Professional Documents

Culture Documents

Adanza - Problem and Chart of Accounts

Uploaded by

Rey Joyce Abuel100%(4)100% found this document useful (4 votes)

1K views1 pagereference

Original Title

Adanza_Problem and Chart of Accounts

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentreference

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(4)100% found this document useful (4 votes)

1K views1 pageAdanza - Problem and Chart of Accounts

Uploaded by

Rey Joyce Abuelreference

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

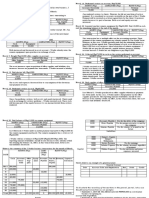

Gina H.

Adanza

AEC 12 – ACB

PROBLEM

Mr. Rolly Salcedo opened an auto repair shop with a trade name Magic Repair Shop. The transactions during the first

month of operations are as follows:

Feb. 1 – Rolly Salcedo invested the following items in the business:

Cash Php100,000

Shop tools Php 40,000

2 – Purchased shop supplies on account, Php4,000

3 – Rendered repair services on account, Php5,000

5 – Paid rent space for 2 months, Php4,000

8 – Purchased office equipment for cash, Php10,000

10 – Rendered repair services for cash, Php3,000

12 – Collected 40% of the account on February 3 transaction

14 – Billed various customers for repair services, Php7,000

15 – Paid Php5,000 for salary of shop workers covering the first half of the month

18 – Withdrew Php2,000 for personal use

20 – Collected the balance of the February 3 transaction

24 – Paid in full the supplies purchased

26 – Rendered repair services amounting to Php5,000, and received a note from the customer

28 – Paid the salary of the shop workers covering the 2nd half of the month, Php5,000

CHART OF ACCOUNTS

Cash Accounts payable Office equipment

Shop tools Accounts receivable Salaries expense

Salcedo, Capital Service income Salcedo, Withdrawals

Supplies expense Rent expense Notes receivable

You might also like

- Assignment Number 2 Financial Accounting Reporting 1Document8 pagesAssignment Number 2 Financial Accounting Reporting 1Sheina Jane AbarquezNo ratings yet

- Act1 Business Acc. HubiernaDocument3 pagesAct1 Business Acc. Hubiernanew genshinNo ratings yet

- Problems in AccountingDocument4 pagesProblems in AccountingRaul Soriano CabantingNo ratings yet

- AccDocument13 pagesAccFrancis V MaestradoNo ratings yet

- Sample Practice Basic AccountingDocument5 pagesSample Practice Basic AccountingLara Alyssa GarboNo ratings yet

- Summative-Test - Louise Peralta - 11 - FairnessDocument3 pagesSummative-Test - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- Accounting Activity 2019Document17 pagesAccounting Activity 2019Cleiton Dave Malabuyoc0% (2)

- Fabm Nites PrintDocument3 pagesFabm Nites Printwiz wizNo ratings yet

- Resuento - Ulob ActivitiesDocument16 pagesResuento - Ulob Activitiesemem resuentoNo ratings yet

- Transaction Analysis For A Service EntityDocument36 pagesTransaction Analysis For A Service EntityJerald Oliver Macabaya50% (4)

- Book 1Document6 pagesBook 1ItsRenz YTNo ratings yet

- Lesson 1 - Basic Consideration and FormationDocument3 pagesLesson 1 - Basic Consideration and FormationRynveeNo ratings yet

- Accounting ReviewerDocument11 pagesAccounting ReviewerKyrzen NovillaNo ratings yet

- Manarang Auto Repair Shop Journal by The Month of January 2019Document9 pagesManarang Auto Repair Shop Journal by The Month of January 2019Renz MoralesNo ratings yet

- Name of Examinee: - : Prepare The FollowingDocument15 pagesName of Examinee: - : Prepare The FollowingNoel CarpioNo ratings yet

- Accounting ActivityDocument2 pagesAccounting ActivityRoberta Gonzales Sison80% (5)

- Activity 1: Recording Transactions in The JournalDocument2 pagesActivity 1: Recording Transactions in The JournalSieadel Dalumpines50% (2)

- Prepare Journal Entries, Ledger and Trial Balance For The Following TransactionsDocument1 pagePrepare Journal Entries, Ledger and Trial Balance For The Following TransactionsRie Cabigon0% (1)

- Bart M ManuelDocument27 pagesBart M ManuelBea TiuNo ratings yet

- 2 CHAPTER Lesson 2 1 AssetsDocument6 pages2 CHAPTER Lesson 2 1 AssetsRegine BaterisnaNo ratings yet

- MIDTERM LESSON 1 Accounting EquationDocument2 pagesMIDTERM LESSON 1 Accounting EquationJomar Villena100% (3)

- Practice Set 1 (Basic Accounting)Document3 pagesPractice Set 1 (Basic Accounting)Maica LagareNo ratings yet

- Adjusting EntriesDocument10 pagesAdjusting EntriesJezmar John B. GulmaticoNo ratings yet

- Enclosure 1. Teacher-Made Learner's Home Task (Week 3)Document7 pagesEnclosure 1. Teacher-Made Learner's Home Task (Week 3)Kim FloresNo ratings yet

- PT AccountingDocument2 pagesPT AccountingzavriaNo ratings yet

- Module 1 Assignment and QuizDocument2 pagesModule 1 Assignment and QuizKim Patrick VictoriaNo ratings yet

- L2: The Accounting Cycle (AJPUAFCPR) : Accounting For Service and Merchandising Entities ACC11Document12 pagesL2: The Accounting Cycle (AJPUAFCPR) : Accounting For Service and Merchandising Entities ACC11Rose LaureanoNo ratings yet

- Bookkeeping Assignment JournalizingDocument1 pageBookkeeping Assignment JournalizingPhilpNil8000No ratings yet

- Activity in IT202Document3 pagesActivity in IT202Tine Robiso100% (1)

- Quizzes - Chapter 6 - Accounting Books - Journal and LedgerDocument5 pagesQuizzes - Chapter 6 - Accounting Books - Journal and LedgerAmie Jane MirandaNo ratings yet

- Accounting ExerciseDocument5 pagesAccounting ExerciseJess Caburnay100% (3)

- MS. MATUTINA Owned A Business Named MATUTINA's GENERAL MERCHANDISE and Had MS. MATUTINA Owned A Business Named MATUTINA's GENERAL MERCHANDISE and HadDocument1 pageMS. MATUTINA Owned A Business Named MATUTINA's GENERAL MERCHANDISE and Had MS. MATUTINA Owned A Business Named MATUTINA's GENERAL MERCHANDISE and HadMelvin Facturanan100% (3)

- Assignment Adjusting EntriesDocument2 pagesAssignment Adjusting EntriesKim Patrick VictoriaNo ratings yet

- Adjusting EntryDocument38 pagesAdjusting EntryNicaela Margareth YusoresNo ratings yet

- Fabm2 Q2 M4 - 4 CsefDocument20 pagesFabm2 Q2 M4 - 4 CsefZeus MalicdemNo ratings yet

- Negros Occidental (ACCOUNTING1)Document7 pagesNegros Occidental (ACCOUNTING1)Maxine Ceballos Glodove100% (1)

- MasUEbi Part 6 Business PlanDocument89 pagesMasUEbi Part 6 Business PlanYves Armin De GuzmanNo ratings yet

- Business Correspondence - Module Number 2-The Parts of A Business Letter Name: - Date Submitted: - InstructorDocument5 pagesBusiness Correspondence - Module Number 2-The Parts of A Business Letter Name: - Date Submitted: - InstructorElle Bee50% (2)

- Journal Entries TradingDocument79 pagesJournal Entries TradingAvox EverdeenNo ratings yet

- Accounting 1 Review Series Worksheet ExercisesDocument14 pagesAccounting 1 Review Series Worksheet ExercisesKayle Mallillin100% (2)

- Fabm1 Completing The Accounting CycleDocument16 pagesFabm1 Completing The Accounting CycleVeniceNo ratings yet

- Cash Flow StatementDocument10 pagesCash Flow StatementSheilaMarieAnnMagcalasNo ratings yet

- Name: Section: Score:: BMSH2003Document2 pagesName: Section: Score:: BMSH2003Peachy Tamayo0% (3)

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- Saint Louis College-Cebu: (Servant Leaders For Mission)Document4 pagesSaint Louis College-Cebu: (Servant Leaders For Mission)Marc Graham NacuaNo ratings yet

- FAR Chapter4 FinalDocument43 pagesFAR Chapter4 FinalPATRICIA COLINANo ratings yet

- Journal Entry DiscussionDocument8 pagesJournal Entry DiscussionAyesha Eunice SalvaleonNo ratings yet

- ActivitiesDocument3 pagesActivitiesRaul Soriano Cabanting50% (2)

- 10 1Document7 pages10 1Maxene YbañezNo ratings yet

- Assignment # 3: Fundamentals of AccountingDocument1 pageAssignment # 3: Fundamentals of AccountingMara Shaira Siega100% (3)

- Bhulero Merchandise Periodic 11 25Document10 pagesBhulero Merchandise Periodic 11 25Mary Jane PalermoNo ratings yet

- Acctg. Ed 1 - Unit2 Module 6 Business Transactions and Their AnalysisDocument29 pagesAcctg. Ed 1 - Unit2 Module 6 Business Transactions and Their AnalysisAngel Justine BernardoNo ratings yet

- Rovelyn E. Forcadas ABM-11 Activity #9-BDocument2 pagesRovelyn E. Forcadas ABM-11 Activity #9-BRovelyn E. ForcadasNo ratings yet

- FS ActivityDocument4 pagesFS ActivityJace LavaNo ratings yet

- Fundamentals of Accountancy, Business and Management (Fabm 1)Document2 pagesFundamentals of Accountancy, Business and Management (Fabm 1)Reese Gerald RobertsNo ratings yet

- Dela Pena, C. Marygold Bank Recon AnswerDocument6 pagesDela Pena, C. Marygold Bank Recon AnswerDe Nev OelNo ratings yet

- Module 5 - Adjusting AccountsDocument16 pagesModule 5 - Adjusting AccountsMJ San PedroNo ratings yet

- Compilation Notes On Journal Ledger and Trial Balance - Part 2Document8 pagesCompilation Notes On Journal Ledger and Trial Balance - Part 2Andra FleurNo ratings yet

- Performance 2Document1 pagePerformance 2Kaye VillaflorNo ratings yet

- Accounting 3Document3 pagesAccounting 3hahaniNo ratings yet

- DL FinalDocument1 pageDL FinalRey Joyce AbuelNo ratings yet

- ReflectionDocument1 pageReflectionRey Joyce AbuelNo ratings yet

- AC Actual SP SC/unit: AQ Used AQ Per UnitDocument18 pagesAC Actual SP SC/unit: AQ Used AQ Per UnitRey Joyce AbuelNo ratings yet

- Memo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesDocument3 pagesMemo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesRey Joyce AbuelNo ratings yet

- Chapter 7 Cash & Cash Equivalents: PayableDocument2 pagesChapter 7 Cash & Cash Equivalents: PayableRey Joyce AbuelNo ratings yet

- PsychDocument6 pagesPsychRey Joyce AbuelNo ratings yet

- Ethics MoralityDocument14 pagesEthics MoralityUsama Javed100% (1)

- Chapter 8 Accounting For Franchise Operations - Franchisor: Learning CompetenciesDocument21 pagesChapter 8 Accounting For Franchise Operations - Franchisor: Learning CompetenciesRey Joyce AbuelNo ratings yet

- AC Actual SP SC/unit: AQ Used AQ Per UnitDocument18 pagesAC Actual SP SC/unit: AQ Used AQ Per UnitRey Joyce AbuelNo ratings yet

- Use The Following Information For The Next Two Questions:: Practice Set # 6: Joint ArrangementsDocument4 pagesUse The Following Information For The Next Two Questions:: Practice Set # 6: Joint ArrangementsRey Joyce Abuel0% (1)

- Coa Guidelines For The Prevention and Disallowance of Iueeu PDFDocument71 pagesCoa Guidelines For The Prevention and Disallowance of Iueeu PDFleah santosNo ratings yet

- ContextDocument2 pagesContextRey Joyce AbuelNo ratings yet

- Factory Overhead: AssumptionsDocument6 pagesFactory Overhead: AssumptionsRey Joyce AbuelNo ratings yet

- Explain The Rights TheoryDocument8 pagesExplain The Rights TheoryDanelle VillanuevaNo ratings yet

- RostowsDocument2 pagesRostowsRey Joyce AbuelNo ratings yet

- Reflection Paper On "Virtue Ethics"Document3 pagesReflection Paper On "Virtue Ethics"Rifa Farhad67% (12)

- Chapter 8 - Teacher's Manual - Afar Part 1Document7 pagesChapter 8 - Teacher's Manual - Afar Part 1Angelic100% (3)

- PS Pink Ni Nga Cartolina Kim, Dakoa Imong Agi Hehehe Tanxx MONOPOLISTIC COMPETITION - Is A Type of Imperfect Competition Such That Competing Producers SellDocument2 pagesPS Pink Ni Nga Cartolina Kim, Dakoa Imong Agi Hehehe Tanxx MONOPOLISTIC COMPETITION - Is A Type of Imperfect Competition Such That Competing Producers SellRey Joyce AbuelNo ratings yet

- Assignment (To Be Submitted On Sept 4 Considered As Final Exam 2)Document1 pageAssignment (To Be Submitted On Sept 4 Considered As Final Exam 2)Rey Joyce AbuelNo ratings yet

- Activity On Architectural Designs:: Rubric For Grading: PPT Video RubricDocument1 pageActivity On Architectural Designs:: Rubric For Grading: PPT Video RubricRey Joyce AbuelNo ratings yet

- FV PV (1+i) FV $ 100 (1+0.10) FVDocument6 pagesFV PV (1+i) FV $ 100 (1+0.10) FVRey Joyce Abuel100% (2)

- Rey Joyce 1Document2 pagesRey Joyce 1Rey Joyce AbuelNo ratings yet

- Structural Change ApproachDocument3 pagesStructural Change ApproachRey Joyce AbuelNo ratings yet

- Gothic ArchitectureDocument2 pagesGothic ArchitectureRey Joyce AbuelNo ratings yet

- 3-15 Free Cash Flow: Rey Joyce B. Abuel July 10, 2018 Aec 13-AcbDocument3 pages3-15 Free Cash Flow: Rey Joyce B. Abuel July 10, 2018 Aec 13-AcbRey Joyce AbuelNo ratings yet

- Exemplar Company Statement of Financial Position As of December 31, 2017Document3 pagesExemplar Company Statement of Financial Position As of December 31, 2017Rey Joyce AbuelNo ratings yet

- Aec 11Document2 pagesAec 11Rey Joyce AbuelNo ratings yet

- Chapter 10: Eucharist: Basic Description of The EucharistDocument1 pageChapter 10: Eucharist: Basic Description of The EucharistRey Joyce AbuelNo ratings yet

- My Company Unadjusted Trial Balance December 31, 2018 Debit CreditDocument9 pagesMy Company Unadjusted Trial Balance December 31, 2018 Debit CreditRey Joyce AbuelNo ratings yet

- Rey Joyce BDocument2 pagesRey Joyce BRey Joyce AbuelNo ratings yet