Professional Documents

Culture Documents

FORM XProvisional Certificate For Exemption From Entertainment Tax PDF

Uploaded by

Ajay HandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FORM XProvisional Certificate For Exemption From Entertainment Tax PDF

Uploaded by

Ajay HandaCopyright:

Available Formats

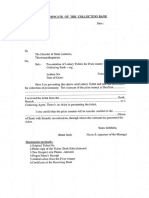

FORM X

(See Rule 43)

Provisional Certificate for Exemption from Entertainment Tax

The Proprietor having paid to the Local Authority the prescribed fee of Rs.5/-this is to certify that the entertainment more

particularly spedcified below having been reported by the proprietor to be done :-

a. Of a wholly educational character

b. Provided for purposes which are partly educational, cultural or scientific by an institution not conducted or established

for profit.

c. provided by an institution not conducted for profit and falling within the scope 37(1) of the Kerala Local Authorities

Entertainment Tax Act, 1961.

(Strike out such of the item as are not applicable) is provisionally exempted from the levy of entertainment tax:-

Description

Date

Place

1) The Proprietor should maintain such accounts and submit to the Officer issuing the Certificate such returns, are as

prescribed by him.

2) The certificate is subject to the confirmation by the competent authority., such confirmation shall be made after

the accounts are checked and if the competent authority is satisfied that the conditions relating to the grant have

been fulfilled.

3) This Certificate must not be used for any entertainment, other than that specified above, and it must be exhibited

in an prominent position of the public entrance to the place of entertainment at the time public are admitted and

during the entertainment. No correction or censure of any kind may be made in the certificate, except under the

initials of the Officer issuing the certificate.

Signature of the Officer

issuing the Certificate

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Application Form For Claiming Vessel Building Subsidy Under Inland Vessel Building Subsidy SchemeDocument2 pagesApplication Form For Claiming Vessel Building Subsidy Under Inland Vessel Building Subsidy SchemeAjay HandaNo ratings yet

- Application For EC (Malayalam)Document2 pagesApplication For EC (Malayalam)Ajay HandaNo ratings yet

- Form No. 40 (Prescribed Under Rule 122) Test Report..... Dust Extraction SystemDocument1 pageForm No. 40 (Prescribed Under Rule 122) Test Report..... Dust Extraction SystemAjay HandaNo ratings yet

- Application For Registration As User of GroundwaterDocument2 pagesApplication For Registration As User of GroundwaterAjay HandaNo ratings yet

- Ug Adm Notice 2019Document1 pageUg Adm Notice 2019Ajay HandaNo ratings yet

- Check Register of Motor Bus Warrant Bills Received in The Office of The . . During 20Document1 pageCheck Register of Motor Bus Warrant Bills Received in The Office of The . . During 20Ajay HandaNo ratings yet

- Lottery Department - Certificate of The Collecting BankDocument1 pageLottery Department - Certificate of The Collecting BankAjay HandaNo ratings yet

- Application For Grant - Renewal of Dealer's LicenseDocument2 pagesApplication For Grant - Renewal of Dealer's LicenseAjay HandaNo ratings yet

- Ug Adm Notice 2019Document1 pageUg Adm Notice 2019Ajay HandaNo ratings yet

- Application For General Transfer 2006-07Document25 pagesApplication For General Transfer 2006-07Ajay HandaNo ratings yet

- Rules & Regulations Governing Participation in Kaun Banega Crorepati-Season 11 I. Contest DescriptionDocument23 pagesRules & Regulations Governing Participation in Kaun Banega Crorepati-Season 11 I. Contest DescriptionAjay HandaNo ratings yet

- Original Application Form 12.1.2011 (Malayalam)Document3 pagesOriginal Application Form 12.1.2011 (Malayalam)Ajay HandaNo ratings yet