Professional Documents

Culture Documents

DeutscheBank NewsAlert 03july2008 1

Uploaded by

ResearchOracleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DeutscheBank NewsAlert 03july2008 1

Uploaded by

ResearchOracleCopyright:

Available Formats

Tel.

+44 (0)20 7232 3090 Traded on

AIM, London

Fax +44 (0)20 7232 3099 Stock Exchange

www.iirgroup.com Regulated and

LSE: IIR authorised by

Deutsche Bank AG 03 July 2008

Company News Alert

Deutsche Bank to acquire commercial banking units in the Netherlands

Common HOLD On 02 July 2008, Deutsche Bank AG (DB) announced that it will acquire some of ABN Amro’s

Direct access

commercial banking to the

units fullNetherlands

in the report free of charge

for €709 at N.V. The company has stated

mn from Fortis

Stock http://www.iirgroup.com/researchoracle/viewreport/show/20181

that this transaction is in line with the company’s strategy to expand its “stable business” and will offer

the company a strong client base in the Netherlands. The bank also issued an update on its quarterly

performance, indicating that it anticipates a profitable 2Q 08, with a Tier 1 ratio of approximately 9%,

Ticker: DBKGn.DE

and that it therefore does not expect any requirement for further capital raising. Despite these positive

Target price: €89.09 developments, we remain concerned about the sensitivity of the global banking sector to ongoing

Current price: €54.48 volatility in global financial markets. Furthermore, Management’s near term outlook on liquidity and the

US housing market is very weak. We plan to lower our estimates and target price significantly when we

revalue the bank in our next full update report. Therefore, although our current common stock target

Price change price suggests a BUY rating, we maintain our HOLD rating.

(37.9%)

since last report:

We will reassess our common stock rating for DB in our next full update report.

NYSE Stock HOLD Following a further change in our currency forecast, we now expect to continue to value the company

over an investment horizon of 6-24 months1. As we now anticipate a negative currency impact on the

NYSE stock, which along with the fundamental reduction will reduce our target price significantly, we

Ticker: DB maintain our HOLD rating at current levels.

Target price: US$111.37

Current price: US$85.64

Price change We will reassess our NYSE stock rating for DB in our next full update report.

(32.4%)

since last report:

Supervisor: Somnath Banerjee

Analyst: Vishal Ajmera

Investment horizon - short term actionable trading strategies

Editor: Heloise Capon This report addresses the needs of strategic investors with a long term investment horizon of 6-24 months. If this

report is provided to you by your broker under the Global Settlement, you may now also access (free of charge) the

Global Research Director: short term trading outlook that we publish from time to time for this issuer, looking at the coming 5-30 days for

Satish Betadpur, CFA readers with a shorter trading horizon. These are available online only at www.researchoracle.com

Next news due:

2Q 08 results, 31 July 2008 On 02 July 2008, DB announced that it plans to acquire some of ABN Amro’s commercial banking

activities in the Netherlands from the Belgian-Dutch bank Fortis for €709 mn (US$1.13 bn) in cash.

DB will acquire two corporate client units, 13 commercial advisory branches that serve medium-sized

clients, parts of the Rotterdam-based bank, Hollandsche Bank Unie N.V. and the Dutch part of ABN

Amro’s factoring unit, IFN Group Finance. The sale price represents a discount of approximately €300

mn to the net asset value of the businesses that are to be sold. The transaction is expected to be

closed at the beginning of 4Q 08. The sale of the businesses is in line with Fortis’ commitment to the

European Commission, to address concerns over concentration in the Dutch banking market resulting

from Fortis’ acquisition of ABN Amro assets. The decision to take over commercial-banking units in the

Netherlands is in line with DB’s strategy to expand its corporate and investment banking in the country

and provides an opportunity for the bank to continue growing its businesses, with the acquisition of

well-established and stable business assets at a healthy discount. The bank’s quarterly performance

update, released on the same day, outlines that it anticipates a profitable 2Q 08, with a Tier 1 ratio of

approximately 9%, and that it has no expectation of a requirement to raise further capital., However,

we remain concerned about Management’s highly uncertain near term outlook regarding liquidity and

the US housing market, and sensitivity of the global banking sector to ongoing volatility in global

financial markets.

Footnote

After a short term appreciation, we now expect the Euro to depreciate against the US dollar to trade at €1.50 over

12 months and €1.35 over 24 months. In order to capture the long term currency impact we expect to maintain our

6-24 month investment horizon for this stock.

Page 1

You might also like

- WNS NewsAlert 11july2008 1Document1 pageWNS NewsAlert 11july2008 1ResearchOracleNo ratings yet

- GrupoAeroCentroNorte NewsAlert 11july2008 1Document1 pageGrupoAeroCentroNorte NewsAlert 11july2008 1ResearchOracleNo ratings yet

- ACE 1Q08Update 11jul2008 1Document1 pageACE 1Q08Update 11jul2008 1ResearchOracleNo ratings yet

- Roundup 10 July 2008Document2 pagesRoundup 10 July 2008ResearchOracleNo ratings yet

- UnileverNV 1Q08Update 10jul08 1Document1 pageUnileverNV 1Q08Update 10jul08 1ResearchOracleNo ratings yet

- EnduranceSpecialty NewsAlert 10july2008 1Document1 pageEnduranceSpecialty NewsAlert 10july2008 1ResearchOracleNo ratings yet

- Sappi 2Q08Update 09july2008 1Document1 pageSappi 2Q08Update 09july2008 1ResearchOracleNo ratings yet

- ChinaEastern FY2007Update 09july2008 1Document1 pageChinaEastern FY2007Update 09july2008 1ResearchOracleNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Nego ReviewerDocument86 pagesNego ReviewerNia JulianNo ratings yet

- Asia Trust Development Bank v. Carmelo H. TubleDocument1 pageAsia Trust Development Bank v. Carmelo H. TubleMacNo ratings yet

- BTC 5Document6 pagesBTC 5Pablo Gabrio100% (4)

- Account Statement: Generated On Saturday, December 04, 2021 7:32:57 PMDocument37 pagesAccount Statement: Generated On Saturday, December 04, 2021 7:32:57 PMdidiNo ratings yet

- Methods of Payment in International Trade, Export and Import FinanceDocument18 pagesMethods of Payment in International Trade, Export and Import Financecharurastogi100% (2)

- Hba Interest CalculationDocument3 pagesHba Interest CalculationparirNo ratings yet

- Unit - 2 Negotiable Instruments: Kantharaju N.P. Ananya Institute of Commerce and ManagementDocument9 pagesUnit - 2 Negotiable Instruments: Kantharaju N.P. Ananya Institute of Commerce and ManagementvasistaharishNo ratings yet

- Factura / Invoice: Bastea EminDocument1 pageFactura / Invoice: Bastea EminEmin BasteaNo ratings yet

- Week 4 Tutorial QuestionsDocument5 pagesWeek 4 Tutorial QuestionsJess XueNo ratings yet

- Administered Interest Rates in IndiaDocument17 pagesAdministered Interest Rates in IndiatNo ratings yet

- ACP - Quiz-On-Cash-Flow - For-PostingDocument3 pagesACP - Quiz-On-Cash-Flow - For-PostingJunel PlanosNo ratings yet

- Passbookstmt PDFDocument4 pagesPassbookstmt PDFGarth GNo ratings yet

- SAP DPMS MobileDocument1 pageSAP DPMS MobileVinod PanchalNo ratings yet

- Ledger Confirmation F.Y. 2019-20Document1 pageLedger Confirmation F.Y. 2019-20GaganDasPapaiNo ratings yet

- Citibank Research PaperDocument5 pagesCitibank Research Paperzwyzywzjf100% (1)

- Checkout and SettlementDocument69 pagesCheckout and Settlementsanath menonNo ratings yet

- Bank Duties and RightsDocument6 pagesBank Duties and RightsSthita Prajna Mohanty100% (1)

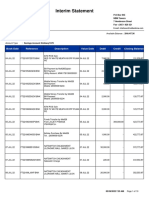

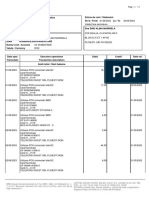

- Interim Statement: Book Date Debit Credit Reference Description Value Date Closing BalanceDocument10 pagesInterim Statement: Book Date Debit Credit Reference Description Value Date Closing BalanceEstherNo ratings yet

- Project Proposal SBI MicrofinanceDocument7 pagesProject Proposal SBI MicrofinanceKiran Chopra100% (1)

- HDFC Bank Treasury Forex Card Rates: Date: 26/03/2019 TimeDocument1 pageHDFC Bank Treasury Forex Card Rates: Date: 26/03/2019 Timekang_warsadNo ratings yet

- FAQs AlBarakaCurrentAccountDocument2 pagesFAQs AlBarakaCurrentAccountAbdullah ShahidNo ratings yet

- Receivable Financing Part 2Document2 pagesReceivable Financing Part 2lcNo ratings yet

- Festus Jan To Now StatementDocument10 pagesFestus Jan To Now StatementAkanwi BrightNo ratings yet

- اتفاقية اتعاب انجليزىDocument2 pagesاتفاقية اتعاب انجليزىibrahemNo ratings yet

- Exxon Mobil: Rank Company Country Sales Profits Assets Market ValueDocument10 pagesExxon Mobil: Rank Company Country Sales Profits Assets Market ValuePetrescu PaulNo ratings yet

- Activity 01Document3 pagesActivity 01Mahra AlMazroueiNo ratings yet

- Grameen America ReportDocument35 pagesGrameen America ReportBradArmstrongNo ratings yet

- SV90483973000 2023 06Document11 pagesSV90483973000 2023 06Alina DinuNo ratings yet

- Gate Ies Psu: New Batches For Gate & Psus 2021Document4 pagesGate Ies Psu: New Batches For Gate & Psus 2021Vijaykumar JatothNo ratings yet

- International Economics TutorialDocument5 pagesInternational Economics TutorialBenjaminNo ratings yet