Professional Documents

Culture Documents

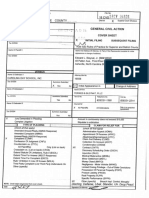

Buncombe County Tax Rate Scenarios

Buncombe County Tax Rate Scenarios

Uploaded by

Jennifer BowmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buncombe County Tax Rate Scenarios

Buncombe County Tax Rate Scenarios

Uploaded by

Jennifer BowmanCopyright:

Available Formats

FY 2019 Tax Rate Change Scenarios 6/21/2018

Below are estimated changes in fund balance and available fund balance based on various levels of

change in the ad valorem tax rate for Buncombe County. Inputs and Assumptions

Below are variables used for change scenarios. Updates to

Tax Rate Appropriated Change in Total Fund Available Fund Available Fund variables here will also update calculations

Change Tax Rate Fund Balance Fund Balance Balance Balance Balance %

2.00 54.90 1,223,134 (726,041) 78,035,741 55,423,913 17.49%

1.75 54.65 2,155,088 205,913 77,103,788 54,491,960 17.20% FY 2019 Budget Variables

1.50 54.40 3,087,041 1,137,866 76,171,834 53,560,006 16.90% Budget: Total Expenditures & Transfers Out 316,861,799

1.25 54.15 4,018,995 2,069,820 75,239,881 52,628,053 16.61% Actual: Total Expenditures & Transfers Out 316,861,799

1.00 53.90 4,950,948 3,001,773 74,307,927 51,696,099 16.32% Budget: Appropriated Fund Balance 8,678,762

0.75 53.65 5,882,902 3,933,727 73,375,974 50,764,146 16.02% Actual: Net Change in Fund Balance** 6,729,587

0.50 53.40 6,814,855 4,865,680 72,444,020 49,832,192 15.73% Value of 1 Cent 3,727,814

0.25 53.15 7,746,809 5,797,634 71,512,067 48,900,239 15.43% Budgeted in Contingency 1,949,175

0.00 52.90 8,678,762 6,729,587 70,580,113 47,968,285 15.14% FY 2019 Balance Sheet Variables*

-0.25 52.65 9,610,716 7,661,541 69,648,160 47,036,332 14.84% Cash, Investments, and Restricted Cash 69,886,139

-0.50 52.40 10,542,669 8,593,494 68,716,206 46,104,378 14.55% Total Liabilities 12,117,244

-0.75 52.15 11,474,623 9,525,448 67,784,253 45,172,425 14.26% Miscellaneous Liabilities 599,355

-1.00 51.90 12,406,576 10,457,401 66,852,299 44,240,471 13.96% Unearned Revenues 2,471,668

-1.25 51.65 13,338,530 11,389,355 65,920,346 43,308,518 13.67%

-1.50 51.40 14,270,483 12,321,308 64,988,392 42,376,564 13.37% Prior Years

-1.75 51.15 15,202,437 13,253,262 64,056,439 41,444,611 13.08% FY 2017 Year End Fund Balance 77,584,700

-2.00 50.90 16,134,390 14,185,215 63,124,485 40,512,657 12.79% FY 2018 Projected Year End Fund Balance 77,309,700

Summary FY18 Fund Balance Available

These assumptions are heavily dependent on projections for FY18 year end and the FY19 budget. (Calculated for Reference) 54,697,872

Note: The Government Finance Officers Association (GFOA) recommends at a minimum that general-

purpose governments maintain unrestricted fund balance of no less than two months of operating *Default balance sheet liability variables equal to FY17 year end. Default

cash and investments variable equal to FY17 year end. Table

expenditures (16.67%). GFOA Best Practice - Fund Balance Guidlines for the General Fund, pg 2.

calculations adjust cash and investments by subtracting total change in

fund balance based on tax rate.

** Estimates saving contingency amount

FY 2020 Tax Rate Change Scenarios - 2% Expenditure Increase // 2% Ad Valorem and Sales Tax 6/21/2018

Below are estimated changes in fund balance and available fund balance assuming a 52.90 tax rate, a

2% increase in expenditures, a 2% increase in Ad Valorem and Sales Tax revenues, and an additional Inputs and Assumptions

increase in property tax revenues of $8.1M due to the sale of Mission Hospital. Below are variables used for change scenarios. Updates

Tax Rate Appropriated Change in Total Fund Available Fund Available Fund to variables here will also update calculations

Change Tax Rate Fund Balance Fund Balance Balance Balance Balance %

2.00 54.90 (5,264,934) (5,264,934) 75,845,047 53,233,219 16.47%

1.75 54.65 (4,314,341) (4,314,341) 74,894,454 52,282,626 16.18% FY 2020 Budget Variables

1.50 54.40 (3,363,749) (3,363,749) 73,943,862 51,332,034 15.88% Budget: Total Expenditures & Transfers Out 323,199,035

1.25 54.15 (2,413,156) (2,413,156) 72,993,269 50,381,441 15.59% Actual: Total Expenditures & Transfers Out 323,199,035

1.00 53.90 (1,462,564) (1,462,564) 72,042,677 49,430,849 15.29% Budget: Appropriated Fund Balance 2,339,807

0.75 53.65 (511,971) (511,971) 71,092,084 48,480,256 15.00% Actual: Net Change in Fund Balance** 2,339,807

0.50 53.40 438,621 438,621 70,141,492 47,529,664 14.71% Value of 1 Cent 3,802,370

0.25 53.15 1,389,214 1,389,214 69,190,899 46,579,071 14.41%

0.00 52.90 2,339,807 2,339,807 68,240,306 45,628,478 14.12% FY 2020 Balance Sheet Variables*

-0.25 52.65 3,290,399 3,290,399 67,289,714 44,677,886 13.82% Cash, Investments, and Restricted Cash 63,156,552

-0.50 52.40 4,240,992 4,240,992 66,339,121 43,727,293 13.53% Total Liabilities 12,117,244

-0.75 52.15 5,191,584 5,191,584 65,388,529 42,776,701 13.24% Miscellaneous Liabilities 599,355

-1.00 51.90 6,142,177 6,142,177 64,437,936 41,826,108 12.94% Unearned Revenues 2,471,668

-1.25 51.65 7,092,769 7,092,769 63,487,344 40,875,516 12.65%

-1.50 51.40 8,043,362 8,043,362 62,536,751 39,924,923 12.35% Prior Years

-1.75 51.15 8,993,955 8,993,955 61,586,158 38,974,330 12.06% FY 2017 Year End Fund Balance 77,584,700

-2.00 50.90 9,944,547 9,944,547 60,635,566 38,023,738 11.76% FY 2018 Projected Year End Fund Balance 77,309,700

FY 2019 Projected Year End Fund Balance 70,580,113

Summary FY18 Fund Balance Available

These assumptions are heavily dependent on projections for FY18 year end and the FY19 budget, and the (Calculated for Reference) 47,968,285

Board of Commissioners adopting a 52.9 cent tax rate.

Note: The Government Finance Officers Association (GFOA) recommends at a minimum that general- *Balance sheet variables are estimated based on FY2019 estimates.

Table calculations adjust cash and investments by subtracting total

purpose governments maintain unrestricted fund balance of no less than two months of operating

change in fund balance based on tax rate.

expenditures (16.67%). GFOA Best Practice - Fund Balance Guidlines for the General Fund, pg 2.

Assumes additional property taxes of $8.1M from Mission sale

Assumes 2% increase in sales and property taxes

Assumes 2% growth in expenditures

FY 2020 Tax Rate Change Scenarios - 1% Expenditure Increase // 2% Ad Valorem and Sales Tax 6/21/2018

Below are estimated changes in fund balance and available fund balance assuming a 52.90 tax rate, a

1% increase in expenditures, a 2% increase in Ad Valorem and Sales Tax revenues, and an additional Inputs and Assumptions

increase in property tax revenues of $8.1M due to the sale of Mission Hospital. Below are variables used for change scenarios. Updates

Tax Rate Appropriated Change in Total Fund Available Fund Available Fund to variables here will also update calculations

Change Tax Rate Fund Balance Fund Balance Balance Balance Balance %

2.00 54.90 (7,604,741) (8,433,552) 79,013,665 56,401,837 17.62%

1.75 54.65 (6,654,148) (7,482,959) 78,063,072 55,451,244 17.33% FY 2020 Budget Variables

1.50 54.40 (5,703,555) (6,532,366) 77,112,479 54,500,651 17.03% Budget: Total Expenditures & Transfers Out 320,030,417

1.25 54.15 (4,752,963) (5,581,774) 76,161,887 53,550,059 16.73% Actual: Total Expenditures & Transfers Out 320,030,417

1.00 53.90 (3,802,370) (4,631,181) 75,211,294 52,599,466 16.44% Budget: Appropriated Fund Balance -

0.75 53.65 (2,851,778) (3,680,589) 74,260,702 51,648,874 16.14% Actual: Net Change in Fund Balance** (828,811)

0.50 53.40 (1,901,185) (2,729,996) 73,310,109 50,698,281 15.84% Value of 1 Cent 3,802,370

0.25 53.15 (950,593) (1,779,404) 72,359,517 49,747,689 15.54%

0.00 52.90 - (828,811) 71,408,924 48,797,096 15.25% FY 2020 Balance Sheet Variables*

-0.25 52.65 950,593 121,782 70,458,331 47,846,503 14.95% Cash, Investments, and Restricted Cash 63,156,552

-0.50 52.40 1,901,185 1,072,374 69,507,739 46,895,911 14.65% Total Liabilities 12,117,244

-0.75 52.15 2,851,778 2,022,967 68,557,146 45,945,318 14.36% Miscellaneous Liabilities 599,355

-1.00 51.90 3,802,370 2,973,559 67,606,554 44,994,726 14.06% Unearned Revenues 2,471,668

-1.25 51.65 4,752,963 3,924,152 66,655,961 44,044,133 13.76%

-1.50 51.40 5,703,555 4,874,744 65,705,369 43,093,541 13.47% Prior Years

-1.75 51.15 6,654,148 5,825,337 64,754,776 42,142,948 13.17% FY 2017 Year End Fund Balance 77,584,700

-2.00 50.90 7,604,741 6,775,930 63,804,183 41,192,355 12.87% FY 2018 Projected Year End Fund Balance 77,309,700

FY 2019 Projected Year End Fund Balance 70,580,113

Summary FY18 Fund Balance Available

These assumptions are heavily dependent on projections for FY18 year end and the FY19 budget, and the (Calculated for Reference) 47,968,285

Board of Commissioners adopting a 52.9 cent tax rate.

Note: The Government Finance Officers Association (GFOA) recommends at a minimum that general- *Balance sheet variables are estimated based on FY2019 estimates.

Table calculations adjust cash and investments by subtracting total

purpose governments maintain unrestricted fund balance of no less than two months of operating

change in fund balance based on tax rate.

expenditures (16.67%). GFOA Best Practice - Fund Balance Guidlines for the General Fund, pg 2.

Assumes additional property taxes of $8.1M from Mission sale

Assumes 2% increase in sales and property taxes

Assumes 1% growth in expenditures

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Book of Lost Spells (Necromancer Games)Document137 pagesBook of Lost Spells (Necromancer Games)Rodrigo Hky91% (22)

- Motion To Seal 911 CallDocument2 pagesMotion To Seal 911 CallJennifer BowmanNo ratings yet

- Joe Carrington ComplaintDocument24 pagesJoe Carrington ComplaintJennifer BowmanNo ratings yet

- Minassian Full Reasons For JudgementDocument69 pagesMinassian Full Reasons For JudgementCityNewsTorontoNo ratings yet

- Design of Yagi Uda Antenna Using HFSS SoftwareDocument10 pagesDesign of Yagi Uda Antenna Using HFSS SoftwareNafi Wibowo0% (1)

- Triveni Kala SangamDocument6 pagesTriveni Kala SangamAh AnNo ratings yet

- Joe Wiseman Sentencing MemorandumDocument56 pagesJoe Wiseman Sentencing MemorandumJennifer BowmanNo ratings yet

- Jon Creighton Sentencing MemoDocument34 pagesJon Creighton Sentencing MemoJennifer BowmanNo ratings yet

- Ellen Frost IndictmentDocument27 pagesEllen Frost IndictmentJennifer BowmanNo ratings yet

- Judge's Order Sealing 911 CallDocument1 pageJudge's Order Sealing 911 CallJennifer BowmanNo ratings yet

- Kate Dreher LetterDocument1 pageKate Dreher LetterJennifer BowmanNo ratings yet

- Christina Rochelle Anglin IndictmentDocument19 pagesChristina Rochelle Anglin IndictmentJennifer BowmanNo ratings yet

- Krista Madden 911 Call TranscriptDocument14 pagesKrista Madden 911 Call TranscriptJennifer BowmanNo ratings yet

- Miller's Presentation To CommissionersDocument15 pagesMiller's Presentation To CommissionersJennifer BowmanNo ratings yet

- Buncombe County Draft Procurement ManualDocument48 pagesBuncombe County Draft Procurement ManualJennifer BowmanNo ratings yet

- BuncombeDocument4 pagesBuncombeJennifer BowmanNo ratings yet

- Superseding Greene IndictmentDocument27 pagesSuperseding Greene IndictmentJennifer BowmanNo ratings yet

- Licensing Board Letter To Buncombe CountyDocument1 pageLicensing Board Letter To Buncombe CountyJennifer BowmanNo ratings yet

- Personnel Ordinance MemoDocument2 pagesPersonnel Ordinance MemoJennifer BowmanNo ratings yet

- English 5 Q2 Week 2Document9 pagesEnglish 5 Q2 Week 2Cristina MoranteNo ratings yet

- Hibernate NotesDocument338 pagesHibernate NotesAnirudha Gaikwad100% (1)

- Catalogo Chaos FW22Document125 pagesCatalogo Chaos FW22KrypttonNo ratings yet

- Jinny Choe Temp Mem CardDocument1 pageJinny Choe Temp Mem CardginauineNo ratings yet

- QM-001 QMS-Quality ManualDocument13 pagesQM-001 QMS-Quality ManualFERNANDO MORANTESNo ratings yet

- Naval Review Vol XXXIII No 3 - August 1945 (British)Document93 pagesNaval Review Vol XXXIII No 3 - August 1945 (British)Philip Sturtivant100% (2)

- 1 DSKP KSSR Bi Year 1 SK - 2018Document3 pages1 DSKP KSSR Bi Year 1 SK - 2018aziawati ahmadNo ratings yet

- PS182 - Terminal Report (1st Q)Document88 pagesPS182 - Terminal Report (1st Q)MarieBalangueNo ratings yet

- An Ocean Without ShoreDocument199 pagesAn Ocean Without ShoreBogdan Scupra50% (2)

- Lecture Programme CCM FULL TIME 201820192Document34 pagesLecture Programme CCM FULL TIME 201820192Rio RimbanuNo ratings yet

- Encumbrance Form KDDocument3 pagesEncumbrance Form KDEntertainment world teluguNo ratings yet

- OASYS GEO v17.8Document4 pagesOASYS GEO v17.8Koresh KhalpariNo ratings yet

- Anatomy Embryology 1&2Document39 pagesAnatomy Embryology 1&2Nadeen ShahwanNo ratings yet

- Mystici Corporis Christi (1943)Document38 pagesMystici Corporis Christi (1943)Jennifer R. RustNo ratings yet

- Importance of The EnglishDocument3 pagesImportance of The EnglishMaria Alejandra Rivas HueteNo ratings yet

- Konsep New PedagogyDocument14 pagesKonsep New PedagogyNUR IZZATI BINTI MOHAMAD SABRI KPM-GuruNo ratings yet

- Homework Not Done Note ParentsDocument8 pagesHomework Not Done Note Parentsafnaoabfuddcdf100% (1)

- Knowledge Is PowerDocument17 pagesKnowledge Is PowerRohitKumarSahu100% (1)

- A STUDY ON CONSUMERS BUYING BEHAVIOUR TOWARDS TVS MOTORS WITH REFERENCE TO TVS VENKATACHALAM IN KOVILPATTI Ijariie14782Document13 pagesA STUDY ON CONSUMERS BUYING BEHAVIOUR TOWARDS TVS MOTORS WITH REFERENCE TO TVS VENKATACHALAM IN KOVILPATTI Ijariie14782Mahendra KotakondaNo ratings yet

- Analysis of Psychological Well-Being in High GradeDocument7 pagesAnalysis of Psychological Well-Being in High GradeFeiNo ratings yet

- J Matpr 2021 06 081Document8 pagesJ Matpr 2021 06 081SREEJITH S NAIR100% (1)

- Skelley Book PreviewDocument30 pagesSkelley Book PreviewBlazeVOX [books]No ratings yet

- IC3 Corporate Finance Photocopiable Teachers NotesDocument10 pagesIC3 Corporate Finance Photocopiable Teachers NotesОля ИгнатенкоNo ratings yet

- Detailed Lesson Plan in English 5 First Quarter Week 2 - Day 2 I. ObjectivesDocument3 pagesDetailed Lesson Plan in English 5 First Quarter Week 2 - Day 2 I. ObjectivesElvz C. DionesNo ratings yet

- SWOT Analysis of Coca Cola: StrengthsDocument6 pagesSWOT Analysis of Coca Cola: StrengthsFaisal LukyNo ratings yet

- Karnataka 12th STD Science 2023 24 Batch Samples 2Document24 pagesKarnataka 12th STD Science 2023 24 Batch Samples 2mayanksharma251307No ratings yet