Professional Documents

Culture Documents

A Study On Working Capital Management at Eastern Condiments (P) LTD

Uploaded by

adharsh vasudevanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On Working Capital Management at Eastern Condiments (P) LTD

Uploaded by

adharsh vasudevanCopyright:

Available Formats

IOSR Journal of Business and Management (IOSR-JBM)

e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 17, Issue 5.Ver. III (May. 2015), PP 53-59

www.iosrjournals.org

A Study on Working Capital Management at Eastern

Condiments (P) Ltd

P.Glen Calister Virge 1, S.Vinitha 2

Final year BBM student Dept. of Commerce and Management Amrita UniversityIndia

Abstract: Working capital management is considered to be a crucial element in determining the financial

performance of an organization. The primary purpose of this paper is to investigate the relationship between

working capital management and financial performance of EASTERN CONDIMENTS PRIVATE LIMITED.

Data were collected from annual reports of sampled firm for the period of 2008 to 2013. Performance was

measured in terms of ratio analysis, trend analysis cash conversion cycle were used as measures of working

capital management. The study has helped us to find out that the company’s needs to reduce its current

liabilities and its payables deferral period to an extent. Also the company needs to increase its cash balance as

it is the most liquid asset.

I. Introduction

In the current economy, numerous companies are under performing. The major reason for this is

underutilization of actual capacity and lack of efficiency in technical and financial management .Efficient

management of the working capital is the key to the success of every business. So, for the efficient management

of working capital, a firm should have an efficient finance department which carries out its functions in the most

effective manner .In this study, an effort is made to analyse the working of the finance department of EASTERN

CONDIMENTS PVT LTD. with regards to working capital and its components. Hence it is stated as ―A Study

to assess the working of the finance department of EASTERN CONDIMENTS PVT LTD with regard to its

working capital management.‖The purpose of the study was to analyse the working capital management of the

company, to analyse the liquidity trend at the company ,to measure the financial soundness of the company by

analysing various ratios.

The Eastern Group of Companies founded by Mr. M.E. MEERAN, started with a dream, making good

products available to the common man at the right prices. The Company was established in 1983, is a pioneer in

the state to produce packaged curry powders, Masala powders, spices and coffee powder. Eastern Condiments

Pvt. Ltd. is a well-established name as Kerala‘s largest manufacturer of condiments and one of the leading brand

among the south India. An expertise and experience collated over a period of 30 years has borne fruit.

Nationwide branches, two well-equipped factories situated in the Eastern high range of South India and over

two million satisfied household all over stand as solid evidence of its exceptional repute. A name that will hold

its own for years to come as the worthwhile manufacturers, distributors and exporters of the quality natural and

blended spices powders and spices.

Eastern At A Glance

• ECPL is the largest manufacturer (by volume) of Powdered Spices in the country.

• ECPL provides one of the best grinding and packing facilities in the Industry.

• ECPL currently has the capability to meet additional demand for spice powders and, in lieu of ongoing

capacity build-up projects, is geared to enhance manufacturing capacity quickly so as to meet market

demands.

• ECPL has one of the best quality testing and microbiological impurity detection labs in the country and has

deployed one of the latest and best equipment, based on global standards.

• ECPL is highly conscious of maintaining stringent quality standards in products as well as processes and in

addition to having HACCP and ISO 222000 certifications has also initiated procedures for acquiring: ISO

14001, BRC, EREP GAP, NABL and other related certifications.

• ECPL has adequate warehousing and specialized storage facilities and is in the process of enhancing

capacity.

• ECPL has a unique logistics set-up and is geared up to quickly acquire further capability to meet increased

in market demand.

• ECPL is revamping its business communication process (hectic activity is on-going so as to be fully —

operational by end of the current financial year), which would enable highly efficient and transparent

business transactions.

DOI: 10.9790/487X-17535359 www.iosrjournals.org 53 | Page

A Study on Working Capital Management at Eastern Condiments (P) Ltd

Competitors The Company has many competitors in the market. Mainly the competitors are Nirapara,

Melam, Brahmins, Double Horse, Priyam, Saras, kaula.

II. Headings

Introduction

Headings

Figures and Tables

Conclusion

Acknowledgements

III. Figures and Tables

Table:1

YEAR 2009 2010 2011 2012 2013

Current assets 7709.33 8492.25 9744.29 10794 10853.7

Current liabilities 1716.24 2697.67 7529.46 9575.29 7809.2

Current ratios 4.49 : 1 3.14 : 1 1.29 : 1 1.12 : 1 1.35 : 1

Fig:1

Table:2

YEARS 2009 2010 2011 2012 2013

Quick assets 5572.75 4821.4 3260.72 3749.22 3354.78

Current liabilities 1716.24 2697.67 7529.46 9575.29 7810.2

Quick ratios 3.24 1.78 0.43 0.39 0.42

Fig:2

Table:3

DOI: 10.9790/487X-17535359 www.iosrjournals.org 54 | Page

A Study on Working Capital Management at Eastern Condiments (P) Ltd

Fig:3

Table:4

YEAR 2009 2010 2011 2012 2013

SALES 27502.45 32025.17 38075.16 46804.44 44515.92

Fig:4

Table:5

YEARS 2009 2010 2011 2012 2013

COST OF GOODS SOLD 18675.02 20399.22 24225.93 31773.22 27148.12

AVERAGE INVENTORIES 2349.54 2903.81 5077.31 6764.17 7271.85

INVENTORY TURNOVER RATIO 7.94 7.02 4.77 4.69 3.73

Fig:5

DOI: 10.9790/487X-17535359 www.iosrjournals.org 55 | Page

A Study on Working Capital Management at Eastern Condiments (P) Ltd

Table:6

YEAR NET SALES WORKING CAPITAL WORKING CAPITAL

TURNOVER RATIO

2008-09 27514.45 5993.09 4.59

2009-10 32025.17 5794.84 5.52

2010-11 38075.16 2214.83 17.19

2011-12 46804.44 1218.71 38.40

2012-13 44515.92 3043.5 14.62

Fig:6

Table:7

YEAR GROSS PROFIT NET SALES G/P RATIO IN %

2009 - 08 8839.43 27514.45 32.12 %

2010 - 09 11625.95 32025.17 36.30 %

2011 - 10 13849.23 38075.16 36.37 %

2012 - 11 15031.22 46804.44 32.11 %

2013 - 12 17367.89 44515.92 39.01%

Fig:7

Table:8

As On As On As On As On

As On

ITEMS 31 MARCH 31 MARCH 31 MARCH 31 MARCH

31 MARCH 2009

2010 2011 2012 2013

RAW MATERIALS 697.66 1532.36 3150.8 3473 3970

WORK –IN -

318.64 479.02 893 821.08 944.56

PROGRESS

FINISHED GOODS 636.69 1015.45 1300.7 1716 1605.29

STOCK IN TRADE 0 13.53 94.1 115.12 109.91

OTHERS(

479.17 627.94 1032.2 927.5 878.69

PACKING)

FUEL 4.42 3.35 12.77 0 0

TOTAL 2136.58 3671.65 6483.57 7044.78 7498.92

DOI: 10.9790/487X-17535359 www.iosrjournals.org 56 | Page

A Study on Working Capital Management at Eastern Condiments (P) Ltd

Fig:8

Table:9

YEAR 2009 2010 2011 2012 2013

Average Accounts Receivable 1781.92 1826.5 2071.8 2155.8 2394.6

Annual Sales 27512.5 32025.2 38075.2 46804.44 44515.9

Days 365 365 365 365 365

Receivables Collection Period (DAYS) 23 21 20 17 20

Fig:9

Table:10

YEARS 2009 2010 2011 2012 2013

Sales 27512.5 32025.2 38075.2 46804.44 44515.9

Average Accounts Payable 496.09 828.93 879.4 1130.94 1544.5

Accounts Payable Deferral Period 6.58 9.44 8.43 8.83 12.66

DOI: 10.9790/487X-17535359 www.iosrjournals.org 57 | Page

A Study on Working Capital Management at Eastern Condiments (P) Ltd

Fig:10

Table:11

YEAR 2009 2010 2011 2012 2013

Sales 27514.5 32026.2 38075.4 46805.44 44535

Cost of goods sold 18675 20399.2 24225.9 31773.22 27148.1

Inventories 2349.54 2903.81 5077.31 6764.17 7271.85

Average accounts receivables 1781.92 1826.5 2071.87 2155.82 2394.61

Average accounts payables 496.09 828.93 879.4 1130.94 1544.5

Days / Year 365 365 365 365 365

Inventory conversion period (DAYS) 46 52 77 78 98

Receivables collection period (DAYS) 23 21 20 17 20

Payables deferral period(DAYS) 7 9 8 9 13

CASH CONVERSION CYCLE 62 64 89 86 105

Fig:11

Findings

The current ratio has been unstable & the company hasn‘t been able to maintain the ideal ratio of 2:1.

The current liabilities of the company are growing at a faster rate than the current assets of the company.

The company‘s quick assets are not sufficient to overcome the current liabilities which are a bad sign of the

company.

The cash and bank balances have been showing an inconsistent trend.

The sales of the company has been increasing and fell in the last year.

Inventories have been increasing through the years of study and raw materials constitute a major portion of

the inventories.

The receivables collection period has been decreasing through the year which is a good sign of the

company.

The payables deferral period shows rising trend from 6.58 in the year 2009 to 12.66 in the year 2013

Cash conversion cycle is showing an increasing trend which is unfavourable for the company, as it implies

that the company takes longer time to convert raw materials into cash and so money is tied up in these

inventories.

DOI: 10.9790/487X-17535359 www.iosrjournals.org 58 | Page

A Study on Working Capital Management at Eastern Condiments (P) Ltd

IV. Conclusion

The study titled ―A STUDY ON WORKING CAPITAL MANAGEMENT AT EASTERN

CONDIMENTS PRIVATE LIMITED‖ has been conducted to analyze the financial strength and weakness of

the firm, and the analysis shows that the working capital was unstable and quite unfavorable to the firm, as it is

showing a decreasing trend from 2008-09 to 2011-12 and rose in the final year (2013-12).the company should

improve its working capital along with current assets and must decrease its current liabilities. The company

should keep their inventories under control, collect their debts in time, increasing their payables deferral period

to a permissible limit and increase sales for a better financial position.

The findings of the study are explained in this project. Based on the study some suggestions are made.

The researcher is sure that by implementing these suggestion, company can enhance the present condition.

Acknowledgements

We thank our eternal gurus, our parents, for supporting, enlightening and helping us complete the

project. The success and knowledge received by such an opportunity and in succeeding all attempts, is forever

fruitful due to the grace and blessings of our beloved AMMA. We are extremely indebted to Mrs. Jayashree

Nair, for providing us the required guidelines in each phase of the internship and for solving the problems

related to the project. Our sincere thanks to all the employees of ‗EASTERN CONDIMENTS PVT LTD who

dedicated themselves in helping me bring meaning to our research. Last but not the least, we would like to thank

everyone who guided and helped us in the completion of the project.

DOI: 10.9790/487X-17535359 www.iosrjournals.org 59 | Page

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Edward Albee and His Mother Characters: An Analysis of Selected PlaysDocument5 pagesEdward Albee and His Mother Characters: An Analysis of Selected PlaysInternational Organization of Scientific Research (IOSR)No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PPP Loans (1.6.2021)Document42 pagesPPP Loans (1.6.2021)Shea CarverNo ratings yet

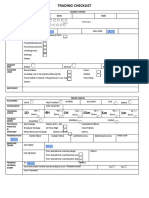

- Trading Checklist BH v2Document2 pagesTrading Checklist BH v2Tong SepamNo ratings yet

- When Collateral Is KingDocument12 pagesWhen Collateral Is KingCoolidgeLowNo ratings yet

- The Impact of Technologies On Society: A ReviewDocument5 pagesThe Impact of Technologies On Society: A ReviewInternational Organization of Scientific Research (IOSR)100% (1)

- Strategic Plan For Seylan Bank PLCDocument48 pagesStrategic Plan For Seylan Bank PLCtinojdomin100% (2)

- Rekening Koran Oktober 2023Document2 pagesRekening Koran Oktober 2023Ade AlfianNo ratings yet

- Socio-Ethical Impact of Turkish Dramas On Educated Females of Gujranwala-PakistanDocument7 pagesSocio-Ethical Impact of Turkish Dramas On Educated Females of Gujranwala-PakistanInternational Organization of Scientific Research (IOSR)No ratings yet

- "I Am Not Gay Says A Gay Christian." A Qualitative Study On Beliefs and Prejudices of Christians Towards Homosexuality in ZimbabweDocument5 pages"I Am Not Gay Says A Gay Christian." A Qualitative Study On Beliefs and Prejudices of Christians Towards Homosexuality in ZimbabweInternational Organization of Scientific Research (IOSR)No ratings yet

- Attitude and Perceptions of University Students in Zimbabwe Towards HomosexualityDocument5 pagesAttitude and Perceptions of University Students in Zimbabwe Towards HomosexualityInternational Organization of Scientific Research (IOSR)No ratings yet

- A Review of Rural Local Government System in Zimbabwe From 1980 To 2014Document15 pagesA Review of Rural Local Government System in Zimbabwe From 1980 To 2014International Organization of Scientific Research (IOSR)No ratings yet

- The Role of Extrovert and Introvert Personality in Second Language AcquisitionDocument6 pagesThe Role of Extrovert and Introvert Personality in Second Language AcquisitionInternational Organization of Scientific Research (IOSR)No ratings yet

- A Proposed Framework On Working With Parents of Children With Special Needs in SingaporeDocument7 pagesA Proposed Framework On Working With Parents of Children With Special Needs in SingaporeInternational Organization of Scientific Research (IOSR)No ratings yet

- Comparative Visual Analysis of Symbolic and Illegible Indus Valley Script With Other LanguagesDocument7 pagesComparative Visual Analysis of Symbolic and Illegible Indus Valley Script With Other LanguagesInternational Organization of Scientific Research (IOSR)No ratings yet

- Assessment of The Implementation of Federal Character in Nigeria.Document5 pagesAssessment of The Implementation of Federal Character in Nigeria.International Organization of Scientific Research (IOSR)No ratings yet

- Investigation of Unbelief and Faith in The Islam According To The Statement, Mr. Ahmed MoftizadehDocument4 pagesInvestigation of Unbelief and Faith in The Islam According To The Statement, Mr. Ahmed MoftizadehInternational Organization of Scientific Research (IOSR)No ratings yet

- An Evaluation of Lowell's Poem "The Quaker Graveyard in Nantucket" As A Pastoral ElegyDocument14 pagesAn Evaluation of Lowell's Poem "The Quaker Graveyard in Nantucket" As A Pastoral ElegyInternational Organization of Scientific Research (IOSR)No ratings yet

- Relationship Between Social Support and Self-Esteem of Adolescent GirlsDocument5 pagesRelationship Between Social Support and Self-Esteem of Adolescent GirlsInternational Organization of Scientific Research (IOSR)No ratings yet

- Topic: Using Wiki To Improve Students' Academic Writing in English Collaboratively: A Case Study On Undergraduate Students in BangladeshDocument7 pagesTopic: Using Wiki To Improve Students' Academic Writing in English Collaboratively: A Case Study On Undergraduate Students in BangladeshInternational Organization of Scientific Research (IOSR)No ratings yet

- Importance of Mass Media in Communicating Health Messages: An AnalysisDocument6 pagesImportance of Mass Media in Communicating Health Messages: An AnalysisInternational Organization of Scientific Research (IOSR)No ratings yet

- Role of Madarsa Education in Empowerment of Muslims in IndiaDocument6 pagesRole of Madarsa Education in Empowerment of Muslims in IndiaInternational Organization of Scientific Research (IOSR)No ratings yet

- Designing of Indo-Western Garments Influenced From Different Indian Classical Dance CostumesDocument5 pagesDesigning of Indo-Western Garments Influenced From Different Indian Classical Dance CostumesIOSRjournalNo ratings yet

- AIB 27th Annual Report 2021..22 CompressedDocument177 pagesAIB 27th Annual Report 2021..22 Compressedfayeraleta2024No ratings yet

- Standard Chartered BankDocument31 pagesStandard Chartered BankSumon AkhtarNo ratings yet

- 3i Group 2008 Annual ReportDocument128 pages3i Group 2008 Annual ReportAsiaBuyouts100% (2)

- CTF StrukturaDocument13 pagesCTF StrukturaDamir KajtezovićNo ratings yet

- Scott 6e PPT ch11Document24 pagesScott 6e PPT ch11anon_757820301No ratings yet

- Percentage of Sales MethodDocument6 pagesPercentage of Sales MethodFrancois Duvenage100% (1)

- Indoco Remedies - Management Meet UpdateDocument6 pagesIndoco Remedies - Management Meet UpdateMalolanRNo ratings yet

- Investment Decision and Portfolio Management (ACFN 632)Document39 pagesInvestment Decision and Portfolio Management (ACFN 632)yebegashetNo ratings yet

- 8db6 - ING Insurance - Asia-PacificDocument16 pages8db6 - ING Insurance - Asia-PacificJessica LopezNo ratings yet

- Chap 006Document115 pagesChap 006Minh NguyễnNo ratings yet

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- 1 Introduction To Credit and CollectionDocument16 pages1 Introduction To Credit and CollectionGigiNo ratings yet

- Investment Appraisal Taxation, InflationDocument8 pagesInvestment Appraisal Taxation, InflationJiya RajputNo ratings yet

- Financial Analysis of OGDCLDocument16 pagesFinancial Analysis of OGDCLsehrish_sadaqat7873100% (1)

- BONDS and STOCKDocument3 pagesBONDS and STOCKSufyan AshrafNo ratings yet

- Short AnswerDocument21 pagesShort AnswerTuan An NguyenNo ratings yet

- 08 G.R. No. 165662 Selegna Management and Development Corp. v. UCPBDocument11 pages08 G.R. No. 165662 Selegna Management and Development Corp. v. UCPBAnn MarinNo ratings yet

- Hastine SummaryDocument2 pagesHastine Summarykasiti constanceNo ratings yet

- Refer2005 enDocument85 pagesRefer2005 enAdminREFERNo ratings yet

- Aza Smart Pen Pro-Forma Income Statement: Less: Cost of Sales (Notes 1 & 2) Gross ProfitDocument1 pageAza Smart Pen Pro-Forma Income Statement: Less: Cost of Sales (Notes 1 & 2) Gross ProfitAzran AfandiNo ratings yet

- Test of Relationship Between Exchange Rate and Inflation in South Sudan: Granger-Causality ApproachDocument7 pagesTest of Relationship Between Exchange Rate and Inflation in South Sudan: Granger-Causality ApproachlukeniaNo ratings yet

- World Bank NotesDocument14 pagesWorld Bank Notes4df994v7zjNo ratings yet

- Pablo Fernandez Book 1-2015Document2 pagesPablo Fernandez Book 1-2015Michael GregoryNo ratings yet

- Accounting and Tally BookDocument10 pagesAccounting and Tally BookCA PASSNo ratings yet

- Lecture 8, 9 and 10 - Plant Assets, Natural Resources and Intangible AssetsDocument60 pagesLecture 8, 9 and 10 - Plant Assets, Natural Resources and Intangible AssetsTabassum Sufia MazidNo ratings yet