Professional Documents

Culture Documents

Bas 8

Uploaded by

Shibli Shaid0 ratings0% found this document useful (0 votes)

36 views27 pagesBangladesh Accounting Standards 08

Original Title

BAS-8

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBangladesh Accounting Standards 08

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

36 views27 pagesBas 8

Uploaded by

Shibli ShaidBangladesh Accounting Standards 08

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 27

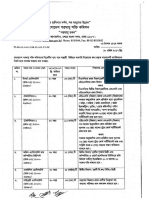

BANGLADESH ACCOUNTING STANDARDS (BAS)

Net Profit or Loss for the Period,

Fundamenial Errors and

‘Changes in Accomnting Policies

Deon eee

Reet Cat}

BAS-8

Contents

BAS 8 : Net Profit or Loss for ths Poriod, Fundamental

Errors and Changes in Accounting Policies

OBJECTIVE

SCOPE Paragraphs 1-5

DEFINITIONS 6

NET PROFIT CRLOSSFORTHE PERIOD 7-50

Extraordinary Items 11-18

Profit ot Loss from Ordinary Activities 16-18

Changes in Accotiting Estimates, 23-30

FUNDAMENTAL ERRORS 31-40

Benchmark Trestment 84-87

Allowed Alternative Treatment 38-40

CHANGES IN ACCOUNTING POLICY 41-57

Adoption of a Bangladesh Accotnting Standard 46-48,

Other Caanges in Accounting Policies -

Benchirark Treatment 49-53

Other Changes in Accounting Policies -

Allowed Alternctive Treatment 54-67

COMPLIANCE WITH INTERNATIONAL

ACCOUNTING STANDARD 68

EFFECTIVE DATE. 59

BASS

BAS & : Net Profit or Loss for the Period,

Fundamental Errors and Changes in

Accounting Policies

Summary

Effective Date : Poriods boginaing on or after 1 January 1096.

ICAB adopted BAS 8 on 1 Jonunry 1901 and

subsequently amended the first version

Objective To prescribe the classification, disclosure, and

accounting treatment of certain items in the

income staterneni so that all enities prepare and

present an income statement on a consistent

basis

Key Featnres : mAll itans of income and expense recognized in a

period should be inchided in the determination

of the net prot ot toss for the period tnless an

BAS requires or permits otherwise, such as

revaluation swpluses BAS 16. Properyy, Plant

ane Eguipmere

w Items of unusual size, nature, ot incidence from

ordinary activties to be separately disclosed.

1 Changes in accounting estimates (for example,

change in usafid life of an assa) are to be

accounted for in the current year, o: future

‘years, or beth (no restaternent),

= A change in accounting policy should only be

made if required by statute of by « siantard-

selling body or s0 a3 to givea more appropricte

presentation,

= A change made on the basis of @ new BAS is

accounted for in accordance withthe iransitional

provisions specified inthe new Standard

BASS

a For correction of fundamental errors that

occurred in prior year, and other non-

mandated changes in accounting policies -

specifies a benchmark ireatment. (astatemant

and adjustment to opening retained earnings)

and allowed alternative treatment (cumulative

effect in net profit or loss for the period plus

proforma information

1 Disclosure requirements

Related, : None

Bangladesh

Accounting

‘Standards:

Interpretation

@as)

PASS

BAS 8 : Net Profit or Loss for the Period,

Fundamental Errors and Changes

in Accounting Policies

The standards, which have bean set in bali walic type,

should be read ia the cantaxt af the background material

and implementation guidance in this Standard, and in the

context of the Framework of Bangladesh Accounting

Standards. Bangladesh Accounting Standards are rot

imanded 10 apply to immaterial itams.

Objective

Tho objective of thie Standird is to procortbe the

clesification, disclosure and accounting treatment of

certain items in the income statement so tht all antarprises

prepare and present an income statement on a consistent

basis, This enhances comparability both with the

enterprise's financial statements of previcus periods and

wih the financial statements of other enterprises

Accordingly, this Standard requires the classification and

disclosiwe of extraordinary items and the disclosure of

certain items within profit or loss stom ordinary activities

It also. specifies the accounting treatment for changes in

accownting estimates, changes in accounting policies and

the correction of fundamental errors,

Scope

This Standard should he applied in presenting profit or loss

from ordinary activities and extraordinary items in the

income statement and in accounting for changes in

accounting estimates, fandamental emors and changes in

accounting policies.

This Standard deals with, among other things, the disclosure

of certain items of net profit or loss for the period.

These disclosures are made in. addition to any other

disclosures required by other Bangledesh Accounting

1

BASS

Standards, including BAS 1, Presentation af Financial

Staramants.

4. The tax effects of extraordinary tems, fundamental enors

and changes in accounting policiss are acceunted for and

5 disclosed in accordance with BAS 12, Income Taxes

5. Where BAS 12 refers to unusual items, this should be raad

as extraordinary items as defined in this Standard

Definitions

6 The following terms are used in this Standard with the

meanings specified:

Extraordinary items are income or expenses that arise

‘fom events or transactions that are clearly distinct from

ihe ordinary activities of the enterprise and therefore are

‘Rot expected to recur frequently or regularly.

Oratnany actiides are any acdivides which are undertaten

‘yan enterprise as part of its business and such related

acthdties in which ihe enterprise engages in furtherance

0G, incidental ta, or atising from these aettuies.

Fundamental errors are errors discovered tn the current

petiod that axe of such significance that the financial

‘slatemenis of ane ot more prior periods can no longer be

considered to have heen reliahle at the date of their issue,

Accounting policies are the specific principles, bases,

‘conventions, rules and practices adopted by an enterprise

in preparing and presenting Financial statements.

49,

a.

BASS

Net Profit or Loss for the Period

ALT items of income and expense recognised in a period

should be included tn the determination of the nei prof

or loss fer the period unless 2 Bangladesh Accounting

‘Standard requires ar permits otnerwise.

Normally, all sams of ticome and expense recognised in a

period are included in the determination of the net profit or

loss for the period. This includes extreordinary items and

the effects of changes in accounting esimates. However,

circumstances may exist when certain items may be

excluded from net profit ot less for the aumrent period. This

Standard deals with two such citcumstances: the correction

of fiandamental errors and the effect of changes in

accounting policies

ther Bangladesh Accounting Standards deal with items

which may meet the Framework definitions of income or

expense but which are usually excluded from the

determination of the net profit or loss. Examples include

revaluation surpluses (see BAS 16, Property, Plant and

Eyuiomend) znd gains and losses arising on the translation

of the finencial statements of a foreign entity (see BAS 21.

The Effects of Changes in Foreign Exchange Rates)

The net profit or loss for the period comprises the faliowing

components, each of which should he disclosed on the face

of the income statement:

(9) profit or loss from ordinary actiities; and

(@) extraordinary itams.

Extraordinary Items

The nature and the amount of cach extraordinary fem

should be separately disclosed.

12,

13,

14

15,

18.

BAS3

Virtually all items of income and expense included in the

detemmination of nat profit ot loss for the pariod arise in the

course of the ordinary activities of the enterprise.

Therefore, only on rare occasions does an event or

transaction giverise to an extraordinary item.

‘Whether an event o trensiction is clearly distinct from the

odinary ectivities of the enterprise is determined by the

nature of the event of transaction in relation to the business

ordinarily carried on by the enterprise rather than by the

frequency with which such events are eepected to occur.

Therefore, an event or transaction may be extraordinary for

one enterprise but not extraordinary for another enterptise

because of the differences between their respective ordinary

adivities, For example, losses sustained as a result of an

earthquake may qualify as an extractdinary tem for many

enterprises. However, claims from policyholders arising

from an earthquake do not qualify as an extreordinary item

for an insurance enterprise thet insures against such risks

Examples of events of transections that generally give tise

to extraordinary items for most enterprises are

(@\ the expropriation of assets: ot

(ban earthquake of other natutel disaster.

The disclosure of the neture and amount of each

extraordinary item may be made on the face of the inceme

statement, or when this disclosure 18 made in the notes to

the fmancial statements, the total amount of all

extraordinary items 1s disclosed on the face of the ineeme

statement.

Profit or Loss from Ordinary Activities

Vien tems of income and expense within proftt or loss

from ordinary activites are of such size, mature or

incidence that their disclosure is relevant to explaia the

4

BAS-8

performance of the enterprise far the period, the nature and

amount of such itams should ba disclosed separately.

17. Although the items of income and expense described in

puagreph 16 ore not actracrdinary itens, the nature and

amount of such items may be ralevant to users of Financial

statements in understanding the financial position and

parformance of an anterprise and in making projections

about financial position and parformance Disclosure of

such information is usually made in the notes to the

Financial statements

18. Circumstances: which may-give rise to the separate

disclosure of items of income and expense in accordance

with paragraph 16 include:

( the write-down of inventotias to net tealisable valtie or

proverty. plant and equipment to recoverable amount. as

well as the reversal of such write-downs:

(b) 2 restructuring of the activities of an enterprise and the

reversal of any provisions for the costs of restructuring:

(0 disposals of items of property, plant end equipment,

(@ disposals of long-term investments;

(Q dscontinsed operations;

(f Migation settlements; and

(@ cther reversals of provisions

19-22, (Deleted)

‘Changes in Accounting Estimates

28. As aresult of the uncertainties inherent in basiness activities,

‘many financial statement items cannot be measured with

precision but can cnly be estimated. The estimation process

5

BAS-8

involves judgements based on the Latest information available.

Estimates may be required, for example, of bad debts,

inventory obsolescence ot the useful lives ot expected

pattern of consumption of economic benefits of deprestable

assets, The use of reasonable estimates 15 an essential part

of the preperation of financial statements and does not

‘undermine their reltabity,

24, An estimate may have to be revised if changes occur

regarding the circumstances oa which the estimate was

besed or as aresul of new informeticn, more experience ot

subsequent developments, By its nature, the revision of the

estimate does not bring the adjustment within the definitions

ofan extreordinary item or a fundamental exter.

25. Sometimes it is difficult to distinguish between a change in

accounting policy and change in an accounting estimate

In such cases, the chenge is treated ao a change in on

accounting estimate, with eppropriete discloswe.

28. The effect of a change in an accounting estimate should be

included in the determination of not profitor loss in:

(@) the pariod of the chango, if the chango affects the

period only: or

(®) ihe pariod of the change and fitare periods, if the

change affects both

27. A change in aa accounting ettimate may affect the currant

paied only or both the current period and future periods.

For exemple, a change i the estimate of the amount of bad

debts affects only the current period and therefore is

recognised inmedictely. However, a change in the

estimated useful life or the expected pattern of consumption

of economic benefits of a deprecicble asset affects the

depreciation expense in the current period and in each

period during the remaining useful life of the asset. In both

cases, the effect of the change relating to the currant period

6

BASS

is tecognised es income or expense in the current period, The

29,

3

2,

effect, if any, on future periods is recognised in future

patiods

The effect of a change in an accounting estimate should

be inclded in the same income statement classification as

‘was used previously for the estimate,

To ensure the compaability of financial statements of

different periods, the effect of a chenge in an accounting

estimate for estimates which were previcusly included in

the profit or loss from ordinary activities is included in that

componert of net profit or less. The effect of a change in

an accounting estimete for an estimate which was

previously included as an extraordinary item is reported as

an extraordinary item.

‘The nature and amount of a change in an accounting

estinaie that has a material effect in the current period oF

Which is expected to Have a material effect in subsequent

periods should he disclosed, If it is impracticable 10

quantity the amount, this fact should Be disciosed.

Fundamental Errors

Errors in the preparation of the financie! statements of one

ot more priot periods may be discovered in the current

period, Errors may occur as a result of mathematical

mistakes, mistakes in applying accounting policies,

misinterpretation of facts, fraud or oversights. The

correction of these e1ots is normally included in the

determination of net profit or loss for the current period,

On rare occasions, an error has such a significant effect on the

Financial aataments of one or more prior periods that those

Financial statements can no longer be considered to have been

reliable at the date of their issue, These errors are refarred to

as findamental errors. An example of a fundamental error is

the inclioion in the financial statements of a previous period of

material amounts of work in progress andreceivables in

1

BASS

respect of fraudulent contracts which canaot be enforced. The

catrection of fundamental etrors that relate to prior periods

requires the restatement of the comparative mformation of the

presentation of eddmonal pro formna information.

38. The comedion of fundemental errors can be distinguished

26.

36

from changes in accounting estimates. Accounting estimates

by thet nature are approximations that may need revision as

additional information becomes known, For example, the

gain or loss recognised ou the outcome of 4 contingency

Which previously could not de estimated reliably does not

constitute the correction ofa fundamental enor

Benchmark Treatment

The amount of the correction of a fandamental error that

‘relates to prior periods should be reported by adjasting the

opening Balance of retained earnings, Comparative

Jnformation should be restated, unless it is impracticable to

oso.

The financial statements, including the comparative

information For prior periods, cro prosenied as if the

fundamental ertos had bean corrected in the poriod in which

it was mado. Therofora, the amount of the correction that

relatas to cach period presented is included within tho net

prof or loss for that poriod, The amount of the corraction

relating to periods pricr to those included in the comparative

information in the financial statements is adjusted against

the opaning balance of reteined earnings in the earliest

period prasented Any other information reported with

respect to peice periods, such as historical summaries of

Financial data, is also restated

‘The testatement of comparative information does not

necessarily give rise to the amendment of financial

statements which have been approved by sharsholders ot

registered or filed with regulatory authorities. However

national laws may require the amendment of such financial

statements.

7.

39

BAS-8

An enterprise should disclose the following:

(@) ihe nature of the fundamental error;

(®) the amount of the correction for the current period

and for each prior period presented;

(@ the amount of the correction relating to periods prior

10 those included in the comparative information; and

(@) the fact that comparative information has been

estated or that it is impracticable to do sa.

Allowed Alte: native Treatment

‘The amount ot» meetin (f 2 1'mdamenial error

should be incladed in tne determination of net profit or

Joss for the c.vnt with. 1 pa-atve information

‘should be prevenind as renoried in the fina aciai statements

of the prior 2a information,

prepared in 34, should be

‘presented unt }

‘The correctiot included in the

detem:mation » amen period.

However, ad anted, often as

separate colt ot loss of the

current. perioc ented 2s if the

fundamental € + period when it

was made I this accounting

treatment in « staternents are

required to include comparative information which agrees

with the frian aC} ASM HEAT HIea|or periods

49. An enterprise should disclose the following:

(3) the nature of the Fundamental error;

(® the amount of the correction recognised in net profit

ar loss for the current period; and

9

a

42.

43,

a4.

BAS-8

(@) tho amount of the correction incladsd in each period

‘far which pro forma information is presanied and the

amount of tho correction rélating to pariods priar to

those incladad in tho pro forma information. If itis

impracticable io presant pro forma information, this

‘fact should be disclosed.

Changes in Accounting Policies

Users nead to be able to compare the financial statements of

an enterprise aver 2 pariod of time to identify trends in iis

financial position, performance and cash flows Therefore,

the same accounting policies ate netmally adopted in each,

period

A change in accounting policy should be made only if

seguired by statute, or by an accounting standard seiting

ody, or if the change will result in a more appropriate

presentation of events or transactions in the financial

Statements of the enterprise.

A mote appropriate presentation of events ot transactions in

the financial statements ocours when the new accounting

policy results in more selevent or reliatle information about,

the financial position, parformance of cash flows of the

entarprise

‘The following are not changes in accounting policies:

(a) the adoption of an accounting policy for events or

transactions that differ in sabstance from previously

occurring events or mansactions; and

() the adoption of a new accounting policy for evenis or

transactions which did not occur previously or that

wore immaterial.

‘The initial adoption of a policy io carry assets at revalued

amounts under the allowed alternative treatment in BAS

16 Property, Plant and Equipment, is a change in

10

5

46.

BASS

accounting policy but it i dealt with as a rovalaation in

accordance with BAS 16, rathar than in accordance with

this Standard. Therefore, paragraphs £8 to $7 of this

Standard are not applicable io such changes in

accounting policy:

A changa in accounting policy is appliad retrospectively of

prospectively in accordance with the requirements of this

Standard Retrospective application results in the new

accounting policy being applied to events and transactions 2s

4 the new accounting policy had always been in use

Therefore, the accounting policy is applied to events and

transactions from the date of origin of sch items

Prospective application mears that the new accounting policy

4s applied to the events and transactions occurring after the

date of the change, No adjustments relating to prior petiogs

remade either tothe opening balance of retained exrnings ct

in teporting the né. grofit ot loss for the current period

because existing balances are not recalculated However, the

new accounting policy is applied to existing balances es from

the date of the change For ezimple, n enterprise may

decide to change its acceunting policy for Lorrowing costs

and capitalise those costs in conformiy with the allowed

altenative treatment in BAS 23, Borrowing Costs. Under

prospective application, the new policy caly applies to

borrowing costs that are incumed afte the date of the change

in accounting policy

Adoption of an Bangladesh Accounting Standard

A change in accounting policy which is made on the

adoption of an Bangladesh Accounting Standard should he

accounted for in accordance with the specific transitional

provisions, i any, in that Bangladesh Accounting

Standard. In the absence of any transitional provisions,

ihe change in accounting polity should be applied in

accordance with the henchmark treatment in paragraphs

4 5? and 53 or the allowed alternative teatment in

paragraphs 52, 56 and 57.

i

a7

43,

49.

50,

51

BAS-8

Tho transitional provisions in « Bangladesh Accounting

Standard may roquite either a retrospective or 2 prospective

application of a change in accounting policy.

When an enterprise has not adopted a new Bangladesh

Accounting Standard which has been published by the

ICAB but which has not yet come into offect, the enterprise

fs encouraged to disclose the mature of the future change in

accounting policy and an estimate of the effect of the

change on is net profit or Loss and financial position.

Other Changes in Accounting Policies - Benchmark

‘Treatment

A. change in accounting policy should be applied

setrospoctivaly unless tho amount of any resulting

adjasiment that relator io prior poriods is not reasonably

determinable. Any resulting adjestment should be reparted

as an adjustment to the opening balance of retained

earnings, Comparative information should be cesiated

‘unless i ls impracticable io do so.

The financial statements, including the comparative

information for prior periods, are presented as if the new

accounting policy had always been in use. Therefor2,

competative infermation is restated in order to reflect the

new eccounting policy. The amount of the adjustment

relating to periods prior to those included mn the nancial

statements is adjusted against the opening balance of

retsined eamings of the earliest period presented. Any other

information with respect to prior periods, such as historical

srarnatios of financial data, is also rastated.

The restatement of comparative information doas not

necassarily give riseto the amendment of financial staternenis

wwhich have heen approved by shareholders or registered or

filed with regulatory authorities However, national laws may

require the amendment of such financial stalements

12

52.

53.

54.

56.

RAS-8

The change in accounting policy should be applied

prospectively when the amount of the adjustment to the

‘opening baianco of retained oarnings required By paragraph

49 camnot bo reasonably datermined.

When a change in accounting policy has a material eftoct on

the current period or any prior period presented or may have

2 material effect in subsequent periods, an enterprise should

disclose the following:

@) the reasons for the change:

(6) the amannt of the adjustment for the current period and

for each period presented:

6) the amount of the adjastment relating to periods prior to

‘thase included in the comparative information; and

@) the fact that comparative information has been restated or

‘that itis impracticable to dosa.

Other Changes in Accounting Policies - Allowed

Alternative Treatment

A change in accounting policy should be applied

yetrospectively unless the amount of any resulting

adjasiment that relates io prior periods is not reasonably

determinable, Any resulting adjustment showld he

jaduded in the detetmination Of the net profit or joss for

the current period. Comparative information should he

presanied a5 reported in the financial statements of the

rior period Additional pro forma comparative

information, prepared in accordance with paragraph 43

should be présented unless itis impracticable to do so. 1

Adjustments resulting from a change in accounting policy

ate included in the cetermination of the net profit ot 1oss for

the period. However, additional comparative information 1s

presented, often as separate columns, in order to show the

net profit or loss and the financial position of the current

poriod and any prior periods presonted a6 if the new

scoounting policy had always been applied. It may be

13

BASS

necessary to apply this accounting treatment in countrios whore

56.

57,

58,

59.

the financial statements are requirad to include comparative

information which agrees wih the financial statements

presented in prior periods.

The change in accounting policy should be applied

(Prospectively sehen the amount to be included in net profit

‘er loss for the current period required By raph 54

ee ele eee

When a change in accounting policy has a material effect

an the crake parlod on a2 tio pedad presented, at

may have 2 material effect in subsequent periods, an

enterprise should disclose the following:

&) the reasons for the change

0) the amount of the adjustment recognised in net profit

ar loss in the current pertod; and

&) the amount of the adjustment incladed in each period

for which pro ferma information 1s prosanted and the

amount of the adjasiment relating fo periods prior io

those included in the financial statements. “If it is

impracticable to present pro forma information, this

‘fact should be disclosed.

Compliance with International Accounting

Standard

Compliance with this BAS ensures compliance in all material

respects with Intemational Accounting Standard 1AS -8

Effective Date

‘This Bangladesh Accounting Standard becomes operative

‘Yor financial statements covering periods beginning on or

after 1 January 1995. Earlier application is encouraged,

Wf an enterprise applies this Standard for financial

Statements covering periods beginning before 1 January

1995, the enterprise Should disclose that fact.

14

BAS.8

Appendix A

The appendix is iMustsatine only and does rot farm past af

the standards. The purpose of the appendix is to illustrate

the application of the standards io assist in clarifying their

meaning. Buracts from income statamente and statements

af ratzined earnings are provided to show the effects on

these financial statements af the transactions dascribed

below These extracts do rat necassasily conform with all

the disclosure and prasentation requirements of other

Bangladesh Accounting Standards.

Extraordinary Items

Alpha Co

Extract from the Income Statement

19x1 190

Gross profit 12,000 10,000

Income tures 800) @,000

Profit from ordinary activities 400 7,000

Extraordinary item-loss on

expropriation of car engine 8,150 -

Net profit 5,260

Extracts from notes to the Financial Statements

On 1 Ociober 191, Alpha's car engine valve manufactiring

qpeations in country R were expropriated, without

compensation, by the Government The results of this

cperation had previously been reported in the valve

manufacturing industry segment and the Pacific geographical

segment. The loss arising from the expropriation has been

accounted for 2s an extraordinary item. The loss arising from

the expropriation is thenet carrying amount of the assets and

liabilities of the operation at the date of expropriation. The

revenues recognised relating to this eperation from 1 Janaary

1X1 until 1 October 19%1 were 10,000 and the profits

before tax were 2,000

15

BAS

Fundamental Errors

During 19%2, Beta Co discovered that certain products that

hhad been sold during 19K1 were inccrrecily included in

inventory at 31 December 19X1 at 6500

Beta's accounting records for 19%2 show sales of 104,000,

cost of goads sold of 86,500 (including 6,600 for error in

opening inventory), and income taxes of 6.260.

In 191, Beta reported

Sales 73,500

Cost of goods sold (68.500)

Profit fram ordinary activities

beforeincome taxes 20,000

Income taxes, (6,000)

Net Profit 14,000

19X1 opening retained eamings was 20,000 and closing

retsined eamings wes $4,000

Bela's income tax rate was 90% for 1902 and 19%

Beta co

Extract fiom the Inenme Statement ner the Benchmark Treatment

(restated)

19x2 1x1

Sales 704,000 “73.500

Cost of goods sold 0.000) (60,000)

Profit from ordinary activities. ~~

beforeincome taxes 24,000 18,500

Income tures (7,209 _4,050)

Net Profit T1630 — oT

16

RAS-8

Beta Co

Steterment of Retained Bamings indee the Beachmerk Treatment

(costated)

texe Lox)

Opening retained earnings as,

previouslyreporied 34,000 20,000

Comection of fundamental emer

(Net of income taxesof 1,980) (Note 1) (4,550) #

Opming retained earnings as restated 29,480

Netprafit 14.800

Closing Retained Eamings 46,250

Extracts from notes to the Financial Statements,

Certain products that hed been sold in 191 were incorrectiy

included in inventory at $1 December 19X1 at 6,500. The

finencial statements of 19X1 have been restated to correct

this error.

Bata Co

Bxtracttram the Income Statement under fe Allowed Alfemative

Trataent pss een.

fesated esate)

tetas 1a 1s.

Sales 1040050 104000 350

Comat gods

sold (Nae) (25096309 8090900)

Prcitfiomosimsy

seis before

incomeares 17500 D0 24.000 13500

tneore wes

(eludes Hoeft:

of ie oaestin

ofafundarerta er) (6,250) 6.001) ___—7.290) (408)

NetPinit 12.200 i 3A

7

BAS-&

Beta Co

‘Statement of Retained Earnings under the Allowed

Alternative Treatment

Pro Forma

(castated) (ostated)

TORE TORT ToXZ 0X1

Opening retained

earnings as

previcusly

reported 34,900 20,000 34,000 20,000

Correction of

fandamentalerror

Net of

fncome tasces

of (1.959)

E550)

Opening retained

earaingsas

restated 34.000 20,000 _29.450 20.000

Net profit 72.20 ~ 14,000 — 16800 ~ 9.450

Closing Retained

Eamings FER “ILO TE T0 WAG.

Extracts fiom notes to the Financial Statements

Cost of goods sold for 102 inckides 6,500 for certain

products that had teen sold: in 191 but were incorrectiy

included in inventory at $1 December 191. Restated pro

forma information for 19X2 and 1X1 is presented as if the

error kad been corrected in 191

18

BASS

‘Changes in Accounting Policy

During 19%2, Gamama Co changed its accounting policy

with respect to the treatment of borrowing costs that are

directly attributable to the acquisition of a hydro-electric

power station which is in course of constuction for use by

Gamma. In previous periods, Gamma had capitalised such

costs, net of income taxes, in aceartance with the allowed

alternative treatment in BAS 23, Bomawing Costs Gamma

has now decided to expanse, tather than captalise, these

costs in otder to conform with the benchmark treatment mn

BAS 23.

Gamma capitalised borrowing costs incurred of 2600

during 19X1 and 5.200 in periods prior to 19X1. All

borrowing costs maurred in previous years in respect to the

acquisition of the power station were capitalised

Gamma’: accounting records for 1922 show profit from

ordinary activities before interest and income tares of

30,000; interest expense of 3,000 (which relates only to

10932); and income taxes of 8,100

Gamma has not yet recognised any deprecistion on the

power station because itis not yet in use

In 19X1, Gamma reported:

Profit from ordinary activities

before interest and incometaxes 18,000

Interest expense 2

Profit from ordinary activities

before income taxes 18,000

Income taces 6,400)

Net Profit 12,600

19X1 opening retained eamings was 20,000 and closing

retained eamings wes $2,500

19

BAS-8

Gammna's ta rate was 30% for 192 and 1031

Camm Co

Extract from the Income Statement under the Banchmack Treatment

(restated)

ToRE TXT

Profit from ordinary

activities before interestand

fncome taxes 30.000 18,000

Interest expense 000) 2.600

Profit from ordinary activities

before incometaxes 27,000 0

Income taces (8.100) (4.620

Net Profit TEBoO Torr

Gamma Co

Statement of Retained Barnings under the Benchmark Treatment

(restated

Tox TSX1

Opening retained earnings

as previcuslyreported 32,600 20,000

Change in eccounting policy with

respect tothe capitalisation of

interest (Net of income

taxzas of 2,340 for 192

and 1,560 for 101)

(Note 1) E460) Cea)

Opening retained eamings

as restated 27,140 16,360

Net profit 18,900 1070

Closing Retained Earnings AHEOEO rrr

‘Extracts from notes to the Financial Statements

During 192, Gamma changed its accounting policy with

tespedt to the treatment of borrowing costs related to a

hyycro-electric power station which 1s in course of

20

BAS

construction for use by Gamma. In ordor to conform with the

tonchmark treatment in BAS 23, Borrowing Costs, the

enterprise now azpensas rather than capitalises such costs

This change in accounting policy bas been accounted fer

retrospectively The comparative statements for 19X1 have

thom restated to conform to the charged policy. The effect,

of the change is an increase in interest expense of 3,000

(19X2) and 2,800 (1X1), Opening ratained eamings for

10X1 have been reduced by 6,200 which is the amount of

the adjustment relating to periods prior to 9X1

Gamma Co

Extract trom fhe ineame Statement ander the AHlowed Altemative

Treatment

Po fern

Gaestaed) restated

1g texte HL

Frofit fomoniinary

setiatie before

inestand

sreeme taxes $0000 1800080001800

Ineestexgene (000) = (om) 500)

Ccuntuatve efoto

charge naceuntng

policy (7,800)

refitfiem onary

setiatie before icone

suse: 1920 1400 ao) BdOD

Tneome taxes (inciudes the:

eifextola chaagein

sccountngpoliny) (6,750) (6400) 100) 4,420)

DetPreit 13440.

a

Gamma Co

Statsmant of Ratzinad Earnings under tha Allowed Altanaative

Treatmont

192

Opening retained

eamingsas

previously

eparted 32,600

Change in

accauntingpolicy

with respect to

thecapitalisation of

interest Net of

income taxes of 2,540

for 19%2 and 1,560

for 191)

iNete 1)

Opming retained

camingsas

restated 32,600

Netprofit 13,440

Closing

Retained

Eareings 46,040

Pro forma

estated)

19X1

20.000

20,000

12,600

22,800

19K2

32,600

(5,460)

27,140

18,800

48,040

Geststed)

1X1

20,000

(540)

16,360

10,780

27,140

Extracts from notes to the Financial Statements

An adjustment of 7,800 has been made in the sncome

statement for 19X2 representing the effect of a change mn

accounting policy with respect to the treatment of

borrowing costs related to a hydrc-electric power station,

22

BASS

which is in course of construction for use by Gamma. In order to

conform with the benchmark traatment in BAS 23,

Borrowing Cests, the enterprise now sepenses rather than

capitalises uch costs. This change in accounting policy has

been accounted for retrospectively. Restated pro ferma

information, which assumes that the new policy had always

been in use, is presented. Opening retainad eamings in the

pro-forma information for 19%1 have bean reduced by

5,200 which is the amcunt of the adjustment relating to

periods price to 191

23

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Book For Fast BowllersDocument16 pagesBook For Fast BowllersShibli ShaidNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Book For Cricket PDFDocument129 pagesBook For Cricket PDFShibli Shaid100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Imaam Ahmad Bin Hanbal - in Light of The MuhadditheenDocument85 pagesImaam Ahmad Bin Hanbal - in Light of The MuhadditheenMountainofknowledgeNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Syllabus For Bcs (Written) ExaminationDocument162 pagesSyllabus For Bcs (Written) ExaminationShibli ShaidNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Book For Cricket PDFDocument129 pagesBook For Cricket PDFShibli Shaid100% (2)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Inventories: International Accounting Standard 2Document6 pagesInventories: International Accounting Standard 2Shibli ShaidNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ias 10Document4 pagesIas 10Shibli ShaidNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Bas 1Document47 pagesBas 1Shibli ShaidNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- E VSKVM© WM JKKB Kwgwu Mwpevjq: Evsjv 'K E VSKDocument22 pagesE VSKVM© WM JKKB Kwgwu Mwpevjq: Evsjv 'K E VSKShibli ShaidNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- E VSKVM© WM JKKB Kwgwu Mwpevjq: Evsjv 'K E VSKDocument22 pagesE VSKVM© WM JKKB Kwgwu Mwpevjq: Evsjv 'K E VSKShibli ShaidNo ratings yet

- Cost Saving in Apparel Industry, Cost Saving Ideas For Garment Manufacturers, Cost Saving in Cutting Section For Apparel ManufacturersDocument3 pagesCost Saving in Apparel Industry, Cost Saving Ideas For Garment Manufacturers, Cost Saving in Cutting Section For Apparel ManufacturersShibli Shaid100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Eae74 Audit Report On Packaging, Bangladesh by Itc 10-04-09Document77 pagesEae74 Audit Report On Packaging, Bangladesh by Itc 10-04-09Shibli ShaidNo ratings yet

- Eae74 Audit Report On Packaging, Bangladesh by Itc 10-04-09Document77 pagesEae74 Audit Report On Packaging, Bangladesh by Itc 10-04-09Shibli ShaidNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Growing Dairy Fruit Beverage CategoriesDocument25 pagesGrowing Dairy Fruit Beverage CategoriesShibli ShaidNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Executive 2ccredit Control Job Post Avery DennisonDocument1 pageExecutive 2ccredit Control Job Post Avery DennisonShibli ShaidNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- QMS Awareness 2016Document16 pagesQMS Awareness 2016Shibli ShaidNo ratings yet

- WMBA Admission Test-Question PatternDocument1 pageWMBA Admission Test-Question Patternhelal uddinNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- CircularDocument3 pagesCircularShibli ShaidNo ratings yet

- Adarsha Hindu Hotel by Bibhutibhushan BandhopadhyayDocument134 pagesAdarsha Hindu Hotel by Bibhutibhushan BandhopadhyaymetinasarkarNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)