Professional Documents

Culture Documents

2008 JOINT DAR AO 9 Revised Rules and Regulation On ARB Membership Status and Valuation .. PDF

Uploaded by

Bienvenido Valerio0 ratings0% found this document useful (0 votes)

21 views62 pagesOriginal Title

2008 JOINT DAR AO 9 Revised rules and regulation on ARB membership status and valuation .. (1).pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views62 pages2008 JOINT DAR AO 9 Revised Rules and Regulation On ARB Membership Status and Valuation .. PDF

Uploaded by

Bienvenido ValerioCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 62

u Le

Department of Agrarian Reform -

Cooperative Development Authority

JOINT DAR-CDA ADMINISTRATIVE ORDER

No_ OG

Series of 2008

Subject: REVISED RULES AND REGULATIONS ON ARB MEMBERSHIP STATUS

AND VALUATION AND/OR TRANSFER OF PAID-UP SHARE CAPITAL IN

AGRARIAN REFOM PLANTATION-BASED COOPERATIVES

ARTICLE|

PRELIMINARY PROVISIONS

Section 1. Prefatory Statement. Pursuant to Article 2 of Republic Act (R.A.) No.

6038, otherwise known as the "Cooperative Code of the Philippines”, Sections 8 and 29 of

R.A. No. 6657, otherwise known as the “Comprehensive Agrarian Reform Law (CARL) of

1988", Sec. 11 of RA. No. 6657, as amended by Sec. 3 of R.A. No. 7881, otherwise known

as "An Act Amending Certain Provisions of R.A. No. 6657 entitled, 'An Act instituting a

‘Comprehensive Agrarian Reform Program to Promote Social Justice and Industrialization,

Providing the Mechanism for Its Implementation, and for Other Purposes”, the Department

of Agrarian Reform (DAR), Cooperative Development Authority (CDA) and Department of

Agriculture (DA) issued Joint Administrative Order (A.0.) No. 2, Series of 1997 titled, "Rules

and Regulations Governing Membership Issues and Concems of Farmworkers and

Employee Beneficiaries in Agrarian Reform Plantation-Based Cooperatives’.

Paragraph 2 of Section 27 of R.A. No. 6687 provides that, “If the land has not yet

been fully paid by the beneficiary, the rights to the land may be transferred or conveyed, with

prior approval of the DAR to any heir of the beneficiary or to any other beneficiary who, as a

condition for such transfer or conveyance, shall cultivate the land himself. xxx"

Section 29 of R.A. No. 6657 states that *x x x In general, lands shall be distributed to

the individual worker-beneficiaries. In case it is not economically feasible and sound to divide

the land, then it shall be owned collectively by the worker-beneficiaries who shall form a

‘workers’ cooperative or association which shall deal with the corporation or business

association.” Further, Article 90 of R.A. No, 6938 provides that "Landholdings ike

plantations, estates or haciendas acquired by the State for the benefit of the workers in

accordance with the Comprehensive Agrarian Reform Program shall be owned collectively

bby the workers-beneficiaries who shall form a cooperative at their option.”

Considering the peculiarities and dynamic conditions of _plantation-based

cooperatives particularly as regards membership of agrarian reform beneficiaries (ARBs) in

plantation-based cooperatives and their multiple but distinct personalities as program

beneficiaries, cooperative members and employees/farmworkers, these rules and

regulations are hereby promulgated to address the valvation of ARB-members’ land share

capital and transferabiityAvithdrawa! of membership share vis-a-vis the status and

qualification of ARBs under the Comprehensive Agrarian Reform Program (CARP).

Sec. 2. Coverage. This Administrative Order (A.0.) covers ARB membership status,

valuation and transfer of membership shares in case of termination/withdrawal of members

from the cooperative in agrarian reform plantation-based cooperatives covered by collective

Certificate of Land Ownership Award (CLOA).

a Y

‘Sec. 3. Definition of Terms. As used in this Order, the following terms are defined

as follows:

a)

b)

9

a

9)

hy

ky

Abandonment is any willful or deliberate failure by an ARB to personally til or

contribute to the productivity of the land for a continuing period of two (2) years with

no intent or prospect of returning to work in the plantation within the same poriod,

Provided that such inability to work in the plantation is not caused by unavailability of

jobs for the ARB.

Agrarian Reform Plantation-Based Cooperative refers to a special cooperative

‘composed exclusively of ARBs awarded with collective CLOA.

Agribusiness Venture Arrangement (AVA) refers to the entrepreneurial

collaboration between ARBs and investors to implement an agribusiness venture

involving lands distributed under CARP. The AVA includes the following schemes:

Joint venture agreement (JVA); production/contract growing/growership/marketing

contract; lease agreement; management contract; service contract; and build~

operate-transfer (BOT),

Authorized Share Capital is the amount of capitalization of the cooperative as

provided for under its Articles of Cooperation.

Books of Accounts refer to the set of books where business transactions are

recorded and classified.

Book Value per Share is the amount of one share capital which is arrived at by

dividing the total members’ equity over the total number of paid-up share capital

(cash and land share capital) at a given period.

Collective CLOA is a single instrument of title issued to a group of qualified ARBs

aggrupated as farmers’ cooperative or some other forms of farmers’ collective

organization, e.g., co-ownership and farmers’ cooperative or association.

Gross Income represents the total income of the cooperative from all its business

operations.

Gainful Employment refers to any type of job or employment where one derives

his/her principal source of income.

Land refers to, for accounting purposes, the amount paid or approved for payment to

the landowner (LO) for a specific parcel of the land and permanent crops including

land improvements thereon, such as, but not limited to, irrigation canals, dikes and

water impounding areas, acquired and awarded to ARBs. This will be recorded as

fixed assets to form part of the plant, property and equipment. The land may be

appraised by an independent accredited appraiser and recordedicarried in the books

at appraisedifair value, at the option of the cooperative.

Land Amortization refers to the annual payment of the ARBs through their

cooperative for the agricultural land awarded to them. itis determined by the Land

Bank of the Philippines (LBP) pursuant to Item V of DAR A.O. No. 02, Series of 1998

or the amount of amortization agreed upon by the LO and the ARB as approved by

DAR in case of Voluntary Land Transfer or Direct Payment Scheme (VLT/DPS)

pursuant to Secs. 20 and 21 of R.A. No, 6657 and related guid

m)

°)

»)

9)

8)

y

u)

yw

XL u

Members Equity is the residual ownership of members over the assets of a

cooperative in excess of the liabilities, capital from extemal sources, statutory

reserves and other necessary funds as may be provided for in the Articles of

Cooperation and By-Laws of the cooperative.

It includes the total paid-up share capital for land amortization and cash payments,

undivided net surplus of the cooperative when an interim financial statement has

been prepared or the net surplus which has not been allocated for distribution, and

donated capital grants or subsidy if such amount is to be distributed to members.

Net Surplus is the excess of gross income, including other income, over expenses

for one accounting period.

Paid-Up Share Capital is the portion of the authorized share capital for land and

cash share capital which have been actually subscribed and paid by the members.

Land Share Capital as basis of recording includes the total amount paid for land

amortization which is credited to the Land Share Capital of each member. The

payment for land amortization is equally allocated to the land share capital of bona

fide members and must be reflected in the individual subsidiary ledgers.

Cash Share Capital represents the total amount paid in cash by the ARB member in

accordance with the cooperative's Articles of Cooperation.

Par Value refers to a value assigned to each share capital whether common:or

Preferred, which should not be less than 21,00.

Permanent Total incapacitated ARB is a natural person who has suffered

Permanent psychological and/or physical condition thal renders himvher unfit to

perform his/her assigned task or job, or to continue employment in the cooperative or

with the investor company that has an existing AVA with the cooperative/association

as certified by a government physician.

Potential ARBs in Plantations are natural persons qualified as beneficiaries of the

CARP pursuant to the order of priorities provided under Sec. 22 of R.A. No. 6657.

Qualified ARB Successor is a natural person who has legal claim on the subject

CARP-awarded land by virtue of hereditary succession, or designation, or nomination

of histher predecessor in the case of plantation-based cooperatives pursuant to

Sections 22 and 27 of R.A. No. 6657.

‘Statement of Financial Condition (Balance Sheet) shows assets, liabilties, and

equity account of a business entity as of a given date. Assets and liabilities are

further classified as current or non-current. Non-current assets include property, plant

and equipment, intangible assets, investments and financial assets (excluding

investments under the equity method, trade and other receivables and cash, and

cash equivatents) while non-current liabilities include long term debt, long term

provisions and other liabilities that will be settled after the current operating cycle or

will not require the use of current assets.

Statement of Operations (Surplus or Income Statement) presents revenues,

costs and expenses, gains and losses and net surplus or net loss. The items

presented are recognized in the books using accrual basis of accounting. The

3

You might also like

- Transpo, Warsaw and IPCDocument22 pagesTranspo, Warsaw and IPCBienvenido ValerioNo ratings yet

- Lay Aside WeightsDocument196 pagesLay Aside WeightsBienvenido ValerioNo ratings yet

- Lease ContractDocument4 pagesLease ContractBienvenido ValerioNo ratings yet

- Orientation-Briefing On The Delivery of Farm Equipment UnderDocument7 pagesOrientation-Briefing On The Delivery of Farm Equipment UnderBienvenido ValerioNo ratings yet

- PAPs of The DAR UnderDocument6 pagesPAPs of The DAR UnderBienvenido ValerioNo ratings yet

- LABCO-LARBECO - CONTRACT - OF - LEASE1ava Reviewed by BenchDocument12 pagesLABCO-LARBECO - CONTRACT - OF - LEASE1ava Reviewed by BenchBienvenido ValerioNo ratings yet

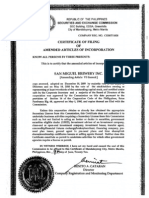

- SMB Amended Articles of IncorporationDocument10 pagesSMB Amended Articles of IncorporationBienvenido ValerioNo ratings yet

- CY 2010 Accomplishment ReportDocument213 pagesCY 2010 Accomplishment ReportBienvenido ValerioNo ratings yet

- Abridged PDP 2017 2022 FinalDocument56 pagesAbridged PDP 2017 2022 FinalMJ CarreonNo ratings yet

- Writ of KalikasanDocument77 pagesWrit of KalikasanBienvenido ValerioNo ratings yet

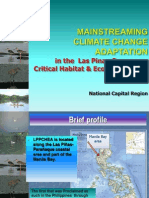

- NCR - Mainstreaming CCA in LPPCHEADocument13 pagesNCR - Mainstreaming CCA in LPPCHEABienvenido Valerio0% (1)

- Dao-2012-07 Irr Eo79Document16 pagesDao-2012-07 Irr Eo79Minnie F. LopezNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)