Professional Documents

Culture Documents

Book 1

Uploaded by

M shahjamal Qureshi0 ratings0% found this document useful (0 votes)

6 views4 pagesOriginal Title

Book1.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesBook 1

Uploaded by

M shahjamal QureshiCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

AMMORTIZATION

LOAN AMMOUNT (BORROWING) 1000000

INTEREST 10%

PERIOD (n) 30

PAYMENT (PMT) ($106,079.25)

YEARS BEGINNING BALANCE PAYMENTS

0 1000000

1 1000000 ($106,079.25)

2 993920.751747366 ($106,079.25)

3 987233.578669469 ($106,079.25)

4 979877.688283782 ($106,079.25)

5 971786.208859526 ($106,079.25)

6 962885.581492845 ($106,079.25)

7 953094.891389495 ($106,079.25)

8 942325.132275811 ($106,079.25)

9 930478.397250758 ($106,079.25)

10 917446.9887232 ($106,079.25)

11 903112.439342886 ($106,079.25)

12 887344.435024541 ($106,079.25)

13 869999.630274361 ($106,079.25)

14 850920.345049163 ($106,079.25)

15 829933.131301445 ($106,079.25)

16 806847.196178956 ($106,079.25)

17 781452.667544218 ($106,079.25)

18 753518.686046006 ($106,079.25)

19 722791.306397972 ($106,079.25)

20 688991.188785136 ($106,079.25)

21 651811.059411015 ($106,079.25)

22 610912.917099483 ($106,079.25)

23 565924.960556797 ($106,079.25)

24 516438.208359843 ($106,079.25)

25 462002.780943194 ($106,079.25)

26 402123.810784879 ($106,079.25)

27 336256.943610733 ($106,079.25)

28 263803.389719172 ($106,079.25)

29 184104.480438456 ($106,079.25)

30 96435.6802296674 ($106,079.25)

INTEREST PAYMENT PRINCIPAL REPAYMENT ENDING BALANCE

0 0 1000000

100000 ($6,079.25) $993,920.75

99392.0751747366 ($6,687.17) $987,233.58

98723.3578669469 ($7,355.89) $979,877.69

97987.7688283782 ($8,091.48) $971,786.21

97178.6208859526 ($8,900.63) $962,885.58

96288.5581492845 ($9,790.69) $953,094.89

95309.4891389495 ($10,769.76) $942,325.13

94232.5132275811 ($11,846.74) $930,478.40

93047.8397250758 ($13,031.41) $917,446.99

91744.69887232 ($14,334.55) $903,112.44

90311.2439342886 ($15,768.00) $887,344.44

88734.4435024541 ($17,344.80) $869,999.63

86999.9630274361 ($19,079.29) $850,920.35

85092.0345049163 ($20,987.21) $829,933.13

82993.3131301446 ($23,085.94) $806,847.20

80684.7196178956 ($25,394.53) $781,452.67

78145.2667544218 ($27,933.98) $753,518.69

75351.8686046006 ($30,727.38) $722,791.31

72279.1306397972 ($33,800.12) $688,991.19

68899.1188785136 ($37,180.13) $651,811.06

65181.1059411015 ($40,898.14) $610,912.92

61091.2917099483 ($44,987.96) $565,924.96

56592.4960556797 ($49,486.75) $516,438.21

51643.8208359843 ($54,435.43) $462,002.78

46200.2780943194 ($59,878.97) $402,123.81

40212.3810784879 ($65,866.87) $336,256.94

33625.6943610733 ($72,453.55) $263,803.39

26380.3389719172 ($79,698.91) $184,104.48

18410.4480438456 ($87,668.80) $96,435.68

9643.5680229667 ($96,435.68) $0.00

RETIREMENT PLANNING FIND

DEPOSITS 1933.923 ?

WITHDRAWALS -10000

INTEREST RATE 10% 10%

DEPOSIT YEARS 15

WITHDRAWAL YEARS 10

YEARS DEPOSIT/WITHDRAWALS BEGINNING BALANCE

1 1933.922608805 0

2 1933.922608805 2127.3148696855

3 1933.922608805 4467.3612263396

4 1933.922608805 7041.4122186591

5 1933.922608805 9872.8683102106

6 1933.922608805 12987.4700109172

7 1933.922608805 16413.5318816944

8 1933.922608805 20182.1999395494

9 1933.922608805 24327.7348031899

10 1933.922608805 28887.8231531944

11 1933.922608805 33903.9203381994

12 1933.922608805 39421.6272417048

13 1933.922608805 45491.1048355609

14 1933.922608805 52167.5301888025

15 1933.922608805 59511.5980773683

16 -10000 67590.0727547906

17 -10000 63349.0800302697

18 -10000 58683.9880332966

19 -10000 53552.3868366263

20 -10000 47907.6255202889

21 -10000 41698.3880723178

22 -10000 34868.2268795496

23 -10000 27355.0495675046

24 -10000 19090.554524255

25 -10000 9999.6099766805

-100000 -6666.6666666667

INTEREST ENDING BALANCE

193.3923 2127.3148696855

406.1237 4467.3612263396

640.1284 7041.4122186591

897.5335 9872.8683102106

1180.679 12987.4700109172

1492.139 16413.5318816944

1834.745 20182.1999395494

2211.612 24327.7348031899

2626.166 28887.8231531944

3082.175 33903.9203381994

3583.784 39421.6272417048

4135.555 45491.1048355609

4742.503 52167.5301888025

5410.145 59511.5980773683

6144.552 67590.0727547906

5759.007 63349.0800302697

5334.908 58683.9880332966

4868.399 53552.3868366263

4355.239 47907.6255202889

3790.763 41698.3880723178

3169.839 34868.2268795496

2486.823 27355.0495675046

1735.505 19090.554524255

909.0555 9999.6099766805

-0.039 -0.4290256514

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Metro FastBet - How To Deposit or WithdrawDocument4 pagesMetro FastBet - How To Deposit or WithdrawMetroManilaTurf71% (56)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

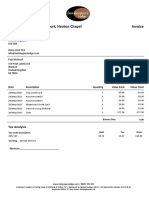

- Ahrefs Invoice AzqJJYTY53mgM1lGODocument2 pagesAhrefs Invoice AzqJJYTY53mgM1lGOlalatendu ParidaNo ratings yet

- Disbursement VoucherDocument3 pagesDisbursement VoucherRejane VidadNo ratings yet

- Carbon Pricing 2023Document78 pagesCarbon Pricing 2023Juni SianiparNo ratings yet

- The Effect of Agricultural Technology On The Speed of DevelopmentDocument16 pagesThe Effect of Agricultural Technology On The Speed of DevelopmentM shahjamal QureshiNo ratings yet

- HospitalDocument1 pageHospitalM shahjamal QureshiNo ratings yet

- RNK 2017Document42 pagesRNK 2017M shahjamal QureshiNo ratings yet

- Survey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicDocument3 pagesSurvey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicM shahjamal QureshiNo ratings yet

- Introduction MBR LabDocument2 pagesIntroduction MBR LabM shahjamal QureshiNo ratings yet

- Survey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicDocument3 pagesSurvey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicM shahjamal QureshiNo ratings yet

- Alishba BaigDocument3 pagesAlishba BaigM shahjamal QureshiNo ratings yet

- FM Lab Week 8Document2 pagesFM Lab Week 8M shahjamal QureshiNo ratings yet

- ASDFDocument5 pagesASDFM shahjamal QureshiNo ratings yet

- The Effect of Agricultural Technology On The Speed of DevelopmentDocument16 pagesThe Effect of Agricultural Technology On The Speed of DevelopmentM shahjamal QureshiNo ratings yet

- Book 3Document4 pagesBook 3M shahjamal QureshiNo ratings yet

- Cash+flow+estimation (14-1759)Document9 pagesCash+flow+estimation (14-1759)M shahjamal QureshiNo ratings yet

- Survey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicDocument3 pagesSurvey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicM shahjamal QureshiNo ratings yet

- HospitalDocument1 pageHospitalM shahjamal QureshiNo ratings yet

- Survey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicDocument3 pagesSurvey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicM shahjamal QureshiNo ratings yet

- Introduction MBR LabDocument2 pagesIntroduction MBR LabM shahjamal QureshiNo ratings yet

- Survey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicDocument3 pagesSurvey Questionnaire: Here Write The Name of You Dependent Variable-Main / The TopicM shahjamal QureshiNo ratings yet

- ASDFDocument5 pagesASDFM shahjamal QureshiNo ratings yet

- Cash+flow+estimation (14-1759)Document9 pagesCash+flow+estimation (14-1759)M shahjamal QureshiNo ratings yet

- FM Lab Week 8Document2 pagesFM Lab Week 8M shahjamal QureshiNo ratings yet

- Axis Bank transaction banking chargesDocument2 pagesAxis Bank transaction banking chargesBokulNo ratings yet

- PDIC Claim FormDocument2 pagesPDIC Claim FormCoolbuster.NetNo ratings yet

- Class 11 Computer-Science-Tm-Sample-MaterialsDocument111 pagesClass 11 Computer-Science-Tm-Sample-MaterialsmonishapanniNo ratings yet

- New Table of ContentsDocument4 pagesNew Table of ContentsSuvro AvroNo ratings yet

- Using Oracle's SOA Suite and Cash Management Within A Complex Banking EnvironmentDocument13 pagesUsing Oracle's SOA Suite and Cash Management Within A Complex Banking EnvironmentfloatingbrainNo ratings yet

- Tumkur Grain Merchants CoDocument35 pagesTumkur Grain Merchants CoAnand Sk100% (1)

- Sujan Raj Bhattarai Final Proposal Global IME - Draft - Rev - 2Document11 pagesSujan Raj Bhattarai Final Proposal Global IME - Draft - Rev - 2Pradip Kumar ShahNo ratings yet

- Statements Jan-23. 12Document3 pagesStatements Jan-23. 12Basmma EidNo ratings yet

- Innkeeper's Lodge Stockport, Heaton Chapel InvoiceDocument1 pageInnkeeper's Lodge Stockport, Heaton Chapel InvoiceAnonymous rUGTU2No ratings yet

- mPassBook - 20230114 - 20230413 - 6005 UNLOCKEDDocument3 pagesmPassBook - 20230114 - 20230413 - 6005 UNLOCKEDAshish kumarNo ratings yet

- FBI Interview of Veldora ArthurDocument9 pagesFBI Interview of Veldora ArthurThe Straw BuyerNo ratings yet

- Mission BkashDocument1 pageMission BkashNiaz AhmedNo ratings yet

- RBI/IBA approved CISP application formDocument3 pagesRBI/IBA approved CISP application formKushlendra SinhNo ratings yet

- Bank statement summary for Parikshit VatsalDocument8 pagesBank statement summary for Parikshit VatsalParikshit VatsalNo ratings yet

- Bangladesh banking general activitiesDocument7 pagesBangladesh banking general activitiesFozle Rabby 182-11-5893No ratings yet

- Leverage Ratio Definition Guide - Understand Debt to Equity, Equity Multiplier & MoreDocument3 pagesLeverage Ratio Definition Guide - Understand Debt to Equity, Equity Multiplier & MoreNiño Rey LopezNo ratings yet

- Module 3 Role of BSPDocument9 pagesModule 3 Role of BSPlord kwantoniumNo ratings yet

- What Is Money? and Its Types and Fuctions?Document2 pagesWhat Is Money? and Its Types and Fuctions?Marivic RamosNo ratings yet

- P1-01 Cash and Cash EquivalentsDocument5 pagesP1-01 Cash and Cash EquivalentsRachel LeachonNo ratings yet

- ConsolidatedStatementReport Mar2024Document15 pagesConsolidatedStatementReport Mar2024Sanjay KumarNo ratings yet

- Negotiable Instruments Case Digest 6 PDF FreeDocument50 pagesNegotiable Instruments Case Digest 6 PDF FreeJr MateoNo ratings yet

- Icici Bank LTDDocument64 pagesIcici Bank LTDumesh kumar sahuNo ratings yet

- Customer Satisfaction Towards Online Banking (A Study On Dinajpur City)Document102 pagesCustomer Satisfaction Towards Online Banking (A Study On Dinajpur City)Nokib Ahammed0% (1)

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- PBCOMDocument2 pagesPBCOMMarlon Carmel Beralde0% (1)

- Central Bank Policies in Mexico: Targets, Instruments, and PerformanceDocument28 pagesCentral Bank Policies in Mexico: Targets, Instruments, and PerformanceAdrian Alberto Martínez GonzálezNo ratings yet

- Savings Account Statement: Capitec B AnkDocument6 pagesSavings Account Statement: Capitec B Anksipho gumbiNo ratings yet