Professional Documents

Culture Documents

PIB, Carga Tributária e Arrecadação No Mundo, 2014

PIB, Carga Tributária e Arrecadação No Mundo, 2014

Uploaded by

Hamilton Reis0 ratings0% found this document useful (0 votes)

9 views16 pagesTabela do PIB e da arrecadação tributária dos países no mundo

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTabela do PIB e da arrecadação tributária dos países no mundo

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views16 pagesPIB, Carga Tributária e Arrecadação No Mundo, 2014

PIB, Carga Tributária e Arrecadação No Mundo, 2014

Uploaded by

Hamilton ReisTabela do PIB e da arrecadação tributária dos países no mundo

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 16

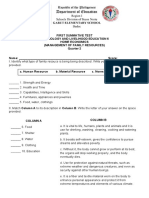

Tax Income

Tax Burden GDP per

Ranking Country Name per Capita in

% of GDP [1] Capita (PPP)

US$

1 Luxembourg 37,1 $79.785,04 $29.600,25

2 Macau 34,5 $78.275,00 $27.004,88

3 Norway 43,2 $55.008,77 $23.763,79

4 Sweden 44,5 $41.191,47 $18.330,21

5 Denmark 48,1 $37.657,20 $18.113,11

6 Austria 42,1 $42.408,58 $17.854,01

7 Belgium 44,0 $37.883,06 $16.668,55

8 Netherlands 38,7 $42.193,69 $16.328,96

9 Finland 43,4 $36.395,01 $15.795,43

10 France 44,2 $35.547,96 $15.712,20

11 Germany 37,1 $39.028,39 $14.479,53

12 Iceland 36,0 $39.223,96 $14.120,62

13 Canada 31,0 $42.734,36 $13.247,65

14 United Kingdom 35,5 $36.941,06 $13.114,08

15 Brunei Darussalam 24,0 $54.388,65 $13.053,28

16 Switzerland 28,5 $45.417,81 $12.944,08

17 Italy 42,9 $30.136,38 $12.928,51

18 United States 25,1 $49.922,11 $12.530,45

19 Ireland 27,6 $41.920,73 $11.570,12

20 Australia 25,6 $42.640,28 $10.915,91

21 Israel 32,6 $32.312,42 $10.533,85

22 Slovenia 36,8 $28.195,24 $10.375,85

23 Japan 27,6 $36.265,75 $10.009,35

24 Spain 31,6 $30.557,47 $9.656,16

25 Czech Republic 35,3 $27.190,92 $9.598,40

26 New Zealand 31,7 $29.730,30 $9.417,37

27 Malta 34,4 $27.022,36 $9.295,69

28 Korea, South 25,9 $32.272,12 $8.358,48

29 Singapore 13,8 $60.409,98 $8.336,58

30 Seychelles 31,7 $25.229,48 $7.997,74

31 Greece 31,2 $24.505,04 $7.645,57

32 Portugal 31,3 $23.385,17 $7.319,56

33 Hong Kong SAR 14,2 $51.494,15 $7.312,17

34 Cyprus 26,5 $27.085,98 $7.177,79

35 Estonia 32,8 $21.713,22 $7.121,94

36 Hungary 35,7 $19.637,59 $7.010,62

37 Slovak Republic 28,8 $24.249,11 $6.983,74

38 Barbados 27,4 $25.372,68 $6.952,11

39 Poland 31,7 $20.591,75 $6.527,59

40 Argentina 34,6 $18.112,33 $6.266,87

41 Croatia 32,6 $17.810,14 $5.806,11

42 Russia 29,5 $17.708,74 $5.224,08

Tax Income

Tax Burden GDP per

Ranking Country Name per Capita in

% of GDP [1] Capita (PPP)

US$

43 Bahamas 16,4 $31.382,41 $5.146,72

44 Latvia 27,2 $18.254,66 $4.965,27

45 Botswana 28,1 $16.820,29 $4.726,50

46 Uruguay 27,2 $15.910,80 $4.327,74

47 Brazil 34,8 $11.875,26 $4.132,59

48 Belarus 24,7 $15.633,70 $3.861,52

49 Turkey 25,0 $15.001,41 $3.750,35

50 Bulgaria 26,1 $14.311,58 $3.735,32

51 Serbia 35,2 $10.404,84 $3.662,50

52 Romania 28,0 $12.808,08 $3.586,26

53 Lithuania 16,0 $21.615,34 $3.458,45

54 Chile 18,7 $18.419,04 $3.444,36

55 Dominica 24,2 $14.166,15 $3.428,21

56 Taiwan 8,8 $38.749,20 $3.409,93

57 Trinidad and Tobago 16,5 $20.087,13 $3.314,38

58 Saint. Lucia 25,1 $13.103,72 $3.289,03

59 Bosnia and Herzegovina 38,9 $8.215,95 $3.196,00

60 South Africa 27,3 $11.375,48 $3.105,50

61 United Arab Emirates 6,1 $49.011,59 $2.989,71

62 Qatar 2,9 $102.211,00 $2.964,12

63 Montenegro 24,2 $11.800,31 $2.855,67

64 Mauritius 18,3 $15.591,97 $2.853,33

65 Ukraine 38,0 $7.373,99 $2.802,12

66 Panama 17,8 $15.616,75 $2.779,78

67 Costa Rica 21,9 $12.606,29 $2.760,78

68 Macedonia 25,6 $10.579,03 $2.708,23

69 Lebanon 17,0 $15.756,94 $2.678,68

70 Saint. Vincent and the Grenadines 22,1 $11.776,12 $2.602,52

71 Malaysia 15,3 $16.922,37 $2.589,12

72 Suriname 19,0 $12.397,85 $2.355,59

73 Namibia 28,0 $7.771,70 $2.176,07

74 Jamaica 23,4 $9.159,24 $2.143,26

75 Tunisia 21,1 $9.774,74 $2.062,47

76 Belize 23,3 $8.753,51 $2.039,57

77 Kazakhstan 14,6 $13.892,83 $2.024,06

78 Albania 23,0 $8.052,18 $1.852,00

79 Peru 17,0 $10.719,48 $1.822,31

80 Mongolia 33,1 $5.371,64 $1.778,01

81 Ecuador 17,6 $10.055,89 $1.769,84

82 China 19,0 $9.161,97 $1.740,77

83 Venezuela 12,5 $13.615,82 $1.701,98

84 Guyana 21,2 $7.938,78 $1.683,02

Tax Income

Tax Burden GDP per

Ranking Country Name per Capita in

% of GDP [1] Capita (PPP)

US$

85 Gabon 10,1 $16.547,59 $1.671,31

86 Thailand 16,2 $10.125,58 $1.640,34

87 Colombia 15,1 $10.791,73 $1.629,55

88 Mexico 10,6 $15.311,77 $1.623,05

89 Turkmenistan 17,8 $8.718,20 $1.551,84

90 Georgia 25,4 $5.929,75 $1.506,16

91 Maldives 16,2 $9.234,85 $1.499,89

92 Samoa 23,4 $6.148,96 $1.438,86

93 Swaziland 23,3 $5.781,53 $1.347,10

94 Azerbaijan 12,8 $10.478,23 $1.338,38

95 Tonga 17,5 $7.547,99 $1.320,90

96 Dominican Republic 12,9 $9.646,07 $1.244,34

97 Solomon Islands 36,9 $3.345,35 $1.234,43

98 Iran 9,3 $13.127,14 $1.220,82

99 Morocco 23,0 $5.265,18 $1.210,99

100 Kiribati 20,2 $5.973,05 $1.206,56

101 Saudi Arabia 3,7 $31.275,49 $1.157,19

102 El Salvador 15,4 $7.437,93 $1.145,44

103 Bolivia 22,2 $5.099,27 $1.132,04

104 Fiji 23,0 $4.785,63 $1.100,69

105 Moldova 30,8 $3.415,03 $1.051,83

106 Armenia 16,7 $5.838,26 $974,99

107 Egypt 13,8 $6.544,87 $903,19

108 Bhutan 13,5 $6.664,71 $899,74

109 Bahrain 3,1 $28.743,82 $891,06

110 Micronesia 12,0 $7.346,28 $881,55

111 Jordan 14,4 $6.042,29 $870,09

112 Cape Verde 20,2 $4.132,81 $834,83

113 Paraguay 13,4 $6.136,46 $822,29

114 Nicaragua 18,4 $4.458,43 $820,35

115 Vanuatu 16,4 $4.916,21 $806,26

116 Lesotho 37,6 $2.137,53 $803,71

117 Kosovo 23,1 $3.453,00 $797,64

118 Sri Lanka 12,4 $6.106,59 $758,45

119 Vietnam 21,1 $3.547,77 $748,58

120 Algeria 10,0 $7.477,07 $747,71

121 Honduras 16,1 $4.609,60 $742,15

122 Papua New Guinea 25,8 $2.797,33 $721,71

123 Uzbekistan 20,2 $3.555,08 $718,34

124 Oman 2,2 $29.166,39 $641,66

125 Indonesia 11,8 $4.977,09 $585,61

126 Guatemala 10,9 $5.208,96 $567,78

Tax Income

Tax Burden GDP per

Ranking Country Name per Capita in

% of GDP [1] Capita (PPP)

US$

127 Philippines 12,3 $4.429,59 $546,97

128 Djibouti 20,3 $2.676,96 $543,42

129 Ghana 14,6 $3.305,10 $482,55

130 Kyrgyz Republic 18,5 $2.376,49 $439,65

131 Tajikistan 19,5 $2.228,60 $433,49

132 Lao P.D.R. 13,7 $3.011,21 $412,54

133 São Tomé and Príncipe 16,8 $2.337,21 $392,65

134 Congo, Republic of 8,4 $4.666,56 $391,99

135 Equatorial Guinea 1,5 $25.929,18 $388,94

136 Eritrea 50,0 $776,79 $388,39

137 Angola 6,1 $6.346,74 $387,15

138 Senegal 19,0 $2.026,55 $385,04

139 Mauritania 17,5 $2.121,62 $371,28

140 Kenya 20,1 $1.802,38 $362,28

141 Zambia 19,3 $1.721,65 $332,28

142 Kuwait 0,8 $39.888,76 $319,11

143 India 7,0 $3.829,70 $268,08

144 Pakistan 9,3 $2.880,67 $267,90

145 Cambodia 10,9 $2.402,33 $261,85

146 Cameroon 11,0 $2.366,24 $260,29

147 Benin 15,5 $1.666,74 $258,34

148 Gambia 13,2 $1.864,39 $246,10

149 Uganda 17,0 $1.414,93 $240,54

150 Tanzania 15,2 $1.566,71 $238,14

151 Mozambique 19,6 $1.169,17 $229,16

152 Côte d'Ivoire 13,1 $1.726,65 $226,19

153 Bangladesh 9,9 $2.039,48 $202,36

154 Rwanda 13,1 $1.485,91 $194,65

155 Burkina Faso 13,7 $1.399,50 $191,73

156 Togo 16,7 $1.096,21 $183,07

157 Guinea 15,6 $1.121,36 $174,93

158 Malawi 19,9 $857,67 $170,68

159 Sudan 6,7 $2.544,63 $170,49

160 Zimbabwe 30,0 $558,58 $167,57

161 Nepal 12,6 $1.308,07 $164,82

162 Haiti 13,1 $1.242,82 $162,81

163 Comoros 12,4 $1.257,99 $155,99

164 Sierra Leone 11,5 $1.344,25 $154,59

165 Mali 14,0 $1.100,24 $154,03

166 Ethiopia 11,3 $1.190,56 $134,53

167 Iraq 1,9 $7.079,89 $134,52

168 Liberia 19,8 $672,56 $133,17

Tax Income

Tax Burden GDP per

Ranking Country Name per Capita in

% of GDP [1] Capita (PPP)

US$

169 Nigeria 4,7 $2.720,01 $127,84

170 Yemen 5,3 $2.282,67 $120,98

171 Libya 1,0 $12.066,45 $120,66

172 Niger 14,1 $815,35 $114,96

173 Madagascar 11,1 $955,31 $106,04

174 Guinea-Bissau 8,6 $1.222,76 $105,16

175 Chad 5,1 $1.923,70 $98,11

176 Afghanistan 8,7 $1.053,81 $91,68

177 Burundi 14,3 $625,43 $89,44

178 Congo, Democratic Republic of the Congo 23,6 $368,91 $87,06

179 Central African Republic 9,4 $800,22 $75,22

180 Burma 3,7 $1.405,03 $51,99

Tax Burden % GDP per Capita Tax Income per

Ranking Country Name

of GDP (PPP) Capita in US$

1 Eritrea 50,00 $776,79 $388,39

2 Denmark 48,10 $37.657,20 $18.113,11

3 Sweden 44,50 $41.191,47 $18.330,21

4 France 44,20 $35.547,96 $15.712,20

5 Belgium 44,00 $37.883,06 $16.668,55

6 Finland 43,40 $36.395,01 $15.795,43

7 Norway 43,20 $55.008,77 $23.763,79

8 Italy 42,90 $30.136,38 $12.928,51

9 Austria 42,10 $42.408,58 $17.854,01

10 Bosnia and Herzegovina 38,90 $8.215,95 $3.196,00

11 Netherlands 38,70 $42.193,69 $16.328,96

12 Ukraine 38,00 $7.373,99 $2.802,12

13 Lesotho 37,60 $2.137,53 $803,71

14 Luxembourg 37,10 $79.785,04 $29.600,25

15 Germany 37,10 $39.028,39 $14.479,53

16 Solomon Islands 36,90 $3.345,35 $1.234,43

17 Slovenia 36,80 $28.195,24 $10.375,85

18 Iceland 36,00 $39.223,96 $14.120,62

19 Hungary 35,70 $19.637,59 $7.010,62

20 United Kingdom 35,50 $36.941,06 $13.114,08

21 Czech Republic 35,30 $27.190,92 $9.598,40

22 Serbia 35,20 $10.404,84 $3.662,50

23 Brazil 34,80 $11.875,26 $4.132,59

24 Argentina 34,60 $18.112,33 $6.266,87

25 Macau 34,50 $78.275,00 $27.004,88

26 Malta 34,40 $27.022,36 $9.295,69

27 Mongolia 33,10 $5.371,64 $1.778,01

28 Estonia 32,80 $21.713,22 $7.121,94

29 Israel 32,60 $32.312,42 $10.533,85

30 Croatia 32,60 $17.810,14 $5.806,11

31 Seychelles 31,70 $25.229,48 $7.997,74

32 Poland 31,70 $20.591,75 $6.527,59

33 New Zealand 31,68 $29.730,30 $9.417,37

34 Spain 31,60 $30.557,47 $9.656,16

35 Portugal 31,30 $23.385,17 $7.319,56

36 Greece 31,20 $24.505,04 $7.645,57

37 Canada 31,00 $42.734,36 $13.247,65

38 Moldova 30,80 $3.415,03 $1.051,83

39 Zimbabwe 30,00 $558,58 $167,57

40 Russia 29,50 $17.708,74 $5.224,08

41 Slovak Republic 28,80 $24.249,11 $6.983,74

42 Switzerland 28,50 $45.417,81 $12.944,08

43 Botswana 28,10 $16.820,29 $4.726,50

44 Romania 28,00 $12.808,08 $3.586,26

45 Namibia 28,00 $7.771,70 $2.176,07

46 Ireland 27,60 $41.920,73 $11.570,12

47 Japan 27,60 $36.265,75 $10.009,35

48 Barbados 27,40 $25.372,68 $6.952,11

49 South Africa 27,30 $11.375,48 $3.105,50

50 Latvia 27,20 $18.254,66 $4.965,27

51 Uruguay 27,20 $15.910,80 $4.327,74

52 Cyprus 26,50 $27.085,98 $7.177,79

53 Bulgaria 26,10 $14.311,58 $3.735,32

54 Korea, South 25,90 $32.272,12 $8.358,48

55 Papua New Guinea 25,80 $2.797,33 $721,71

56 Australia 25,60 $42.640,28 $10.915,91

57 Macedonia 25,60 $10.579,03 $2.708,23

58 Georgia 25,40 $5.929,75 $1.506,16

59 United States 25,10 $49.922,11 $12.530,45

60 Saint. Lucia 25,10 $13.103,72 $3.289,03

61 Turkey 25,00 $15.001,41 $3.750,35

62 Belarus 24,70 $15.633,70 $3.861,52

63 Dominica 24,20 $14.166,15 $3.428,21

64 Montenegro 24,20 $11.800,31 $2.855,67

65 Brunei Darussalam 24,00 $54.388,65 $13.053,28

66 Congo, Democratic Republic of the Congo 23,60 $368,91 $87,06

67 Jamaica 23,40 $9.159,24 $2.143,26

68 Samoa 23,40 $6.148,96 $1.438,86

69 Belize 23,30 $8.753,51 $2.039,57

70 Swaziland 23,30 $5.781,53 $1.347,10

71 Kosovo 23,10 $3.453,00 $797,64

72 Albania 23,00 $8.052,18 $1.852,00

73 Morocco 23,00 $5.265,18 $1.210,99

74 Fiji 23,00 $4.785,63 $1.100,69

75 Bolivia 22,20 $5.099,27 $1.132,04

76 Saint. Vincent and the Grenadines 22,10 $11.776,12 $2.602,52

77 Costa Rica 21,90 $12.606,29 $2.760,78

78 Guyana 21,20 $7.938,78 $1.683,02

79 Tunisia 21,10 $9.774,74 $2.062,47

80 Vietnam 21,10 $3.547,77 $748,58

81 Djibouti 20,30 $2.676,96 $543,42

82 Uzbekistan 20,21 $3.555,08 $718,34

83 Kiribati 20,20 $5.973,05 $1.206,56

84 Cape Verde 20,20 $4.132,81 $834,83

85 Kenya 20,10 $1.802,38 $362,28

86 Malawi 19,90 $857,67 $170,68

87 Liberia 19,80 $672,56 $133,17

88 Mozambique 19,60 $1.169,17 $229,16

89 Tajikistan 19,45 $2.228,60 $433,49

90 Zambia 19,30 $1.721,65 $332,28

91 Suriname 19,00 $12.397,85 $2.355,59

92 China 19,00 $9.161,97 $1.740,77

93 Senegal 19,00 $2.026,55 $385,04

94 Chile 18,70 $18.419,04 $3.444,36

95 Kyrgyz Republic 18,50 $2.376,49 $439,65

96 Nicaragua 18,40 $4.458,43 $820,35

97 Mauritius 18,30 $15.591,97 $2.853,33

98 Panama 17,80 $15.616,75 $2.779,78

99 Turkmenistan 17,80 $8.718,20 $1.551,84

100 Ecuador 17,60 $10.055,89 $1.769,84

101 Tonga 17,50 $7.547,99 $1.320,90

102 Mauritania 17,50 $2.121,62 $371,28

103 Lebanon 17,00 $15.756,94 $2.678,68

104 Peru 17,00 $10.719,48 $1.822,31

105 Uganda 17,00 $1.414,93 $240,54

106 São Tomé and Príncipe 16,80 $2.337,21 $392,65

107 Armenia 16,70 $5.838,26 $974,99

108 Togo 16,70 $1.096,21 $183,07

109 Trinidad and Tobago 16,50 $20.087,13 $3.314,38

110 Bahamas 16,40 $31.382,41 $5.146,72

111 Vanuatu 16,40 $4.916,21 $806,26

112 Maldives 16,24 $9.234,85 $1.499,89

113 Thailand 16,20 $10.125,58 $1.640,34

114 Honduras 16,10 $4.609,60 $742,15

115 Lithuania 16,00 $21.615,34 $3.458,45

116 Guinea 15,60 $1.121,36 $174,93

117 Benin 15,50 $1.666,74 $258,34

118 El Salvador 15,40 $7.437,93 $1.145,44

119 Malaysia 15,30 $16.922,37 $2.589,12

120 Tanzania 15,20 $1.566,71 $238,14

121 Colombia 15,10 $10.791,73 $1.629,55

122 Ghana 14,60 $3.305,10 $482,55

123 Kazakhstan 14,57 $13.892,83 $2.024,06

124 Jordan 14,40 $6.042,29 $870,09

125 Burundi 14,30 $625,43 $89,44

126 Hong Kong SAR 14,20 $51.494,15 $7.312,17

127 Niger 14,10 $815,35 $114,96

128 Mali 14,00 $1.100,24 $154,03

129 Singapore 13,80 $60.409,98 $8.336,58

130 Egypt 13,80 $6.544,87 $903,19

131 Lao P.D.R. 13,70 $3.011,21 $412,54

132 Burkina Faso 13,70 $1.399,50 $191,73

133 Bhutan 13,50 $6.664,71 $899,74

134 Paraguay 13,40 $6.136,46 $822,29

135 Gambia 13,20 $1.864,39 $246,10

136 Côte d'Ivoire 13,10 $1.726,65 $226,19

137 Rwanda 13,10 $1.485,91 $194,65

138 Haiti 13,10 $1.242,82 $162,81

139 Dominican Republic 12,90 $9.646,07 $1.244,34

140 Azerbaijan 12,77 $10.478,23 $1.338,38

141 Nepal 12,60 $1.308,07 $164,82

142 Venezuela 12,50 $13.615,82 $1.701,98

143 Sri Lanka 12,42 $6.106,59 $758,45

144 Comoros 12,40 $1.257,99 $155,99

145 Philippines 12,35 $4.429,59 $546,97

146 Micronesia 12,00 $7.346,28 $881,55

147 Indonesia 11,77 $4.977,09 $585,61

148 Sierra Leone 11,50 $1.344,25 $154,59

149 Ethiopia 11,30 $1.190,56 $134,53

150 Madagascar 11,10 $955,31 $106,04

151 Cameroon 11,00 $2.366,24 $260,29

152 Guatemala 10,90 $5.208,96 $567,78

153 Cambodia 10,90 $2.402,33 $261,85

154 Mexico 10,60 $15.311,77 $1.623,05

155 Gabon 10,10 $16.547,59 $1.671,31

156 Algeria 10,00 $7.477,07 $747,71

157 Bangladesh 9,92 $2.039,48 $202,36

158 Central African Republic 9,40 $800,22 $75,22

159 Iran 9,30 $13.127,14 $1.220,82

160 Pakistan 9,30 $2.880,67 $267,90

161 Taiwan 8,80 $38.749,20 $3.409,93

162 Afghanistan 8,70 $1.053,81 $91,68

163 Guinea-Bissau 8,60 $1.222,76 $105,16

164 Congo, Republic of 8,40 $4.666,56 $391,99

165 India 7,00 $3.829,70 $268,08

166 Sudan 6,70 $2.544,63 $170,49

167 United Arab Emirates 6,10 $49.011,59 $2.989,71

168 Angola 6,10 $6.346,74 $387,15

169 Yemen 5,30 $2.282,67 $120,98

170 Chad 5,10 $1.923,70 $98,11

171 Nigeria 4,70 $2.720,01 $127,84

172 Saudi Arabia 3,70 $31.275,49 $1.157,19

173 Burma 3,70 $1.405,03 $51,99

174 Bahrain 3,10 $28.743,82 $891,06

175 Qatar 2,90 $102.211,00 $2.964,12

176 Oman 2,20 $29.166,39 $641,66

177 Iraq 1,90 $7.079,89 $134,52

178 Equatorial Guinea 1,50 $25.929,18 $388,94

179 Libya 1,00 $12.066,45 $120,66

180 Kuwait 0,80 $39.888,76 $319,11

Tax Burden GDP per Capita Tax Income per

Ranking Country Name

% of GDP (PPP) Capita in US$

1 Qatar 2,90 $102.211,00 $2.964,12

2 Luxembourg 37,10 $79.785,04 $29.600,25

3 Macau 34,50 $78.275,00 $27.004,88

4 Singapore 13,80 $60.409,98 $8.336,58

5 Norway 43,20 $55.008,77 $23.763,79

6 Brunei Darussalam 24,00 $54.388,65 $13.053,28

7 Hong Kong SAR 14,20 $51.494,15 $7.312,17

8 United States 25,10 $49.922,11 $12.530,45

9 United Arab Emirates 6,10 $49.011,59 $2.989,71

10 Switzerland 28,50 $45.417,81 $12.944,08

11 Canada 31,00 $42.734,36 $13.247,65

12 Australia 25,60 $42.640,28 $10.915,91

13 Austria 42,10 $42.408,58 $17.854,01

14 Netherlands 38,70 $42.193,69 $16.328,96

15 Ireland 27,60 $41.920,73 $11.570,12

16 Sweden 44,50 $41.191,47 $18.330,21

17 Kuwait 0,80 $39.888,76 $319,11

18 Iceland 36,00 $39.223,96 $14.120,62

19 Germany 37,10 $39.028,39 $14.479,53

20 Taiwan 8,80 $38.749,20 $3.409,93

21 Belgium 44,00 $37.883,06 $16.668,55

22 Denmark 48,10 $37.657,20 $18.113,11

23 United Kingdom 35,50 $36.941,06 $13.114,08

24 Finland 43,40 $36.395,01 $15.795,43

25 Japan 27,60 $36.265,75 $10.009,35

26 France 44,20 $35.547,96 $15.712,20

27 Israel 32,60 $32.312,42 $10.533,85

28 Korea, South 25,90 $32.272,12 $8.358,48

29 Bahamas 16,40 $31.382,41 $5.146,72

30 Saudi Arabia 3,70 $31.275,49 $1.157,19

31 Spain 31,60 $30.557,47 $9.656,16

32 Italy 42,90 $30.136,38 $12.928,51

33 New Zealand 31,68 $29.730,30 $9.417,37

34 Oman 2,20 $29.166,39 $641,66

35 Bahrain 3,10 $28.743,82 $891,06

36 Slovenia 36,80 $28.195,24 $10.375,85

37 Czech Republic 35,30 $27.190,92 $9.598,40

38 Cyprus 26,50 $27.085,98 $7.177,79

39 Malta 34,40 $27.022,36 $9.295,69

40 Equatorial Guinea 1,50 $25.929,18 $388,94

41 Barbados 27,40 $25.372,68 $6.952,11

Tax Burden GDP per Capita Tax Income per

Ranking Country Name

% of GDP (PPP) Capita in US$

42 Seychelles 31,70 $25.229,48 $7.997,74

43 Greece 31,20 $24.505,04 $7.645,57

44 Slovak Republic 28,80 $24.249,11 $6.983,74

45 Portugal 31,30 $23.385,17 $7.319,56

46 Estonia 32,80 $21.713,22 $7.121,94

47 Lithuania 16,00 $21.615,34 $3.458,45

48 Poland 31,70 $20.591,75 $6.527,59

49 Trinidad and Tobago 16,50 $20.087,13 $3.314,38

50 Hungary 35,70 $19.637,59 $7.010,62

51 Chile 18,70 $18.419,04 $3.444,36

52 Latvia 27,20 $18.254,66 $4.965,27

53 Argentina 34,60 $18.112,33 $6.266,87

54 Croatia 32,60 $17.810,14 $5.806,11

55 Russia 29,50 $17.708,74 $5.224,08

56 Malaysia 15,30 $16.922,37 $2.589,12

57 Botswana 28,10 $16.820,29 $4.726,50

58 Gabon 10,10 $16.547,59 $1.671,31

59 Uruguay 27,20 $15.910,80 $4.327,74

60 Lebanon 17,00 $15.756,94 $2.678,68

61 Belarus 24,70 $15.633,70 $3.861,52

62 Panama 17,80 $15.616,75 $2.779,78

63 Mauritius 18,30 $15.591,97 $2.853,33

64 Mexico 10,60 $15.311,77 $1.623,05

65 Turkey 25,00 $15.001,41 $3.750,35

66 Bulgaria 26,10 $14.311,58 $3.735,32

67 Dominica 24,20 $14.166,15 $3.428,21

68 Kazakhstan 14,57 $13.892,83 $2.024,06

69 Venezuela 12,50 $13.615,82 $1.701,98

70 Iran 9,30 $13.127,14 $1.220,82

71 Saint. Lucia 25,10 $13.103,72 $3.289,03

72 Romania 28,00 $12.808,08 $3.586,26

73 Costa Rica 21,90 $12.606,29 $2.760,78

74 Suriname 19,00 $12.397,85 $2.355,59

75 Libya 1,00 $12.066,45 $120,66

76 Brazil 34,80 $11.875,26 $4.132,59

77 Montenegro 24,20 $11.800,31 $2.855,67

78 Saint. Vincent and the Grenadines 22,10 $11.776,12 $2.602,52

79 South Africa 27,30 $11.375,48 $3.105,50

80 Colombia 15,10 $10.791,73 $1.629,55

81 Peru 17,00 $10.719,48 $1.822,31

82 Macedonia 25,60 $10.579,03 $2.708,23

Tax Burden GDP per Capita Tax Income per

Ranking Country Name

% of GDP (PPP) Capita in US$

83 Azerbaijan 12,77 $10.478,23 $1.338,38

84 Serbia 35,20 $10.404,84 $3.662,50

85 Thailand 16,20 $10.125,58 $1.640,34

86 Ecuador 17,60 $10.055,89 $1.769,84

87 Tunisia 21,10 $9.774,74 $2.062,47

88 Dominican Republic 12,90 $9.646,07 $1.244,34

89 Maldives 16,24 $9.234,85 $1.499,89

90 China 19,00 $9.161,97 $1.740,77

91 Jamaica 23,40 $9.159,24 $2.143,26

92 Belize 23,30 $8.753,51 $2.039,57

93 Turkmenistan 17,80 $8.718,20 $1.551,84

94 Bosnia and Herzegovina 38,90 $8.215,95 $3.196,00

95 Albania 23,00 $8.052,18 $1.852,00

96 Guyana 21,20 $7.938,78 $1.683,02

97 Namibia 28,00 $7.771,70 $2.176,07

98 Tonga 17,50 $7.547,99 $1.320,90

99 Algeria 10,00 $7.477,07 $747,71

100 El Salvador 15,40 $7.437,93 $1.145,44

101 Ukraine 38,00 $7.373,99 $2.802,12

102 Micronesia 12,00 $7.346,28 $881,55

103 Iraq 1,90 $7.079,89 $134,52

104 Bhutan 13,50 $6.664,71 $899,74

105 Egypt 13,80 $6.544,87 $903,19

106 Angola 6,10 $6.346,74 $387,15

107 Samoa 23,40 $6.148,96 $1.438,86

108 Paraguay 13,40 $6.136,46 $822,29

109 Sri Lanka 12,42 $6.106,59 $758,45

110 Jordan 14,40 $6.042,29 $870,09

111 Kiribati 20,20 $5.973,05 $1.206,56

112 Georgia 25,40 $5.929,75 $1.506,16

113 Armenia 16,70 $5.838,26 $974,99

114 Swaziland 23,30 $5.781,53 $1.347,10

115 Mongolia 33,10 $5.371,64 $1.778,01

116 Morocco 23,00 $5.265,18 $1.210,99

117 Guatemala 10,90 $5.208,96 $567,78

118 Bolivia 22,20 $5.099,27 $1.132,04

119 Indonesia 11,77 $4.977,09 $585,61

120 Vanuatu 16,40 $4.916,21 $806,26

121 Fiji 23,00 $4.785,63 $1.100,69

122 Congo, Republic of 8,40 $4.666,56 $391,99

123 Honduras 16,10 $4.609,60 $742,15

Tax Burden GDP per Capita Tax Income per

Ranking Country Name

% of GDP (PPP) Capita in US$

124 Nicaragua 18,40 $4.458,43 $820,35

125 Philippines 12,35 $4.429,59 $546,97

126 Cape Verde 20,20 $4.132,81 $834,83

127 India 7,00 $3.829,70 $268,08

128 Uzbekistan 20,21 $3.555,08 $718,34

129 Vietnam 21,10 $3.547,77 $748,58

130 Kosovo 23,10 $3.453,00 $797,64

131 Moldova 30,80 $3.415,03 $1.051,83

132 Solomon Islands 36,90 $3.345,35 $1.234,43

133 Ghana 14,60 $3.305,10 $482,55

134 Lao P.D.R. 13,70 $3.011,21 $412,54

135 Pakistan 9,30 $2.880,67 $267,90

136 Papua New Guinea 25,80 $2.797,33 $721,71

137 Nigeria 4,70 $2.720,01 $127,84

138 Djibouti 20,30 $2.676,96 $543,42

139 Sudan 6,70 $2.544,63 $170,49

140 Cambodia 10,90 $2.402,33 $261,85

141 Kyrgyz Republic 18,50 $2.376,49 $439,65

142 Cameroon 11,00 $2.366,24 $260,29

143 São Tomé and Príncipe 16,80 $2.337,21 $392,65

144 Yemen 5,30 $2.282,67 $120,98

145 Tajikistan 19,45 $2.228,60 $433,49

146 Lesotho 37,60 $2.137,53 $803,71

147 Mauritania 17,50 $2.121,62 $371,28

148 Bangladesh 9,92 $2.039,48 $202,36

149 Senegal 19,00 $2.026,55 $385,04

150 Chad 5,10 $1.923,70 $98,11

151 Gambia 13,20 $1.864,39 $246,10

152 Kenya 20,10 $1.802,38 $362,28

153 Côte d'Ivoire 13,10 $1.726,65 $226,19

154 Zambia 19,30 $1.721,65 $332,28

155 Benin 15,50 $1.666,74 $258,34

156 Tanzania 15,20 $1.566,71 $238,14

157 Rwanda 13,10 $1.485,91 $194,65

158 Uganda 17,00 $1.414,93 $240,54

159 Burma 3,70 $1.405,03 $51,99

160 Burkina Faso 13,70 $1.399,50 $191,73

161 Sierra Leone 11,50 $1.344,25 $154,59

162 Nepal 12,60 $1.308,07 $164,82

163 Comoros 12,40 $1.257,99 $155,99

164 Haiti 13,10 $1.242,82 $162,81

Tax Burden GDP per Capita Tax Income per

Ranking Country Name

% of GDP (PPP) Capita in US$

165 Guinea-Bissau 8,60 $1.222,76 $105,16

166 Ethiopia 11,30 $1.190,56 $134,53

167 Mozambique 19,60 $1.169,17 $229,16

168 Guinea 15,60 $1.121,36 $174,93

169 Mali 14,00 $1.100,24 $154,03

170 Togo 16,70 $1.096,21 $183,07

171 Afghanistan 8,70 $1.053,81 $91,68

172 Madagascar 11,10 $955,31 $106,04

173 Malawi 19,90 $857,67 $170,68

174 Niger 14,10 $815,35 $114,96

175 Central African Republic 9,40 $800,22 $75,22

176 Eritrea 50,00 $776,79 $388,39

177 Liberia 19,80 $672,56 $133,17

178 Burundi 14,30 $625,43 $89,44

179 Zimbabwe 30,00 $558,58 $167,57

180 Congo, Democratic Republic of the Congo 23,60 $368,91 $87,06

[1] Fonte: http://www.heritage.org/index/explore?view=by-variables

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Subramanyam FSA Chapter 01 - ETJDocument44 pagesSubramanyam FSA Chapter 01 - ETJMaya AngrianiNo ratings yet

- G2 - Sample ######1### 0 30 30 Per 1 9 15 20 10 G1 - 44 55 ###2### 0 100 100 Num 0 9 15 70 30Document22 pagesG2 - Sample ######1### 0 30 30 Per 1 9 15 20 10 G1 - 44 55 ###2### 0 100 100 Num 0 9 15 70 30The HoangNo ratings yet

- Y10 IGCSE Economics Test 4 Ans - Class 5Document6 pagesY10 IGCSE Economics Test 4 Ans - Class 5K Lam LamNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Assignment On Ratio Analysis of Eastern Bank LTD: Submitted byDocument11 pagesAssignment On Ratio Analysis of Eastern Bank LTD: Submitted bySumaiya AkterNo ratings yet

- Accounting Lesson4 BAsic Financial StatementsDocument24 pagesAccounting Lesson4 BAsic Financial Statementspeter banjaoNo ratings yet

- Poverty and Inequality in India - M.phil ThesisDocument77 pagesPoverty and Inequality in India - M.phil Thesissukumarnandi@hotmail.comNo ratings yet

- FCO InfographicsDocument5 pagesFCO InfographicspouljunkerandersenNo ratings yet

- CBSE XII Economics NotesDocument165 pagesCBSE XII Economics NoteschehalNo ratings yet

- Ae 112 Prelim - SolutionsDocument8 pagesAe 112 Prelim - SolutionsRica Ann RoxasNo ratings yet

- ICARE First Preboard TAXDocument12 pagesICARE First Preboard TAXLuna VNo ratings yet

- BSRM Steel LimitedDocument15 pagesBSRM Steel LimitedSarjil alamNo ratings yet

- Preparation of Income Statement Using Absorption and VariableDocument2 pagesPreparation of Income Statement Using Absorption and VariableDave CansicioNo ratings yet

- First Summative Test-Tle He6Document6 pagesFirst Summative Test-Tle He6Jassim Magallanes100% (1)

- Personal Financial ManagementDocument42 pagesPersonal Financial ManagementBleoobi Isaac A Bonney100% (1)

- 4 Differences Between GDP and GNPDocument5 pages4 Differences Between GDP and GNPAmpy SasutonaNo ratings yet

- Business Trade & CommerceDocument6 pagesBusiness Trade & Commerceincredible meNo ratings yet

- Chapter 18 Government GrantsDocument6 pagesChapter 18 Government Grantsalexandra rausaNo ratings yet

- Kaspi Bank 21Document4 pagesKaspi Bank 21Serikkizi FatimaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAmit SharmaNo ratings yet

- ITC Report and Accounts 2023 185Document1 pageITC Report and Accounts 2023 185Nishith RanjanNo ratings yet

- Intercompany-Profit Transaction: Plant AssetDocument29 pagesIntercompany-Profit Transaction: Plant AssetCici SintamayaNo ratings yet

- Chapter 5Document16 pagesChapter 5JAHANZAIBNo ratings yet

- FRA AssignmentDocument31 pagesFRA AssignmentPranav Viswanathan100% (1)

- Bachelor'S Degree Programme Term-End Examination December, 2017 Elective Course: Commerce Eco-011: Elements of Income TaxDocument6 pagesBachelor'S Degree Programme Term-End Examination December, 2017 Elective Course: Commerce Eco-011: Elements of Income TaxAnkit KumarNo ratings yet

- ZCOM Volume 42 Issue 4 Pages 3-22Document19 pagesZCOM Volume 42 Issue 4 Pages 3-22Ean OngNo ratings yet

- Fundamental Analysis of Fertilizer SectorDocument13 pagesFundamental Analysis of Fertilizer SectorAmit SinghNo ratings yet

- IA3 Cash Basis VALIXDocument18 pagesIA3 Cash Basis VALIXHafie DiranggarunNo ratings yet

- List of Accounting Materials PDFDocument9 pagesList of Accounting Materials PDFKing Nufayl SendadNo ratings yet

- Income Under The Head House Property2Document80 pagesIncome Under The Head House Property2bhuvana600048No ratings yet