Professional Documents

Culture Documents

Ar 3

Uploaded by

Jesebel AmbalesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ar 3

Uploaded by

Jesebel AmbalesCopyright:

Available Formats

PROBLEM 3

On January 1, 2013, Handsome Co. extended a loan to Beautiful Co. and received a five-year,

12%, P5,000,000 note. The amount extended resulted to a yield rate of 10%. The note calls for

annual interest to be paid every December 31.

Handsome received the 2013, 2014 and 2015 interest on schedule, however, during 2016,

Beautiful had been experiencing financial difficulties. On December 31, 2016, Beautiful was not

able to pay the interest. Handsome recorded the accrued interest for 2016.

Beautiful communicated to Handsome a revised payment scheme due to the recent financial

difficulty the entity had experience. The payment schedule included the following:

Beautiful will not be paying the interest anymore

The principal will be paid in four (4) equal instalments starting December 31, 2018

The effective interest rate on December 31, 2016 is 13%.

Note: round-off present value factors to 4 decimal places (i.e. x.xxxx)

Requirements:

1. What is the amount of loan extended to Beautiful Co.?

2. How much is the interest income for 2016?

3. What is the present value of the recoverable amount on December 31, 2016?

4. How much is the impairment loss?

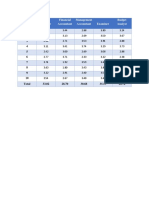

5. How much is the interest income for 2017, 2018, 2019, 2020, and 2021?

6. What is the balance of loan receivable as of December 31, 2017, 2018, 2019, 2020, and

2021?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ibaloi HousesDocument14 pagesIbaloi HousesJesebel Ambales50% (2)

- Ar 5Document1 pageAr 5Jesebel AmbalesNo ratings yet

- Ar 5Document1 pageAr 5Jesebel AmbalesNo ratings yet

- Ar 5Document1 pageAr 5Jesebel AmbalesNo ratings yet

- Ar 5Document1 pageAr 5Jesebel AmbalesNo ratings yet

- Ar 2Document1 pageAr 2Jesebel AmbalesNo ratings yet

- Standard Costing 2 PDFDocument59 pagesStandard Costing 2 PDFMariver LlorenteNo ratings yet

- A Guide To TRAIN RA10963 PDFDocument18 pagesA Guide To TRAIN RA10963 PDFJay Ryan Sy Baylon100% (2)

- Obtaining Audit Evidence on AssertionsDocument7 pagesObtaining Audit Evidence on AssertionsJesebel AmbalesNo ratings yet

- ItemsDocument1 pageItemsJesebel AmbalesNo ratings yet

- The Ethnic TraditionDocument25 pagesThe Ethnic TraditionMaricris BoteroNo ratings yet

- A Guide To TRAIN RA10963 PDFDocument18 pagesA Guide To TRAIN RA10963 PDFJay Ryan Sy Baylon100% (2)

- Audit Cash Equivalents ReportDocument3 pagesAudit Cash Equivalents ReportJesebel AmbalesNo ratings yet

- Moment of InertiaDocument11 pagesMoment of InertiaJesebel AmbalesNo ratings yet

- Standad CostingDocument4 pagesStandad CostingJesebel AmbalesNo ratings yet

- Train Law PDFDocument27 pagesTrain Law PDFLanieLampasaNo ratings yet

- Beam Deflection FormulaeDocument2 pagesBeam Deflection Formulae7575757575100% (6)

- 2012 APA Referencing 6th EditionDocument28 pages2012 APA Referencing 6th EditionJie Shiz PekNo ratings yet

- Income TaxDocument3 pagesIncome TaxJesebel AmbalesNo ratings yet

- Beam Deflection FormulaeDocument2 pagesBeam Deflection Formulae7575757575100% (6)