Professional Documents

Culture Documents

Ireland Is No Iceland

Uploaded by

CharlieFell0 ratings0% found this document useful (0 votes)

35 views2 pagesThe yield on ten-year bonds has jumped from below 5 per cent at the start of August to as high as 6. Per cent in recent sessions. The premium for five-year Irish credit default swaps soared to 520 basis points, a level that is exceeded only by Venezuela, Argentina, Greece and Pakistan. However, a default is highly unlikely in the medium-term and the necessary adjustment can be made.

Original Description:

Original Title

Ireland is No Iceland

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe yield on ten-year bonds has jumped from below 5 per cent at the start of August to as high as 6. Per cent in recent sessions. The premium for five-year Irish credit default swaps soared to 520 basis points, a level that is exceeded only by Venezuela, Argentina, Greece and Pakistan. However, a default is highly unlikely in the medium-term and the necessary adjustment can be made.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views2 pagesIreland Is No Iceland

Uploaded by

CharlieFellThe yield on ten-year bonds has jumped from below 5 per cent at the start of August to as high as 6. Per cent in recent sessions. The premium for five-year Irish credit default swaps soared to 520 basis points, a level that is exceeded only by Venezuela, Argentina, Greece and Pakistan. However, a default is highly unlikely in the medium-term and the necessary adjustment can be made.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Ireland is No Iceland

October 1st, 2010

The sick men of Europe’s monetary union are in the spotlight once again, and none more

so than Ireland, as fears that the eventual cost of recapitalising the ailing banking sector

will bring the sovereign nation to its knees, has precipitated panic in the domestic bond

market.

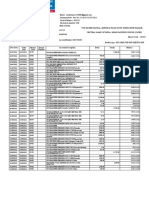

The yield on ten-year bonds has jumped from below 5 per cent at the start of August to as

high as 6.7 per cent in recent sessions, the highest level since 1997 and a record spread

versus German bunds. Meanwhile, the premium for five-year Irish credit default swaps

(CDS), soared to 520 basis points, a level that is exceeded only by Venezuela, Argentina,

Greece and Pakistan. Market psychology has clearly turned against the Irish sovereign

and commentators are divided as to whether a humiliating default can be avoided.

It is undoubtedly true that Ireland walks a fine tightrope, as the ultimate cost of

recapitalising the banking sector versus GDP is likely to rank alongside the South Korean

and Turkish crises of 1997 and 2000 respectively. Meanwhile, the fiscal adjustment

required to bring the deficit down to three per cent of GDP in 2014 is equivalent to that

achieved over a nine-year period between 1981 and 1989. In spite of the herculean task

facing the government however, a default is highly unlikely in the medium-term and the

necessary adjustment can be made, though perhaps over a longer time frame.

The current panic is clearly related to solvency and not liquidity, as the government holds

very large cash reserves as a funding buffer that amount to roughly 15 per cent of GDP.

This means that liquidity does not become an issue until next summer at the earliest.

Furthermore, the National Pension Reserve Fund offers the government further liquid

resources as a buffer that amount to roughly 12 per cent of GDP. Thus, an immediate

default is simply out of the question.

In relation to solvency concerns, a financial balance approach suggests that the necessary

fiscal adjustment can be achieved, in which case the outstanding stock of public debt will

peak at circa 100 per cent of GDP. It is important to recognise that the sum of the fiscal

balance and the domestic private sector financial balance equals the current account

balance. Thus, an improvement in the fiscal position must be accompanied by a

declining private sector balance, an improving current account balance or some

combination of both.

In this respect, the Irish fundamentals compare favourably with its ailing European

neighbours, as the private sector is running a large surplus that is in double-digits as a

percentage of GDP, and the current account deficit has narrowed to just one per cent.

The current account should move to surplus next summer, while, a reduction in the

private sector surplus is possible, so long as confidence and the global economic climate

remain conducive. Thus, the fiscal adjustment is possible.

The fundamentals are not as poor as current bond yields suggest, but market psychology

dominates in the current climate. The government’s efforts are not being helped in this

respect by negative commentary that relies on spurious examples and the selective use of

data to prove a point. A recent example argues that the Irish government should follow

Iceland’s example and default. Readers are led to believe that Iceland is enjoying a

vibrant economic recovery and international investors are chomping at the bit to return.

The truth of the matter is that the Icelandic economy remains mired in deep recession;

output shrank more than three per cent quarter-on-quarter in the three months to June

30th, and has now registered eight consecutive quarters of negative year-on-year growth.

Furthermore, the latest data available from the World Bank show that Iceland’s gross

national income per capita has shrunk from parity to a level one-third below that of

Denmark, Finland, and Sweden.

Unemployment is indeed declining, and dropped by one percentage point to 8.3 per cent

during the second quarter. However, the improvement is a mirage, as changes in the

methodology used to calculate unemployment has caused the rate to measure half to one

percentage points lower than it would have otherwise been. Furthermore, the figure has

been helped by emigration, as Iceland’s population fell last year for the first time since

1889.

It is argued that declining interest rates demonstrate that confidence has returned. Short-

term rates have been cut from a peak of 18 per cent two years ago to 6.25 per cent today,

but they still remain among the highest in the developed world. Furthermore, interest

rates have been cut in response to an appreciating krona, which has benefitted from a firm

lid being placed on capital outflows at the height of the crisis. Long-term yields actually

rose on the latest cut, as the gradual removal of capital controls draw ever nearer and

there is understandable fear that the holders of Glacier bonds will exit at the first

opportunity. Needless to say, the notion that international investors are set for an

imminent return is bunkum.

Ireland does indeed stand on the precipice, but the idea that we follow Iceland’s example

is simply ludicrous. Investors would do well to ignore such spin, and base their opinions

on fact-based analyses.

www.charliefell.com

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- What Caused The Euro CrisisDocument2 pagesWhat Caused The Euro CrisisCharlieFellNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Debunking The Fed ModelDocument3 pagesDebunking The Fed ModelCharlieFellNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Double-Dip RealityDocument3 pagesDouble-Dip RealityCharlieFellNo ratings yet

- Hard Core PIGSDocument2 pagesHard Core PIGSCharlieFellNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Mini Case CH 11-12Document14 pagesMini Case CH 11-12Irwan Hermantria50% (2)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- VP Director Finance Securitization in USA Resume Timothy LoganDocument3 pagesVP Director Finance Securitization in USA Resume Timothy LoganTimothyLoganNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Feasibility Study of A Medium - Sized Full Service Hotel in Bauchi Metropolis, Bauchi NigeriaDocument5 pagesFeasibility Study of A Medium - Sized Full Service Hotel in Bauchi Metropolis, Bauchi NigeriaFuadNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- BNP Paribas - Paris Saint Paul - Le MaraisDocument1 pageBNP Paribas - Paris Saint Paul - Le MaraisfredericcroyNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- ch12 PDFDocument4 pagesch12 PDFCarmela Isabelle DisilioNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- List PDFDocument4 pagesList PDFPam Welch HeuleNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- CIR Vs PhilamlifeDocument2 pagesCIR Vs PhilamlifeBreAmberNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Economics - Updated - Notes - by - Afreen MamDocument89 pagesEconomics - Updated - Notes - by - Afreen MamKajal RanaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Unit 2 Legal Basis of Public Sector Accounting Acc 558 2020 LecturesDocument70 pagesUnit 2 Legal Basis of Public Sector Accounting Acc 558 2020 LecturesElvis YarigNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Chap 004Document30 pagesChap 004Tariq Kanhar100% (1)

- 01 Course Outline Accounting For Business CombinationDocument2 pages01 Course Outline Accounting For Business CombinationMa Jessa Kathryl Alar IINo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Account StatementDocument12 pagesAccount StatementAbhinav AnkarNo ratings yet

- RPSC JR Accountant Second Paper 2015Document55 pagesRPSC JR Accountant Second Paper 2015yeshrockNo ratings yet

- Kaiser Supplemental Savings and Retirement Plan Annual Report Form 5500Document37 pagesKaiser Supplemental Savings and Retirement Plan Annual Report Form 5500James LindonNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Chapter 2Document25 pagesChapter 2heobenicerNo ratings yet

- AccountStatement 3286686240 Aug04 185310 PDFDocument2 pagesAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Philippine Stock ExchangeDocument11 pagesPhilippine Stock ExchangeJyasmine Aura V. AgustinNo ratings yet

- ZPPF Loan Recoverable ApplicationDocument3 pagesZPPF Loan Recoverable ApplicationNaga ManoharababuNo ratings yet

- Account CurrentDocument13 pagesAccount Currentfathima.comafug23No ratings yet

- Marriott International COPORATE STRATEGYDocument5 pagesMarriott International COPORATE STRATEGYYasir Jatoi100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- RII (Renewal Rewrite), Effective Date 20221128, Transaction 00280Document16 pagesRII (Renewal Rewrite), Effective Date 20221128, Transaction 00280Pete PoliNo ratings yet

- Tally Era Conti...Document5 pagesTally Era Conti...Olivia OwenNo ratings yet

- Taxation CPALE by WMGDocument19 pagesTaxation CPALE by WMGJona Celle Castillo100% (1)

- Business Plan Investors BankersDocument199 pagesBusiness Plan Investors BankersDJ-Raihan RatulNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Equity ReleaseDocument17 pagesEquity ReleaseEquity Release WiseNo ratings yet

- Poultry Broiler FarmingDocument16 pagesPoultry Broiler FarmingB.p. MugunthanNo ratings yet

- ExerciseDocument4 pagesExercisemuneeraaktharNo ratings yet

- Utilization of IP and Need For ValuationDocument15 pagesUtilization of IP and Need For ValuationBrain LeagueNo ratings yet

- AIF DataDocument32 pagesAIF DataYASH CHAUDHARYNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)