Professional Documents

Culture Documents

International Finance

Uploaded by

fendy0 ratings0% found this document useful (0 votes)

3 views2 pagesfinance course

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfinance course

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesInternational Finance

Uploaded by

fendyfinance course

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

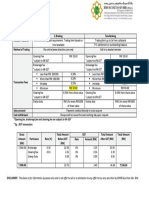

Subject: INTERNATIONAL FINANCE

Course objectives:

1. Introduction to the “International Finance”

- Multinational Corporations, Globalization Process, Financial Crises

- Theory of Comparative Advantages

2. Balance of Payments

- Commercial and Noncommercial Payments

- Structure of Balance of Payments

- Balance of Payments and Exchange Rate

3. Determination of Exchange Rate I

- Exchange Market, Exchange Market Law, Supply and Demand of Foreign

Currency, Speculations on the Exchange Market

- Exchange Rate Recording, Cross Rates, Arbitrage

4. Determination of Exchange Rate II

- Forward Rate, “One price” Law, Power Purchasing Parity (PPP), Exchange

Rate Deviation Index (ERDI),

- Inflation Differential, Import Duty, Import Contingents, Import/Export

Instruments

5. Fisher Effect, International Fisher Effect, Interest Rate Parity, Interest Rate

Differential

6. Theories of Exchange Rate

- Theory of Balance Payments

- Monetary Theory

- Dornbusch Dynamic Rule of Exchange Rate Overshooting

- Theory of Financial Assets

- Portfolio Theory

7. Future Spot Exchange Rates Forecasting on the Base of their Previous Development

- Fundamental and Technical Analysis

8. Financial Derivatives

- Futures Contracts, Forwards Contracts

9. Financial Derivatives

- Options Contracts, Swaps Contracts

10. International Investments

- Foreign Direct Investment (FDI), International Portfolio Investment

- Return of Individual Foreign Assets

- Risk and Return of Portfolio

- Markowitz Model

- CAPM – Capital Assets Pricing Model

- CML - Capital Market Line, SML- Security Market Line

11. European Monetary System

- European Monetary Integration: the Single Currency (Euro)

- The European Central Bank

12. International Monetary and Financial Institutions

- International Monetary Fund (IMF)

- World Bank (WB)

- Other Financial Institutions (IBRD, IFC, MIGA, IDA, BIS, EIB)

13. Payment System

- Payment Instruments

You might also like

- UBS Training #1Document243 pagesUBS Training #1Galen Cheng100% (15)

- Pine Script Language TutorialDocument70 pagesPine Script Language TutorialArinze Anozie83% (12)

- Pine Script Language TutorialDocument70 pagesPine Script Language TutorialArinze Anozie83% (12)

- Risk, Stop Loss and Position Size: Author ofDocument7 pagesRisk, Stop Loss and Position Size: Author offendy100% (1)

- Does Sector Rotation WorkDocument9 pagesDoes Sector Rotation WorkfendyNo ratings yet

- Mba IV International Financial Management (12mbafm426) NotesDocument149 pagesMba IV International Financial Management (12mbafm426) NotesHarjeet Singh100% (3)

- Capital Markets SyllabusDocument4 pagesCapital Markets SyllabusAdnan MasoodNo ratings yet

- Trading ViewDocument13 pagesTrading ViewfendyNo ratings yet

- Mba IV International Financial Management (12mbafm426) NotesDocument149 pagesMba IV International Financial Management (12mbafm426) Notesamoghvkini82% (17)

- Day Trading Videos and StrategiesDocument30 pagesDay Trading Videos and StrategiesfendyNo ratings yet

- Nism Currency Derivatives Study NotesDocument23 pagesNism Currency Derivatives Study NotesNavjyot Singh Cheema100% (1)

- Semester 4Document1 pageSemester 4Yash KumarNo ratings yet

- BA4T6F International Financial ManagementDocument1 pageBA4T6F International Financial ManagementRamkumarNo ratings yet

- International Finance & Risk ManagementDocument4 pagesInternational Finance & Risk ManagementJyoti WadakarNo ratings yet

- BBAFINSC505 - International FinanceDocument2 pagesBBAFINSC505 - International FinanceTushar PandeyNo ratings yet

- International FinanceDocument2 pagesInternational FinanceSK MunafNo ratings yet

- Intl Fin Course OverviewDocument2 pagesIntl Fin Course OverviewLakshmi RawatNo ratings yet

- Syllabus For Test On Awareness About Securities Market' of Phase I Securities MarketsDocument5 pagesSyllabus For Test On Awareness About Securities Market' of Phase I Securities MarketsManipal SinghNo ratings yet

- IFM SyllabusDocument1 pageIFM SyllabusNarayanan RamakrishnanNo ratings yet

- If SyllabusDocument2 pagesIf SyllabusraviNo ratings yet

- International Finance NotesDocument42 pagesInternational Finance NotesShilu MNo ratings yet

- Monetary and Financial Economic: 2 Année de La Grande Ecole de L'institut de RabatDocument23 pagesMonetary and Financial Economic: 2 Année de La Grande Ecole de L'institut de RabatIsmaîl TemsamaniNo ratings yet

- Banking: General Information Course ObjectivesDocument3 pagesBanking: General Information Course ObjectivesHammad MughalNo ratings yet

- 2021 - Lecture - 3 - Components of IFSDocument22 pages2021 - Lecture - 3 - Components of IFSBogdan BNo ratings yet

- GCM Mod 1Document9 pagesGCM Mod 1Chinmayee ChoudhuryNo ratings yet

- 421 Ifm - Question BankDocument1 page421 Ifm - Question BankJ.M Sai TejaNo ratings yet

- Syllabus Int FinanceDocument1 pageSyllabus Int FinanceSanjoli GuptaNo ratings yet

- AN INTRODUCTION TO INTERNATIONAL FINANCIAL, MONETARY AND BANKING SYSTEM - ShortDocument6 pagesAN INTRODUCTION TO INTERNATIONAL FINANCIAL, MONETARY AND BANKING SYSTEM - ShortNavidEhsanNo ratings yet

- Syllabus Faculty Economic and Business International Program For Islamic Economics and Finance (Ipief)Document4 pagesSyllabus Faculty Economic and Business International Program For Islamic Economics and Finance (Ipief)HegandNo ratings yet

- Introduction To Treasury ManagementDocument4 pagesIntroduction To Treasury ManagementClyncia PereiraNo ratings yet

- Core Specializations (: Banking, Finance and Insurance)Document2 pagesCore Specializations (: Banking, Finance and Insurance)likitha sNo ratings yet

- CH 18Document17 pagesCH 18Cruz RuiNo ratings yet

- 3rd Sem MBA - International FinanceDocument1 page3rd Sem MBA - International FinanceSrestha ChatterjeeNo ratings yet

- Chapter 6. Forgein Currency TransactionsDocument45 pagesChapter 6. Forgein Currency TransactionsAnh Nguyen MinhNo ratings yet

- INTERNATIONAL FINANCIAL MANAGEMENT GUIDEDocument34 pagesINTERNATIONAL FINANCIAL MANAGEMENT GUIDEDr RizwanaNo ratings yet

- Course II "International Financial Markets and Institutions"Document22 pagesCourse II "International Financial Markets and Institutions"Valentina OlteanuNo ratings yet

- Page - 1 Course Lecturer: Mr. Boyd Muleya BSC, Isp, Pgdipltm, Msc-Econfin, Mba-Financial MarketsDocument4 pagesPage - 1 Course Lecturer: Mr. Boyd Muleya BSC, Isp, Pgdipltm, Msc-Econfin, Mba-Financial MarketsKahbwe Kãytiencë ChamaNo ratings yet

- Fin Mar Prelim ReviewerDocument4 pagesFin Mar Prelim ReviewerGhillian Mae GuiangNo ratings yet

- Intro to International Finance ConceptsDocument1 pageIntro to International Finance ConceptsShivarajkumar JayaprakashNo ratings yet

- Inancial Ystem: Prof. Manoharan.MDocument10 pagesInancial Ystem: Prof. Manoharan.MKaran NarangNo ratings yet

- Paper 307 A - International Financial ManagementDocument103 pagesPaper 307 A - International Financial ManagementSwapnil SonjeNo ratings yet

- The Premises and Difficulties Related To Trade of Options in Financial Markets. Case Study of Republic of MoldovaDocument15 pagesThe Premises and Difficulties Related To Trade of Options in Financial Markets. Case Study of Republic of MoldovaTrifan_DumitruNo ratings yet

- MBA SyllabusDocument4 pagesMBA SyllabusMorerpNo ratings yet

- Syllabus International FinanceDocument1 pageSyllabus International FinanceRabin JoshiNo ratings yet

- Capital MarketsDocument4 pagesCapital MarketsMubashir KhanNo ratings yet

- Future of Derivatives in India: RATAN DEEP SINGH - 200628522Document52 pagesFuture of Derivatives in India: RATAN DEEP SINGH - 200628522Pranjal jainNo ratings yet

- Unit IDocument1 pageUnit IKarthik PrasathNo ratings yet

- IFMDocument2 pagesIFMtraderescortNo ratings yet

- Financial Markets and InstitutionsDocument16 pagesFinancial Markets and Institutionszeyad GadNo ratings yet

- Mcm4ef03 (190619)Document145 pagesMcm4ef03 (190619)PradeepNo ratings yet

- Finance (Yale Lecture 1)Document8 pagesFinance (Yale Lecture 1)kevintanyjNo ratings yet

- BBA SyllabusDocument8 pagesBBA SyllabussmartculboflacmNo ratings yet

- Globalization of Banking and Finance-I: DR HK PradhanDocument17 pagesGlobalization of Banking and Finance-I: DR HK PradhanBhargav Sri DhavalaNo ratings yet

- General OverviewDocument92 pagesGeneral OverviewGetachew AbrhaNo ratings yet

- Derivatives MarketsDocument13 pagesDerivatives Marketsfridabass3No ratings yet

- Chapter 6. Forgein Exchange RiskDocument18 pagesChapter 6. Forgein Exchange RiskHong NguyenNo ratings yet

- Uf1 - 3 - Medios de Pago Internacionales - Gestion de Riesgos en InglesDocument8 pagesUf1 - 3 - Medios de Pago Internacionales - Gestion de Riesgos en InglesJosemi CastellóNo ratings yet

- Solution Manual For Introduction To Finance Markets Investments and Financial Management Melicher Norton 15th EditionDocument16 pagesSolution Manual For Introduction To Finance Markets Investments and Financial Management Melicher Norton 15th EditionDanielPattersonqdgb100% (41)

- Chap 2-3 - 4 - 5 LTTCDocument24 pagesChap 2-3 - 4 - 5 LTTCQuyên NguyễnNo ratings yet

- Ch01 - Intro To Money and Financial SystemDocument16 pagesCh01 - Intro To Money and Financial SystemammendNo ratings yet

- Securities Market (Basic) Module CurriculumDocument2 pagesSecurities Market (Basic) Module CurriculumnavtejsbhriNo ratings yet

- Financial MarketsDocument19 pagesFinancial Marketslidiamarial9No ratings yet

- Nmba Ib 03Document1 pageNmba Ib 03shobhikatyagiNo ratings yet

- Global Securities Markets: ObjectivesDocument9 pagesGlobal Securities Markets: ObjectivesAkshayNo ratings yet

- 10 GSM - SB - 191104 PDFDocument9 pages10 GSM - SB - 191104 PDFAkshayNo ratings yet

- Risk in the Global Real Estate Market: International Risk Regulation, Mechanism Design, Foreclosures, Title Systems, and REITsFrom EverandRisk in the Global Real Estate Market: International Risk Regulation, Mechanism Design, Foreclosures, Title Systems, and REITsNo ratings yet

- Traders' Almanac: S&P 500 Index: Support Remains FirmDocument3 pagesTraders' Almanac: S&P 500 Index: Support Remains FirmfendyNo ratings yet

- Traders' Almanac: Soybean Oil - Breakout MoveDocument3 pagesTraders' Almanac: Soybean Oil - Breakout MovefendyNo ratings yet

- BM Construction Index - Rebound Likely Underway: Traders' AlmanacDocument3 pagesBM Construction Index - Rebound Likely Underway: Traders' AlmanacfendyNo ratings yet

- This Course Syllabus Provides A General Plan For The Course Deviations May Be NecessaryDocument6 pagesThis Course Syllabus Provides A General Plan For The Course Deviations May Be NecessaryfendyNo ratings yet

- Warren Buffett Way PDFDocument8 pagesWarren Buffett Way PDFIsrael ZepahuaNo ratings yet

- Bursa Malaysia Technology Index extends gainsDocument3 pagesBursa Malaysia Technology Index extends gainsfendy100% (1)

- NMM 2014 Fight Obesity Guidebook PDFDocument42 pagesNMM 2014 Fight Obesity Guidebook PDFIndecisiveGurlNo ratings yet

- T E: FIN 230: Rading and Xchanges Professor OslerDocument9 pagesT E: FIN 230: Rading and Xchanges Professor OslerfendyNo ratings yet

- Brent Crude Oil - Testing Critical Resistance: Traders' AlmanacDocument3 pagesBrent Crude Oil - Testing Critical Resistance: Traders' AlmanacfendyNo ratings yet

- BM Construction Index - Rebound Likely Underway: Traders' AlmanacDocument3 pagesBM Construction Index - Rebound Likely Underway: Traders' AlmanacfendyNo ratings yet

- KLCON Index Made A Critical Reversal Within Support Zones: Traders' AlmanacDocument3 pagesKLCON Index Made A Critical Reversal Within Support Zones: Traders' AlmanacfendyNo ratings yet

- Cs PDFDocument12 pagesCs PDFfendy100% (1)

- Nasdaq 100 Index: Stronger Base Has Been Established: Traders' AlmanacDocument3 pagesNasdaq 100 Index: Stronger Base Has Been Established: Traders' AlmanacfendyNo ratings yet

- TradersDocument7 pagesTradersfendyNo ratings yet

- TradersDocument3 pagesTradersfendyNo ratings yet

- IntroductionDocument36 pagesIntroductionfendyNo ratings yet

- Traders' Almanac: Palm Oil - The August RallyDocument7 pagesTraders' Almanac: Palm Oil - The August RallyfendyNo ratings yet

- Lecture 5Document15 pagesLecture 5fendyNo ratings yet

- BIMB SecuritiesDocument1 pageBIMB SecuritiesfendyNo ratings yet

- Movement of Money, Capital, and People: Lecture OutlineDocument13 pagesMovement of Money, Capital, and People: Lecture OutlinefendyNo ratings yet

- Movement of Money, Capital, and People: Lecture OutlineDocument13 pagesMovement of Money, Capital, and People: Lecture OutlinefendyNo ratings yet

- Lecture 5Document15 pagesLecture 5fendyNo ratings yet

- Explaining Divergent Economic Development Patterns After 1870Document11 pagesExplaining Divergent Economic Development Patterns After 1870fendyNo ratings yet

- Politics and The World Economy: Lecture Outline 1. Our Political Economy FrameworkDocument14 pagesPolitics and The World Economy: Lecture Outline 1. Our Political Economy FrameworkfendyNo ratings yet