Professional Documents

Culture Documents

Sample 2

Sample 2

Uploaded by

Kurt Canero0 ratings0% found this document useful (0 votes)

3 views1 pageasdasdsadsa

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentasdasdsadsa

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageSample 2

Sample 2

Uploaded by

Kurt Caneroasdasdsadsa

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 1

Franchise Accounting Page 2

Deposit on franchise or Unearned Franchise FeesP80,000 + (P40,000 x 3.17)206,800

Aug. 15, �8:Deferred franchise costs25,000Cash25,000Nov. 10, �8:Deferred franchise

costs10,000Cash10,000Dec. 31, �8:Discount on notes receivable6,340Interest revenue

(40,000 x 3.17)6,340 Jan. 10, �9:Deferred franchise costs35,000Cash35,000 Jan. 15,

�9:Deposit on franchise206,800Franchise revenue206,800Franchise costs70,000Deferred

franchise costs70,000 July 1, �9Cash40,000Notes receivable40,000Dec. 31, �9Discount

on notes receivable11,314Interest income11,3142. Jade Enterprises, a franchisor,

charges new franchisees a �franchise fee� of P500,000. Of thisamount, P200,000 is

payable at the time the agreement is signed and the balance in P100,000non-

interest bearing notes due every year thereafter. Jade agrees to assists in

locating a suitablebusiness site, conduct a market study, supervise construction of

facilities, and provide initialtraining for employees.Required:Assuming an implicit

interest rate of 12%, prepare first year entries relating to each of thefollowing

assumptions:1.Down payment is refundable, but no services have been rendered so

far; collection of notesis reasonably assured.2.Down payment is nonrefundable, and

substantial services, costing P250,000, have beenperformed; collections of notes is

certain.3.Down payment is nonrefundable, and substantial services, costing P300,000

have beenperformed; collection of notes is doubtful.4.Same as #3, except cost

recovery method will be used.Case 1:Deposit MethodCash200,000Note

receivable300,000Discount on notes receivable59,800Deposit on franchise440,200Case

2:Full Accrual MethodCash200,000Notes receivable300,000Discount on notes

receivable59,800Deposit on franchise440,200Deferred franchise

costs250,000Cash250,000Cost of franchise fee revenue250,000Deposit on

franchise440,200Deferred franchise costs250,000Franchise fee revenue440,200

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Scope of The Study - URCDocument2 pagesScope of The Study - URCKurt CaneroNo ratings yet

- Scope of The Study - URCDocument2 pagesScope of The Study - URCKurt CaneroNo ratings yet

- Domain Control: Information Technology General Controls (Itgcs)Document3 pagesDomain Control: Information Technology General Controls (Itgcs)Kurt CaneroNo ratings yet

- Good Governance IcedDocument5 pagesGood Governance IcedKurt CaneroNo ratings yet

- Literature ReviewDocument15 pagesLiterature ReviewKurt CaneroNo ratings yet

- Chikaraaa ChecklistDocument6 pagesChikaraaa ChecklistKurt CaneroNo ratings yet

- Sinx Basic GuideDocument3 pagesSinx Basic GuideKurt CaneroNo ratings yet

- Theoretical Framework of The StudyDocument16 pagesTheoretical Framework of The StudyKurt CaneroNo ratings yet

- SIS AT EMAMI LTD SUMMER PROJECT REPORT Submitted by Under The Guidance ofDocument2 pagesSIS AT EMAMI LTD SUMMER PROJECT REPORT Submitted by Under The Guidance ofKurt CaneroNo ratings yet

- Jpia Topnotchers Music Lyrics To Be Used in The Event: Dancing With A StrangerDocument27 pagesJpia Topnotchers Music Lyrics To Be Used in The Event: Dancing With A StrangerKurt CaneroNo ratings yet

- Theoretical Framework of The Study: Ratio AnalysisDocument39 pagesTheoretical Framework of The Study: Ratio AnalysisKurt CaneroNo ratings yet

- Anti-Takeover Measure: Measures Protect A Company's Autonomy and Market CompetitivenessDocument4 pagesAnti-Takeover Measure: Measures Protect A Company's Autonomy and Market CompetitivenessKurt CaneroNo ratings yet

- Comp HW KayceeDocument6 pagesComp HW KayceeKurt CaneroNo ratings yet

- New Intern Information FormDocument6 pagesNew Intern Information FormKurt CaneroNo ratings yet

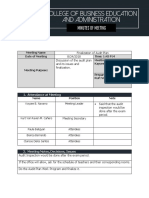

- COA Minutes of MeetingDocument3 pagesCOA Minutes of MeetingKurt CaneroNo ratings yet

- Request Letter & Interview GuideDocument5 pagesRequest Letter & Interview GuideKurt CaneroNo ratings yet

- New Era University: College of AccountancyDocument1 pageNew Era University: College of AccountancyKurt CaneroNo ratings yet

- Request LetterDocument3 pagesRequest LetterKurt Canero0% (1)

- Board Exam Readiness Survey: New Era UniversityDocument3 pagesBoard Exam Readiness Survey: New Era UniversityKurt CaneroNo ratings yet

- QuestionnairesDocument2 pagesQuestionnairesKurt CaneroNo ratings yet

- Mom 3Document1 pageMom 3Kurt CaneroNo ratings yet

- Interviewee InformationDocument2 pagesInterviewee InformationKurt CaneroNo ratings yet

- New Era University: College of AccountancyDocument1 pageNew Era University: College of AccountancyKurt CaneroNo ratings yet

- CBA Audit Plan TemplateDocument1 pageCBA Audit Plan TemplateKurt CaneroNo ratings yet