Professional Documents

Culture Documents

Errors Revealed by Trial Balance

Errors Revealed by Trial Balance

Uploaded by

Edu TainmentOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Errors Revealed by Trial Balance

Errors Revealed by Trial Balance

Uploaded by

Edu TainmentCopyright:

Available Formats

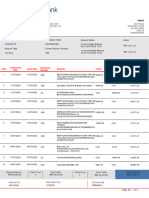

TRIAL BALANCE

Definition:

Trial Balance is a statement prepared with the debit and credit balances of ledger accounts to

verify the arithmetical accuracy of the book.

The Trial Balance checks the equality of debits and credits in the ledger by listing each

account along with its ending balance.

Accounts to be placed Accounts to be placed

on debit side on credit side

Assets Liabilities

Expenses Capital

Drawings Revenue

ERRORS REVEALED BY TRIAL BALANCE

Errors in calculation

Any calculation mistake, especially totaling mistake or balancing mistake will be revealed by

Trial Balance as both the side will not match.

Errors of omission of one entry

If by mistake only one entry is made for a transaction, Trial Balance will not balance.

Posting to the wrong side of an account

In case any entry is made on the wrong side of the account, it will be revealed by the Trial

Balance. For example Credit sale of $100 was debited to Sales account.

Posting of wrong amount

When two different amounts are entered for the same entry, both the sides of the Trial balance

will not match. For example, Credit sales of $123 to James. James was debited with $123 but

Sales was wrongly credited as $132.

LIMITATION OF TRIAL BALANCE

Though Trial Balance is prepared to check the arithmetical accuracy of double entries, there

are still some mistakes which cannot be identified by Trial Balance. These are:

Errors of omission

These are errors where the transactions are totally omitted. They are neither recorded in the

Journal or Ledge and thus do not appear in the Trial Balance.

Errors of commission

This means that a wrong amount is entered from the very starting in the Journal or Ledger and

thus a Trial Balance based on this amount may not show any mistake at all.

Errors of Principle

These errors occur when the classification of accounts is wrongly done. For example revenue

expenditure may be considered as capital expenditure. Repairs of machinery $200 was

debited to Machinery account whereas it should have been debited to ‘Repairs of machinery

account’.

Complete reversal of entries

Complete reversal of entries cannot be revealed by Trial Balance. This is when entries have

been made to both the sides and thus there is no arithmetical mistake. Good sold to Raman

were entered as Sales debited and Raman Credited, whereas, it should have been vice versa.

Compensating errors

These errors are those which cancel themselves because the same error is committed on both

sides. For example, Purchases were debited by $100 more and at the same time Sales were

also credited by $100. This will neutralize the effect of both the entries.

You might also like

- Revision Answers History Grade 8 (Last Three Chapters)Document7 pagesRevision Answers History Grade 8 (Last Three Chapters)Edu Tainment50% (2)

- 7 Mark Question ListDocument1 page7 Mark Question ListEdu TainmentNo ratings yet

- Class VIII Heat Gain and Heat LossDocument5 pagesClass VIII Heat Gain and Heat LossEdu TainmentNo ratings yet

- Class VIII Chemical Changes Day 2Document15 pagesClass VIII Chemical Changes Day 2Edu TainmentNo ratings yet

- Profitability and LiquidityDocument5 pagesProfitability and LiquidityEdu TainmentNo ratings yet

- Chapter 9: Finding A Solution To The Problems Between 1940-1947Document20 pagesChapter 9: Finding A Solution To The Problems Between 1940-1947Edu TainmentNo ratings yet

- Class 7 - Unit Plan 8 - AurangzebDocument20 pagesClass 7 - Unit Plan 8 - AurangzebEdu Tainment100% (1)

- Income Statement and Balance Sheet FormatDocument3 pagesIncome Statement and Balance Sheet FormatEdu TainmentNo ratings yet

- History Answers (Chapters 6,7,8)Document8 pagesHistory Answers (Chapters 6,7,8)Edu Tainment100% (1)

- List of Accounts When They INCREASE: Drawings Return Inwards Discount Allowed DepreciationDocument2 pagesList of Accounts When They INCREASE: Drawings Return Inwards Discount Allowed DepreciationEdu TainmentNo ratings yet

- Heating and Cooling Day 4 Class VIIIDocument13 pagesHeating and Cooling Day 4 Class VIIIEdu TainmentNo ratings yet

- THE PUNJAB LOCAL GOVERNMENT ACT 2019 Final PrintoutsDocument88 pagesTHE PUNJAB LOCAL GOVERNMENT ACT 2019 Final PrintoutsEdu TainmentNo ratings yet

- The Local Government & Community Development (LG&CD) DepartmentDocument43 pagesThe Local Government & Community Development (LG&CD) DepartmentEdu TainmentNo ratings yet

- Accounts Lesson PlanningDocument28 pagesAccounts Lesson PlanningEdu TainmentNo ratings yet

- Class 8 - Science - Topic - Light: Subjective PartDocument6 pagesClass 8 - Science - Topic - Light: Subjective PartEdu TainmentNo ratings yet

- Class 8 - Science - Topic - Light: Subjective PartDocument6 pagesClass 8 - Science - Topic - Light: Subjective PartEdu TainmentNo ratings yet

- IX - Cambridge - Unit Asessment - Business - Chapter 7Document3 pagesIX - Cambridge - Unit Asessment - Business - Chapter 7Edu TainmentNo ratings yet

- Class 7 - History - Unit Planning - Chapter 5 - Coming of MughalsDocument3 pagesClass 7 - History - Unit Planning - Chapter 5 - Coming of MughalsEdu TainmentNo ratings yet

- Level .1: .Blue .Color .-.20 .Pounds .Of .Resistance . - .Includes .Starter-Pack .Case .& .Extra .Bite .Strips Front View Side ViewDocument2 pagesLevel .1: .Blue .Color .-.20 .Pounds .Of .Resistance . - .Includes .Starter-Pack .Case .& .Extra .Bite .Strips Front View Side ViewEdu TainmentNo ratings yet

- Business Studies - Objective Part - Section 1Document64 pagesBusiness Studies - Objective Part - Section 1Edu TainmentNo ratings yet

- Revision Resources - War of IndependenceDocument7 pagesRevision Resources - War of IndependenceEdu TainmentNo ratings yet

- Class 6 Geography Monthly Test - Weather and ClimateDocument3 pagesClass 6 Geography Monthly Test - Weather and ClimateEdu Tainment100% (2)

- TEST As Accounting Double EntryDocument1 pageTEST As Accounting Double EntryEdu TainmentNo ratings yet

- Education System of PakistanDocument62 pagesEducation System of PakistanEdu TainmentNo ratings yet

- Business Studies - Mid Term PreparationDocument8 pagesBusiness Studies - Mid Term PreparationEdu TainmentNo ratings yet

- Monthly TEST IX C Accounts - 21.02.2017Document3 pagesMonthly TEST IX C Accounts - 21.02.2017Edu TainmentNo ratings yet

- Book of Original Entries - Class ActivityDocument2 pagesBook of Original Entries - Class ActivityEdu TainmentNo ratings yet

- Accounts Revision - Chapter 1-9 - TestDocument6 pagesAccounts Revision - Chapter 1-9 - TestEdu TainmentNo ratings yet

- Balance SheetsDocument13 pagesBalance SheetsEdu TainmentNo ratings yet

- Paper 01 2015 7110 9 CDocument5 pagesPaper 01 2015 7110 9 CEdu TainmentNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- E Business Accounting Tally Notes IV SemDocument90 pagesE Business Accounting Tally Notes IV SemPrajwalNo ratings yet

- Dr. Nick Marasigan AccountsDocument11 pagesDr. Nick Marasigan AccountsNicole SarmientoNo ratings yet

- Ch18 Revenue RecognitionDocument42 pagesCh18 Revenue RecognitionSheena Pearl AlinsanganNo ratings yet

- HI5001 Extensive Exervises P1 T1 17Document5 pagesHI5001 Extensive Exervises P1 T1 17Md Jahid HossainNo ratings yet

- Principal of Accounting-1Document34 pagesPrincipal of Accounting-1thefleetstrikerNo ratings yet

- 7 Finalnew Sugg June09Document17 pages7 Finalnew Sugg June09mknatoo1963No ratings yet

- Comprehensive Problem - (Merchandising Concern)Document19 pagesComprehensive Problem - (Merchandising Concern)Hannah Pearl Flores VillarNo ratings yet

- Far2018 AccountingDocument10 pagesFar2018 Accountingjoanna mercado0% (2)

- Ethiopian Govt Acct Extension ExamDocument3 pagesEthiopian Govt Acct Extension Examsamuel debebe88% (8)

- Oracle Financial TablesDocument9 pagesOracle Financial TablesShahzad945No ratings yet

- 3tay1112 Jpia Finals E-Review - Actbas1Document3 pages3tay1112 Jpia Finals E-Review - Actbas1CGNo ratings yet

- Setup and Use The AP AR Netting & Intercompany Netting FeatureDocument13 pagesSetup and Use The AP AR Netting & Intercompany Netting FeatureSathya Moorthy0% (1)

- AST Midterms PDFDocument36 pagesAST Midterms PDFMidas Troy VictorNo ratings yet

- Cash Flow StatementDocument40 pagesCash Flow Statementtairakazida100% (3)

- Ca Q&a Dec 2017Document101 pagesCa Q&a Dec 2017Bruce GomaNo ratings yet

- Valor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsDocument1 pageValor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsFreelance WorkerNo ratings yet

- Common Terms in AccountingDocument2 pagesCommon Terms in AccountingRazvanRzvNo ratings yet

- Cash and AccrualDocument3 pagesCash and AccrualHarvey Dienne Quiambao100% (2)

- Book-Keeping & Accounts/Series-2-2005 (Code2006)Document14 pagesBook-Keeping & Accounts/Series-2-2005 (Code2006)Hein Linn Kyaw100% (2)

- Ma Si 8 Ms UAIf CDSFBDocument15 pagesMa Si 8 Ms UAIf CDSFBFiroj Md ShahNo ratings yet

- Module 7 - Merchandising Business Special TransactionsDocument40 pagesModule 7 - Merchandising Business Special TransactionsMaria Nicole OroNo ratings yet

- Account Statement 10230002147823 3Document2 pagesAccount Statement 10230002147823 3Nabaratna BiswalNo ratings yet

- ch04 Advanced AccountingDocument66 pagesch04 Advanced Accountingthescribd94100% (1)

- Full Practical FileDocument20 pagesFull Practical FileNeeraj GadviNo ratings yet

- Rs. Rs. Add:: © The Institute of Chartered Accountants of IndiaDocument8 pagesRs. Rs. Add:: © The Institute of Chartered Accountants of Indiaomkar sawantNo ratings yet

- Incomplete RecordsDocument13 pagesIncomplete RecordsSylvan Muzumbwe MakondoNo ratings yet

- What Is Meant by Deferred COGS in R12Document3 pagesWhat Is Meant by Deferred COGS in R12devender143No ratings yet

- Handbook For FPOs Accounting by UttarakhandDocument85 pagesHandbook For FPOs Accounting by UttarakhandgulamNo ratings yet

- History of AccountingDocument22 pagesHistory of AccountingGia Patricia SalisiNo ratings yet