Professional Documents

Culture Documents

Pmla Summary

Uploaded by

Meet Mehta0 ratings0% found this document useful (0 votes)

9 views4 pagesPmla summary CA final

Original Title

1106014_20180620091402_pmla_summary

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPmla summary CA final

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views4 pagesPmla Summary

Uploaded by

Meet MehtaPmla summary CA final

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

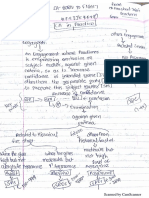

Summary of Important topics of PMLA, 2002

1. DEFINITIONS

a) Money Laundering (Sec 2(1)(p) + Sec 3) b) Proceeds of Crime (Sec 2(1)(u))

c) Scheduled Offence (Sec 2(1)(y)

ia.

2. Punishment for money-laundering (Sec 4)

*Any contravention in relation to poppy straw, coca leaves, opium, cannabis etc is covered in Para 2

of Part A of Schedule

3. Section 12 - Obligations of Banking Companies, Financial institutions & Intermediaries

of securities market

*The record of transactions is required to be maintained for 5 years from the date of transaction

## The records are to maintained for 5 years after the business relationship between client & the reporting

entity has ended or the account has been closed, whichever is later

4.) Provisions relating to Special Court (Section 43-45)

a) Section 43 - Power of CG to designate/notify court of sessions as Special Court in consultation

with Chief Justice of HC

b) Section 44 —

Special Court takes cognizance of offence on written complaint by authorised authority. So no

requirement of police report of facts.

c) Section 45 - Offences to be cognizable & non-bailable

No person accused of offence punishable for a term of imprisonment of more than 3 years under

Part A of the Schedule shall be released on bail or on his own bond unless:

1) The public prosecutor has been given an opportunity to oppose the application for such

release; and

2) Courts satisfied that there are reasonable ground for believing that he is not guilty of the

offence and he is not likely to commit any offence while on bail

3) Person < 16 years, women or sick person can be released on bail on directions of Special

Court

5,) Remedies available to person aggrieved by order of Adjudi

(Section 25,26 & 42)

ting Authority under the Act

6.) Prevention of Money-laundering (Amendment) Act 2009

Enabled India’s entry into FATF

Objective : To Strengthen existing legal framework & to effectively combat

Y Terror Financing

Y Cross border economic offences

v¥ Money laundering

Implications: Full fledged money-lenders, Money transfer service providers, credit card

operators, casinos brought under the ambit of PMLA & need to report to the authorities

It also keeps a check on misuse of Promissory Notes by Flls who would now be required to

furnish all details of their source

7.) Difference between Siphoning of Funds & Money Laundering

Merely obtaining money or income or deriving property by committing a crime amounts to

Siphoning of fund.

Whereas Money Laundering is moving illegally acquired cash through financial system so

that it appears to be legally acquired. It is conversion of illegally obtained money. .

You might also like

- Class NotesDocument8 pagesClass NotesMeet MehtaNo ratings yet

- 0 PDFDocument80 pages0 PDFVinay kumarNo ratings yet

- 5 6154613235233325279 PDFDocument21 pages5 6154613235233325279 PDFMeet MehtaNo ratings yet

- CA Final Direct Tax Flow Charts May 2017 2SDMBZA2Document92 pagesCA Final Direct Tax Flow Charts May 2017 2SDMBZA2Meet Mehta100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)