Professional Documents

Culture Documents

TAX1syllabus AttyZarate

TAX1syllabus AttyZarate

Uploaded by

Reynaldo Yu0 ratings0% found this document useful (0 votes)

5 views27 pagessyllabus

Original Title

TAX1syllabus_AttyZarate

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsyllabus

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views27 pagesTAX1syllabus AttyZarate

TAX1syllabus AttyZarate

Uploaded by

Reynaldo Yusyllabus

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 27

LYCEUM OF THE PHILIPPINES UNIVERSITY

COLLEGE OF LAW

TAXATION | (SY 2018-2019)

References:

National Internal Revenue Code of 1997, as amended by pertinent laws

REPUBLIC ACT NO. 10963 - TRAIN

‘Any book with annotations on General Principles of Taxation and Income Taxes

Assigned Supreme Court Cases

Relevant Bureau of Internal Revenue issuances

ALL SECTION REFERENCES PERTAIN TO NIRC, AS AMENED, UNLESS OTHERWISE

STATED

References in RED are new or at jents by TRAIN.

PARTI

TAXATION IN GENERAL

CHAPTER | - GENERAL PRINCIPLES OF TAXATION

1. TAXATION

1. Definition of Taxation

a. 71.Am Jur 2™ 342

2. Nature of internal Revenue Laws

a. Hilado v. CIR, 100 Phil 288,

3. Scope of Taxation

a. §28, Art. VI, 1987 Constitution

b. 71 Am Jur 2" 394-395

c. 71m Jur 2 397-398

d. Chamber of Real Estate and Builders’ Association (CREBA) v. Romulo,

‘Amatong and Parayno, G.R. No. 160756, March 9, 2010

e. Sison v. Ancheta, 130 SCRA 654 (citing C.J. John Marshall [McCulloch

v. Maryland] and J. Holmes [Panhandle Oil Co. v. Mississippi])

f. Sarasola v. Trinidad, 40 Phil. 259, G.R. No. 14595, October 11, 1919

ng theory and basis

a. 71.Am Jur 2"! 346-347

b. CIR. Algue, Inc. L-28896 Feb 17, 1988

5. Principles of a Sound Tax System

a. Abakada Guro Party List Officers v. Ermita, et. al., G.R. No. 168056,

September 1, 2005

b. Diaz and Timbol v. Secretary of Finance and the Commissioner of

Internal Revenue [6.R. No. 193007. July 19, 2011,]

Page|2

6. Comparison with Police Power and Eminent Domain

a. Similarities and distinctions 71 Am Jur 2" 395-397

b. Gerochi, et al. v. DOE, et al., G.R. No. 159796, July 17, 2007

¢. Matalin Coconut Co., Inc. v. Mun, Council of Malatiang, 143 SCRA 404

d. Lutz v. Araneta, 98 Phil 48

e. NTCv. CA, 311 SCRA 508 (1999)

7. Stages or Aspects of Taxation

TAXES

1. Definition

a. 71. Am Jur 2° 343-346

b. Republic v. Philippine Rabbit Bus Lines, I

30,1970

2. Essential Characteristics of Taxes

3. Taxes distinguished from:

a. Debts

i, 71. Am Jur 2% 345-346

li, Caltex v. COA, 208 SCRA 726

fil, Francia v. IAC, 162 SCRA 753

iv. Philex Mining Corp. v. CIR, CA, and CTA, G.R. No, 125704,

‘August 28, 1998

b. License Fees

1. 71m Jur 2% 352-353

fi, Progressive Dev. Corp. v. QC, 172 SCRA 629

c. Special Assessments (now special levies under the 1991 Local

Government Code)

i, Apostolic Prefect v. Treasurer of Baguio, 71 Phil. 547

4. Tolls

1.71 Am Jur 2 352

ii, Diaz and Timbol v. The Secretary of Finance et al., G.R. No.

193007, July 19, 2011 ~See above I.5.b (Principles of Sound Tax

systems)

e. Penalties

i. NDCv. CIR, 151 SCRA 472

f. Custom duties

., G.R, No, L-26862, March

IIL, CLASSIFICATION OF TAXES

1. As to subject matter

a. 71. Am Jur 2357-361

b. Capitation or poll taxes

c. Property taxes

d. Excise or license taxes

2. Asto incidence or burden

a. 71 Am Jur 2" 354

course ourune sr 20182018

TATY,KATHYRN A, ZARATE

age?

b. Direct Taxes

c._ Indirect Taxes

d. Maceda v. Macaraig 223 SCRA 217, G.R. No, 88291, June 8, 1993

3. Asto determination of amount

a. 71 Am Jur 2" 355

b. Specific taxes ~ Sec. 129, NIRC

c. Ad valorem taxes—Sec. 129, NIRC

4, sto purpose

a. 71 Am Jur 2°4 355 — 356

b. General or Fiscal

c. Special, Regulatory or Sumptuary

5. Asto scope

‘a. National taxes

b. Local taxes

6. Asto graduation or rate

a. Progressive

b. Regressive

c. Mixed

d. Proportionate

1V, DOCTRINES IN TAXATION

1. Prospectivity of Tax Laws

a. Hydro Resources v. CA, G.R, No. 80276, December 21, 1990, 192 SCRA

604

2. Imprescriptibility of Taxes

a. CIR v. Ayala Securities Corporation, G.R. No, L-29485, November 21,

1980, 101 SCRA 231

3. Double Taxation

a. Definition and Nature. 71 Am Jur 2" 362-365

b. Villanueva v. City of lloilo, G.R. No. L-26521, December 28, 1968, 26

SCRA 578

c. Sanchez v. CIR 97 Phil. 687, G.R. No. L-7521, October 18, 1955.

d. Punsalan v. Mun Board of Manila 95 Phil. 46

e. The City of Manila, et al. v. Coca-Cola Bottlers Philippines Inc., G.R.

No, 181845, August 4, 2009

4, Power to Tax involves the Power to Destroy

5. Doctrine of Equitable Recoupment

a. USv. Dalm, 494 U.S. 596 (1990)

6. Methods of avoiding the occurrence of double taxation

a, Tax Treaty

i, Deutsche Bank AG Manila Branch v. CIR [G.R. No. 188550.

August 28, 2013.]

b. Tax Credit

1. CIR. Lednicky, G.R. Nos.

1964

18169, L-18286, & 1-21434, July 31,

Course ourunes¥ 2018-2018

IATY, RATER ZARATE

7. Taxpayer's Suit

a. Nature and Concept

i, Land Bank v. Cacayuran, G.R. No, 191667, April 17, 2013

b. As distinguished from a citizen’s suit

i. Biraogo v. The Philippine Truth Commission of 2010, G.R. No.

192935, December 7, 2010

c. Requisites of a taxpayer's suit challenging the constitutionality of a tax

measure or act of a taxing authority; concept of locus standi, doctrine

of transcendental importance and ripeness for judicial determination

i, Lozano v. Nograles, G.R. No. 187883, June 16, 2009

CHAPTER

LIMITATION UPON THE POWER OF TAXATION

INHERENT LIMITATIONS.

1. Public Purpose

a. Pascual v. Sec. of Public Works, 110 Phil 331

2. Taxing power is inherently legislative

a, Ingeneral - Delegata potestas non potest delegari

b. Exceptions:

i. Local Government Units

1) Quezon City, et al. v. Bayantel, G.R. No. 162015, March

6, 2006

Delegation to President -§28(2), Art. VI, 1987 Constitution

iii, Administrative Rate Fixing

1) Smith Bell & Co. v CIR, G.R. No. L-28271, July 25, 1975

3. Territoriality or Situs of Taxation

‘a. Meaning and scope of limitation

b. Situs of Taxation

i. Meaning

Determination of Situs/Factors in determining Situs

i. Situs of subjects of taxation

1) Persons —-§157-158, 1991 LGC

a) Community Tax ~ individuals and corporate

2) Lex Situs or Lex Rel Sitae - Real Property §42(A)(5) and

(CIS), NIRC

3) Mobilia Sequuntur Personam - | Personal Property

{§42(A)(6) and (E), NIRC

4) Income

a) Interests - §42(A)(1) and (C)(2), NIRC

Dividends - §42(A)(2) and (C)(2), NIRC

i, Manila Gas v, Collector, 62 Phil 895 (G.R.

No. 42780, January 17, 1936)

©) Services - §42(A)(3) and (C)(3), NIRC

‘xATION

Course ourune 123182018

IATY,KATHRN 2 ZAATE

Pages

1. GIR v. Baier-Nickel, G.R. No. 153793,

‘August 29, 2006

CIR v. Marubeni Corporation, G.R. No.

137377, December 18, 2001

4). Rentals and Royalties -§42(Aj(4) and (C)(4), NIRC

5) Business, Occupation, Transaction

a) Manila Electric Company v. Yateo, G.R. No.

45697, November 1, 1939, 69 Phil 89

6) Transfer of property by death or gift

a) Wells Fargo Bank v. Col, 70 Phil. 325

7) Multiple situs of taxation

4, International Comity (in par parem, non habet imperium — An equal has no

power over an equal)

CONSTITUTIONAL LIMITATIONS

1. Due process Clause

a. §1, Art. Ill, 1987 Constitution

b. Com. of Customs v. CTA & Campos Rueda Co., 152.SCRA 641, G.R. No.

70648, July 31, 1987

2. Equal Protection Clause

a, §1, Art. Ill, 1987 Constitution

b. Ormoc Sugar Co. v. Treasurer of Ormoc City 22 SCRA 603, G.R. No. L-

23794, February 17, 1968

3. Rule of Taxation shall be Uniform and Equitable

a. §28(1), Art. VI, 1987 Constitution

b. British American Tobacco v. Camacho and Parayrio, G.R. No. 163583,

‘August 20, 2008 and April 15, 2009

4, Non-impairment of Contracts

a. §10, Art. Ill & §11, Art. XIl, 1987 Constitution

b. Imus Electric Co. v. CTA and CIR, G.R. No, L-22421, March 18, 1967

c. Phil. Rural Electric Cooperatives Association Inc., et al. v. DILG and

DOF, G.R. No. 143076, June 10, 2003

5, Non-imprisonment for non-payment of poll tax:

a. §20, Art. Ill, 1987 Constitution

6. Prohibition against taxation of real property of charitable institutions,

churches, parsonages or convents, mosques and non-profit cemeteries

‘a, §28(3), Art. VI, 1987 Constitution

b. Abra Valley Collecge, Inc. v. Aquino, G.R. No. L-39086, June 15, 1988,

162 SCRA 106

c. Lung Center v. QCet. al. G.R. No. 144104, June 29, 2004

7. Prohibition against taxation of non-stock non-profit educational institutions

a. §4(3), Art. XIV, 1987 Constitution

b. §30(H), NIRC

c. CIR v. CA & YMCA, 298 SCRA 83

Gourse ourunes¥ 2018 2013

[ATV KATHNGN A ZARATE

Peer

d. CIR v. CA, CTA and Ateneo De Manila University, G.R. No. 115349,

April 18, 1997

e. CIR. DLSU, G.R. No. 196596, November 9, 2016

8. Passage of tax bills

a. §24, Art. VI, 1987 Constitution

b. Tolentino v. Secretary of Finance 249 SCRA 628

¢. Abakada Guro Party List Officers v. Ermita, et. all, G.R. No. 168056,

‘September 1, 2005 [See Sec. | (5)(a) ~ Principles of aSound Tax System]

9. Granting of tax exemption

a. §28(4), Art. VI, 1987 Constitution

b. John Hay Peoples Alternative Coalition, et.

119775, October 24, 2003

10. Veto power of the President

a. §27(2), Art. Vi, 1987 Constitution

11. Judicial Power to review legality of tax

a. §5(2){b) AVIll, 1987 Constitution

v. Lim, et al,, G.R. No.

CHAPTER Ill — EXEMPTIONS FROM TAXATION

IN GENERAL

1. Definition

2. Kinds of Exemption

a. Express

b. Implied or by Omission

© Contractual

Nature of power to grant tax exemption

Constitutional Exemption

Legislative grant of exemption

a. CIR v Botelho Shipping Corp. 20 SCRA 487, G.R. No. L-21633-34, June

29, 1967

b. CIRVCTA, GCL Retirement Plan, 207 SCRA 487, G.R, No. 95022. March

23, 1992

PAGCOR v. BIR, [G.R. No. 172087. March 15, 2011,]

Exemption created by Treaty

. Exemption of Government and Government Agencies

a. §27(C), NIRC

b. §30(1), NIRC

c §32(8)(7){b), NIRC

4d. Philippine Ports Authority v. City of Iloilo, G.R. No. 109791, July 14,

2003

Philippine Fisheries Development Authority v. CA, G.R. No. 169836,

July 31, 2007

{. City of Pasig v. Republic of the Philippines represented by PCGG [G.R.

No. 185023. August 24, 2011.]

yap

THxATION

cust ourune sy 2318-2019

IATY,KATHYER & ZARATE

Poe

ll, COMPROMISE, ABATEMENT AND TAX AMNESTY

1. Compromise §204 (A)

a. RR 30-2002 as amended by RR 8-04

b. Cases which may be compromised

Cases which may not be compromised

4. Basis for Acceptance of Compromise Settlement

@. Delegation of power to compromise §7(c)

2, Abatement §204(B)

a. RR13-01

b. When may penalties be abated or cancelled

3. Definition and Sample Tax Amnesty Program: RA No. 9480

a. Philippine Banking Corporation vs. CIR, G.R. No, 170574, January 30,

2009

b. CSGARMENT, INC., vs. COMMISSIONER OF INTERNAL REVENUE, [6.R.

No. 182399. March 12, 2014,]

4, Voluntary Assessment Program/Last Priority in Audit

a. CIRv. Gonzalez et al., G.R, No. 177279, October 13, 2010

Ill, ESCAPE FROM TAXATION

1. Shifting of Tax Burden

2. Tax Avoidance vs. Tax Evasion

a. CIR v. The Estate of Benigno P. Toda, G.R. No. 147188, Sept 14, 2004

b. BIR vs. COURT OF APPEALS, et. al., [G.R. No. 197590. November 24,

2014.)

AND |CTION OF TAX LAWS

1, SOURCES OF TAX LAW

1. Statutes

a. Existing Tax Laws

i. National - National Internal Revenue Code of 1997 as amended

i, Local - Book Il, 1991 Local Government Code

|. Tariff and Customs Code

BCDA Law

v. PEZA Law

vi. Omnibus investment Law

2. Revenue Regulations

‘a. Authority to promulgate. §244, NIRC

b._ Specific provisions to be contained in RR. §245, NIRC

Powers and duties of the BIR §2

d. Force and effect of RR? Art. 7, Civil Code

‘axAMON

"ATTY RATHYRIA,ZARATE

Page?

i. BPI Leasing Corp v. CA and CIR, G.R. No. 127624, November 18,

2003

BIR Issuances BIR Revenue Administrative Order (RAO) No. 2-2001

a, BIR Rulings

i. Rulings of first impression

ii. Rulings with established precedents

ili, Power of CIR to Interpret Tax Laws. §4, NIRC

iv. Non-Retroactivity of Rulings §246, NIRC

v. CIR. Burroughs Ltd., G.R, L-66653. June 19, 1986

vi. CIR v. Philippine Health Care Providers, Inc, G.R. No. 168129,

April 24, 2007

Exceptions

PBCOM vs. CIR 302 SCRA 241

Revenue Memorandum Rulings (RMR)

Revenue Travel Assignment Orders (RTAO)

Revenue Special Orders (RSO)

Revenue Memorandum Circulars (RMC)

Revenue Memorandum Orders (RMO)

Revenue Audit Memorandum Orders (RAMO)

Revenue Delegation of Authority Orders (RDAO)

i. Revenue Administrative Orders (RAO)

Farpaoe

Opinions of the Secretary of Justice

Legislative Materials

Court Decision

Hl, CONSTRUCTION AND INTREPREATION OF TAX LAWS, EXEMPTIONS AND

REFUNDS.

1. General Rules of Construction of Tax Laws

oe

‘a. Luzon Stevedoring v Trinidad, 43 Phil. 803,

b. Philippine Health Care Providers, Inc. v. CIR, G.R. No. 167330,

‘September 18, 2009

Construction of Tax Exemptions

a. City of lloilo v, Smart, G.R. No. 167260, February 27, 2009

b. Rodriguez, Inc. v Collector 28 SCRA 119

. Wonder Mechanical Engineering v. CTA 64 SCRA 555

d. Republic Flour Mills v CIR, 31 SCRA 148, G.R. No. L-25602, February

18, 1970

Construction of Tax Refunds

a. Resins, Inc. v. Auditor Gen. 25, SCRA 754, G.R. No, 1-17888, October

29,1968

b. Kepco Philippines Corp. v. CIR GR No. 179356, December 14, 2009

Tax Rules and Regulations

Penal Provi

Non-Retroactive application

Ns of Tax Laws

TAXATION

cobRSE OUTUNE SY 2018-2019

[ATTY KATHYR A ZARATE

Pape

PART II

INCOME TAX

Revenue Regulations No. 2-40 Consolidated Income Tax Regulations

CHAPTER

ENER: IPLES

1. OVERVIEW OF INCOME TAXATION

1. Whats Income Tax?

a. Fisher v. Trinidad, 43 Phil 973,

2. Philippine Income Tax Law

3. Income Tax Systems

a. Global Tax System

b. Schedular Tax System

©. Semi-schedular or semi-global Tax System

d. Progressive System

fe. Regressive System

4, Features of Philippine income Taxation

a. Direct

b. Progressive

c. Comprehensive

d. Semi-schedular or semi-global

e. American origin

5. Criteria in Imposing Income Tax

c. Source

ll. GENERAL PRINCIPLES OF INCOME TAXATION §23, TAX CODE

Resident Filipino Citizen

Nonresident Filipino Citizen

Overseas Filipino contract worker or seaman

Resident or non-resident alien individual

Domestic corporation

Foreign corporation

oy eee

CHAPTER II - CLASSIFICATION OF INCOME TAXPAYERS

1. SCOPE OF INCOME TAXATION

1. Definition of a Taxpayer §22(N), NIRC

‘TAKATION

ITTY. ATHYRN A ZARATE

Definition of a Person §22(A), NIRC

Who is a “Person liable to tax”

CIR vs. Procter & Gamble, G.R. No. 66838, December 2, 1991, 204 SCRA 378

Silkair (Singapore) PTE. LTD. v. CIR, G.R. No. 184398, February 25, 2010

waun

Il. INDIVIDUAL TAXPAYERS

1. Citizens §1 ~ §2, Art IV 1987 Constitution

a. Resident Citizens

b, Non-Resident Citizens §22(€), NIRC

2. Alien

a. Resident Alien §22(F), NIRC

b. 55 last par, Revenue Regulations No. 2

c. Non-resident Alien §22(6)

|. engaged in trade or business §25(A), NIRC

ji, not engaged in trade or business §25(8), NIRC

3. General Professional Partnership S22(B)

a. Tan vs. Del Rosario and CIR, G.R. No. 109289, October 3, 1994

IM, ESTATES AND TRUSTS

Definition of Estates & Trusts, Art. 1440-1457, Civil Code

Application of Tax, $60, NIRC

IR v. Visayan Electric, [G.R. No. L-22611. May 27, 1968.]23 SCRA 715

CIR v. CA, CTA, GCL Retirement Plan, [G.R. No, 95022. March 23, 1992.] 207

‘SCRA 487

eeNe

IV. CORPORATIONS,

1. Definition of a corporation §22(B), NIRC

a. Partnerships and Joint Ventures Art. 1767 ~ 1769, Civil Code

i. Lorenzo Offa v. CIR, G.R. No, L-19342, May 25, 1972, 45 SCRA

74

ii, Evangelista vs. Collector, G.R. No. L-9996, October 15, 1957,

102 Phil 140

I. Afisco Insurance Corp vs. CIR, G.R. No. 112675, Jan 25, 1999,

302 SCRA1

b. Co-ownership Art. 484 Civil Code

i. Pascual v. CIR, 166 SCRA 560

2. Domestic Corporation §22(C), NIRC

a. Proprietary Educational Institutions and Hospitals §27(B), NIRC

i, Commissioner v. St. Luke's Medical Center, G.R. No. 195909,

September 26, 2012

b. Government-owned or -Controlled Corporation §27(C), NIRC

3. Foreign Corporation §22(D), NIRC

4, Resident Foreign Corporation §22(H), NIRC

‘TaKATION

‘corse ourune st 2018-2019

ATV. KATHIRN A ARATE

age 10

International Air Carrier §28(A)(3)(a), NIRC

International shipping §28(A)(3)(b), NIRC

Offshore Banking Units §28(A)(4), NIRC

Regional or Area Headquarters and Regional Operating Headquarters

of Multinational Companies §28(A)(6), NIRC

. Subsidiary vs. Branch of a Foreign Corporation

5. Non-Resident Corporation §22(1), NIRC

a. Non-resident Cinematographic Film Owner, Lessor or Distributor

§28(8)(2), NIRC

b. Non-resident Owner or Lessor of Vessels Chartered by Philippine

Nationals §28(B)(3), NIRC

©. Non-resident Owner or Lessor of

Equipment §28(8)(4), NIRC

pose

ircraft, Machineries and Other

CHAPTER Ill - INCOME

1. Taxable Income

1. Definition §31, NIRC, as amended by TRAIN

Sec 36 ~ 38, Regulations No. 2

3. Difference between Capital & Income

a, Madrigal v. Rafferty 38 Phil 14

4, Requisites for Income to be Taxable

a. Existence of income;

b. Realization of income;

i. Test in determining income / Doctrines on Determination of

‘Taxable income

1. Realization Test

a. Elsner v. Macomber, 252 US 89

b. Fisher v. Trinidad, 43 Phil 973

2. Doctrine of command or control of income

a. Helvering vs. Horst, 311 U.S. 112 (1940)

3. Claim of right doctrine or Doctrine of ownership

‘2. Commissioner vs. Javier, 199 SCRA 824

b. Commissioner vs. Wilcox, 327 U.S. 404 (1945)

. James vs. US, 366 US 213 (1961) [overturning

Commissioner vs. Wilcox)

4. Income from whatever source

a. Gutierrez vs, Collector, G.R, Nos. 1-9738 & L-

9771, May 31, 1957, 101 Phil 713

b. Forgiveness of Indebtedness, §50, Revenue

Regulations No. 2

c. Farmers & Merchants Bank v, CIR, 59 F2nd 912

li, Actual vs. constructive receipt

1. Limpan Investment Corp. v. CIR, G.R. No. L-21570, July

26, 1966

TAXATION!

‘cobrse ourunes¥ 2028-2018

ITTY. HATHRN A. ZARATE

Recognition of income;

Methods of accounting: |

i. Cash method vs. accrual method |

ji, Installment payment vs. deferred payment vs. percentage of

completion |

fe. Income is not exempt.

ao

H,— Gross income

1, Definition §32(A), NIRC |

2. Gross Income vs. Net Income vs. Taxable Income

3. Classification of Income subject to Tax

a. Compensation Income

i. Definition Sec 2.78.2 (A) RR2-98; Read AR §-2018,

Backwages

Exception: Minimum Wage Earners §24{A), as amended by

TRAIN |

jv, Fringe Benefits §33(A) NIRC, as amended by TRAIN

1. Definition and Inclusions §33(B) NIRC, as amended by

TRAIN |

2. Rate §33(A) NIRC, as amended by TRAIN

3. Tax Base §33(A) NIRC, as amended by TRAIN

4. Exceptions §33(C) NIRC |

a. Exempt under special laws

b. Contributions of employets to retirement,

insurance and hospitalization benefit plans

Benefits to Rank & File Emplayees

d. De Minimis Benefits

i. Definition of De |Minimis Benefits

§2.78.4(A)(3), RR 2-98 as amended by RR

5-2008, 10-2008, 5-2011, 8-2012, 1-2015

and RR 11-2018

5. Collector v. Henderson, 1 SCRA 649)

6. GIR v. Castaneda, G.R. No. 96016,

SCRA 72

b._ Income from the exercise of profession

©. Income from business

i. See §43~47, Revenue Regulations No. 2

4. Income derived from dealings in property

i. Types of Properties

1. Ordinary assets $39(A)(1)

2. Capital Assets §39(A)(1)

i. Types of Income from dealings in property

1. Ordinary income and Loss §22(2)

2. Capital Gains and Loss

2. Net Capital Gain §89(A)(2)

(Oct 17, 1991, 203

‘TaKATION

‘coast ourue st 2018-2019

ATTY AATHRN A ZARATE

Page 12

b. Net Capital Loss §39(A)(3)

3. Holding Period §39(8)

4, Limitation on Capital Losses §39(C)

5. Net Loss Carry Over §39(D)

Computation of gain or loss

1. General §40(A)

2. Basis for Determining Gain or Loss §40(8)

3. Exchange of Property |

a. General Rule §40(C){1)

b. Exceptions: No gain of loss if certain exchanges

of properties $40(C)(2)

Commissioner of Internal Revenue v. Filinvest

Development Corporation, G.R. No. 163653,

July 19, 2011

e. Passive Income

i. Interest from Deposits, Deposit Substitutes, Trust Funds and

Similar Arrangements

ii. Dividends

1. Distribution of Dividends §73

a. Liquidating Dividend

b. Cash Dividend

©. Stock Dividend

d._Property Dividend

2. Wise & Co., Inc., et al., vs. Meer [G.R. No. 48231. June

30, 1947.]

3. CIRv. CA, CTA, & ANSCOR, G.R. No. 108576, January 30,

1999

4. Elsner v, Macomber, 252 US 89, supra

ili, Royalties

iv. Rental Income

1. Lease of personal property

2. Lease of real property

a. Leasehold improvements by lessee

b. Advance rent

Annuities, proceeds from life insurance or other type of insurance

Prizes and winnings

Pensions, retirement benefits or separation pay

Partner's distributive share in a general professional partnership §26

Income from whatever source

i. Forgiveness of Debt

li, Recovery of accounts previously written off

i. Receipt of refund or credit

ins from Gross Income

a. In general, §32{B), as amended by TRAIN

13™ month pay and other benefits, §32(8)(7)(e), as amended by TRAIN.

©. See2.78.1 (B)(11) RR 2-98, as amended by RR 11-2018

f

g

he

i

i

‘axanion

‘cobs ourune sv 2018-2018

TITY. NATHYRN A ZARATE

Pages

d. CIR v, CA & Castaneda, G.R. No. 96016, Oct 17, 1991, 203 SCRA 72,

supra

5. Source Rules |

a. Interests §42(A)(1) and (C)(1)

b. Dividends §42(A)(2) and (C)(2)

Services §42(A)(3) and (C)(3)

d._ Rentals §42(A)(4) and (C)(4)

e. Royalties $42(A)(4) and (c)(4)

f. Sale of Real Property §42(A)(5) and (C)(5)

g. Sale of Personal Property §42(E) in relation to SA2(AK(6)

hh. Sale of Shares of Stock of corporation

(CHAPTER Ill — TAX BASE & TAX RATES

(Assignment: Fill up Tax Matrix ~ See Annex A]

1. INDIVIDUALS

1. Resident Citizens & Resident Aliens §24

a. Taxable Income

b. Purely Self-Employed Individuals and/or Professionals §24(A)(2)(b)

TRAIN

©. Mixed Income Earners §24(A)(2)(c) TRAIN

Read also Revenue Regulations No. 8-2018

e. Passive Income

Interest §24(8)(1); $27(DM3); §28(4)(7)(b) |

Royalties §24(B)(1)

Prizes & Other Winnings §24(B)(1)

iv. Dividends §24(8)(2)

f. Capital gains on shares of stocks §24(C)

Capital gains on real property §24(D)(1)

i. Exception: Sale of Principal Residence §24(D)(2); Read RR No.

13-99 as amended by RR 14-00

1. What is a Principal Residence §2.1, RR 13-99 as

amended |

2. Conditions for Exemption §3, RR 13-99, as amended

3. Consequence if requisites not met, §5, RR 13-99, as

amended

2. Non-Resident Aliens

a. Engaged in trade or business

i. Taxable Income §25(A)(1};

ii. Passive Income §25(A)(2); §27(D)(3) last paragraph

lil, Capital gains on Sale of Shares of Stock §24(C)

iv. Capital gains on Sale of Real Property §24(D)(1) & (2)

ATION

‘copes ourune st 2018-2018

ATTY. KATHYRW A, ZARATE

Pages

b. Not engaged in trade or business |

i. All Income §25(B)

ii, Capital Gains on Sale of Shares of Stock §24(C) in relation to

§25(8) |

. Capital Gains on Sale of Real Property §25(8)

Special Aliens §25(F) in relation to §25(C) and President's Veto; §4 of

RR8-2018 |

i. Allen Individual Employed by Regional or Area Headquarters

and Regional Operating Headquarters | of Multinational

Companies

ii, Alien Individual Employed by Offshore Banking Units

li, Alien individual Employed by Petroleum Service Contractor and

Subcontractor

3. Minimum Wage Earners (MWE)

a. Definition §22(HH) |

b. Taxation §24(A)(2)(a) last paragraph TRAIN, RR 8-2018

¢. Coverage of exemption §3(8), last par RR 8-2018,

4, Members of General Professional Partnership §26, §3(C), AR 8-2018

Hl. Corporations

2. Domestic Corporations

a. Ingeneral, §27(A)

b. Special Corporations

i. Proprietary Educational institutions and Hospitals §27(8)

ji, Government Owned and Controlled Corporations §27(C)

. Passive Income |

i. Interest and royalties §27(D)(1); $28(A\7)(H)

idends §27(0)(4)

d._ Capital gains

i. Sale of Real Property classified as capital asset §27(D)(5)

li, Sale of Shares of Stock not Traded in the Stock Exchange

§27(D)(2)

iii, Sale of Shares of Stock Traded in the Stock Exchange §127(A)

. Expanded Foreign Currency Deposit System §27(0)3)

f. Minimum Corporate Income Tax (MCIT)

1. Tax Rate and Base §27(E)(1)

Carry Forward Excess Minimum Tax §27(E)(2)

iii, Gross income; Cost of Goods Sold; Cost of Goods Manufactured

‘and Sold; Cost of Services §27(E)(4)

1. Chamber of Real Estate and Builders’ Associations, Inc.

v, Romula, et al., G.R. No. 160756, March 9, 2010

2, The Manila Banking Corporation |v. CIR, G.R. No.

168118, August 28, 2006

TANATON

‘cobase ourunes¥ 2028-2018

[TT HATHYRN A ZARATE

Pages

ident Foreign Corporations

a. In general, §28(A)(1)

b. Minimum Corporate Income Tax on Resident Foreign Corporations

§28(A)(2)

c. Branch Profits Remittance Tax (BPRT) §28(A)(5)

4d. Special Foreign Corporations

i, International Carriers §28(A)(3)(a)

International Shipping §28(4)(3)(b)

Offshore Banking Units §28(A)(4)

iv. Regional or Area Headquarters and Regional Operating

Headquarters §28(A)(6)

e. Passive income

Interest and Royalties §28(A)(7)

ji, Dividends §28(4)(7)(d)

f. Capital gains

i. Sale of Real Property Classified as a Capital Asset §28(A)(1)

li, Sale of Shares of Stock Not Traded in the Stock Exchange

§28(A)(7)(c) in relation to §27(D)(2)

Sale of Shares of Stock Traded in the Stock Exchange §127(A)

g. Income Derived under the Expanded Foreign Currency Deposit System

§28(A)(7)(b)

h. Branch Profit Remittance Tax

i. Marubeni Corp v. Commissioner, G.R, No. 76573, 14

September 1989, 177 SCRA 500

ji, Bank of America NT & SA vs. CA & CIR, G.R. No. 103092, July

21, 1994, 234 SCRA 302

4, Nonresident Foreign Corporation

a. In general, §28(8)(1)

b. Special Non-Resident Foreign Corporations

i Non-resident Cinematographic Film Owner, Lessor or

Distributor §28(B)(2), NIRC

ji, Non-resident Owner or Lessor of Vessels Chartered by

Philippine Nationals §28(8)(3), NIRC

ili, Non-resident Owner or Lessor of Aircraft, Machineries and

Other Equipment §28(B)(4), NIRC

c. Passive Income

i. Interest on Foreign Loans §28(8)(5)(a)

ji, Dividends §28(8)(5)(b)

1. Commissioner v. Procter & Gamble PMC, G.R. No.

66838, December 2, 1991, 204 SCRA 377

2. Commissioner v. Wander Phils., G.R. No. 68375, April

15, 1988, 160 SCRA 573

4. Capital gains

|. Sale of Real Property Classified as a Capital Asset §28(8)(1)

Sale of Shares of Stock Not Traded in the Stock Exchange

§28(8)(5)(c)

‘TaNATION

‘cobese aurune sv 2018-2018

ITTY HATHYRN A ZARATE

Pages

iil. Sale of Shares of Stock Traded in the Stock Exchange §127(/)

5. Improperly Accumulated Earnings Tax (IAET)

a. Definition and Tax Rate §29(A) and (B)(2)

b, Corporations subject to IAET §29(B)(1)

©. Exceptions §29(8)(2)

d._ Evidence of Purpose to Avoid Income Tax §29(C)

e. Improperly Accumulated Taxable Income §29(D)

1. Cyanamid vs, CA 322 SCRA 639 [G.R. No. 198067. January 20,

2000.)

6. Exemption from Tax on Corporation

a. Educational: Jesus Sacred Heart College v. Collector of Internal

Revenue, G.R. No. L-6807, May 24, 1954

b. Cooperatives: Dumaguete Cathedral Credit Cooperative (DCCCO) v.

‘CIR, G.R. No. 182722, January 22, 2010

CHAPTER V— DEDUCTIONS

Conditions for deductibility of business expenses

1. It must be ordinary and necessary §34(A)(1)(a)

a. Test of Deductibility

i. ESO. CIR, G.R. Nos. L-28508-9, July 7, 1989, 175 SCRA 149

il, Zamora v. Collector 8 SCRA 163, G.R. No, L-15290, May 31,

1963

Kuenzle & Streiff, Inc. v. CIR, G.R. No. L-18840, May 29, 1969

b. Test of Reasonableness

i, CM Hoskins & Co., Inc. v. Commissioner, G.R. No. L-24059,

November 28, 1969, 30 SCRA 434

ji, CIR v. General Foods (Phils), Inc., G.R. No, 143672, April 24,

2003

2. It must be paid or incurred during the taxable year §34(A)(1)(a)

2 GIR v. Isabela Cultural Corporation, G.R. No. 172231, February 12,

2007

3. It must be paid or incurred in carrying on, or which are directly attributable to

the development, management, operation and/or conduct of the trade,

business or exercise of profession §34(A)(1)(a), NIRC

a. CIR vs. CTA & Smith Kline & French Overseas Co (Phil Branch), 127

SCRA 9, G.R. No. 1-54108, January 17, 1984

b. Gutierrez v. Collector, 14 SCRA 33

4, It must be supported by adequate invoices or receipts §34(A)(1)(b), NIRC

a. Gancayco vs, Collector, 1 SCRA 980, G.R. No. L-13325, April 20, 1961.

5. It is not contrary to law, public policy or morals; §34(A)(1)(c)

a. 3M Philippines, Inc. v. CIR, G.R. No. 82833, September 26, 1988

6. The tax required to be withheld on the expense paid or payable was remitted

tothe BIR

ToXATION

CcobRse OUTUNES¥ 2928-2038

a. Requirements for Deductibility §34(K) Revenue Regulations No. 12-13

revoked by RR No. 6-2018, reinstating §2.58.5 bf RR 14-2002, as

amended by RR 17-2003

Il. Types of Deductions

1. Itemized Deductions §34(A) to (3)

2. Optional Standard Deduction §34(L)

3. Special Deductions under the NIRC and special laws §37 and 38.

I Itemized Deductions

1. Interest

a. Requisites for Deductibility §34(B)(1)

b. Disallowed Interest on Tax Arbitrage §34(B)(1)

c. Exceptions §34(B)(2)

d. Optional Treatment of Interest Expense §34{B)(3)

i, Palanca v. CIR, G.R. No. L-16626, October 29, 1966, 18 SCRA

496

li, Paper Industries Corp. (PICOP) v. CA, CIR & CTA, G.R. No.

106949-50, December 1, 1995, 250 SCRA 434

2. Taxes

a. Requisites for Deductibility §34(C)(1)

b. Exceptions §34(C)(1)

¢. Limitation on Deductions in case of NRAETB §34(C)(2)

i, CIR v. Lednicky, G.R. No. L-18169, July 31, 1964

d. Foreign Tax Credits

i. Persons allowed §34(C)(3)

ji, Limitations on Credit §34(C)(4)

3. Losses

a. Requisites for Deductibility §34(D)(1)

i. Marcelo Steel Corp. v. Collector, G.R. No. L-12401, October 31,

1960, 109 Phil 921

ji, Plaridel Surety & Ins Co v. CIR, G.R. No, L-21520. December

14, 1967, 21 SCRA 1187

iii, CIR v. Priscilla Estate, G.R. No. L-18282, May 29, 1964

b. Ordinary Loss v. Capital Loss

i, Limitation on Capital Losses §34(D)(4)(a)

ii, Securities Becoming Worthless §34(D)(4)(b)

iii, China Bank Corp vs. CA, CIR, CTA, G.R. No. 125508, July 19,

2000, 336 SCRA 178

©. Wash Sales §34()(5) & §38

d. Wagering Losses §34(D)(6)

2. Abandonment Losses §34(0)(7)

f. Net Operating Loss Carry Over (NOLCO) §34(D)(3), RR No. 14-2001

i. What is NOLCO?

ji, How does NOLCO work?

iil, When not allowable?

iv. PICOP v. CA, CIR & CTA, G.R. No. 106949-50, December 1, 1995,

250 SCRA 434, supra

TwxATON

Couns OUTUNES¥ 2028-2019

Pago ts

i. Transactions between related parties §36(B) in relation to

§34(E)(1)

ii, Recovery of bad debt previously written off|

1. Tax Benefit Rule §34(E)(2)

b. Collector v. Goodrich International Rubber Co.,|G.R. No. L-22265,

December 22, 1967, 21 SCRA 1336

Phil Refining Company v. CA, CTA and Commissioner, G.R. No. 113794,

May 8, 1996, 326 Phil 680

5. Depreciation

a. Requisites for Deducti

b. Methods of Depreciation

i, Straight Line Method

ji. Declining Balance Method

ili, Sum of the Years Digit Method

Special Rules on Depreciation

|. Private Educational institutions $34(A)(2)

li, Petroleum Operations $34(F)(4)

ili, Mining Operations $34(F)(5)

iv. For Nonresident Aliens Engaged in Trade or Business or

Resident Foreign Corporation $34(F)(6)

4d. Basilan Estate, inc. v. Commissioner, 21 SCRA 17

e. Zamora v. Collector, 8 SCRA 163

f. US. Ludley, 247 US 295

6. Depletion

a, ingeneral, §34(G)(1)

b. USv. Ludley, 247 US 295, supra

7. Charitable & other Contributions

8. Requisites for Deductibility §34(H)(1)

a, Limited Deductibility §34(H)(1)

b, Deductible in Full §34(H)(2)

Roxas v. CTA, 23 SCRA 276

9. Research & Development §34()

10. Contribution to Pension Trust

a. Requisites for Deductibility §34(1)

IV. Optional Standard Deduction (OSD) §34(L), RR No. 16-08

1. Requisites for OSD

2. OSD for individuals

3. OSD for Corporations

Premium Payments on Health/Hospitalization insurance §34(M)

|. Allowance for Personal & Additional Exemption §12, TRAIN

1. Personal Exemption §35(A)

a. Single

b. Married

Head of Family

ty §34(F)(1)

ss

TRXATION

‘copes ourunes¥ 2028-2038

ATTY, KATHYRN A, ZARATE

Pages

4. Estates and Trusts $62

‘Additional Exemption for dependents §35(8)

Definition of “Dependent” §35(8)

In case of married individuals §35(8)

In case of legally separated spouses §35(8)

Change of Status §35(C)

Personal Exemption Allowable to Nonresident Alien Individual §35(D)

Vi. tems not Deductible

1. General Rule §36(A)

2. Atlas Consolidated Mining Co. v. CIR, G.R. No. L-26911, January 27,

1981, 102 SCRA 246

b. Gancayco v. Collector, 1 SCRA 980, G.R. No, 1-13325, April 20, 1962

2. Losses from sales or exchanges of property between related parties §36(B)

oy ReN

(CHAPTER VI~ PARTNERSHIP

|. Taxation of General Partnership §22(B)

I. Taxation of General Professional Partnership §26

CHAPTER Vil — ESTATES & TRUSTS

|. Application of Tax §60(A)

|i, Exception §60(8)

Ill, Computation and Payment §60(C)

1. Ingeneral, §60(C)(1)

Consolidation of income of two or more trusts §60(C)(2)

Taxable Income §61

Exemption allowed to Estates and Trusts §62

Revocable trusts 663,

Income for benefit of grantor §64(A)

Meaning of “in the discretion of the grantor” §64(B)

Noween

CHAPTER Vill = ACCOUNTING PERIODS AND METHODS OF ACCOUNTING

|. Accounting Periods

1. Taxable year §22(P)

2. Calendar year

b. Fiscal year §22(Q)

General Rule on computation of taxable income §43

Period in which items of Gross Income Included §44

Period in which Deductions and Credits taken $45

5. Change of Accounting Period §46

Hl, Accounting Methods

1. Cash receipts and disbursements method

2. CIR. Isabela Cultural Corp, G.R. No. 172231, February 12, 2007

2. Accrual Method

copese ourune sv 2038 2018

ATTY. KATHYRW A. ZARATE

Page20

a. Filipinas Synthetic Fiber Corp vs. CA, 316 SCRA 480

Long-term Contracts §48

Sec 44, Regulations No. 2

Installment Basis §49

Sec 51, Regulations No. 2

1X - WITHHOLDING TAXES

|. Concept of Withholding Tax

1. CIR. Solidbank Corporation, G.R, No. 148191, November 25, 2003

Il. Types of Withholding Tax

1. Withholding on Wages

a. Requirement for withholding §79(A)

b. Tax paid by recipient $79(8)

© Refunds or credits §79(C)

4. Year-end adjustment §79(H)

e. Liability for tax 880

2. Withholding Tax at Source

2. Final Withholding Taxes §57(A)

i. RCBCv. CIR, G.R. No. 170257, September 7, 2011

. Creditable Withholding Taxes or Expanded Withholding Tax §57(B)

i. Chamber of Real Estate and Builders’ Associations, Inc. v.

Romulo, et al., G.R. No. 160756, March 9, 2010

3. Withholding VAT §14a(c)

4. Fringe Benefits Tax (FBT) §33

ayae

CHAPTER X ~ RETURNS AND PAYMENT OF TAX

1. Individuals

1. Income Tax Return

a. Who are required to file an income Tax Return (ITR) §51(A)(1)

i, Married Individuals §54(D)

ii, Income of minor children §54(E)

iii, Individuals deriving purely compensation income

iv. Professionals and Self-employed individuals

1. InGeneral, §74(A)

2. Quarterly ITR §74(8)

b. Who are not required to file an ITR §51(A)(2)

Substituted Filing of ITR by Employees Receiving Putely Compensation

Income §51-A, TRAIN

|. Venue of Filing of ITR §52(8)

Time of Filing of ITR §51(C)

Payment of income tax §56(A)

Installment payment §56(8)

pital Gains Returns

geres

2:

‘axATON

cobase ourunes¥ 2018-2018

ATTY. KATHNRN A, ZARATE

Pagezt

a. For sale or exchange of shares of stock not traded in a local stock exchange

§52(C(2)(a)

b. For sale of real property §51(C)(2)(a)

I Corporations

1. Income Tax Return §52(A)

2. Quarterly Corporate Income Tax Return §75

b. Final Adjustment Return §76

i. Place of Filing §77(A)

Time of Filing §77(8)

Time of Payment §77(C)

1. United International Pictures, AB v. Commissioner of Internal

Revenue, G.R. No. 168331, October 11, 2012

2. Capital Gains Tax Return

3. Capital Gains Returns

a. For sale or exchange of shares of stock not traded in a local stock exchange

$52(D)

b. For sale of real property

Ill Estates and Trusts §65

IV. General Professional Partnerships §55

\V. Withholding Tax Returns

Quarterly Returns and Payments of Tax Withheld §58(A)

Certificate of Tax Withheld §58(B)

Annual information Return (Alpha List) §58(8)

Income of Recipient §58(D)

ds

2.

3.

4

TAKATION

codase ourune sv 2018-2018

[ATTY KATHI A ZARATE

Page

“CITIZENS:

Resident

Non-resident incldg

Compensation-|— Professionals

Self-Employed /

PSM

Within & Without the

PHS24(A)(1)(a)

S24(A)(1)a) $24(A)(1)(b)

S24(A)(A){b)8&(C)

PASSIVE INCOME

§24(B)(1)

§24(8)(1)

__§24(8)(1)

§24(8)(1) i

Prizes & Winnings

$§24(B)(1)

business (NRANETB)

$24(8)(1) |

Cash/Property

contractors

| Dividends §24(8)(2) §24(8)(2) $24(8)(2), §25(A)(2) §25(8)

CAPITAL GAINS TAX

|

Real Property

Classified as Capital 524(0)(2) §24(0)(2) pane | ee ean

Asset §24(D)(2) §24(D)(2) §24(D)(2) §25(A\(1)

Shares of Stock not 524(C)in

listed/traded in PSE §24(C) §24(C) §24(C) relation to §25(B)

ae §25(A)(2)

SPECIAL ALIENS aa

Aliens employed by:

Regional or area See §25(F) in

headquarters relationto | _|

Offshore banking} See 25(F) in relation to $25(C) §25(C) and

unit and VETO; VETO; :

Petroleum — servi §4RR8-2018 $4 RR 8-2018

Taxarion

COURSE OUTUNESY 20182019

‘ATTY KATHYRN A ZARATE

Poge2e

REE ea ae

ree eee FOREIGN CORPORATIONS

Domestic aes Resident Nor-resident

TAXABLE INCOME _ : ae

Source ___827(a) §28(A)(1) §28(8)

TaxBase 221A) 528(A)(2)

Hnaaeeces| s27(€)() §28(A)(2) ser

Rate 527(A) 528(4)(1)

soe) §28(4)(2) | see)

PASSIVE INCOME - alescreere

Interest from esas

Bankdeposis (Rese) 527(0\(1) §28(A)(7)(a) 52818)

FCDU/OBU §27(D)(3)

S27i0Kt) S28{A)(7N0) ales 528(4)(7)(b)

pee eee eeeen ees §27(0)(4) 528(A\(7\(a) §28(8)

Foreign Loans NA NA §28(B}(5)(a) (subject to

ot aoe preferential tax treaty rates)

ee §27(0)(1) §28(A)(2) crea Mey ce

Pres & Winnings win : Taal

‘COURSE OUTUNES¥ 20182038

TATY,KATHYRW A ZARATE

Pages

'§28(8) (subject to preferential tax

. gees treaty rates)

i §28(8)

Cash/Property Dividends §28(8)(5)(b)

B27 S2B{AIC7NA) (subject to preferential tax treaty

rates)

(CAPITAL GAINS TAX aaEannE EE

Real Property Classified as

Capital Asset §27(0)15) ___§28(A)(1) §28(8)

Shares of Stock not

isted/traded in PSE §27(D)(2) §28(A)(7)(c) §28(8)(5)(c)

BRANCH PROFIT nA NA

REMITTANCE TAX (BPRT) Heed §28(A)(5)

IMPROPERLY ACCUMULATED

EARNINGS TAX (IAET) §29(A) i =

‘SPECIAL CORPORATIONS =

international Carriers (Air or

Sea) 827(A)(3)

Offshore Banking Units s271aya)

Regional or Area

leadquarters §22(DD) 7 §27(A)(5)(a)

Regional Operating

Headquarters §22(EE) §27(A)'SKb)

Non-resident

cinematographic fi

lesor or estibutor ene

rweation |

‘course ourues 20182013

[ATIY,KATHYBN A ZARATE

Page 26

Non-resident owner or lessor

of vessels

Non-resident owner or lessor

of aircraft, machineries and

| equipment eece]

Proprietary Educational

Institutions and nonprofit

|_hospital

52718)

‘COURSE OUTUNE St 2018-2039

Page27

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Civil Law Compilation Bar Q&a 1990-2017 PDFDocument380 pagesCivil Law Compilation Bar Q&a 1990-2017 PDFReynaldo Yu100% (10)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BOI Self-Rating ScorecardDocument2 pagesBOI Self-Rating ScorecardReynaldo YuNo ratings yet

- General Insurance V. NG Hua: GR No. L-14373, Jan 30, 1960Document8 pagesGeneral Insurance V. NG Hua: GR No. L-14373, Jan 30, 1960Reynaldo YuNo ratings yet

- National Government's Power To Impose Amusement Tax Is Provided UnderDocument2 pagesNational Government's Power To Impose Amusement Tax Is Provided UnderReynaldo YuNo ratings yet

- Civrev DigestDocument2 pagesCivrev DigestReynaldo YuNo ratings yet

- Civil Procedure OutlineDocument17 pagesCivil Procedure OutlineReynaldo YuNo ratings yet

- Font: Arial Font Size: Heading: 12 Body: 10: Page 1 of 1Document1 pageFont: Arial Font Size: Heading: 12 Body: 10: Page 1 of 1Reynaldo YuNo ratings yet

- Annex B - Health Screening Form For VisitorsDocument1 pageAnnex B - Health Screening Form For VisitorsReynaldo YuNo ratings yet

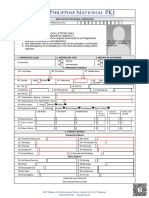

- PNPKI Individual Certificate Application Form Fillable v2.4 4Document4 pagesPNPKI Individual Certificate Application Form Fillable v2.4 4Reynaldo Yu67% (3)

- Last Will and TestamentDocument2 pagesLast Will and TestamentReynaldo YuNo ratings yet

- SALN PresentationDocument102 pagesSALN PresentationReynaldo YuNo ratings yet

- Circular 2014-01 - CancellationDocument2 pagesCircular 2014-01 - CancellationReynaldo YuNo ratings yet

- RMC No 14-2012Document1 pageRMC No 14-2012Reynaldo YuNo ratings yet

- IPL Assignment Feb 21Document1 pageIPL Assignment Feb 21Reynaldo YuNo ratings yet

- Train Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsDocument2 pagesTrain Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsReynaldo YuNo ratings yet

- Taxation Notes: Are Deemed To Be The Laws of The Occupied Territory and Not of The Occupying EnemyDocument18 pagesTaxation Notes: Are Deemed To Be The Laws of The Occupied Territory and Not of The Occupying EnemyReynaldo YuNo ratings yet

- VI Union Representation CasesDocument15 pagesVI Union Representation CasesReynaldo YuNo ratings yet

- Taxation Notes I. Taxation 1. Definition of Taxation Taxation As A PowerDocument17 pagesTaxation Notes I. Taxation 1. Definition of Taxation Taxation As A PowerReynaldo YuNo ratings yet

- ReviewerDocument1 pageReviewerReynaldo YuNo ratings yet