Professional Documents

Culture Documents

Project V 3visit Us at Management - Umakant.info

Uploaded by

welcome2jungleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project V 3visit Us at Management - Umakant.info

Uploaded by

welcome2jungleCopyright:

Available Formats

Project Report 2010

EXECUTIVE SUMMARY

The project ‘Marketing Equity Products to HNI Customers’ is done at Hedge

Equities Limited (mentioned here after as ‘Hedge’). Hedge has internally classified their

target market into nine categories based on two parameters; knowledge level of equity market

and investment capability. Individuals who are capable of investing more than 2 million in

equities are classified as a High Net worth Individual or HNI. Due to the influence of Kerala

cultural traits, equity investment is considered as a gambling and not understood as a real

investment opportunity among the investors. Studies show that only 5% of keralites are

investing in equity. Similar is the case with the HNIs. So here I am trying to find out the

customer preference while they go for an investment decision and the factors influencing the

selection with special reference to the HNI customers in and around Cochin, who are

currently reluctant to equity investments.

But for an efficient study we have to identify whether these factors actually have an

influence on people. So an exploratory research has been conducted and the main factors

which influence the people have been identified and with that further study has been carried

out. The method adopted in the study is mostly of exploratory and analytical. Explorative

research design is flexible enough to permit the consideration of many different aspects of a

phenomenon. It is highly unstructured. Primary data was collected through interviews and

well designed and purposefully created questionnaire Secondary data was collected by means

of magazines, text books, company documents, company website and other related websites.

The sample population to be surveyed was provided from the internal database of Hedge. The

consumer responses are analyzed with the help of tables and are presented graphically.

The results of the study shows that the most preferred investment avenues of the

target group are bank fixed deposits, real estate and gold. The lack of knowledge in the equity

investment is found to be one of the major barriers in investing. The company has to position

itself as a friendly advisor imparting more knowledge to customers. Consumer education

camps and workshops on equity investment can serve these purposes. Empowered customers

can be attracted to invest in equities once the fear factor is eliminated from their minds. Also

it was found that the investment goals of different age group differ. Hence for an effective

marketing and generating consumer interest, the company should design its products to cater

the individual needs of the customers.

School of Management Studies, CUSAT Page | 1

Project Report 2010

1.1. Introduction

Wealth management addresses the need of managing the assets of high net-worth

individuals to meet their financial goals. Investment means conversion of cash or money into

a monetary asset or a claim on future money for a return. The return is for saving, parting

with saving or liquidity and for taking a risk involving uncertainty of return, time of waiting

and cost of getting funds back. Financial investment refers to the exchange of financial

claims like stocks, bonds mortgages and real estate.

High Net-worth Individual (HNI) is defined as those people with a potential of more

than INR 2 million to invest in equities alone. These individuals form the top end of market

and exhibits very particular buying behavior. The service delivery standard is as important as

the quality of the offering. It is also important that the offering must be customized to

develop brand loyalty among the customers. Hence marketing is more a relation building

process.

Investment choices or decisions are found to be the outcome of three different but

related classes of factors. They may be described as factual or information premises,

Expectation premise and valuation premise. The factual premise of investment decisions are

provided by many streams of data which taken together, represent to an investor the

observable environment and general as well as particular features of securities and firms and

firms in which they invest. The expectation premise argues that outcomes of alternative

investments are subjective and hypothetical in any case but their foundations are provided by

the environment and the financial facts available to the investor. The valuation premise on the

other hand refers to the structure of subjective for the size and regularity of income to be

received and safety and negotiability of specific investments or combination of investments.

1.2. The Investment Needs of an Investor

By and large, most investors have eight common needs from their investments:

1. Security of Original Capital;

2. Wealth Accumulation

3. Comfort Factor;

4. Tax Efficiency;

5. Life Cover;

School of Management Studies, CUSAT Page | 2

Project Report 2010

6. Income;

7. Simplicity;

8. Liquidity or Ease of Withdrawal;

1.3. Financial Planning

1.3.1. Need for Financial Planning

Everyone needs to plan for tomorrow. As an individual, every one of us is

often confronted with a number of diverse financial goals. These goals could

include: available cash for emergencies, education for children, care for family

members, retirement, a nest egg to permit a career change, acquiring or selling

business, estate planning, financial independence or personal objectives such

as a special vacation or a second home.

Financial planning helps as individual to develop well-defined goals and to

map out appropriate strategies to turn these dreams into reality. Financial

planning requires a thorough analysis of an individual’s current position

including issues such as your will, marital status, contractual obligations and

any personnel preferences. It also requires an in-depth knowledge of the

various options that are available, and the financial, tax and legal consequence

of each.

1.3.2. Role of Hedge in Investment Advisory

These days many banks are proving investment advisory services to

individuals. The investment advisory services of banks provide the investors

with comprehensive financial advice. This is because most of the private

banks offer advice on a gamut of products right from bank fixed deposits to

equities. Moreover they can be ideal partners in the life cycle financial

planning process of individuals as they can also guide the individual on their

requirements for loans in addition to offering them advice on their assets.

Banks have now become one stop shop for financial services, selling mutual

School of Management Studies, CUSAT Page | 3

Project Report 2010

funds, insurance policies and brokerage services for equities, derivatives and

commodities

1.3.3. Steps in Financial Planning

a. Identifying investment objectives of an individual

Investment Objectives

Short term goals Medium term goals Long term goals

b. Determining risk tolerance of an individual

c. Evaluating current financial position of the individual in terms of his

income, expenditure, assets and liabilities

d. Current investment portfolio

1.4. Different Investment Avenues

The problem of surplus gives rise to the question of where to invest. In the past

investment avenues were limited to real estate, post office schemes and Banks. At present

wide variety of investment avenues are open for investors to choose from. The knowledge

about the different avenues enables the investor to choose intelligently. The required level

of interest and the risk tolerance level decide the investor’s choice.

Fixed Deposits – They cover the fixed deposits of varied tenors offered by the commercial

banks and other non-banking financial institutions. These are generally a low risk

prepositions as the commercial banks are believed to return the amount due without

default. By and large these FDs are the preferred choice of risk-averse Indian investors

who rate safety of capital & ease of investment above all parameters. Largely, these

investments earn a marginal rate of return of 6-8% per annum.

Government Bonds – The Central and State Governments raise money from the market

through a variety of Small Saving Schemes like national saving certificates, Kisan Vikas

Patra, Post Office Deposits, Provident Funds, etc. These schemes are risk free as the

School of Management Studies, CUSAT Page | 4

Project Report 2010

government does not default in payments. But the interest rates offered by them are in the

range of 7% - 9%.

Money-back insurance - Insurance in India is mostly sold and bought as investment

products. They are preferred because of their add-on benefits like financial life-cover, tax-

savings and satisfactory returns. Even if one does not manage to save money and invest

regularly in financial instruments, with insurance, the policyholder has no choice. If he

does not pay his premiums on time, his insurance cover will lapse. Money-back Insurance

schemes are used as investment avenues as they offer partial cash-back at certain intervals.

This money can be utilized for children’s education, marriage, etc.

Endowment Insurance – These policies are term policies. Investors have to pay the

premiums for a particular term, and at maturity the accrued bonus and other benefits are

returned to the policyholder if he survives at maturity.

Bullion Market – Precious metals like gold and silver had been a safe haven for Indian

investors since ages. Besides ornamental purpose, these metals are used for investment

purposes also. Since last 1 year, both Gold and Silver have highly appreciated in value

both in the domestic as well as the international markets. In addition to its attributes as a

store of value, the case for investing in gold revolves around the role it can play as a

portfolio diversifier.

Stock Market – Indian stock markets particularly the BSE and the NSE, had been a

preferred destination not only for the Indian investors but also for the Foreign investors.

Although Indian Markets had been through tough times due to various scams, but history

shows that they recovered very fast. Many types of scrip had been value creators for the

investors. People have earned fortunes from the stock markets, but there are people who

have lost everything due to incorrect timings or selection of fundamentally weak

companies.

Real Estate- Returns are almost guaranteed because property values are always on the rise

due to a growing world population. Residential real estate is more than just an investment.

There are more ways than ever before to profit from real estate investment.

School of Management Studies, CUSAT Page | 5

Project Report 2010

Mutual Funds - There is a collection of investors in Mutual funds that have professional

fund managers that invest in the stock market collectively on behalf of investors. Mutual

funds offer a better route to investing in equities for lay investors. A mutual fund acts like a

professional fund manager, investing the money and passing the returns to its investors. All

it deducts is a management fee and its expenses, which are declared in its offer document.

Unit Linked Insurance Plans - ULIPs are remarkably alike to mutual funds in terms of

their structure and functioning; premium payments made are converted into units and a net

asset value (NAV) is declared for the same. In traditional insurance products, the sum

assured is the corner stone; in ULIPs premium payments is the key component.

Exhibit 1. Types of Investments

School of Management Studies, CUSAT Page | 6

Project Report 2010

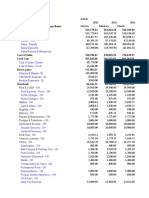

Exhibit 2: Characteristics of Different Investment Avenues

Volatilit

Return Safety Liquidity Convenience

y

Equity High Low High High Moderate

Moderat Moderat

Bonds High Moderate High

e e

Moderat Moderat

Debenture Moderate Low Low

e e

s

Moderat

Co. FDs Low Low Low Moderate

e

Bank

Low High Low High High

Deposits

Moderat

PPF High Low Moderate High

e

Life

Insuranc Low High Low Low Moderate

e

Moderat Moderat

Gold High Moderate Gold

e e

Real

High Moderate High Low Low

Estate

Mutual Moderat

High High High High

Funds e

1.5. Asset Allocation

School of Management Studies, CUSAT Page | 7

Project Report 2010

An essential ingredient of any model trying to understand the optimum allocation of

assets or trading behavior is an assumption about investor preferences according to well

defined risk profiles or about how investors evaluate risky gambles. The prospect theory

argues that when choosing between gambles, people compute the gains and losses for each

one and select the one with the highest prospective utility. In the financial context, the

potential gains and losses in the value of their holdings and then taking the allocation with

the prospective utility.

Another possibility is that people rationally could consider only consumption related

utility. Some investors know that the right thing to do when considering a stock market that

the right thing to do when considering a stock market investment is to merge the stock

market.

1.5.1. Investor Profiling

Investor profiling consist primarily in understanding a client’s risk tolerance

in relation to his or her current financial situation and future financial needs, and

proposing the most appropriate risk profile and related investment strategy.

Risk profiling is a well established, scientific and robust way of profiling

risk among investors. Research has established clear relationships between

demographic attributes of investors and their investment risk appetite. It aims at

understanding the client’s attitude towards risk and expectations of returns so as

to be able to serve him/her better. Hedge equities have already conducted the

market research and have categorized target customers to 9 categories based on

two parameters; financial background and knowledge in equity investment,

which varies among high, medium and low.

1.5.2. Asset Allocation and Hedge Equities

Hedge equities should act as platform for the investors managing their

assets to meet their needs, in other words Hedge should convert itself as an

investment manager of the investors. The asset allocation decision is the most

crucial one for an investment manager because it plays such an important role in

determining investment performance and shaping the manager client

relationship. The following precepts underlie the asset allocation decision:

School of Management Studies, CUSAT Page | 8

Project Report 2010

The client and the manager should decide on it together.

Risk is a primary determinant of assets mix because it is of great

concern to clients.

The major role of the advisor is to be able to present the client with

probable risk return characteristics of various asset mixes so that the

client can make an informed decision

It can also be seen that greater is the allocation to the equities, greater is the

volatility of the portfolio.

The asset allocation decision chosen by the individual is generally

influenced by the following factors:

1. The market outlook (a bearish market outlook translates into

conservative asset mix).

2. Time horizon (longer horizons translates into greater equity exposure)

3. If an inherited portfolio is heavily concentrated in a few securities,

begin to diversify immediately

4. Communicate regularly with the client explaining all transactions

especially when losses have occurred.

Thus to perform the asset allocation, the Hedge equities will require the

following information

The client’s objectives and constraints, including: time horizon,

liquidity needs, tax and regulatory consideration

Forecast of returns of each asset class

Estimates of risk for each asset class

Estimates of correlations between asset classes

1.6. Characteristics of Marketing Financial Products to HNI

School of Management Studies, CUSAT Page | 9

Project Report 2010

Marketing products to HNIs is one of the hardest hobs of any marketing person. It is

very difficult to convince the target customers and the competition also will be pretty high.

Some of the characteristics and behavior shown by the affluent people is described below.

Expertise – Many affluent individuals are skeptical about the ability of others to

make better decisions than they do. Financial advisors must demonstrate superior knowledge

and experience in their area. Prospects in their 40s are more likely to defer to recognized

authorities; but prospects in their 50s are more likely to see themselves as the best judge. It is

not necessary for an advisor to be an expert in all areas of service to the client. It is necessary

for the advisor to be able to bring in specialized expertise seamlessly when it is needed.

Informed Decision Making – Few affluent individuals want to turn financial

management or decisions over to another party. Many prefer to be educated as to the process

and the choices in a time-efficient manner, and to stay in control of the decision-making

process.

Access to a Wide Variety of Products – Many affluent individuals want access to

the widest possible variety of products and product providers, rather than proprietary

products. The intelligent firm may offer its own funds or products, but will also have the

flexibility to go into the market and access any product the client may desire.

Approach – Introductions by mail are more successful than by phone, but the

approach must be highly personalized, not an obvious form letter. There is some secretarial

screening to be overcome, but widespread warm response to personalized, signed, stamped

letters. Some are receptive to highly targeted, well thought-out brochures – but they must be

brief, direct, to the point. Given their high net worth status, these individuals receive many

solicitations every week from telemarketers who all sound like they went to the same school.

The main point is to differentiate your approach, and to demonstrate sensitivity and

thoughtfulness.

Holistic Orientation – High net worth individuals typically have complex financial

profiles. Most advisors focus on their own functional area of expertise. The advisor who can

integrate and coordinate different aspects of the client’s situation – who can see to the

implementation of recommendations – provides a valuable and rare service.

Seminars – The affluent generally eschew the typical marketing seminars many

professionals use to get clients. The topics are often considered either too simplistic or simply

not applicable. They are receptive, however, to seminars on topics that are tailored to their

unique situation.

School of Management Studies, CUSAT Page | 10

Project Report 2010

Newsletters – They give a similar response to the average advisor newsletter that they

do to the typical seminar. They do value original research and publications of substance

Relationship with Advisor – The affluent value a strong bond of trust with their

advisors, and turnover can be very touchy. They expect their advisors to act as their

advocates. They also expect the advisor to actively suggest ideas or opportunities and make

them aware of new products or services that may be of benefit to them. For the most part, age

and gender of the advisor does seem not to matter, but affluent women may sometimes feel

patronized by older, male contacts.

1.7. Background of the study

In Kerala, in the influence of some cultural traits, equity investment is considered as a

gambling and not understood as a real investment opportunity among the common masses.

Investment is mainly conformed to bank FD, real estate and gold. Market studies show that

only 5% of keralites are investing in equity. This peculiarity in investment choices is also

exhibited among the HNIs.

Hedge has internally classified their target market into nine categories based on two

parameters; knowledge level of equity market and investment capability. One category

comprises of that category of people who has high fund availability vis. more than 2 million

to invest in equity alone but is not currently investing due to some factors like lack of

confidence in investing, bitter experiences in the past etc. This segment comprises of a major

portion of the HNI population of Kerala. The study was commissioned to study the

investment behavior of the people in this category and formulate an appropriate strategy to

attract them to equity investment

1.8. Nature of the study

The method adopted in the study is mostly of exploratory and analytical. Both

primary and secondary data have been used for the study. The collection of primary data has

been attempted through (i) questionnaires (ii) methods of personal interview and

observations. The secondary data have also been supplemented at appropriate places

In the primary analysis it was seen that the major factor that prevents customers from

investing in equity is the lack of knowledge in the stock market procedures. People tend to

invest in those avenues to which they are familiar. For an efficient study we have to identify

School of Management Studies, CUSAT Page | 11

Project Report 2010

whether these factors actually have an influence on people. So an exploratory research has

been conducted and the main factors which influence the people have been identified and

with that further study has been carried out.

1.9. Objectives of the study

The present study entitled “Marketing Equity Products to HNI Customers” is

undertaken with the following objectives:

1. To analyze the preferred avenues of investment by HNIs.

2. To identify the factors influencing the investment decision.

3. To formulate a marketing strategy to convert non-investors to investors in equity

market

1.10 Research Methodology

The method adopted in the study is mostly of exploratory and analytical. Both

primary and secondary data have been used for the study. The collection of primary data has

been attempted through

Methods of personal interview and observations.

Schedules

The secondary data have also been supplemented at appropriate places.

1.10.1. Tools used for data collection and analysis

1. Interview

Interviews with the top management and the relationship managers of the Hedge was

done to understand the current market scenario

2. Schedule

A schedule was developed in which each question and the options were explained to

the respondents and response was noted.

3. Graph

Pie charts and bar diagrams are used for the present study to summarize the data

collected from the study.

4. Simple percentage analysis

School of Management Studies, CUSAT Page | 12

Project Report 2010

This method is used to make comparisons between two or more series of data.

Relative differences can be easily found out with this method.

1.10.2. Collection of Data

Primary Data

Primary data was collected through interviews and well designed and purposefully

created schedules.

Secondary Data

Secondary data was collected by means of magazines, text books, company documents,

company website and other related websites.

1.10.3 Sampling Frame

In the current study the sampling frame was the high net-worth or affluent individuals

who are not investing or afraid of investing in equities. It was selected from the internal

database of Hedge.

1.10.4 Sampling Unit

The sampling unit was selected on the basis of proportional stratified sampling. So the

total population is divided into four on the basis of their age. Age was taken as a criterion

because the risk appetite and investment goals of people vary with their age. From each

stratum, the respondents are selected by the convenience sampling method.

1.10.5 Sampling Size

The selected sample size was 50 comprising of 12 people under the age of 30, 13

respondents between 30 & 45, 13 respondents between 45 & 60 and 12 respondents with age

above 60.

1.10.6 Limitations of the study

School of Management Studies, CUSAT Page | 13

Project Report 2010

1. The analysis of the study has mainly depended on the personal views of the

respondents and as such an element of subjectivity can’t be ruled out

2. For convenience the respondents chosen were those who are residing around

Cochin city limit and the findings can’t be generalised to all areas.

3. The period of the study was limited to two months; this period was too short for

conducting broad and deep study.

4. All limitations pertaining to the schedule method might also affect the study.

5. The sample size is short.

School of Management Studies, CUSAT Page | 14

Project Report 2010

2.1. INTRODUCTION

In general, the financial market divided into two parts, Money market and capital

market. Securities market is an important, organized capital market where transaction of

capital is facilitated by means of direct financing using securities as a commodity. Securities

market can be divided into a primary market and secondary market.

PRIMARY MARKET

The primary market is an intermittent and discrete market where the initially listed

shares are traded first time, changing hands from the listed company to the investors. It refers

to the process through which the companies, the issuers of stocks, acquire capital by offering

their stocks to investors who supply the capital. In other words primary market is that part of

the capital markets that deals with the issuance of new securities. Companies, governments or

public sector institutions can obtain funding through the sale of a new stock or bond issue.

This is typically done through a syndicate of securities dealers. The process of selling new

issues to investors is called underwriting. In the case of a new stock issue, this sale is called

an initial public offering (IPO). Dealers earn a commission that is built into the price of the

security offering, though it can be found in the prospectus.

SECONDARY MARKET

The secondary market is an on-going market, which is equipped and organized with a

place, facilities and other resources required for trading securities after their initial offering. It

refers to a specific place where securities transaction among many and unspecified persons is

carried out through intermediation of the securities firms, i.e., a licensed broker, and the

exchanges, a specialized trading organization, in accordance with the rules and regulations

established by the exchanges.

A bit about history of stock exchange they say it was under a tree that it all started in

1875.Bombay Stock Exchange (BSE) was the major exchange in India till 1994.National

Stock Exchange (NSE) started operations in 1994.

NSE was floated by major banks and financial institutions. It came as a result of

Harshad Mehta scam of 1992. NSE was the first to introduce electronic screen based trading.

BSE was forced to follow suit. The present day trading platform is transparent and gives

School of Management Studies, CUSAT Page | 15

Project Report 2010

investors prices on a real time basis. With the introduction of depository and mandatory

dematerialization of shares chances of fraud reduced further. A typical trading day starts at 9

ending at 3.30, Monday to Friday. BSE has 30 stocks which make up the Sensex .NSE has 50

stocks in its index called Nifty. FII s Banks, financial institutions mutual funds are biggest

players in the market. Then there are the retail investors and speculators. The last ones are the

ones who follow the market morning to evening; Market can be very addictive like blogging

though stakes are higher in the former.

2.2. BRIEF HISTORY OF STOCK EXCHANGES

The origin of India's premier stock exchange Bombay Stock Exchange (BSE) trace

back to as far as 125 years when it started as a voluntary non-profit making association.

Stocks of public limited companies are bought and sold at a stock exchange. A stock

exchange is an organized marketplace for securities (like stocks, bonds, options) featured by

the centralization of supply and demand for the transaction of orders by member brokers, for

institutional and individual investors. The exchange makes buying and selling easy.

ORIGIN OF INDIAN STOCK MARKET

The origin of the stock market in India goes back to the end of the eighteenth century

when long-term negotiable securities were first issued. However, for all practical purposes,

the real beginning occurred in the middle of the nineteenth century after the enactment of the

companies Act in 1850, which introduced the features of limited liability and generated

investor interest in corporate securities.

An important early event in the development of the stock market in India was the

formation of the native share and stock brokers 'Association at Bombay in 1875, the

precursor of the present day Bombay Stock Exchange. This was followed by the formation of

associations/exchanges in Ahmedabad (1894), Calcutta (1908), and Madras (1937). In

addition, a large number of ephemeral exchanges emerged mainly in buoyant periods to

recede into oblivion during depressing times subsequently.

Stock exchanges are intricacy inter-woven in the fabric of a nation's economic life.

Without a stock exchange, the saving of the community- the sinews of economic progress

and productive efficiency- would remain underutilized. The task of mobilization and

allocation of savings could be attempted in the old days by a much less specialized institution

than the stock exchanges. But as business and industry expanded and the economy assumed

School of Management Studies, CUSAT Page | 16

Project Report 2010

more complex nature, the need for 'permanent finance' arose. Entrepreneurs needed money

for long term whereas investors demanded liquidity – the facility to convert their investment

into cash at any given time. The answer was a ready market for investments and this was how

the stock exchange came into being.

Stock exchange means a body of individuals, whether incorporated or not, constituted

for the purpose of regulating or controlling the business of buying, selling or dealing in

securities. These securities include:

(i) Shares, scrip, stocks, bonds, debentures stock or other marketable securities of a like

nature in or of any incorporated company or other body corporate;

(ii) Government securities; and

(iii) Rights or interest in securities.

The Bombay Stock Exchange (BSE) and the National Stock Exchange of India Ltd

(NSE) are the two primary exchanges in India. In addition, there are 22 Regional Stock

Exchanges. However, the BSE and NSE have established themselves as the two leading

exchanges and account for about 80 per cent of the equity volume traded in India. The NSE

and BSE are equal in size in terms of daily traded volume. The average daily turnover at the

exchanges has increased from Rs 851 crore in 1997-98 to Rs 1,284 crore in 1998-99 and

further to Rs 2,273 crore in 1999-2000 (April - August 1999). NSE has around 1500 shares

listed with a total market capitalization of around Rs 9, 21,500 crore.

The BSE has over 6000 stocks listed and has a market capitalization of around Rs 9,

68,000 crore. Most key stocks are traded on both the exchanges and hence the investor could

buy them on either exchange. Both exchanges have a different settlement cycle, which allows

investors to shift their positions on the bourses. The primary index of BSE is BSE Sensex

comprising 30 stocks. NSE has the S&P NSE 50 Index (Nifty) which consists of fifty stocks.

The BSE Sensex is the older and more widely followed index.

Both these indices are calculated on the basis of market capitalization and contain the heavily

traded shares from key sectors. The markets are closed on Saturdays and Sundays. Both the

exchanges have switched over from the open outcry trading system to a fully automated

School of Management Studies, CUSAT Page | 17

Project Report 2010

computerized mode of trading known as BOLT (BSE on Line Trading) and NEAT (National

Exchange Automated Trading) System.

It facilitates more efficient processing, automatic order matching, faster execution of

trades and transparency; the scrip's traded on the BSE have been classified into 'A', 'B1', 'B2',

'C', 'F' and 'Z' groups. The 'A' group shares represent those, which are in the carry forward

system. The 'F' group represents the debt market (fixed income securities) segment. The 'Z'

group scrip's are the blacklisted companies. The 'C' group covers the odd lot securities in 'A',

'B1' & 'B2' groups and Rights renunciations. The key regulator governing Stock Exchanges,

Brokers, Depositories, Depository participants, Mutual Funds, FIIs and other participants in

Indian secondary and primary market is the Securities and Exchange Board of India (SEBI)

Ltd.

2.3. REGULATION OF BUSINESS IN THE STOCK EXCHANGES

Under the SEBI Act, 1992, the SEBI has been empowered to conduct inspection of

stock exchanges. The SEBI has been inspecting the stock exchanges once every year since

1995-96. During these inspections, a review of the market operations, organizational structure

and administrative control of the exchange is made to ascertain whether: the exchange

provides a fair, equitable and growing market to investors the exchange's organization,

systems and practices are in accordance with the Securities Contracts (Regulation) Act

(SC(R) Act), 1956 and rules framed there under the exchange has implemented the

directions, guidelines and instructions issued by the SEBI from time to time. The exchange

has complied with the conditions, if any, imposed on it at the time of renewal/ grant of its

recognition under section 4 of the SC(R) Act, 1956.

During the year 1997-98, inspection of stock exchanges was carried out with a special

focus on the measures taken by the stock exchanges for investor's protection. Stock

exchanges were, through inspection reports, advised to effectively follow-up and redress the

investors' complaints against members/listed companies. The stock exchanges were also

advised to expedite the disposal of arbitration cases within four months from the date of

filing.

During the earlier years' inspections, common deficiencies observed in the

functioning of the exchanges were delays in post trading settlement, frequent clubbing of

settlements, delay in conducting auctions, inadequate monitoring of payment of margins by

School of Management Studies, CUSAT Page | 18

Project Report 2010

brokers, non-adherence to Capital Adequacy Norms etc. It was observed during the

inspections conducted in 1997-98 that there has been considerable improvement in most of

the areas, especially in trading, settlement, collection of margins etc.

Dematerialization

Dematerialization in short called as 'demat' is the process by which an investor can get

physical certificates converted into electronic form maintained in an account with the

Depository Participant. The investors can dematerialize only those share certificates that are

already registered in their name and belong to the list of securities admitted for

dematerialization at the depositories.

Depository: The organization responsible to maintain investor's securities in the electronic

form is called the depository. In other words, a depository can therefore be conceived of as a

"Bank" for securities. In India there are two such organizations viz. NSDL and CDSL. The

depository concept is similar to the Banking system with the exception that banks handle

funds whereas a depository handles securities of the investors. An investor wishing to utilize

the services offered by a depository has to open an account with the depository through

Depository Participant.

Depository Participant: The market intermediary through whom the depository services can

be availed by the investors is called a Depository Participant (DP). As per SEBI regulations,

DP could be organizations involved in the business of providing financial services like banks,

brokers, custodians and financial institutions. This system of using the existing distribution

channel (mainly constituting DPs) helps the depository to reach a wide cross section of

investors spread across a large geographical area at a minimum cost. The admission of the

DPs involves a detailed evaluation by the depository of their capability to meet with the strict

service standards and a further evaluation and approval from SEBI. Realizing the potential,

all the custodians in India and a number of banks, financial institutions and major brokers

have already joined as DPs to provide services in a number of cities .

Advantages of a depository services:

Trading in demat segment completely eliminates the risk of bad deliveries. In case of

transfer of electronic shares, you save 0.5% in stamp duty. Avoids the cost of courier/

School of Management Studies, CUSAT Page | 19

Project Report 2010

notarization/ the need for further follow-up with your broker for shares returned for company

objection No loss of certificates in transit and saves substantial expenses involved in

obtaining duplicate certificates, when the original share certificates become mutilated or

misplaced.

Lower interest charges for loans taken against demat shares as compared to the

interest for loan against physical shares. RBI has increased the limit of loans availed against

dematerialized securities as collateral to Rs 20 lakh per borrower as against Rs 10 lakh per

borrower in case of loans against physical securities. RBI has also reduced the minimum

margin to 25% for loans against dematerialized securities, as against 50% for loans against

physical securities. Fill up the account opening form, which is available with the DP. Sign the

DP-client agreement, which defines the rights and duties of the DP and the person wishing to

open the account. Receive your client account number (client ID)

This client id along with your DP id gives you a unique identification in the

depository system. Fill up a dematerialization request form, which is available with your DP,

Submit your share certificates along with the form; write "surrendered for demat" on the face

of the certificate before submitting it for demat) Receive credit for the dematerialized shares

into your account within 15 days.

2.4. MARKET CAPITAL OF INDIAN STOCK MARKET

With over 20 million shareholders, India has the third largest investor base in the

world after the USA and Japan. Over 9,000 companies are listed on the stock exchanges,

which are serviced by approximately 7,500 stockbrokers. The Indian capital market is

significant in terms of the degree of development, volume of trading and its tremendous

growth potential.

There are 23 recognized stock exchanges in India, including the Over the Counter

Exchange of India (OTCEI) for small and new companies and the National Stock Exchange

(NSE) which was set up as a model exchange to provide nation-wide services to investors.

NSE, which in the recent past has accounted for the largest trading volumes, has a fully

automated screen based system that operates in the wholesale debt market segment as well as

the capital market segment.

India's market capitalization was amongst the highest among the emerging markets.

Total market capitalization of the BSE as on July 31, 1997 was Rs 5,573.07 billion growing

School of Management Studies, CUSAT Page | 20

Project Report 2010

by 18 percent over a period of twelve months and as of August 2007 was over $1090 billion

(over Rs 43 lakh crores).

India has emerged as the world’s 10th largest equity market after it added several

companies to the billion dollar club in terms of capitalization, taking the total to 81

companies. India has become the third largest Asian market (excluding Japan and Australia)

after having toppled Korea, China and Singapore that have 80, 50 and 47 firms with billion-

dollar market capitalization respectively. India is also inching closer to outpacing Taiwan that

has 84 such companies but lags far behind Hong Kong which has 107, the highest in Asia.

2.5. MAJOR STOCK BROKERS IN KERALA

Geojit BNP Paribas

Geojit BNP Paribas today is a leading retail financial services company in India with

a growing presence in the Middle East. The company rides on its rich experience in the

capital market to offer its clients a wide portfolio of savings and investment solutions. The

gamut of value-added products and services offered ranges from equities and derivatives to

Mutual Funds, Life & General Insurance and third party Fixed Deposits. The needs of over

495,000 clients are met via multichannel services - a countrywide network of over 500

offices, phone service, dedicated Customer Care centre and the Internet.

Geojit BNP Paribas has membership in, and is listed on, the National Stock Exchange

(NSE) and the Bombay Stock Exchange (BSE). In 2007, global banking major BNP Paribas

joined the company’s other major shareholders - Mr. C.J.George, KSIDC (Kerala State

Industrial Development Corporation) and Mr.Rakesh Jhunjhunwala – when it took a stake to

become the single largest shareholder.

Strategic joint ventures and business partnerships in the Middle East has provided the

company access to the large Non-Resident Indian(NRI) population in the region. Now, as a

part of the BNP Paribas global network, Geojit BNP Paribas is well positioned to further

expand its reach to NRIs in 85 countries. Barjeel Geojit Securities is the joint venture with

the Al Saud group in the United Arab Emirates that is headquartered in Dubai with branches

in Abu Dhabi, Ras Al Khaimah, Sharjah and Muscat. Aloula Geojit Brokerage Company

headquartered in Riyadh is the other joint venture with the Al Johar group in Saudi Arabia.

The company also has a business partnership with the Bank of Bahrain and Kuwait, one of

the largest retail banks in Bahrain and Kuwait.

School of Management Studies, CUSAT Page | 21

Project Report 2010

At the forefront of the many fruitful associations between Geojit BNP Paribas and

BNP Paribas is their joint venture, namely, BNP Paribas Securities India Private Limited.

This JV was created exclusively for domestic and foreign institutional clients. An industry

first was achieved when Geojit BNP Paribas became the first broker in India to offer full

Direct Market Access (DMA) on NSE to the JV’s institutional clients.

A strong brand identity and extensive industry knowledge coupled with BNP Paribas’

international expertise gives Geojit BNP Paribas a competitive advantage.

JRG

JRG is one of the foremost brokerage houses, being a member of various exchanges

in the capital and commodity markets and the insurance sector. JRG is a member of the

National Stock Exchange of India (NSE), the Bombay Stock Exchange, the National Multi

Commodity Exchange of India Ltd (NMCEIL), the National Commodities Derivatives

Exchange Ltd (NCDEX), the Multi Commodity Exchange of India Ltd (MCX) and the Indian

Pepper and Spices Trades Association (IPSTA). JRG is a full-fledged depository participant

of the National Securities Depository Ltd and Central Depository Services (India) Limited.

JRG is also one of southern India's leading Insurance Brokers. JRG constantly infuses quality

into service. JRG provides clients full expertise to play in the market with confidence by

availing full-fledged trading facilities and services through its nation-wide offices in

securities and in commodities.

Karvy

The Karvy group was formed in 1983 at Hyderabad, India. Karvy ranks among the

top player in almost all the fields it operates. Karvy Computershare Limited is India’s largest

Registrar and Transfer Agent with a client base of nearly 500 blue chip corporate, managing

over 20 million accounts. Karvy Stock Brokers Limited, member of National Stock Exchange

of India and the Bombay Stock Exchange, ranks among the top 5 stock brokers in India. With

over 6,00,000 active accounts, it ranks among the top 5 Depositary Participant in India,

registered with NSDL and CDSL. Karvy Comtrade, Member of NCDEX and MCX ranks

among the top 3 commodity brokers in the country. Karvy Insurance Brokers is registered as

a Broker with IRDA and ranks among the top 5 insurance agent in the country. Registered

with AMFI as a corporate Agent, Karvy is also among the top Mutual Fund mobilizer with

over Rs. 5,000 crores under management. Karvy Realty Services, which started in 2006, has

quickly established itself as a broker who adds value, in the realty sector. Karvy Global offers

School of Management Studies, CUSAT Page | 22

Project Report 2010

niche off shoring services to clients in the US. Karvy has 575 offices over 375 locations

across India and overseas at Dubai and New York. Over 9,000 highly qualified people staff

Karvy.

Doha Brokerage & Financial Services

Established in 1992, as one of the first corporate brokerages in India, The Doha

Brokerage & Financial Services Ltd (formerly Select Securities Ltd), is the flagship company

of the DBFS group. Doha Brokerage & Financial Services Ltd is focused on creating utmost

value for its customers, consistently by drawing on our collective expertise, resources and

global exposure.

To serve customers better, the company has gone beyond the traditional brokerage

business, and offers a wide range of services, which include total wealth management and

investment solutions. With a pan Indian presence, which comprises over 180 branches across

major cities, as well as in Dubai and Doha in the Middle East, DBFS is always closer to its

customers. DBFS is always keen in stretching its horizons to explore into newer areas of

services and solutions. Because, in a fast paced world, customer expectations and

requirements are growing, at an equal pace. To take on the challenging needs, DBFS is

rolling out a host of new products and services. The company is gearing up to widen its

presence, both in India and overseas, with the support of its strategic partner

School of Management Studies, CUSAT Page | 23

Project Report 2010

3.1 HEDGE EQUITIES

Hedge Equities is one of the leading Financial Services Company in Kerala,

specialized in offering a wide range of financial products, tailor made to suit individual

needs. As a first step to make our presence Global, Hedge Equities have initiated operations

in Middle East to cater to the vast Non Resident Indian (NRI) population in that region. Ever

since its inception in May 2008 in the midst of global recession, Hedge has spanned its

presence all over India through meticulous research, high brand awareness, intellectual

management and extensive industry knowledge. Hedge believes in creating a new breed of

Investors who take judicious decisions through its well timed and effective investment

advices.

3.2 VISION

‘Evolving into a financial supermarket which will be a one stop shop for all financial

solutions’

3.3 MISSION

To create an ethical and sustainable financial services platform for our customers and

partner them to build business, to provide employees with meaningful work, self-

development and progression, and to achieve a consistent and competitive growth in profit

and earnings for our shareholders and staff

3.4 SERVICES OFFERED

3.4.1 Equity and Derivatives

Equity is an investment area which you can capitalize on with proper assistance

regardless of the market circumstances. Hedge Equities opens the door to this highly lucrative

investment opportunity that could provide a feasible solution for all your financial queries.

Hedge also deals in Futures and Options (F&O). F&O are derivatives that use equity as their

base.

3.4.2 Commodities

School of Management Studies, CUSAT Page | 24

Project Report 2010

Commodity trading is an area which has gained prominence ever since the dawn of

civilization. It can be attributed to the fact that commodities are an integral part of our lives.

Over these years there has been a tremendous growth in this segment which in turn has acted

as the pillar of strength for the development of our economy. This had made it an attractive

investment avenue for investors. Earlier we witnessed lot of money being invested in those

companies which specialized in the production of commodities. Now we have a trend

reversal; commodities have gained popularity over the times.

3.4.3 Currency

Investments in Currency Derivatives can help the customers to diversify their

portfolio from traditional asset classes. Any individual or corporate, expecting to receive or

pay certain amounts in foreign currencies at future date can avail these products to opt for a

fixed rate - by which the currencies can be exchanged at current levels. Currency derivative

serves the purpose of financial risk management encompassing various market risks.

Currency Futures will bring in more transparency and efficiency in price discovery,

elimination of counterparty credit risk, providing access to all types of market participants,

offering standardized products and transparent trading platforms.

3.4.4 Mutual Funds and Insurance

Risk appetite differs from one person to another. For a person with mediocre risk

taking capacity, Mutual Funds is an experimental investment avenue. The main focal point of

Mutual Funds is ‘not to lay all the eggs in one basket’. Mutual Funds make it possible for

individual investors to achieve more diversification with minimal effort when compared to

investing in individual stocks. At Hedge Equities, funds are professionally scrutinized by an

investment research team. Based on their advice and suggestions investments are made by

taking the client’s needs into account. Mutual Funds can be seen as an unperturbed

investment with large amount of transparency and flexibility, amplified by high tax benefits.

Hedge Equities not only focuses on wealth creation activities but also concentrates on

wealth protection activities through its various Insurance schemes in practice.

3.4.5 Depository

Hedge Equities is an electronic custodian registered with Central Services Depository

Ltd (CSDL) with utmost focus given to enhance customer comfort by enabling paperless

School of Management Studies, CUSAT Page | 25

Project Report 2010

trading across the country. This allows non trading members to open demat accounts with

Hedge and receive regular reports as per the rules of NSE. A team of professional and the

latest technological expertise allocated exclusively to the Hedge’s demat division makes the

response time quick and delivery impeccable.

3.4.6 PMS and Research Reports

A new feather in Hedge Equities’ cap, Portfolio Management Services helps investors

who need personal experts to manage their investments. Having to make a right investment

decision with key focus on safety and sizable return is a herculean task. This is where

investors require professional help and that’s when an expert like Hedge Equities comes into

picture. Hedge Equities constantly strive to deliver insightful research to enable pro-active

investment decisions. The Research Department is broadly divided into two divisions –

Fundamental Analysis Group (FAG) and Technical Analysis Group (TAG). Hedge is

equipped with cutting-edge technologies for technical charting which provides assistance to

technical analysts to predict both upside and downside movements efficiently for the benefit

of the clients. Hedge Equity research products include sector reports, weekly technical

reports, monthly research report, SMS alerts, daily morning brief, stock tips etc.

3.5 DIRECTORS AND TOP MANAGEMENT OF HEDGE EQUITIES

Team Hedge is a balanced mix of more than 15 years of experience cutting across

various industries with a strong background in the financial markets. The board comprises of

six power houses in their respective fields - Fedex Securities, Baby Marine Exports, Thakker

Developers, Smart financial, SM Hegde (CFO, Videocon Industries) and Padmashree

MohanLal

List of Directors and Top Management Executives:

Managing Director : Mr. Alex K. Babu

Directors : Mr. Mohanlal

: Mr. Krishnadas

: Mr. Pradeep Kumar C

Chief Executive Officer : Mr. Bhuvanendran

Chief Operations Officer : Mr. Bobby J Arakunnel

School of Management Studies, CUSAT Page | 26

Project Report 2010

The data analysis and the findings are derived from the data prepared on the basis of

the experience obtained from the exposure with the management and the sales team of Hedge

and the market survey conducted with the help of questionnaires which are given in the

appendix.

The first step in the study was to identify the existing market conditions and the

methodology of marketing at Hedge. At Hedge, HNI clients are dealt directly from the head

office. Head office employs a customer relations wing (CRW) and an HNI desk for providing

necessary services to the target customers. The data of the clients are collected by the branch

offices in the respective areas, through referrals, social gatherings and other external

databases like club member database etc. The CRW contacts the customers and fix an

appointment for the marketing team comprising of top executives and relationship managers.

The past experiences show that the company is very successful in obtaining the data

of potential customers through its marketing channels and has been consistently achieving a

very high conversion rate once the appointment is fixed with the customer. The problem

occurs when the CRW executives call for appointment. More than 90% of the calls are not

converted into appointments. These customers are reluctant to equity investment due to

various reasons.

The executives at hedge found that the main reasons for the reluctance are

a. Lack of knowledge about the equity market.

b. Loss of money in any previous instance of investing.

c. Orientation towards more traditional avenues of investing like fixed deposits,

real estate etc.

Based on the inputs and insights given by the Hedge team a questionnaire was

framed. The questionnaire is provided in appendix 1. The total population is divided into four

on the basis of their age. Age was taken as a criterion because the risk appetite and

investment goals of people vary with their age.

The selected sample size was 50 comprising of 12 people under the age of 30, 13

respondents between 30 & 45, 13 respondents between 45 & 60 and 12 respondents with age

above 60.

School of Management Studies, CUSAT Page | 27

Project Report 2010

4.1. Most Preferred Investment Options

The knowledge of the current choice of investment avenues are to be known to

formulate an appropriate marketing strategy by positioning the product well in the market.

The respondents were requested to give their choice of top three choices of investment from a

list of 6 major investment options in the market viz. Fixed Deposit, Mutual fund, Real Estate,

Gold, Insurance, Equity Investment.

4.1.1 Investment Choice No:1

The investment avenues chosen as the most preferred investment option is given in

the table below:

Sl. No: of

%

No. Investment Option Respondents

1 Fixed Deposit 21 42

2 Mutual fund 0 0

3 Real Estate 11 22

4 Gold 12 24

5 Insurance 6 12

6 Equity Investment 0 0

Table 4.1.1: First priority Investment choice

42% of the respondents chose fixed deposits as their most favorite investment option,

mainly attributed to the security and liquidity it offers. Gold and real estate was chosen by

24% and 22% of the respondents respectively. Insurance by 6 respondents and none has

chosen both equity and mutual funds. This shows the accuracy of the sampling done in the

research.

The results of the study has been graphically represented in the pie chart below

School of Management Studies, CUSAT Page | 28

Project Report 2010

option 1

Insurance

12%

Fixed Deposit

Gold 42%

24%

Real Estate

22%

Chart: 4.1.1 First priority Investment choice

4.1.2 Investment Choice No:2

After the first choice of investment avenues, second most preferred investment option

chosen by the respondents was taken and is given in the table below

Sl. No: of

%

No. Investment Option Respondents

1 Fixed Deposit 9 18

2 Mutual fund 3 6

3 Real Estate 13 26

4 Gold 16 32

5 Insurance 8 16

6 Equity Investment 1 2

Table 4.1.2: Second priority Investment choice

18% of the respondents chose fixed deposits as their second most favorite investment

option. Gold and real estate was chosen by 32% and 26% of the respondents respectively.

Insurance by 16 respondents, while 3 respondents ie 6% has chosen to go for mutual funds

and none has chosen equity. This again demonstrates the accuracy of the sampling done in

the research concentrating on HNI who are reluctant to invest in equities.

School of Management Studies, CUSAT Page | 29

Project Report 2010

The results of the study has been graphically represented in the pie chart below

option 2

Equity Investment

2%

Insurance Fixed Deposit

16% 18% Mutual fund

6%

Gold Real Estate

32% 26%

Chart: 4.1.2 Second priority Investment choice

4.1.3 Investment Choice No:3

The third and final preference in the investment options chosen by the respondents are

given in the table below

Sl. Investment Option No: of %

School of Management Studies, CUSAT Page | 30

Project Report 2010

No. Respondents

1 Fixed Deposit 10 20

2 Mutual fund 7 14

3 Real Estate 14 28

4 Gold 10 20

5 Insurance 9 18

6 Equity Investment 0 0

Table 4.1.3: Third priority Investment choice

20% of the respondents chose fixed deposits as their second most favorite investment

option. Gold and real estate was chosen by 20% and 28% of the respondents respectively.

Insurance by 19(18) respondents, while 7 respondents i.e. 14% has chosen to go for mutual

funds and none has chosen equity. This again demonstrates the accuracy of the sampling

done in the research concentrating on HNI who are reluctant to invest in equities.

option 3

Insurance

18% Fixed Deposit

20%

Mutual fund

Gold 14%

20%

Real Estate

28%

Chart: 4.1.3 Third priority Investment choice

4.1.4 Summary of Responses

School of Management Studies, CUSAT Page | 31

Project Report 2010

A summary of responses in all three investment options is given below

Sl No. investment option No: of Respondents %

1 Fixed Deposit 40 80

2 Mutual fund 10 20

3 Real Estate 38 76

4 Gold 38 76

5 Insurance 23 46

6 Equity Investment 1 2

Table 4.1.4: Investment choices

The table shows that 80% of the respondents opted bank FD as one of their

investment choices. 76% of the respondents chose real estate and gold deposits to be in their

investment portfolio. 46% of the respondents chose insurance while 20% opted for mutual

funds and only 2% of the respondents are interested in equity.

4.1.4 Analysis of Data

The data shows that the most preferred investment option of the customers is fixed

deposit. 80% of the respondents prefer to invest in FD. The main reason for the trend is the

security and liquidity offered by the FD. Fixed deposit was chosen by most of the people as

their most preferred option. The main drawback of FD, perceived by the respondents, is its

low rate of return. A further analysis of data has shown that 100% of those who are above the

age of 45 and salaried employees prefer fixed deposits because it match with their risk

profile.

Real estate and gold are the next preferred option of investors, both chosen by 76% of

the respondents. Both are very traditional avenues of investment and offer a promising return.

Real estate field has shown a setback in last couple of years due to economic recession, but

booming economy has raised hope of the investors. This makes real estate a promising

investment. Gold is a very established investment for ages. Price of gold is touching new

limits day after day, making it a shining investment option. Gold offers high liquidity for

investors, making it more attractive. Another reason for investment in these assets is the

advantage of possession it is offering. Unlike equity, these investments offer a strong tangible

presence.

School of Management Studies, CUSAT Page | 32

Project Report 2010

Mutual fund and insurance has attracted 20% and 46% of the respondents. Only 2%

of the respondents expressed interest in equities. It is clearly visible that there is a trend for

investing in established modes of investing.

School of Management Studies, CUSAT Page | 33

Project Report 2010

4.2. Knowledge in Preferred Investment Options

Knowledge in the technical aspects of an investment option may motivate to invest in

that. This may serve as a reason for non-participating behavior of this segment in equity

investments. To analyze this, the knowledge of the respondents in their chosen investment

options was enquired. Knowledge in this context means a more detailed awareness about the

functioning of the option like the factors may affect gold prices in case they have chosen gold

as an investment option.

4.2.1. Knowledge in Preferred Investment Option No:1

The response of level of knowledge in the first preferred option is given below

Knowledge in option #1 %

1 Very high 41 82

2 High 6 12

3 Average 3 6

4 Low 0 0

5 very low 0 0

Table 4.2.1Knowledge in Preferred Investment Option No: 1

Most of the respondents (82%) have very good knowledge in their first chosen

investment opportunity. 12% have fairly good knowledge and 6% has an average knowledge

about the investment option they preferred. The significance of the result is that none of them

has chosen an investment option in which they don’t have a significant knowledge

School of Management Studies, CUSAT Page | 34

Project Report 2010

high

12% average

6%

Very high

82%

Chart 4.2.1Knowledge in Preferred Investment Option No: 1

4.2.2. Knowledge in Preferred Investment Option No: 2

Knowledge in option #2 %

1 Very high 32 64

2 High 9 18

3 Average 6 12

4 Low 3 6

5 very low 0 0

The response of level of knowledge in the second preferred option is given below

An almost same trend continued in the case of second investment option also but

exhibited a downward trend also. 64% has recorded that their knowledge level in the second

investment option is very high, while 18% and 16% has a high and average level of

knowledge in the options selected. It must be noted that 6% has rated their knowledge in the

preferred investment as low and none rated very low.

Table 4.2.2: Knowledge in Preferred Investment Option No: 2

School of Management Studies, CUSAT Page | 35

Project Report 2010

average

12% low

6%

high

18%

Very high

64%

Chart 4.2.2: Knowledge in Preferred Investment Option No: 2

4.2.3. Knowledge in Preferred Investment Option No: 3

The response of level of knowledge in the third preferred option is given below

Knowledge in option #3 %

1 Very high 16 32

2 High 15 30

3 Average 10 20

4 Low 7 14

5 very low 2 4

The downward trend in the level of knowledge was clear in this response. 32% have

expressed that they have very high knowledge in the third preferred option of investment.

30% and 20% of the respondents rated their knowledge level in the third avenue as high and

School of Management Studies, CUSAT Page | 36

Table 4.2.3: Knowledge in Preferred Investment Option No: 3

Project Report 2010

average respectively. 14% of the people have rated their knowledge in this option as low and

a 4% of the respondents found their knowledge in the investment option as very low.

low

14% very low

4% Very high

32%

average

20%

high

30%

Chart 4.2.3: Knowledge in Preferred Investment Option No: 3

4.2.4. Analysis of data

The response to the knowledge level in the investment shows that knowledge in any

investment avenues positively influences the investor’s feelings towards investing. Of the

respondents 82% has very high knowledge in their most preferred investment and none of

them are unaware about their first choice on investment. A very low knowledge to a preferred

investment mode was shown only in third investment option that too a very low response of

4%.

There is a notable case in the responses that there is a decrease in knowledge in the

investments options 2 and it further decreases in investment choice 3. This shows that most of

the respondents are not very sure about their investment preferences. This shows that

majority of the people has a strong knowledge only in one investment option. Investing the

bulk of one’s saving in a particular mode is very risky. It is essential to have a diversified

School of Management Studies, CUSAT Page | 37

Project Report 2010

portfolio of investment to reduce risk of failure of a particular medium of investment. This

provides an opportunity to develop regular customers by educating the potential customers.

Hence the results of the survey shows that the customers tend to invest more in those

areas where they have more knowledge. So an intense effort should be initiated by the

organization to educate the customers and convert them to equity investors.

School of Management Studies, CUSAT Page | 38

Project Report 2010

4.3. Risk Perception on Equity Investment

Since the target customer group is negligent to the equity investments at present, basic

reason of this behavior has to be found out. Equity has a widespread image as a very risky

investment among masses. This has been made very strong by the recent recession. Reports

of stock market crashes are heavily celebrated by the media making it somewhat a nightmare

for public and also for those who has experienced the darker side of stock trading.

For a detailed analysis of the behavior of the target segment we should understand the

risk perception on the equity investments. The respondents was requested to rate how they

feel about the risk factor involved with the equity investments on a five point scale.

Is equity risky %

1 strongly agree 28 56

2 Agree 16 32

3 Neutral 5 10

4 Disagree 1 2

5 strongly disagree 0 0

Table 4.3 Risk Perception on Equity Investment

No wonder in the outcomes of the result, 56% of the respondents strongly agreed that

the equity investments are risky and 32% agreed it as risky combined to get a total of 88% of

the respondents finding it risky. 10% of the respondents take neutral stand on the question.

Only 1 respondent has a disagreement with the question and nobody strongly disagreed to it.

The responses have been plotted on a pie chart and presented below

School of Management Studies, CUSAT Page | 39

Project Report 2010

IS EQUITY RISKY?

disagree

neutral 2%

10%

strongly agree

agree 56%

32%

Fig: 4.3 Risk Perception on Equity Investment

4.3.1. Analysis of Data

No surprise in the outcome of the survey, none of the respondents strongly disagree

that equity investment is risky. As high as 88% of the respondents founds it very risky to

invest in equities and this forms a major influence for the target group’s reluctance to invest

in equity. A combined effort by the industry will be more appropriate and effective to

overcome this marketing barrier rather than an individual effort by Hedge alone. This

requires a high level collaboration between the firms.

School of Management Studies, CUSAT Page | 40

Project Report 2010

4.4. Influence of Knowledge

In an interaction with the relationship managers at Hedge, it was found that when they are

able to educate a customer about the stock market activities, they were able to attract the

customer to invest in equities. This shows that knowledge building may serve as a motivating

factor to invest. The results of the survey are shown in the table

More knowledge may motivate %

1 Strongly agree 15 30

2 Agree 18 36

3 Neutral 7 14

4 Disagree 8 16

5 Strongly disagree 2 4

Table 4.4 Knowledge as a motivator

30% of the respondents strongly believe that more knowledge in the equity

investment may motivate them to invest in equities and 36% of the respondents also agreed to

it. 14% remained neutral in their approach. 16% have disagreed to invest in equities and 4%

strongly disagreed.

School of Management Studies, CUSAT Page | 41

Project Report 2010

more knowledge may motivate

disagree strongly disagree

16% 4% strongly agree

30%

neutral

14%

agree

36%

Fig: 4.4 Knowledge as a motivator

4.4.1. Analysis of Data

The survey shows that 66% respondents feel that more knowledge may motivate them

to invest in equities. This is a very promising result and it combined with the analysis in the

section 4.2 shows that knowledge can certainly be motivating factor for investing in the

equities. The company has to concentrate on consumer education campaigns to attract them

to equity investments. Hedge has already launched a strong ad campaign on this respect.

School of Management Studies, CUSAT Page | 42

Project Report 2010

4.5. Investment Goals of the Target Group

Investment is made by a person to meet some requirement that may arise in the future.

The requirements are called investment goals. The investment goals are classified into two

based on the time span: short term and long term. If the goals are to be achieved in less than 6

years they are classified short term else long term.

Investment goal of a customer is very important in every investment decision.

Choosing an inappropriate investment alternative may not meet the objectives of the investor.

Here an attempt is made to understand the investment goals of the respondents

Investment goal %

1 Short term 28 44

3 Long term 22 56

Table 4.5. Investment Goals of the Target Group

44% of the respondents said that their investment goals are short term while 56% have

responded that they have long terms goals as their priority. For a detailed analysis age-wise

distribution of the investment goals are taken.

The general investment goals of the respondents are plotted below in a pie chart:

INVESTMENT GOAL

Short term

44%

Long term

56%

Chart4.5. Investment Goals of the Target Group

School of Management Studies, CUSAT Page | 43

Project Report 2010

4.5.1. Age Wise Investment Goals

For a detailed analysis of the investment goals and for identifying the needs of

customers, an age wise distribution of investment goals is generated from the responses. The

results are given below

Short Term Long Term

Invest goal

Number % Number %

UPTO 30 9 75 3 25

UPTO 45 2 15.38 11 84.62

Age

UPTO 60 3 23.08 10 76.92

ABOVE 60 8 66.67 4 33.33

Table 4.5.1 Age Wise Investment Goals

75% of the respondents up to 30 years of age has pointed that they have short term

investment goals while 25% have long term goals. The goals included new car, starting new

business etc. The majority of respondents in the age group up to 45 and up to 60 (85% and

77% respectively) have recorded that they have long term goals like life after retirement and

kid’s education etc. Only a minority (15% and 23% respectively) in this group have short

term goals. In the group of customers above the age of 60 67% have short term goals while

33% have long term goals.

The age-wise distribution of the investment goals are plotted in the graph below

School of Management Studies, CUSAT Page | 44

Project Report 2010

90

80

70

60

Age UPTO 30

50 Age UPTO 45

Age UPTO 60

40 Age ABOVE 60

30

20

10

Chart4.5.1. Age Wise Investment Goals

4.5.2. Analysis of data

The every age group has shown considerable interest in both long term security and

short term objectives. The customers of age less than 30 and above 60 have shown a major

interest in short term objectives. But it cannot be forgotten that 25% and 33% of the

respective age group has shown interest in long term goals.

Respondents between the age of 30 and 60 have shown a major interest in long term

investment goals especially income after retirement, higher education of wards etc. But a

considerable percent, 15% under 45 and 23% under 60, have short term goals.

The survey shows that the company has to focus on investment portfolios that will

give short term returns and long term returns. The product package that must be offered to the

customers should be customized on the basis of their risk appetite and goals. A personal

touch should be given to the customer to develop confidence in the company.

School of Management Studies, CUSAT Page | 45

Project Report 2010

4.6. Influence of Friends/Relatives

Investment decision may be one of the most informed decisions made by a person.

Friends and family members may have wide influence in making the investment. If a family

member has got a fortune from an investment then it may drive others to invest in similar

avenues. Similarly a negative impression about any mode of investment by an individual may

de motivates others close to him from investing. To understand this enquiry was made in the

respondents. The results are given below.

Friend/relative suggestion %

1 strongly agree 17 34

2 Agree 19 38

3 Neutral 7 14

4 Disagree 5 10

5 strongly disagree 2 4

Table: 4.6 Influence of Relatives

The results of the survey shows that 34% of the respondents strongly agree that they

listen to their friends/relatives opinions or value their experiences while choosing an

investment avenue. 38% of the respondents also agree to this making total of those who listen