

- Risky Bonds and CDS Valuation in PythonDocument10 pagesRisky Bonds and CDS Valuation in Pythontheodor_munteanuNo ratings yet

- Numerical Methods For Solutions of Equations in PythonDocument9 pagesNumerical Methods For Solutions of Equations in Pythontheodor_munteanuNo ratings yet

- Recursive LU Factorization of A Matrix in PythonDocument4 pagesRecursive LU Factorization of A Matrix in Pythontheodor_munteanuNo ratings yet

- Stochastic Calculus For Finance (Exam 5)Document24 pagesStochastic Calculus For Finance (Exam 5)theodor_munteanuNo ratings yet

- Stochastic Calculus For Finance (Exam 9)Document28 pagesStochastic Calculus For Finance (Exam 9)theodor_munteanuNo ratings yet

- Stochastic Calculus For Finance (Exam 4)Document14 pagesStochastic Calculus For Finance (Exam 4)theodor_munteanuNo ratings yet

- How Much Costs A Nobel Peace PrizeDocument2 pagesHow Much Costs A Nobel Peace Prizetheodor_munteanuNo ratings yet

- Numerical Methods To Solve Systems of Equations in PythonDocument12 pagesNumerical Methods To Solve Systems of Equations in Pythontheodor_munteanuNo ratings yet

- UN BlacklistDocument2 pagesUN Blacklisttheodor_munteanuNo ratings yet

- Stochastic Calculus For Finance (Exam 7)Document15 pagesStochastic Calculus For Finance (Exam 7)theodor_munteanuNo ratings yet

- Stochastic Calculus For Finance (Exam 2)Document13 pagesStochastic Calculus For Finance (Exam 2)theodor_munteanuNo ratings yet

- Stochastic Calculus For Finance (Exam 1)Document14 pagesStochastic Calculus For Finance (Exam 1)theodor_munteanuNo ratings yet

- Stochastic Calculus For Finance (Exam 11)Document14 pagesStochastic Calculus For Finance (Exam 11)theodor_munteanuNo ratings yet

- Stochastic Calculus For Finance (Exam 10)Document19 pagesStochastic Calculus For Finance (Exam 10)theodor_munteanuNo ratings yet

- Stochastic Calculus For Finance (Exam 6)Document13 pagesStochastic Calculus For Finance (Exam 6)theodor_munteanuNo ratings yet

- Stochastic Calculus For Finance (Exam 3)Document16 pagesStochastic Calculus For Finance (Exam 3)theodor_munteanuNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Competition Law and Guideliges For The Digital EnvironmentDocument8 pagesCompetition Law and Guideliges For The Digital EnvironmentVarshini PrabaharanNo ratings yet

- Accounting Integration: Management Advisory Services Jjaur 1 Microeconomics MAY 2022Document24 pagesAccounting Integration: Management Advisory Services Jjaur 1 Microeconomics MAY 2022Elle WoodsNo ratings yet

- Arbitrage in India: Past, Present and FutureDocument22 pagesArbitrage in India: Past, Present and FuturetushartutuNo ratings yet

- Strategy Index 10 UpdateDocument1 pageStrategy Index 10 UpdateChanuka PrabhashNo ratings yet

- Scale-Up Business Game ENDocument129 pagesScale-Up Business Game ENHermesOrestes0% (1)

- Annapurna Swadisht - PR - Final - 1808Document2 pagesAnnapurna Swadisht - PR - Final - 1808RajNo ratings yet

- Berkshire Hathaway Annual MeetingDocument18 pagesBerkshire Hathaway Annual Meetingbenclaremon100% (8)

- Various Types of Mutual Fund Schemes ExplainedDocument10 pagesVarious Types of Mutual Fund Schemes ExplainedKeyur ShahNo ratings yet

- Chapter One Investment Tast Bank SolutionDocument25 pagesChapter One Investment Tast Bank SolutionAbdelnasir HaiderNo ratings yet

- Samsung BSC AnalysisDocument13 pagesSamsung BSC AnalysisBernardus Alan Handoko100% (16)

- Mg309 Strategic Management: Name: Victoria Fisiihoi Student ID: S11152196 Campus: USP TongaDocument7 pagesMg309 Strategic Management: Name: Victoria Fisiihoi Student ID: S11152196 Campus: USP Tongavictoria fisiihoiNo ratings yet

- Voucher ID: 159979 Voucher ID: 159979 Voucher ID: 159979: Bank Copy School Copy ParentDocument1 pageVoucher ID: 159979 Voucher ID: 159979 Voucher ID: 159979: Bank Copy School Copy ParentAwc Mailbox0% (1)

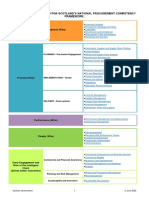

- Scottish Procurement Competency Framework June 2020Document42 pagesScottish Procurement Competency Framework June 2020መቅዲ ሀበሻዊትNo ratings yet

- Processes 06 00238 PDFDocument45 pagesProcesses 06 00238 PDFgoogley71No ratings yet

- 11..chapter 2Document29 pages11..chapter 2Hannan NadkarNo ratings yet

- Generic StrategiesDocument7 pagesGeneric StrategiesMagnus ColacoNo ratings yet

- Rawkat Literature ReviewDocument3 pagesRawkat Literature ReviewShadman Shahriar 1925389060No ratings yet

- FIN 440: International Finance: Larry Schrenk, Instructor Video 14.1 Multinational Capital BudgetingDocument23 pagesFIN 440: International Finance: Larry Schrenk, Instructor Video 14.1 Multinational Capital BudgetingYến NhiNo ratings yet

- Technical AnalysisDocument3 pagesTechnical AnalysisShalu PurswaniNo ratings yet

- How Digital Tools Can Help Transform African Agri-Food SystemsDocument9 pagesHow Digital Tools Can Help Transform African Agri-Food SystemsRodrigo GiorgiNo ratings yet

- (Media Planning) Chapter 5Document27 pages(Media Planning) Chapter 5NgocDiep NguyenNo ratings yet

- Managerial Economics: Geetika, Piyali Ghosh & Purbaroy ChoudhuryDocument3 pagesManagerial Economics: Geetika, Piyali Ghosh & Purbaroy ChoudhuryVidya Hegde KavitasphurtiNo ratings yet

- This Study Resource Was: Being Prepared: Unanticipated Dealings in The International MarketplaceDocument3 pagesThis Study Resource Was: Being Prepared: Unanticipated Dealings in The International Marketplaceakshita ramdasNo ratings yet

- Contoh Portfolio Digital MarketingDocument18 pagesContoh Portfolio Digital MarketingConan Edogawa Shinichi KudoNo ratings yet

- Ib SMB202 4Document108 pagesIb SMB202 4RanjitNo ratings yet

- An Article On Current Trends in Consumer BehaviourDocument2 pagesAn Article On Current Trends in Consumer BehaviourprashantNo ratings yet

- CH 12 - NEW! Mini Sim - AdvertisingDocument3 pagesCH 12 - NEW! Mini Sim - AdvertisingGene'sNo ratings yet

- Balance Growth - FinalDocument8 pagesBalance Growth - FinalMahendra ChhetriNo ratings yet

- Risk Management in Banks DDocument63 pagesRisk Management in Banks DAryan KumarNo ratings yet

- Learning About Trading PlatformDocument8 pagesLearning About Trading PlatformGuan ChuangNo ratings yet