Professional Documents

Culture Documents

Section 80 Deduction Table

Section 80 Deduction Table

Uploaded by

vineyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Section 80 Deduction Table

Section 80 Deduction Table

Uploaded by

vineyCopyright:

Available Formats

Section 80 Deduction Table

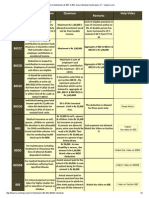

Section Deduction on FY 2016-17

Section 80C Investment in PPF Rs. 1,50,000

Employee’s share of PF contribution

NSCs

Life Insurance Premium payment

Children’s Tuition Fee

Principal Repayment of home loan

Investment in Sukanya Samridhi

Account

ULIPS

ELSS

Sum paid to purchase deferred annuity

Five year deposit scheme

Senior Citizens savings scheme

Subscription to notified

securities/notified deposits scheme

Contribution to notified Pension Fund

set up by Mutual Fund or UTI.

Subscription to Home Loan Account

Scheme of the National Housing Bank

Subscription to deposit scheme of a

public sector or company engaged in

providing housing finance

Contribution to notified annuity Plan of

LIC

Subscription to equity shares/

debentures of an approved eligible issue

Subscription to notified bonds of

NABARD

80CC For amount deposited in annuity plan of –

LIC or any other insurer for pension from a

fund referred to in Section 10(23AAB).

80CCD(1) Employee’s contribution to NPS account –

(maximum up to Rs 1,50,000)

Section Deduction on FY 2016-17

80CCD(2) Employer’s contribution to NPS account Maximum up to 10% of salary

80CCD(1B) Additional contribution to NPS Rs. 50,000

80TTA(1) Interest Income from Savings account Maximum up to 10,000

80GG For rent paid when HRA is not received Least of :

from employer

Rent paid minus 10% of

total income

Rs. 5000/- per month

25% of total income

80E Interest on education loan Interest paid for a period of 8

years

80EE Interest on home loan for first time home Rs 50,000

owners

80CCG Rajiv Gandhi Equity Scheme for Lower of

investments in Equities

50% of amount invested in

equity shares or

Rs 25,000

80D Medical Insurance – Self, spouse, children Rs. 25,000

Medical Insurance – Parents more than 60 Rs. 30,000

years old or (from FY 2015-16) uninsured

parents more than 80 years old

80DD Medical treatment for handicapped o Rs. 75,000

dependant or payment to specified scheme

for maintenance of handicapped Rs. 1,25,000

dependant

Disability is 40% or more but less

than 80%

Section Deduction on FY 2016-17

Disability is 80% or more

80DDB Medical Expenditure on Self or Dependent Lower of Rs 40,000 or the

Relative for diseases specified in Rule amount actually paid

11DD Lower of Rs 60,000 or the

amount actually paid

For less than 60 years old Lower of Rs 80,000 or the

For more than 60 years old amount actually paid

For more than 80 years old

80U Self suffering from disability:

Individual suffering from a physical o Rs. 75,000

disability (including blindness) or

mental retardation. Rs. 1,25,000

Individual suffering from severe

disability

80GGB Contribution by companies to political Amount contributed (not allowed

parties if paid in cash)

80GGC Contribution by individuals to political Amount contributed (not allowed

parties if paid in cash)

80RRB Deductions on Income by way of Royalty Lower of Rs 3,00,000 or income

of a Patent received

CHAPTER VIA DEDUCTIONS :

Gross Total Income (GTI) means the aggregate of income computed under each head as per

provisions of the Act. GTI is computed after giving effect to the provisions for clubbing of

incomes and set off of losses, but before making any deductions under Chapter VIA of the

Act. In order to compute ‘Total Income or Net Total Income’, deductions under Chapter VIA

are considered and adjusted from GTI. The aggregate amount of deductions under Chapter

VIA cannot exceed GTI of the assesse. For the purpose of calculating Income Tax Total

Income will be considered.

Deductions Available under Chapter VIA

Section Brief Information about the Section Deduction Limit

Amount paid or deposited towards life insurance, contribution to

Provident Fund set up by the Government, recognized Provident Fund,

contribution by the assessee to an approved superannuation fund,

subscription to National Savings Certificates, tuition fees, payment/

80C

repayment for purposes of purchase or construction of a residential

house and many other investments. For full list, please refer to section

80C of the Income-tax Act. ( The aggregate amount of deduction under

section 80C, 80CCC and 80CCD(1) shall not exceed Rs. 1,50,000/- )

80C + 80CCC+ 80CCD(1)

Deduction in respect of Payment of premium for annuity plan of LIC or

should be less than or equal to

any other insurer. Deduction is available upto a maximum of Rs.

Rs. 1,50,000

150,000/-.

80CCC

The premium must be deposited to keep in force a contract for an

annuity plan of the LIC or any other insurer for receiving pension from

the fund.

Deduction for contribution in pension scheme notified by the

80CCD(1) Government to the extent of 10% of salary in case of employees and 10%

of total income in case of others.

Contribution to National Pension Scheme. The deduction is in addition to

80CCD(1B) the maximum deduction of Rs. 1,50,000/- available under 80C, 80CCC Rs. 50,000

and 80CCD(1).

80CCD(2) Contribution by employer in pension scheme notified by the Government Max 10% of salary.

upto 50% of the amount

80CCG Investment in Rajiv Gandhi Equity Saving Scheme invested

( Max. of Rs. 25,000 )

Medical Insurance Premium for Self and family members.

For self, spouce and children ( any one age < 60 yrs ) Rs. 25,000

80D For Parents - Father or mother or both (any one age < 60 yrs) Rs. 25,000

For self, spouce and children ( any one age > 60 yrs ) Rs. 30,000

For Parents - Father or mother or both (any one age > 60 yrs) Rs. 30,000

Deduction in respect of maintenance including medical treatment of Rs. 1 lac - severe diability

80DD

dependent who is a person with disability. Rs. 50,000 - others

Medical treatment of specified disease or ailment for self or dependent

80DDB Max Rs. 40000

relative.

Interest on loan taken for pursuing higher education of self or family

80E No limit

members or a relative.

upto either 100% or 50% with

80G Eligible Donations

or without restriction

80GG House Rent ( for self employed and emp. Who have not recived HRA ) Rs. 60,000

80TTA Interest on Saving accounts Rs. 10,000

Severe Disability - Rs. 1,00,000

80U Person with disability.

General Disability - Rs. 50,000

You might also like

- Income Taxation Banggawan 2019 Ed Solution ManualDocument40 pagesIncome Taxation Banggawan 2019 Ed Solution ManualVanilla VanillaNo ratings yet

- Proprietary Trading - Truth and FictionDocument3 pagesProprietary Trading - Truth and Fictionclmagnaye100% (4)

- Analysing Risk and Return On Chargers Products' Investments: Case Analysis in BA 142Document7 pagesAnalysing Risk and Return On Chargers Products' Investments: Case Analysis in BA 142ice1025No ratings yet

- Income Tax DepartmentDocument4 pagesIncome Tax Departmentmansi joshiNo ratings yet

- Deduction From Gross Total IncomeDocument4 pagesDeduction From Gross Total Incomedevak shelarNo ratings yet

- Section Deduction On Allowed Limit (Maximum) FY 2018-19Document3 pagesSection Deduction On Allowed Limit (Maximum) FY 2018-19Praveen kumarNo ratings yet

- Net Income How To Calculate Net Income in Income TaxDocument34 pagesNet Income How To Calculate Net Income in Income TaxSeetha SenthilNo ratings yet

- CFP Theory MaterialDocument45 pagesCFP Theory MaterialShobhit KumarNo ratings yet

- Income Tax Deductions ListDocument4 pagesIncome Tax Deductions Listamitks525No ratings yet

- DeductionsDocument7 pagesDeductionsAnurag BishtNo ratings yet

- Principles of Taxation Law - (Week 8)Document56 pagesPrinciples of Taxation Law - (Week 8)Snigdha RohillaNo ratings yet

- Section Deduction On Allowed Limit (Maximum) FY 2018-19Document2 pagesSection Deduction On Allowed Limit (Maximum) FY 2018-19amarjeet mahapatraNo ratings yet

- Tax Planning IndiaDocument13 pagesTax Planning Indiajsaideep23No ratings yet

- Deduction ProvisionsDocument11 pagesDeduction ProvisionsdevasrisaivNo ratings yet

- DeductionsDocument7 pagesDeductionsManjeet KaurNo ratings yet

- Deductions Available Under Chapter VI of Income TaxDocument4 pagesDeductions Available Under Chapter VI of Income TaxDeepanjali NigamNo ratings yet

- Summary Charts Deduction Chapter ViaDocument4 pagesSummary Charts Deduction Chapter ViaUttam Gagan18No ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- On Employee Tax SavingDocument21 pagesOn Employee Tax SavingChaitanya MadisettyNo ratings yet

- Atc AtuDocument9 pagesAtc AtuKeshav SagarNo ratings yet

- Section 80 Deduction ListDocument6 pagesSection 80 Deduction ListMURALIDHARA S VNo ratings yet

- Inc Tax DedDocument38 pagesInc Tax DedpoojaNo ratings yet

- Deductions Under Chapter VI CalculatorDocument2 pagesDeductions Under Chapter VI CalculatorAjay PratapNo ratings yet

- Investments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenDocument8 pagesInvestments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenGourav BathejaNo ratings yet

- Deductions Under Chapter VI A - d17d562d b594 4627 9fb3 E1efc2352b13Document37 pagesDeductions Under Chapter VI A - d17d562d b594 4627 9fb3 E1efc2352b13Subiksha LakshNo ratings yet

- 80C IndiaDocument7 pages80C IndiapingbadriNo ratings yet

- Taxation Ce2Document10 pagesTaxation Ce2Ratnesh PalNo ratings yet

- Income Tax Section 80Document19 pagesIncome Tax Section 80DEV HUGENNo ratings yet

- Deductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActDocument8 pagesDeductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActalisagasaNo ratings yet

- Basic Income Tax StructureDocument69 pagesBasic Income Tax StructureAditya AnandNo ratings yet

- Income Tax Guide FY 2023-24Document11 pagesIncome Tax Guide FY 2023-24akshay yadavNo ratings yet

- Section 80cDocument4 pagesSection 80cKarthick BalajiNo ratings yet

- Tax SavingsDocument32 pagesTax Savingsh946073000850% (2)

- Deductions From Gross Total IncomeDocument4 pagesDeductions From Gross Total Income887 shivam guptaNo ratings yet

- Income Tax Deductions.Document22 pagesIncome Tax Deductions.Dhruv BrahmbhattNo ratings yet

- Income Tax DeductionsDocument17 pagesIncome Tax DeductionsSaikat PayraNo ratings yet

- Income Tax Deductions and ExemptionsDocument2 pagesIncome Tax Deductions and ExemptionsHusen AliNo ratings yet

- India Income Tax Deductions How To Save TaxDocument24 pagesIndia Income Tax Deductions How To Save TaxRK PHOTO LABSNo ratings yet

- Section 80C To 80U 1Document41 pagesSection 80C To 80U 1karanmasharNo ratings yet

- IncomeTax DeductionsDocument5 pagesIncomeTax DeductionsAjay MagarNo ratings yet

- Income Tax Savings SectionsDocument2 pagesIncome Tax Savings Sectionsharvinder thukralNo ratings yet

- Chapter ViaDocument4 pagesChapter ViaCA Gourav JashnaniNo ratings yet

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryDocument2 pagesEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777No ratings yet

- Taxation Law ProjectDocument15 pagesTaxation Law Projectraj vardhan agarwalNo ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- Unit-1 2 Set Off Losses and DeductionsDocument34 pagesUnit-1 2 Set Off Losses and DeductionsLiam JuddNo ratings yet

- PFP Chapter 04Document38 pagesPFP Chapter 04murudkaraditya110No ratings yet

- Snehal - Sec80 of Income TaxDocument29 pagesSnehal - Sec80 of Income TaxHetvi KatariaNo ratings yet

- Deductions From Gross Total IncomeDocument12 pagesDeductions From Gross Total Incomeansh071102No ratings yet

- Chapter-7 DeductionDocument7 pagesChapter-7 DeductionBrinda RNo ratings yet

- Income Tax Deductions and Exemptions in India 2018: MenuDocument7 pagesIncome Tax Deductions and Exemptions in India 2018: MenusandeshNo ratings yet

- Deductions From Gross Total Income: HapterDocument20 pagesDeductions From Gross Total Income: HapterJAWED MOHAMMADNo ratings yet

- DeductionsDocument11 pagesDeductionsguest1No ratings yet

- Explanation of Tax Benefits: Overall Deduction Limit - Section 80CCEDocument7 pagesExplanation of Tax Benefits: Overall Deduction Limit - Section 80CCEAbrendra SinghNo ratings yet

- Income Tax Law & PracticeDocument29 pagesIncome Tax Law & PracticeMohanNo ratings yet

- On Deductions Under Section 80C To 80U (Unit - 4) Bcom 6 SEMDocument11 pagesOn Deductions Under Section 80C To 80U (Unit - 4) Bcom 6 SEMMudasir LoneNo ratings yet

- 10B - Deduction s80 IndividualsDocument14 pages10B - Deduction s80 IndividualsabhishekNo ratings yet

- ClubbingDocument8 pagesClubbingSiddharth VaswaniNo ratings yet

- Income Tax Rate 2010Document6 pagesIncome Tax Rate 2010Vishal JwellNo ratings yet

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDocument19 pagesIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharNo ratings yet

- Handbook - Tax Planning Level 2Document30 pagesHandbook - Tax Planning Level 2Malli Arjun staff guitar zgkNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Financial Market InstitutionsDocument63 pagesFinancial Market Institutionsmengistu jiloNo ratings yet

- Securitization: Final Term ReportDocument35 pagesSecuritization: Final Term ReportMohsin HassanNo ratings yet

- New RMP PlanDocument54 pagesNew RMP Plancontactavnish100% (1)

- Partnership Board ReviewerDocument13 pagesPartnership Board ReviewerRobert ApolinarNo ratings yet

- Corporate Governance in AfricaDocument23 pagesCorporate Governance in AfricaIrwan Setiawan FauziNo ratings yet

- Vanguard Charitable Endowment Foundation Form 990 (2010)Document121 pagesVanguard Charitable Endowment Foundation Form 990 (2010)bangpoundNo ratings yet

- Ahmed Madad Proposal NormalDocument29 pagesAhmed Madad Proposal NormalDhaabar Salaax100% (1)

- Balance Sheet 2022 - YukaDocument16 pagesBalance Sheet 2022 - YukaShivam BhatiaNo ratings yet

- RDocument3 pagesRAminul Haque RusselNo ratings yet

- Financial Accounting For ManagersDocument127 pagesFinancial Accounting For ManagerssowmtinaNo ratings yet

- Ranking Investment Proposals: Learning ObjectiveDocument5 pagesRanking Investment Proposals: Learning ObjectivePratibha NagvekarNo ratings yet

- RCBC Home Loan ApplicationDocument4 pagesRCBC Home Loan ApplicationGABRONINO CATHERINENo ratings yet

- Accountingstudyguide Subscription AccountDocument65 pagesAccountingstudyguide Subscription AccountThokozaniMpofuNo ratings yet

- 2 Employee Proof Submission (EPS) Form-TemplateDocument13 pages2 Employee Proof Submission (EPS) Form-TemplateAnil GanduriNo ratings yet

- Chapter 3Document51 pagesChapter 3Aminul Islam AmuNo ratings yet

- S.Y.T.Y.B.a. B.com M.com M.A. Prospectus1Document32 pagesS.Y.T.Y.B.a. B.com M.com M.A. Prospectus1Vibha ShahNo ratings yet

- Accounts Project Yamini JainDocument57 pagesAccounts Project Yamini Jainbabaraligour234No ratings yet

- Trắc nghiệmDocument8 pagesTrắc nghiệmHồ Đan Thục0% (1)

- Palkka Mepv2022k12a1t36702c0 09.12.2022Document3 pagesPalkka Mepv2022k12a1t36702c0 09.12.2022CesarNo ratings yet

- UATQ1 ResultDocument3 pagesUATQ1 ResultramsesiNo ratings yet

- AFAR - Corp LiqDocument1 pageAFAR - Corp LiqJoanna Rose Deciar0% (1)

- Forex Fund Manager Trade With Cabana CapitalsDocument2 pagesForex Fund Manager Trade With Cabana Capitalsneil fxNo ratings yet

- Asx Announcement: Wednesday 26 August 2009Document105 pagesAsx Announcement: Wednesday 26 August 2009aspharagusNo ratings yet

- Activity of Credit Intermediation and Factoring Companies in PolandDocument5 pagesActivity of Credit Intermediation and Factoring Companies in PolandjournalNo ratings yet

- ASC - Fraud Seminar - 2023 Din - 03Document18 pagesASC - Fraud Seminar - 2023 Din - 03jannahNo ratings yet

- Introduction To Accounting: Dr. Seema PanditDocument29 pagesIntroduction To Accounting: Dr. Seema Panditiiidddkkk 230No ratings yet

- Risk and Return: Past and PrologueDocument39 pagesRisk and Return: Past and ProloguerrNo ratings yet