Professional Documents

Culture Documents

Optimizador de Portafolios

Uploaded by

LuigiCastroAlvisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Optimizador de Portafolios

Uploaded by

LuigiCastroAlvisCopyright:

Available Formats

401684517.

xlsx

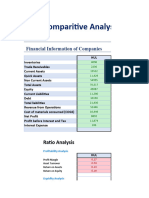

PORTFOLIO OPTIMIZER

OPTIMAL TANGENCY

Risk Aversion 1.8985 PORTFOLIO PORTFOLIO

Target Return 0.1 (set risk aversion=0 to activate Riskless 0.00%

Riskless Rate 0.02 XOM 255.21% 255.21%

GE -75.47% -75.47%

EXPECTED STANDARD PFE -117.29% -117.29%

RETURN DEVIATION WMT 34.88% 34.88%

XOM 18.02% 20.09% MSFT 2.67% 2.67%

GE -0.41% 18.17%

PFE -3.69% 21.76% Expected Return 51.81% 51.81%

WMT 3.09% 18.39% Standard Deviation 51.22% 51.22%

MSFT 3.82% 22.49%

XOM GE PFE WMT MSFT

XOM 1.0000 0.2402 0.2738 0.1388 0.2145

GE 0.2401905988 1.0000 0.2978 0.2846 0.2928

CORRELATIONS PFE 0.2738443301 0.2977695521 1.0000 0.2603 0.1916

WMT 0.1387851212 0.2846075485 0.2602615988 1.0000 0.2441

MSFT 0.2144869515 0.292774861 0.19164494 0.2440721749 1.0000

EXPECTED RETURN

0.70

0.60

0.50

Frontier without Riskless

Asset 1

0.40 Asset 2

Asset 3

0.30 Asset 4

Asset 5

0.20 Frontier with Riskless

Tangency Portfolio

Your Portfolio

0.10

0.00

-0.10 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70

-0.10

STANDARD DEVIATION

Page 1

You might also like

- Portfolio Optimizer: Optimal Tangency Portfolio PortfolioDocument1 pagePortfolio Optimizer: Optimal Tangency Portfolio PortfolioEvelyn ToralvaNo ratings yet

- Holding Equity Normal SummaryDocument1 pageHolding Equity Normal SummaryMeet GandhiNo ratings yet

- Adform MIA Report SI December, 2016Document429 pagesAdform MIA Report SI December, 2016Anonymous SI88NnSlsNo ratings yet

- ReportDocument4 pagesReportLâm Bá ĐạtNo ratings yet

- ClarksonDocument22 pagesClarksonfrankstandaert8714No ratings yet

- StatisticsDocument4 pagesStatisticsManish PatelNo ratings yet

- Franklin IndustDocument10 pagesFranklin Industkhanhamzu006No ratings yet

- Accuracy Graph Sheet Rev.1Document1 pageAccuracy Graph Sheet Rev.1Gustavo GustavoNo ratings yet

- Portofoliu DividendeDocument7 pagesPortofoliu DividendeLucian LadicNo ratings yet

- Crypto 6Document1 pageCrypto 6M WNo ratings yet

- Remedium LifeDocument10 pagesRemedium Lifeprajwal17803No ratings yet

- Moneycontrol 1Document1 pageMoneycontrol 1dakshdudeNo ratings yet

- 22 HulDocument10 pages22 HulAnushka Chhabra H22067No ratings yet

- Vortex Accuracy Graph: Flow Technology AdvisorDocument1 pageVortex Accuracy Graph: Flow Technology AdvisordsdeNo ratings yet

- Progress ITDocument4 pagesProgress ITArie HaryantoNo ratings yet

- Lecture 8Document195 pagesLecture 8Nguyệtt HươnggNo ratings yet

- Psychrometric Chart PDFDocument1 pagePsychrometric Chart PDFAlfonso AlmeidaNo ratings yet

- TAGOLOAN Mindanao FURTHER Product Mix - February 2019Document30 pagesTAGOLOAN Mindanao FURTHER Product Mix - February 2019Khel De JesusNo ratings yet

- Tata CommunicationDocument5 pagesTata CommunicationkmmohammedroshanNo ratings yet

- Biogeo Tema 3Document3 pagesBiogeo Tema 3Alin MihaiNo ratings yet

- AHO-OFDM Dimming PDFDocument1 pageAHO-OFDM Dimming PDFRashed IslamNo ratings yet

- Exchange Levarage and FeesDocument3 pagesExchange Levarage and FeesSilat KaliNo ratings yet

- 4 - (1) - (0007.1.2) - Izolatii I (... ) - F3nr - LISTA Cu Cantitati (... )Document4 pages4 - (1) - (0007.1.2) - Izolatii I (... ) - F3nr - LISTA Cu Cantitati (... )crystyNo ratings yet

- Uji Deskriptif FafaDocument11 pagesUji Deskriptif FafaArdian CahyoNo ratings yet

- Sun Pharmaceutical IndustriesDocument2 pagesSun Pharmaceutical Industriessharmasumeet1987No ratings yet

- L001E HTM Leaflet - enDocument8 pagesL001E HTM Leaflet - enDeyvid OliveiraNo ratings yet

- Date Account Size Side PNL % ReturnDocument12 pagesDate Account Size Side PNL % ReturnMarvin DimaguilaNo ratings yet

- Analisa Beli Via BankDocument19 pagesAnalisa Beli Via Bankalim pujiantoNo ratings yet

- GDL LeasingDocument32 pagesGDL LeasingXicaveNo ratings yet

- Sample Question 1: TimestampDocument9 pagesSample Question 1: Timestampsaurabh kumarNo ratings yet

- Risk and Return: Portfolio Theory and Assets Pricing Models: Problem 1Document3 pagesRisk and Return: Portfolio Theory and Assets Pricing Models: Problem 1anubha srivastavaNo ratings yet

- StreamDocument4 pagesStreamNARAYAN DESAINo ratings yet

- RiBS Review Report - 2022 - 02 - 25Document5 pagesRiBS Review Report - 2022 - 02 - 25Andy Dwi SaputraNo ratings yet

- 10-09-2022 RTM Copy of BOM (RTM) With RupaliDocument16 pages10-09-2022 RTM Copy of BOM (RTM) With RupalikumailNo ratings yet

- JuniorMasculino FS ScoresDocument1 pageJuniorMasculino FS ScorespedrolamelasNo ratings yet

- Exemplo de Granulometria Correta - Aula10Document9 pagesExemplo de Granulometria Correta - Aula10Sandro Dias PenaNo ratings yet

- Aranceles Del Perú: Part A.1 Tariffs and Imports: Summary and Duty RangesDocument2 pagesAranceles Del Perú: Part A.1 Tariffs and Imports: Summary and Duty RangesJhordam Maxwell Gómez TorresNo ratings yet

- CMI Presentation G12Document19 pagesCMI Presentation G12aryaman chakrabortyNo ratings yet

- 4Document6 pages4Irina BesliuNo ratings yet

- Tiempo (H) PP (Increm. MM) Intensidad (MM/H) FT FT (Tasa Inf Potencial)Document7 pagesTiempo (H) PP (Increm. MM) Intensidad (MM/H) FT FT (Tasa Inf Potencial)VictoriaSantosNo ratings yet

- Mechanical Dimensions: PackageDocument3 pagesMechanical Dimensions: PackageSec!No ratings yet

- Activity Statement: Account InformationDocument9 pagesActivity Statement: Account InformationAlexandru SimaNo ratings yet

- B) " Data - Frame".: Outliers and Missing Values (8 Marks) AnswerDocument23 pagesB) " Data - Frame".: Outliers and Missing Values (8 Marks) AnswerRaveendra Babu Gaddam100% (1)

- Seismic Hazard Exposure: Social Indicators Risk IndicatorsDocument2 pagesSeismic Hazard Exposure: Social Indicators Risk IndicatorsSundak HidayatNo ratings yet

- ETF Expected Returns Annualized Standard DeviationDocument98 pagesETF Expected Returns Annualized Standard DeviationJayash KaushalNo ratings yet

- Ca150032 305 24 02Document1 pageCa150032 305 24 02juan francisco urzua ramirezNo ratings yet

- LM337 (1) 2Document3 pagesLM337 (1) 2Sec!No ratings yet

- Final Mock CalculationsDocument5 pagesFinal Mock CalculationsfadsNo ratings yet

- FIPI Summary Report March 31, 2020 PDFDocument1 pageFIPI Summary Report March 31, 2020 PDFHaseebPirachaNo ratings yet

- European ETF StatisticDocument4 pagesEuropean ETF Statistic0840328818zNo ratings yet

- Bissmillah PharmacyDocument1 pageBissmillah Pharmacydell78677No ratings yet

- Company Segments Market Share Market Share Largest CompetitorDocument2 pagesCompany Segments Market Share Market Share Largest CompetitorthivahgaranNo ratings yet

- Rate of Reaction Chem IADocument3 pagesRate of Reaction Chem IAJessica SieNo ratings yet

- 6.3 Lintel Beams: % Accomp. Total Cost % Accomp. Total Cost % Accomp. Total CostDocument22 pages6.3 Lintel Beams: % Accomp. Total Cost % Accomp. Total Cost % Accomp. Total Costmhel vianney bariquitNo ratings yet

- Book 1Document2 pagesBook 1veereshjaiswalNo ratings yet

- Etude AppartementDocument4 pagesEtude AppartementBintou RassoulNo ratings yet

- Billing (Engr Aizon)Document9 pagesBilling (Engr Aizon)mhel vianney bariquitNo ratings yet

- Simple Kriging DemoDocument6 pagesSimple Kriging Demokosaraju suhasNo ratings yet

- Sample Apple MatricesDocument17 pagesSample Apple Matricesesther muendindutiNo ratings yet

- Entrepreneur: Warren BuffetDocument12 pagesEntrepreneur: Warren BuffetAnadi GuptaNo ratings yet

- Q - 1 (MTP 2, A - 2021, N S) : Z Score AreaDocument2 pagesQ - 1 (MTP 2, A - 2021, N S) : Z Score AreaSiva Kumar ReddyNo ratings yet

- Ducati Valuation - LPDocument11 pagesDucati Valuation - LPuygh gNo ratings yet

- CemDocument6 pagesCemSamaresh ChhotrayNo ratings yet

- Karl Marx's TheoryDocument2 pagesKarl Marx's TheoryHassaan RajputNo ratings yet

- CHPT 1 MacroecosDocument30 pagesCHPT 1 MacroecossylbluebubblesNo ratings yet

- Fox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Document27 pagesFox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Chapter 11 DocketsNo ratings yet

- Joint Venture AgreementDocument4 pagesJoint Venture AgreementDefit Archila KotoNo ratings yet

- Executive SummaryDocument56 pagesExecutive Summarybooksstrategy100% (1)

- NEFT FormDocument3 pagesNEFT FormDeepika ManglaNo ratings yet

- Chapter 4 EnterpriseDocument5 pagesChapter 4 Enterpriseapi-207606282No ratings yet

- KDocument121 pagesKspmzNo ratings yet

- EMS Project On SARBDocument2 pagesEMS Project On SARBMichael-John ReelerNo ratings yet

- Activity Based CostingDocument8 pagesActivity Based CostingAli AhmiiNo ratings yet

- j.1835-2561.2008.0032.x Topic PrintDocument8 pagesj.1835-2561.2008.0032.x Topic PrintFahim AhmedNo ratings yet

- Jaipur National University: Dainik Bhaskar Jid Karo Duniya BadloDocument33 pagesJaipur National University: Dainik Bhaskar Jid Karo Duniya BadloAkkivjNo ratings yet

- Chapter 4 - Review Questions Accounting Information SystemDocument2 pagesChapter 4 - Review Questions Accounting Information SystemBeny MoldogoNo ratings yet

- Chapter 5 - Business To Business MarketingDocument15 pagesChapter 5 - Business To Business MarketingHassan SiddiquiNo ratings yet

- Ekonomi Paint SectorDocument4 pagesEkonomi Paint SectorDilansu KahramanNo ratings yet

- Claims Adjustment Report: Description Price Parts Tinsmith PaintingDocument2 pagesClaims Adjustment Report: Description Price Parts Tinsmith PaintingMark Dave Joven Lamasan AlentonNo ratings yet

- AgricultureDocument11 pagesAgricultureDjewer GhazaliNo ratings yet

- Digital India in Agriculture SiddhanthMurdeshwar NMIMS MumbaiDocument4 pagesDigital India in Agriculture SiddhanthMurdeshwar NMIMS MumbaisiddhanthNo ratings yet

- Case Study Barclays FinalDocument13 pagesCase Study Barclays FinalShalini Senglo RajaNo ratings yet

- NeocolonialismDocument1 pageNeocolonialismManny De MesaNo ratings yet

- Financial Plan Template 26Document8 pagesFinancial Plan Template 26MOHD JIDINo ratings yet

- ACT450 - Fa20 - Project Deliverable PDFDocument10 pagesACT450 - Fa20 - Project Deliverable PDFHassan SheikhNo ratings yet

- An Introduction To The Supply Chain Council's SCOR MethodologyDocument17 pagesAn Introduction To The Supply Chain Council's SCOR MethodologyLuis Andres Clavel Diaz100% (1)

- Panasonic1 DamanDocument7 pagesPanasonic1 DamanTarun PatelNo ratings yet

- Assignment III - Descriptive QuestionsDocument2 pagesAssignment III - Descriptive QuestionsAndroid AccountNo ratings yet

- Presentation ACT110Document34 pagesPresentation ACT110Nezam MarandaNo ratings yet