Professional Documents

Culture Documents

2009 Set II0001

Uploaded by

Sohrab Ali Choudhary0 ratings0% found this document useful (0 votes)

7 views13 pagesproject paper

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentproject paper

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views13 pages2009 Set II0001

Uploaded by

Sohrab Ali Choudharyproject paper

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 13

ICFAI University

Dehradun

MBA Program: Class of 2009

Terminal Make up Examination

‘Semester 0 Course Financial Management - Il

Program Course Code

MBA SL FI 502

QUESTION ‘OM’ ‘QUESTION,

BOOKLET CODE ‘COURSE CODE BOOKLET NO.

| A | 86 |

«Tobe filled by the candidate

ENROLLMENT NO. |

This question booklet comprises of Part A, Part B & C:

Part A:

Part A consists of 30 multiple choice questions which test your understanding of basic

concepts in the subject.

ii Part A to be answered in OMR sheet provided to you separately. Detailed instructions for

answering are given on OMR sheet and also overleaf.

iii, _ Time allotted for answering Part A is 30 minutes.

Part B&

iv. Part B consists of Problems testing, Conceptual Understanding and Application, Analytical

Ability, Caselets, Situational Analysis / Applications of concepts.

v. Part C consists of case analysis.

vi, Total time allotted for answering Part B & C is 2% hours.

vil, Both Parts B & C will be answered in a SINGLE ANSWER BOOKLET.

Part A: Basic Concepts

TOTAL MARKS: 30 MAXIMUM TIME: 30 Minutes

From the following information, compute the operating cycle of LMP Ltd. No. of

days the raw material remain in stock is 60 days, supplier's credit available for 15

days, production time 15 days, finished goods inventory period 15 days, realization

from customers takes 25 days. The operating cycle therefore would be:

a. 115 days

b. 100 days

c. 75 days

d. 85 days

2 90days

Commercial paper, is a short term usance promissory note with fixed maturity period,

issued by:

Corporates & primary dealers

All India Financial Institutions

Banks

(a) and (6) above

None of the above

seoge

Surabhi Enterprises has given you the following information, The Re-order level

4000 units, minimum usage 300 units per week, minimum lead time 2 weeks and re-

ordering quantity 2000 units. ‘The maximum stock level of Surabhi Enterprises

should be:

1900 units

b. 5400 units

c. 2900 units

d. 4000 units

e, 6000 units

Under cash budget system method, working capital is determined by:

a, Ascertaining level of current assets

b. Ascertaining level of current li

. Finding cash gap after taking in to account projected cash inflows and

Outflows

d. Allof the above

€. (a) & (d) above

10.

Which of the following is not part of working capital management?

a. Credit period to buyers

Proportion of current assets to be financed by long term debt

©. Dividend payout

d. Cash credit limit

¢. None of the above.

A low current assets ratio implies one of the following:

a. Greater liquidity & lower risk

b. Poor liquidity & higher risk

©. Greater liquidity & greater risk

4d. Poor liquidity & lower risk

e. None of the above.

Financial temporary cusrexs zssets with short term finance and permanent current

Assets with long term finance refers to:

a. Matching approach

b. Conservative approach

c. Casual approach

4d. Conservative approach

€. Dual aspect approach

Banks generally prefer Debt Equity Rati

sae

None of the above

Ifa company issues bonus shares the debt equity ratio will

a. Remain unaffected

Will be affected

Will improve

Will be negatively affected

None of the above.

pags

In the balance sheet amount of total assets is Rs.10 lac, current liabilities Rs.5 lac

& capital & reserves are Rs.2 lac . What is the debt equity ratio?

A

1

1

LL

2:1

a.

b.

6

a.

e

‘None of the above.

a Oa 00 On Ma hy AE a Oe ee ee ee

a a a aE

ML.

12.

4,

15.

16.

The long term use is 120% of long term source. This indicates the unit has

Current ratio 1.2:1

Negative tnw

Low capitalization

Negative nwe.

Positive npv

Current ratio is 4:1.Net Working Capital is Rs.30,000.Find the amount of current

Assets.

a, Rs.10,000

Rs.40,000

Rs.24,000

Rs.6,000

Rs.41000

sees

Quick assets do not include

a. Govt. bond

b. Book debts

¢. Advance for supply of raw materials

4._Inventofies.

e. None of the above

Financial leverage means

a. Use of more debt capital to increase profit

b. High degree of solvency

c. Low bank finance

4. Decrease in efficiency

€. None of the above

‘The past returns on a security are taken as proxy for the return required in future by

the investors under:

a. Capital Assets Pricing Model Approach

Earnings Price Ratio Approach

Bond Yield Plus Risk Premium Approach

Realized Yield Approach

None of the above

The following does not affect the capital structure of a business entity:

a, Cost of Capital

b. Size of the Company

. Market Rate of Return

d. Floatation Costs

e. None of the above

17,

18,

19,

20,

2

‘The following is not an assumption of Miller and Modigli

a

proach:

Capital Markets are perfect

b. Investors are rational and behave accordingly

The

‘The average expected future operating earings of a firm are subjected to

random variables

There is corporate or personal income tax

None of the above

of Public Deposits as a percentage of paid up capital and free reserves for

Government Companies is:

20%

25%

30%

d. 35%

None of the above

If the credit terms is net 2/15 Net 30 it simply means:

a

b.

c

4d.

e.

2% - 15 % discount if dues are paid within 30 days

2% discount if dues are paid between 15 ~ 30 days

2% discount if dues are paid within 15 days but no discount if dues are paid

beyond 15" day but on the 30" day.

30% discount if dues are paid between 2 ~ 15 days

None of the above

Factoring where the factor purchases receivables on the condition that any loss arising

out of irrecoverable receivables will be bore by the client:

b,

c.

d.

e.

Recourse Factoring

. Full Factoring

Maturity Factoring

Bad Debts Factoring

. None of the above

The following committee was not appointed to suggest measures for regulating bank

Tandon Committee

Chore Committee

Birla Committee

Marathe Committee

None of the above

nnn

22.

23,

24,

25,

26.

Under the ABC Analysis control ofthe following category of items needs to be

intensive:

a. Category C

Category B

Category A

Raw Material

‘None of the above

pecs

One of the costs considered while calculating EOQ is:

Promotion Costs

Ordering Costs

Bonus paid to Workers

Capital Expenditure

None of the above

pacer

The credit policy of a company does not include the following variable:

a. Credit Standards

b. Credit Period

c. Cash Diseount to be extended

4. Monitoring Receivables

e. None of the above

The amount of cheques deposited by a company in the bank awaiting cl

called:

a. Net Float

Gross Float

Collection Float

Payment Float

None of the above

eaog

The Benefit Cost Ratio is also known as:

a, Wholesale Index

b. Consumer Price Index

¢. Profitability Index

4. Opportunity Cost Index

©. None of the above

21.

28,

29.

30.

The process of buying out a significant portion of the equity of an unlisted company

by an investor or a group of

a

sees

Earning powe:

a

b,

ce

d.

e

estors in called:

Bought Out Deals

Hostile Takeover

Private Placement

Initial Public Offering

None of the above

a measure of:

Measuring Gross Margin

Profit hefore Tax

Operating Profitability

Profit after Tax

None of the above

‘The ultimate test of liquidity is the ability of the company:

.. To meet its current obligations

To maintain regularity in production

To achieve equality in current assets and current liabilities,

To raise equity as and when required

€. None of the above

‘The abbreviation CAS stands for:

a

b,

c

4.

e.

Central Accounting System

Current Asset Standards

. Chartered Accounting System

Credit Authorization Scheme

. None of the above

END OF Part A

Part-B & C

TOTAL MARKS: 70 (MAXIMUM TIME: 2% HOURS

INSTRUCTIONS TO CANDIDATES

1. Answer Part B & Part C in SINGLE ANSWER BOOKLET

2. Write your enrollment number on the first page of the

only.

swer book at the space provided

All ough work must be done on any blank pa

Pencil should not be used for answering.

The unused portion of the answer book must be boldly crossed prior to submitting

Attempt all questions

in the answor book.

see ae

Marks are indicated against each question.

Part B: (50 marks: 120 minutes)

Problems testing, Conceptual Understanding and Application Analytical Ability,

Caselets, Situational Analysis

The Balance sheet of Om Shanti Om Ltd., as on 31° December2004 and 2005

Qu.

alll are given below:

31.12.2004 31.12.2005

Share Capital 300000 400000

Capital Reserve 10000

General Reserve 170000 200000

Profit and Loss Account 60000 75000

Debentures 200000 140000

Current Liabilities 120000 130000

Provision for tax 90000-85000

Proposed idend 30000 36000

Unpaid Dividend 4000

970000 _ 1080000

Fixed Assets at Cost 800000 950000

Depreciation 230000 __ 290000

570000 660000

‘Trade Investment 100000 80000

Current Assets 280000 330000

Preliminary Expenses 20000 10000

970000 1080000

During the year 2005, the company-

i) Sold Machine for RS.25000, the cost of which was Rs.50000 and depreciation

provided was Rs.21000

ii) Provided depreciation Rs.95000.

Redeemed 30% of Debentures @103

iv) Sold Trade investments at a profit which was credited to Capital Reserve.

¥) Decided to value stock t cost where previously the practice was to value stock

at cost less 10%. The stock according to the book on 313122004 was

Rs.54000. The stock on 31.12.2005 was correctly valued at Rs.75000 and

vi) Decided to write off Fixed Assets costing Rs.14000,

‘You are required to prepare the statement of Sources and Application of Funds during

2005, showing the changes in working capital. (10 Marks)

Q2. With the given information complete the Accounts of Big B Limited

Current Asset Ratio 2:1

Closing Stock is 25% of Sales

Proposed dividends are 40% of paid up capital

Gross profit Ratio is 60%

Ratio of current Ii ies to debentures is 2:

Transfer to general reserve is equal to proposed dividend

Tax rate is 50% of profits

Profits carried forward are 10% of Proposed dividend

Balance to th redit of general reserve at the beginning of the year is

twice the amount transferred to that account from current profits

Ti

ing and Profit and Loss account for the year ended 31st March 2006

To Opening Stock

To Purchases

To Other Expenses

To Gross Profit

To Office and other Expenses =

To interest on Debentures 30000 | By Commission 50000

To prvision for Taxation

To Net Profit for the year

To proposed dividend

To Transferto general reserve

To Balance C/f

350000 | By Sales

87500 | By Closing Stock

By Gross Profit

By Balance B/d 70000

By Net profit for the year

40

Balance sheet as at 31st December 2006

Assests

Paid up Capital 500000 | Fixed Assets

Plant and machinery -

General Reserve Other Fixed assets cs

Bal in the Beginning

Addition Current Assets |

Stock in trade

Profit and loss App A/c Sundry debtors

Bank Bal

; 10% Debentures

5 Current

Workings should form part of your answer (10 Marks)

Q3. _Chetna Corporation requires 200 units of a certain item per year the purchase

price per unit in is Rs.30. the carrying cost is 25% of the inventory value and,

fixed coSt value per order is Rs.1000

i Determine the EOQ

‘What will be the total cost of carrying and ordering inventory when 4

orders of equal size are placed? (8 Marks)

Q4. The earnings per share of the company is Rs.8 and the rate of capitalization

applicable is 10%. The company has before it an option of adopting (i)50%,

(Gi) 75%, and (iii) 100% dividend payout ratio, Compute the market price of

the company’s quoted shares as per Walters model if it can ea a return of

(@)15%, (b) 10% and (¢)5% on its retained earnings. (7 Marks)

Q5. The following information relates to Mritunjaya Hospitality Limited:

‘Actual Sales ‘May — Rs.1,00,000 | June —Rs.1,20,000

‘Actual Purchases ‘May — Rs.80,000 Sune = Rs.60,000

Projected Sales July Rs.1,00,000 | August Rs.1,50,000__| September Rs.1,20,000

Projected Purchases | July Rs.90,000__| August Rs.70,000__| September Rs.80,000

‘Composition of Sales 20 % on Cash Basis | 80 % on Credit

Collection Pattern 60% one month after_| 40 % after two month's

sales sales

"

Payment Pattern 50% one month after | 50% two month's after

purchases purchases

‘Wages and Salaries will be paid at the rate of Rs.20,000/- per month

Other Manufacturing Expenses are estimated to be Rs.12,000/- per month

Selling and General Administration Expenses are estimated to be Rs.8,000/-, Rs.10,000/-and

Rs.8,000/- for the month of July, August and September respectively.

Proceeds from Sale of Fixed Assets are expected to be Rs.20,000/- July.

Payment of Tax of Rs.35,000/- is expected to be paid in September.

Cash Balance at the start of July was Rs.25,000/-. The minimum cash balance required by the

company is Rs.25,000/-

Prepare Cash Budget for the months of July 07", August 07’ and September 07’ indicating the

surplus / doficit in balance taking into consideration the minimum cash balance. (15 Ma:¥s}

Part C: (20 marks: 30 minutes)

Case Analysis / Applications of concepts

Q.6. The follwing are the financial statements for XYZ Co., for 19X4:

XYZ Company

Balance Sheet

as on 31 December, 19X3

Liabilities & Capital Rs. Assets Rs

Creditors 780,000 Cash 70,000

Bills payable 140,000. Debtors 350,000

Outstanding exps. 40,000. Stock 490,000

Provision for tax 100,000 Fixed assets, net 1,050,000

Long - term debt 840,000 Goodwill 140,000

Preference share capital 280,000

Equity share capital 140,000

Reserves 280,000

~ 2,100,000 ~~ 2,100,000

2

XYZ Company

Profit and Loss Ale

for the year ended 31 December, 19X3 Rs)

Sales

Cash 2,80,000

Credit 1,120,000

1,400,000"

Less: Expenses:

Cost of goods sold 840,000

Selling, administrative and general expenses 140,000

Depreciation 98,000

Interest on long - term debt 42,000. 1,120,000

Profit before taxes “280,000

Taxes 140,000

Profit after taxes ~ 140,000

Less: Preference dividend 17,000

Net profit for ordinary shareholders ~~ 123,000

Add: Reserve at | January, 19X3 182,000

305,000

Less: Dividend paid to equity shareholders 25,000

Reserve at 31 December, 19X3 ~~ 280,000

‘The ratio’s for the years 19X1 and 19X2 for XYZ company and their industry ratios are given

below:

13

19X1 19x2 Industry

‘Current ratio 2.54 2.10 2.30

Acid — test ratio 1.10 0.96 1.20

Debtors turnover 6.00 4.80 7.00

Stock turnover 3.80 3.05 3.85

Long — term debt to total 37% 42% 34%

capital

Gross profit me 38% 41% 40%

Net profit margin 18% 16% 15%

Return on equity 24% 29% 19%

Return on total assets ™M% 6.8% 8%

Tangible assets turnover 0.80 0.70 1.00

Interest coverage 10 9 10

(@) Calculate ratios for 19X3 and evaluate the company’s financial posit

(b) Using relevant ratios, indicate what decision should be taken in the following

situations: (i) XYZ Co. wants to buy material of Rs 70,000 on a three months credit

from A. (ii) XYZ Co. offers to sell 70,000 additional shares for Rs 112 per share toa

financial institution. (iii) XYZ Co. wants to issue 16% debentures of Rs 300,000

with a ten — year maturity.

(20 Marks)

[ EN OF THE QUESTION PAPER

“

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

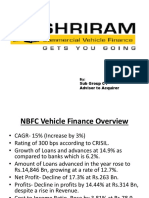

- Sriram Transport FinanceDocument6 pagesSriram Transport FinanceSohrab Ali ChoudharyNo ratings yet

- Sa A AssingmentDocument31 pagesSa A AssingmentSohrab Ali ChoudharyNo ratings yet

- Ift Group 2Document18 pagesIft Group 2Sohrab Ali ChoudharyNo ratings yet

- Futures: Present By: Saif Adnaan Sohrab Ali Choudhary Priyanka Anand Sanket GargDocument12 pagesFutures: Present By: Saif Adnaan Sohrab Ali Choudhary Priyanka Anand Sanket GargSohrab Ali ChoudharyNo ratings yet

- Report On StockDocument1 pageReport On StockSohrab Ali ChoudharyNo ratings yet

- Report On StockDocument1 pageReport On StockSohrab Ali ChoudharyNo ratings yet

- Ibs SipDocument38 pagesIbs SipSohrab Ali ChoudharyNo ratings yet

- Samsung CellphoneDocument40 pagesSamsung CellphoneSohrab Ali ChoudharyNo ratings yet

- Competitive AdvantageDocument31 pagesCompetitive AdvantageSohrab Ali ChoudharyNo ratings yet

- Cost Sheet PDFDocument17 pagesCost Sheet PDFRajuSharmiNo ratings yet