Professional Documents

Culture Documents

5 2 PDF

Uploaded by

Pranav Shauche0 ratings0% found this document useful (0 votes)

12 views5 pagesOriginal Title

5.2.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views5 pages5 2 PDF

Uploaded by

Pranav ShaucheCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 5

91972018 Managerial Economies

PRINTED BY: hgil’530@ucumberlands.ed, Printing is for personal, private use only. No part of this book may be reproduced or ansmited without

publisher's prior permission Violators will be prosecuted.

‘58 SECTION « Pobiem Sang ane Desiston Mating

Ler's look more generally at the problem of post investraent hold-up by

ewriting profit as a function of the difference berween price and average cost.

Profit = Rev ~ Gast = Q* P~ Q* (Cast! Q) = Q* (P ~ AC}

If “Cost” includes all your cost, including your opportunity cost of

capital, chen you ate just breaking even (earning zero profi) when P = AC.

If price falls below AC, tien you are losing money.

“Toste how this affees investment decisions, imagine thar you areadvising

regional commercial printer, who is negotiating wit a magazine, ike National

(Geographic. For the magazine, using a regional printer reduces shipping co

Barto print a high-quality magazine, the printer must buy 2 $12 milion oto-

gravure printing press, For the sake of caviry, we assume thar the press has no

resale value and the fim has no capital cost ie can borrow money and pay n0

lnerest). Suppose thatthe MG of printing a single copy s $2 and the printer

expects to print one million copies per year over a two-year petiod.

Tr the following cable, we compare the average cos of printing the maga-

zine over the length of the contract.

RP

Quay ‘arable Cost |S2/Uni)

o $12,000,000

1 1,000,000 $2,000,000,

2 1,000,000 $2,000,000,

Tout 2,900,000 $12,900,000 $4,000,000

Average ss 2

Average Coxe 3

Inthe above table, we ee that $8 is the average cost of printing magazines

ver the length of the conteac. This ste breakeven price forthe printer and

represents her bocrom lie in negotiations withthe magazine. Before they are

incurred, sunk costs are relevant ro che negotiation,

QUESTION: Now suppose chat the magazine accepts your offer of S8/

tunic and immediately hands you a purchase order for $8,000,000, far the

first-year production. Do you accept che purchase order?

IF you said "Yes" you have just been held up. Since the $12M cose of ce

printer is sunk, the magazine can device to reduce its second-year price to only

52, and you wonld have no option but to aecepe i. Instead, you should instead

refs the purchase order at that price.

TF the printer anccipaces hold-up, ic will be celuctant o deal with the mag-

zine. When this happens, hold-up becomes 2 problem not just forthe poten-

‘ial vietim but also for the potential perpetrator. The one dessom of business

hitpslcongage-vtalsource.comiiibooks/27813374680 Sic t56/4i4@0.00.0.00

91972018 Managerial Economies

PRINTED BY: hgill?530@ucumberlands.ed. Printing is for personal, private use only. No part of this book may be reproduced or tansmited without

publisher's prior permission Violators will be prosecuted.

CVAPTER 5 « IrvestnentDeslons: Look Angad ars Reason Gack $9

is to figure out how ro profitably consummars the transaction between the

printer and che magazine.

If possible, the printer will negotiate a contract that penalizes the maga

zine should it decce to hold them up. With the assurance of a contract, the

printer may fel confident enough to ineur sunk costs. But contracts are often

difficue and costly ra enforce. A better solution might be to make che maga-

zine purchase che printing press and thea lease it to te printex. In this ease, the

magazine no longer poses hold-up chreat ra the printer because the printer

has incurred no sank costs.”

‘Note that ifthe cost of che printing press fied, meaning that it ean

be recovered by selling the machine, tien hold-up is Rot 2 problem. If che

magazine cies co renegotiate a priceless than average cost, the printer will

refuse the business, soll the press, and recover its entire investment. Hold-up

‘aan occur only if costs are suk,

In general, many inverements are vulnerable to hold-up. Anytime that

‘one party makes a specific investment-—one that is sunk or lacks value out-

side of 2 trading relaionship—the party can be held up by is trading part-

het. If one party anticipates thac she is at risk of eing held up, she will he

reluctant to make relationship-specifc investments, or demand costly safe-

‘poare, inching compensation in the form of beter terms from her trading

partner. This gives both parties an inceative to adopt conteacts or organiza

fHonal forms, such as investments in eeputation or merges to reduce the ris

‘of hold-up. The goal is to eusure that each party has both the incentive to

make reationship-specific investments and ta trade after these investments

have been made.

Contracts shotld enconnage both investment and trade.

For example, marriages ae wulaerabl ro the same rype of posefavestment

‘opportunism that plagues commercial relationships. Partce inves i, energy,

‘and money ina maesiage, the kinds ofinvescmenss thar differentiate marriages

from more casual relationships, which can be thought of as spot-markertrans-

actions. These javestments ate valuable 0 the marrage partes but are largely

in that they have a much lower value outside the selationship, The

iage contract penalizes post investment hold-up (ue. divorce) aad this

‘makes couples wiling ro invest more i the marrage."

‘We close the chaprer with the story of an economist and his fiancée who

were receiving premarital counseling from 2 priest before he would marry

them. The priests fest question tothe couple was “Why do you want ta get

‘married?” Tae economist's fiancée answered, “Because I love him and want

to spend che res of my lfe with him.” As you might imagine, the economist

hhad a dtferent answer, “Because longe-teom contracts induce higher levels of

relatioaship-specitic investment.”

A year lates trying hard co find che right words to express how he felt

about his wife, he wrote an anniversary e-miail—using @ cursive fom—

declaring that his “relationship-specific investment was earning an above-

average race of recur.”

hitpslcongage-vtalsource.comiiibooks/27813374680 Sic t56/4i4@0.00.0.00

91972018 Managerial Economies

PRINTED BY: hgil’530@ucumberlands.ed. Printing is for personal, private use only. No part of this book may be reproduced or tansmited without

publisher's prior permission, Violators will be prosecuted.

160 SECTION « Pobiem Sang ane Desiton Mating

‘SUMMARY & HOMEWORK PROBLEMS

Summary of Main Ponts

+ Allinvestment decisions involve a wade-off

berween eure sarifce and future pain.

Before investing you need ro know whether

the fate bens ae bigee than the cur

rent cons, Discounting allows you 0 figure

this out

+ Companies, ike individuals, have diferear

discount rates determined by ther cost of

capital Thy invest ony in projec that

am a return higher than the cost of capa

+ TheNPY rae tae hat the ne pres

et value ofthe et eash lows from an

investment repose, the projec cars

conomic profit the investment ears more

than the cot of capil

+ Although NPV isthe correct way to

iyzeinvesenenes, nr all companies se

Tastad hey use a variety of shortcuts like

ay back period they are oe easier 0

fo and more inte

+ Breal-oen quant bogul to xed cost

divided bythe contabution mange you

fxpect to vell more than the breakeven gua

tiysthen your investment willbe rofiabl

+ Avoidable coms can be recovered by shut

ting dows. If the benefits of shutting down

{you get back your avoidable costs) are

Jangr than the cost (you give up your

revese hen shut dor. The break-even

Price is average avoidable cost

‘+ TEyoutincar son coms, you are vainers-

‘eto postiavestment hold-up. Anvciate

folds and choos eantracts or organzs-

tional forms that gieeach parry bth the

Incenive wo make sunkccos vestments an

to wade after these invesunens are made.

ah

‘Muttiple-Choice Questions

1. Which of the following will increase the

break-even quanticy?

a. A decrease in overall fixed costs

by A decrease in the marginal costs

hitpslcongage-vtalsource.comiiibooks/27813374680 Sic t56/4i4@0.00.0.00

A dectense inthe price level

d. An increase in price level

2. ‘The higher the discount rates,

a. the more value individuals place on

facure dollars

b, the more value individuals place on

current dollars.

«the more investments will ake place,

4d. does not affect the investmant strategy

|. Assume a fir has the following cost and

revenue characteristics a its current level

of output price = $10.00, average variable

ose = $4.00, and average fied cost =

$4.00. This frm is

2. inearring a loss of $2.00 per unit and

should shut down.

realizing only a normal profi.

realizing an economic profit of $2.00

per unit.

4. incurring a loss per unit of $2.00 bur

should continue t operate in the short

Sarah's Machinery Company is deciding

‘0 dump its current technology A fora

‘new technology B with smaller fixed coms

but bigger MCs. The current technology

has fixed cost of 8500 and MCs of $50,

whereas the new technology has fixed costs

‘of $250 and MCs of $100. At what quan-

try is Sarah's Machinery Company indif-

ferenc beeween two technologies?

‘Whar isthe not present value ofa project

‘thac requires a $100 investment roday and

zetums $50 atthe end of the fist year and

$40 at the end of the second year? Assume

a discount rate of 10%,

a $10.52

b su:

© Sisis

d. $30.00

35

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Practical Connection AssignmentDocument4 pagesPractical Connection AssignmentPranav Shauche67% (3)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Role of Advertinsing in Promoting ProductDocument61 pagesRole of Advertinsing in Promoting Productప్రభాకర్ రాజ్No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Roof Deck: Activating Underutilized Urban SpacesDocument5 pagesThe Roof Deck: Activating Underutilized Urban SpacesPranav ShaucheNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

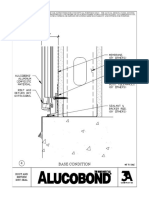

- Rout and Return Dry-Seal - 04 Base Condtion-ModelDocument1 pageRout and Return Dry-Seal - 04 Base Condtion-ModelPranav ShaucheNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Design Guide For Behavioral HealthDocument114 pagesDesign Guide For Behavioral HealthPranav Shauche100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- MITC Student Loan March 2015 CArd DetailsDocument2 pagesMITC Student Loan March 2015 CArd DetailsPranav ShaucheNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Fabric Canopy ArmstrongDocument2 pagesFabric Canopy ArmstrongPranav ShaucheNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Pol HouseDocument6 pagesPol HouseVarsha DasNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Average Weather For AhmedabadDocument8 pagesAverage Weather For AhmedabadPranav ShaucheNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)