Professional Documents

Culture Documents

Joint and by

Joint and by

Uploaded by

Angela0 ratings0% found this document useful (0 votes)

60 views4 pagesJoint and By

Original Title

Joint and By

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJoint and By

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

60 views4 pagesJoint and by

Joint and by

Uploaded by

AngelaJoint and By

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

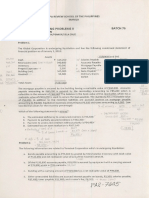

CPA REVIEW SCHOOL OF THE PHILIPPINES

MANILA

PRACTICAL ACCOUNTING PROBLEMS I! BATCH 76

(GUERRERO/GERMAN/LIM/SIY/FERRER/DELA CRUZ

JOINT & BY-PRODUCT COSTING

Problem 1.

RB Company manufactures Products A and 8 from a joint process that also yields a by-product,

X. The net realizable value of the by-product is expected to be significant and the recognition of

the incidental output is upon production, Additional information were as follows:

A & x Total

Units produced 15,000 3,000 6,000 30,000

Joint costs .. 5 330,000

Market value at split-off 362,500 + 187,500 P12,500 _P562,500

etal 9507,

‘Assuming that joint product costs

the joint cost allocated to Produc

e allocated using the market value at the split-off approach,

care

F A> 562,500,

Je 9307 ‘ FS

A 9067 Bd me fused) Be 199, Sasa 917,500 (GIB

cc. P110,000 Rem, Je 319,506

D, P108,239

Problem 2

CQ Corporation manufactures liquid chemicals A and 8 from a joint process. Joint costs are

allocated on the basis of relative market value at split-off. It costs P68,400 to process 7,500

gallons of Product A and 15,000 gallons of Product B to the split-off point. The market value at

split-off is P10 per gallon for Product and P14 for Product(B) Product B requires an additional

process beyond split-off at a cost of P2 per gallon before it can be sold.

What is GCO's cost to produce 15,000 gallons ofiProduct B?

B = aot /aest x

iS P72,900 4.

oe

AGV Company processes raw material into products R1, R2, and R3. Each ton of raw material

produces five units of Rd, two units of R2, and three units of R3. Joint processing costs to the

split-off point are P105 per ton. Further processing results in the following per unit figures:

Ra 2 3

‘Additional processing costs per unit. P1968 210 P175

Selling price per unit 210 245 245

IF joint costs are allocated by the net realizable value of finished product, what proportion of

Joint costs should be allocated tolR1? Final

A. 20% RL xs =

pee see PA2-76//

‘ 2

Problem 4 sleint Products

SPV Company produces trarlsgarent soaps, Giyctrin soaps as joint products and liquie|soaps as a

by-product. The bottled liquid soaps can be sold for B2 perliter. Liquid soaps require packaging

costs of PO,10 per liter and sales commissions at 10% of sales price, The net revenug of the by-

product is treated as a reduction from the joint costs. Joint products are assigned joint costs

based on the amount liters produced.

nat realinable vole

4p a Transparent soaps 320,000 Iters7 4eor

Pe G10x2) (2) Glycering soaps hi

% (10 Liquid soaps 1,600 liters X1-7 = 2.3.90

130, Joint costs, 80,000

‘What is the cost assigned to transparent soaps?

‘A. P51,200

ve gor “Wams.tonp = 820)00x77,200.

B. P51,412 By fred. hare. (2,20) > 5LS20 j

Cc. P51,520 74,280. sal

D. P53,332 oe

Problem 5

VCX manufactures products B, C and D from a joint process. The total cost in February is

P500,000. Other information for the month were as follows: {

B c D

Ultimate sales value 300,000 550,000 P4S0,000

Processing cost after SO baga,opo 150,000 PB 00

> oT

Quantity sold fo00 | “2000 joo” SP

Ending Inventory in units 5000 6000 4000

What isthe total production cast of product?

‘A. 300,000 finduct

B. 275,000 Je share (Scot xA%G00) = a50T

C. P350,000 Pa. {sot

D. 400,000 $cc

Problem 6

MYB Company produces joint products{A and B)together with by product. A is sold at split off

but B and C undergo additional processing, Production data pertaining to these products for

year ended December 31, 2013 were as follows:

A BG c Total

Joint Costs 3,900,000-

Separable costs /prc 71,413,750 182,000. 1,595,750

Production in pounds 325,000 487,500 130,000 942,500

Sales price per pound °5. ppt | ace |

1.4287 Ae |

There are no beginning or ending inventories. No materials are spoiled in production. Joint costs

are allocated to joint products fo achieve the same gross profit ratefor each joint product. Net

revenuie from by producti, rom joint production costs of the main product.

by pl deducted fi ofthe mainproduct. ue. 8,

How much is the share of B in the joint cost? Ae eet ee ee aa

nn seats gan fata ~ Wls2io = 2 Soe ae!

A. 1,397,500 By duct: : 402,502 4990790 BAST =

& 2359500 BAKED 22

Cc. P2,7a1geg Serco M1821) (1497). = 40/1

D. 2,429,440 Je share 3757 PAL fig, = 4

Problem 7

JBP Company buys Article RS for P5,60 unit, At the end of processing in Department 1 Article RS

split into products J, K and L. Product J is sold at spilt-off point with no further processing, K and

L require further processing before they can be sold; K is processed in Department 2; and L is

processed in Department 3. The following is @ summary of costs and other related data for the

year ended July 31, 2013.

epee! Department 2 erence

Cost of Article RS

Direct Materials 10,080,000 P 105,000 1,020,000

Direct Labor P 1,470,000 4,323,000 P4,860,000

Factory overhead P 1,050,000 2,205,000 5,145,000

Product J Product K Product L

Unit sold 750,000 1,125,000 1,687,500

Units on hand at uly 32,2013 375,000 112,500 562,500

sales 3,150,000 10,080,000 14,883,750

JBP uses the estimated net realizable value method to allocate joint cost.

The cost of Product{K Sold for the year ended July 31, 2013

The total manufacturing cast of Products)

The cost of ending inventory for ProductiLfor the year ended July 31, 2013

Problem 8

The FCD Chemical Company produces a product known as “mentolux" from which by product

results, This by-product can be sold at PSO.per pound. The manufacturing costs of the main

product and by-product up to the point of separation for the three months ended March 32,

2014 follows: Materials, PB75,000; Labor, P500,000; Overhead, P500,000. = {,2797 /©

The units processed were 175,000 pounds of the main product and 17,500 pounds of the by-

product. During the period 157,500 pounds of the “mentolux” were sold at P240,, while the

Company was able to sell 13,125 pounds of the by-product. Selling and administrative expenses

felated to the main product amounted to P2,050,000. Disposal cost per each unit of the by:

products P10.

‘Assume that the by-product is inventoried and recorded at net realizable value. What is the

unit cost of “mentolux"? Assume that the by-product is recorded as realized. What is the cost

of inventory of mentolux? Pos SALE op 90

ue 2357 c

Byfied. share _ =

Units Prod

IST IN TIME/BACKFLUSH COSTING |)

Problem 2

‘The BGC Manufacturing Company uses a Materials and In-Process (MIP) inventory account. At

the end of each month, all inventories are counted, their conversion costs components are

estimated, and inventory account balances are adjusted accordingly. Raw materials is

backflushed from MIP account to Finished Goods account. The following data is for the month of

February: Nat —> Fe

beginning balance of MIP account 333,625

ammo toctinltfed 2,000

Faw materials purchased FAG-7C// 250000

Conversion cost allocated 46,375)”

Ending balance of MIP account 366,625

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Multiple Choice Question On IFRS - Caglobal PDFDocument103 pagesMultiple Choice Question On IFRS - Caglobal PDFAngela100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- RFBT Nmbe 2018 PDFDocument20 pagesRFBT Nmbe 2018 PDFAngelaNo ratings yet

- Corporate Liquidation PDFDocument4 pagesCorporate Liquidation PDFAngela100% (3)

- CPAR First Preboard in Prac II With Answer PDFDocument10 pagesCPAR First Preboard in Prac II With Answer PDFAngelaNo ratings yet

- Partnership Lump Sum & Installment Liquidation PDFDocument4 pagesPartnership Lump Sum & Installment Liquidation PDFAngela100% (1)

- Corporate Liquidation PDFDocument4 pagesCorporate Liquidation PDFAngelaNo ratings yet